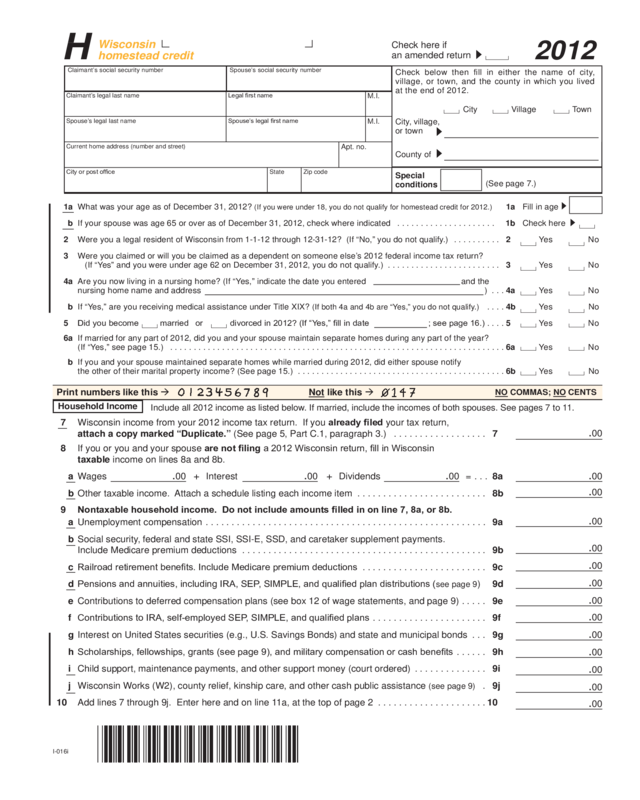

Fillable Printable 2012 Schedule H Homestead Credit Form (Pdf Fillable Form)

Fillable Printable 2012 Schedule H Homestead Credit Form (Pdf Fillable Form)

2012 Schedule H Homestead Credit Form (Pdf Fillable Form)

Check below then fill in either the name of city,

village, or town, and the county in which you lived

at the end of 2012.

Not like this Print numbers like this

NO COMMAS; NO CENTS

City

1a What was your age as of December 31, 2012? (If you were under 18, you do not qualify for homestead credit for 2012.) 1a Fill in age

b If your spouse was age 65 or over as of December 31, 2012, check where indicated ..................... 1b Check here

2 Were you a legal resident of Wisconsin from 1-1-12 through 12-31-12? (If “No,” you do not qualify.) .......... 2 Yes No

3 Were you claimed or will you be claimed as a dependent on someone else’s 2012 federal income tax return?

(If “Yes” and you were under age 62 on December 31, 2012, you do not qualify.) ........................ 3 Yes No

4a Are you now living in a nursing home? (If “Yes,” indicate the date you entered and the

nursing home name and address ) ... 4a Yes No

b If “Yes,” are you receiving medical assistance under Title XIX? (If both 4a and 4b are “Yes,” you do not qualify.) .... 4b Yes No

5 Didyoubecome married or divorcedin2012?(If“Yes,”llindate ;seepage16.) ....5 Yes No

6a If married for any part of 2012, did you and your spouse maintain separate homes during any part of the year?

(If “Yes,” see page 15.) ....................................................................... 6a Yes No

b If you and your spouse maintained separate homes while married during 2012, did either spouse notify

the other of their marital property income? (See page 15.) ............................................ 6b Yes No

Wisconsin

homestead credit

2012

H

County of

7 Wisconsin income from your 2012 income tax return. If you already led your tax return,

attach a copy marked “Duplicate.” (See page 5, Part C.1, paragraph 3.) .................. 7

8 If you or you and your spouse are not linga2012Wisconsinreturn,llinWisconsin

taxable income on lines 8a and 8b.

a Wages + Interest + Dividends = ... 8a

b Other taxable income. Attach a schedule listing each income item ......................... 8b

9 Nontaxable household income. Do not include amounts lled in on line 7, 8a, or 8b.

a Unemployment compensation ...................................................... 9a

b Social security, federal and state SSI, SSI-E, SSD, and caretaker supplement payments.

Include Medicare premium deductions ............................................... 9b

c Railroadretirementbenets.IncludeMedicarepremiumdeductions ........................ 9c

dPensionsandannuities,includingIRA,SEP,SIMPLE,andqualiedplandistributions(see page 9) 9d

e Contributions to deferred compensation plans (see box 12 of wage statements, and page 9) ..... 9e

f ContributionstoIRA,self-employedSEP,SIMPLE,andqualiedplans...................... 9f

g Interest on United States securities (e.g., U.S. Savings Bonds) and state and municipal bonds ... 9g

hScholarships,fellowships,grants(seepage9),andmilitarycompensationorcashbenets...... 9h

i Child support, maintenance payments, and other support money (court ordered) .............. 9i

j Wisconsin Works (W2), county relief, kinship care, and other cash public assistance (see page 9) . 9j

10 Add lines 7 through 9j. Enter here and on line 11a, at the top of page 2 ..................... 10

.00.00

.00

.00 .00

Household Income

Include all 2012 income as listed below. If married, include the incomes of both spouses. See pages 7 to 11.

I-016i

LegalrstnameClaimant’s legal last name

Spouse’slegalrstnameSpouse’s legal last name

Current home address (number and street)

State

Cityorpostofce Zip code

Spouse’s social security number

M.I.

M.I.

City, village,

or town

Village Town

Special

conditions

(See page 7.)

Apt. no.

