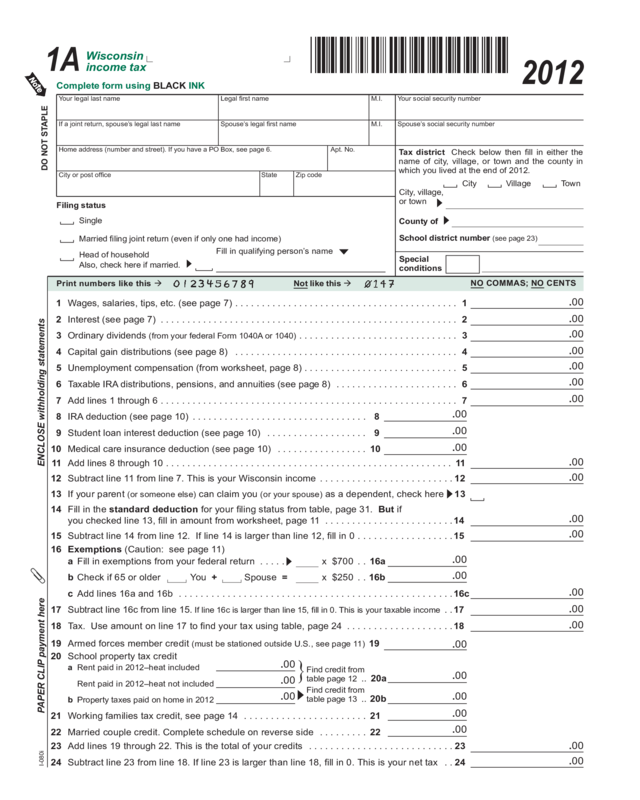

Fillable Printable 2012 I-080 Form 1A, Wisconsin Income Tax

Fillable Printable 2012 I-080 Form 1A, Wisconsin Income Tax

2012 I-080 Form 1A, Wisconsin Income Tax

12Subtract line 11 from line 7. This is your Wisconsin income .........................12

13If your parent (or someone else) can claim you (or your spouse) as a dependent, check here 13

14Fill in the standard deduction for your ling status from table, page 31. But if

you checked line 13, ll in amount from worksheet, page 11 ........................14

15Subtract line 14 from line 12. If line 14 is larger than line 12, ll in 0 ..................15

16Exemptions (Caution: see page 11)

aFill in exemptions from your federal return .....x $700 ..16a

bCheck if 65 or older You +Spouse =x $250 ..16b

cAdd lines 16a and 16b ................................................... 16c

17Subtract line 16c from line 15. If line 16c is larger than line 15, ll in 0. This is your taxable income ..17

18Tax. Use amount on line 17 to nd your tax using table, page 24 ....................18

Print numbers like this

NO COMMAS; NO CENTS

19Armed forces member credit (must be stationed outside U.S., see page 11)19

20School property tax credit

a Rent paid in 2012–heat included

Rent paid in 2012–heat not included

bProperty taxes paid on home in 2012

21Working families tax credit, see page 14 .......................21

22Married couple credit. Complete schedule on reverse side .........22

23Add lines 19 through 22. This is the total of your credits ...........................23

24Subtract line 23 from line 18. If line 23 is larger than line 18, ll in 0. This is your net tax ..24

1Wages, salaries, tips, etc. (see page 7) ..........................................1

2Interest (see page 7) ........................................................2

3Ordinary dividends (from your federal Form 1040A or 1040) ..............................3

4Capital gain distributions (see page 8) ..........................................4

5Unemployment compensation (from worksheet, page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

6Taxable IRA distributions, pensions, and annuities (see page 8) .......................6

7Add lines 1 through 6 ........................................................7

8IRA deduction (see page 10) ................................. 8

9Student loan interest deduction (see page 10) ...................9

10Medical care insurance deduction (see page 10) .................10

11Add lines 8 through 10 ......................................................11

}

Find credit from

table page 12 ..20a

Find credit from

table page 13 .. 20b

I-080i

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

PAPER CLIP payment here

ENCLOSE withholding statements

.00

.00

.00

.00

DO NOT STAPLE

2012

Complete form using BLACK INK

Wisconsin

income tax

1A

Legal rst nameYour legal last name

Spouse’s legal rst nameIf a joint return, spouse’s legal last name

Home address (number and street). If you have a PO Box, see page 6. Apt. No.

StateCity or post ofceZip code

Tax districtCheck below then ll in either the

name of city, village, or town and the county in

which you lived at the end of 2012.

School district number (see page 23)

Spouse’s social security number

Your social security numberM.I.

M.I.

City, village,

or town

Special

conditions

County of

VillageTownCity

Head of household

Also, check here if married.

Single

Fill in qualifying person’s name

Married ling joint return (even if only one had income)

Filing status

.00

.00

.00

.00

.00

.00

Not like this

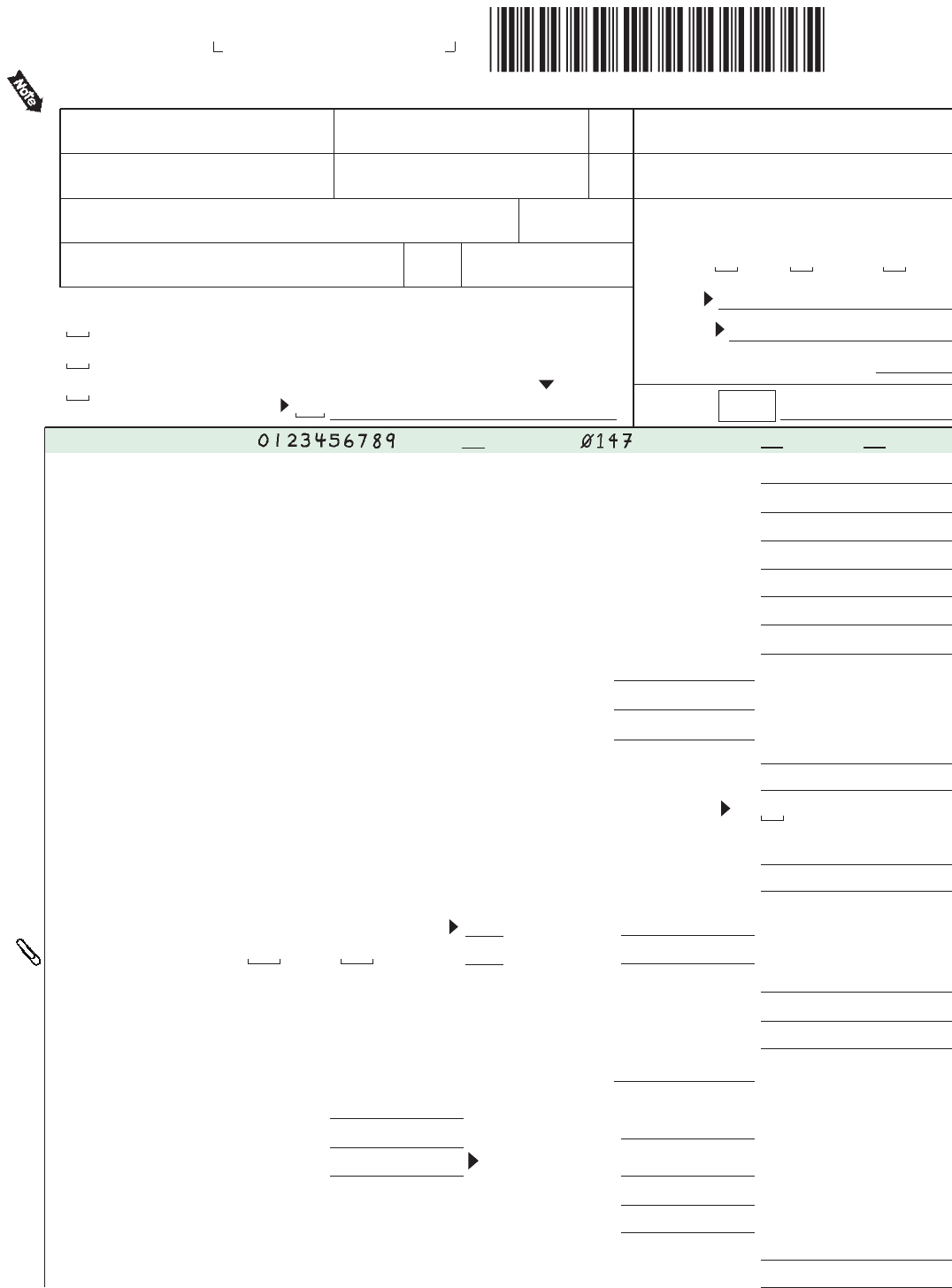

25Fill in net tax from line 24 ......................................................25

26Sales and use tax due on Internet, mail order, or other out-of-state purchases (see page 15)26

If you certify that no sales or use tax is due, check here ........................

27Donations (decreases refund or increases amount owed)

aEndangered resources fFireghters memorial ......

bPackers football stadium gMilitary family relief ........

cCancer research .....h

Second Harvest/Feeding Amer.

dVeterans trust fund . . . . i Red Cross WI Disaster Relief

eMultiple sclerosis .....j Special Olympics .........

Total (add lines a through j) ..27k

28Add lines 25, 26, and 27k .....................................................28

29Wisconsin income tax withheld. Enclose withholding statements ......29

302012 estimated tax payments and amount applied from 2011 return ...30

31Earned income credit (see page 16)

Qualifying Federal

children credit ...x % = ...31

32Homestead credit. Attach Schedule H or H-EZ ................... 32

33Eligible veterans and surviving spouses property tax credit (see page 17)33

34Add lines 29 through 33 ......................................................34

35If line 34 is more than line 28, subtract line 28 from line 34. This is the AMOUNT YOU OVERPAID 35

36Amount of line 35 you want REFUNDED TO YOU ..................................36

37Amount of line 35 you want applied to your 2013 estimated tax .....37

38If line 34 is less than line 28, subtract line 34 from line 28. This is the AMOUNT YOU OWE ..38

39Underpayment interest. Fill in exception code – See Sch. U 39

(See page 19)

NO COMMAS; NO CENTS

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Mail your return to:Wisconsin Department of Revenue If tax due ........................................PO Box 268, Madison WI 53790-0001

If homestead credit claimed ...........PO Box 34, Madison WI 53786-0001

If refund or no tax due ....................PO Box 59, Madison WI 53785-0001

.00

.00

.00

.00

.00

.00

.00

.00

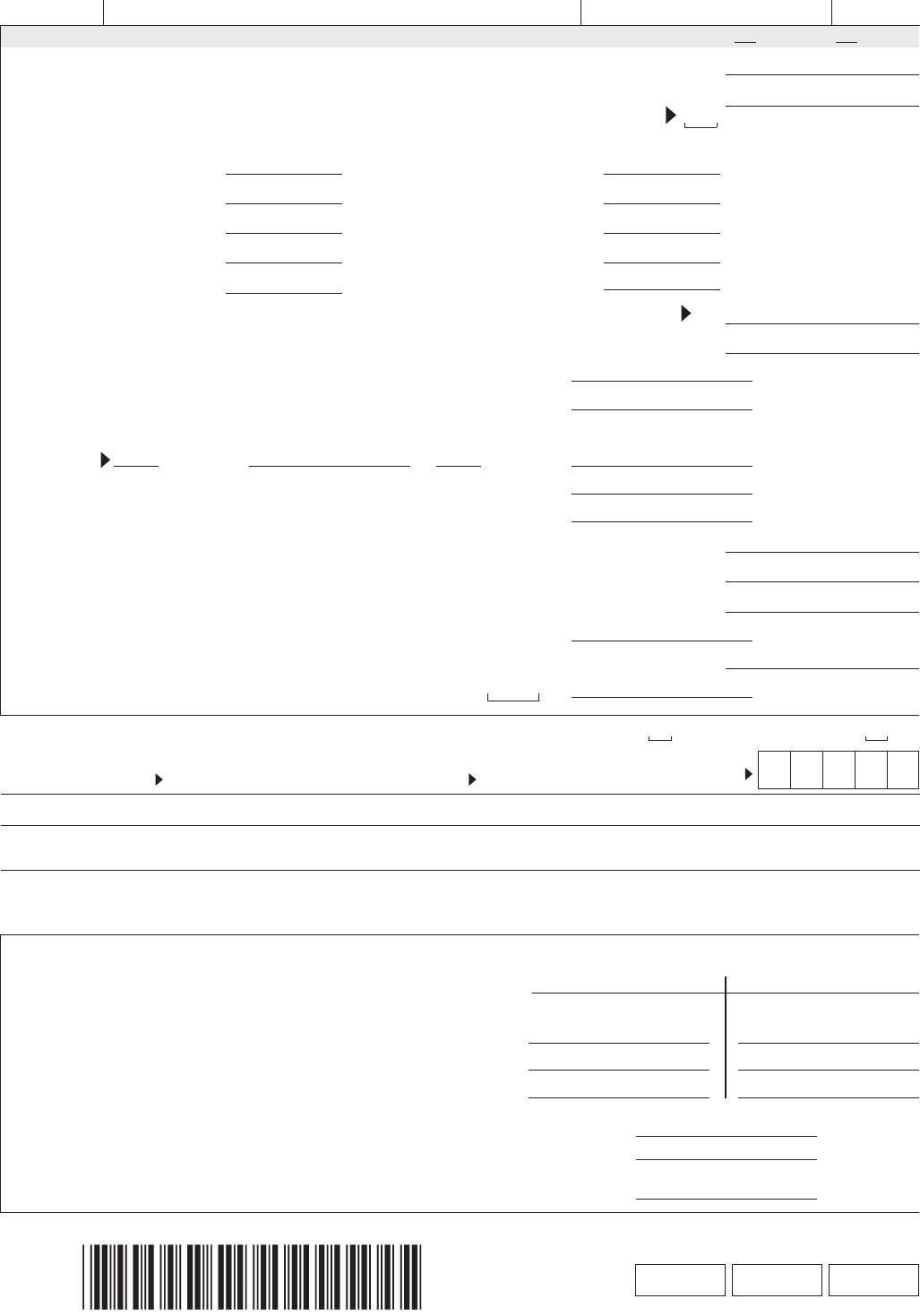

1Wages, salaries, tips, and other employee compensation from

line 1 of Form 1A. Do not include deferred compensation or

scholarships and fellowships that are not reported on a W-2 ....1

2IRA deduction, if any, from line 8 of Form 1A .................2

3Subtract line 2 from line 1 ...............................3

4Compare amounts in columns (A) and (B) of line 3. Fill in the

smaller amount here. If more than $16,000, ll in $16,000 ...................4

5Rate of credit is .03 (3%) .............................................5

6Multiply line 4 by line 5. Round the result and ll in here and on line 22

of Form 1A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Do NOT ll in more than $4806

Married Couple Credit When Both Spouses Are Employed

(B) YOUR SPOUSE

X .03

.00

.00

.00

.00

.00

.00

.00

.00.00

.00

Sign below

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Third

Party

Designee

Designee’s

name

Phone

no. ( )

Do you want to allow another person to discuss this return with the department (see page 19)? YesComplete the following.No

Personal

identication

number (PIN)

(A) YOURSELF

Your signature Spouse’s signature (if ling jointly, BOTH must sign) Date Daytime phone

( )

.00.00

2012

Form 1A

Page 2 of 2

C

For Department Use Only

.00

NameSSN