Claimant’s social security number

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Check here if

an amended return

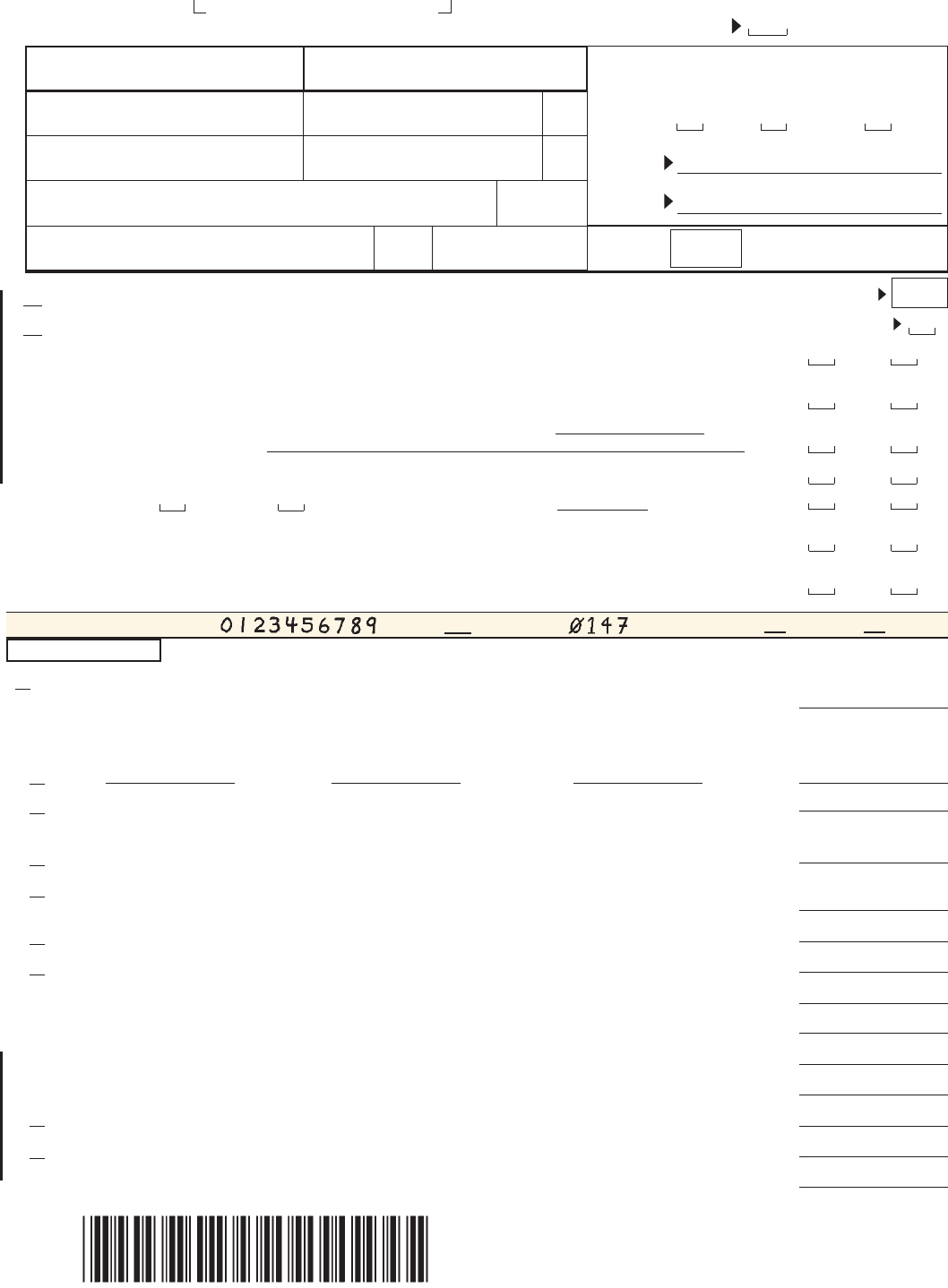

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or Enter.

Save

Print

Clear

Go to Page 2

13 Homeowners – Net 2012 property taxes on your homestead, whether paid or not ............. 13

14 Renters – Rentfromyourrentcerticate(s),line13a (or Shared Living Expenses Schedule). See pages 12 to 14.

Heat included (13bofrentcerticateis“Yes”) ............ 14a x .20 (20%) = 14b

Heat not included (13bofrentcerticateis“No”) .......... 14c x .25 (25%) = 14d

15 Total of lines 13, 14b, and 14d (or amount from line 6 of Schedule 3) .......................... 15

2012

H Page 2 of 3

11 a Enter amount from line 10 here .................................................... 11a

b Workers’ compensation, income continuation, and loss of time insurance (e.g., sick pay) ........ 11b

c Gain from sale of home excluded for federal tax purposes (see instructions) ................. 11c

d Other capital gains not taxable ..................................................... 11d

e Net operating loss carryforward and capital loss carryforward ............................. 11e

f Incomeofnonresidentspouseorpart-yearresidentspouse;nontaxableincomefrom

sourcesoutsideWisconsin;residentmanager’srentreduction;clergyhousingallowance;

and nontaxable Native American income ............................................. 11f

g Partner’s, LLC member’s, and S corporation shareholder’s distributive share of depreciation,

Section 179 expense, depletion, amortization, and intangible drilling costs. If none was claimed,

write “None” on federal Schedule E, Part II, near the entity’s name ......................... 11g

h Car or truck depreciation (standard mileage rate) ...................................... 11h

i Other depreciation, Section 179 expense, depletion, amortization, and intangible drilling costs ... 11i

12 a Subtotal. Add lines 11a through 11i ................................................. 12a

b Number of qualifying dependents. Do not count yourself or your spouse (see page 11) x $500 = 12b

c Household income. Subtract line 12b from line 12a (if $24,680 or more, no credit is allowed) . . . . . . . . . . 12c

Check here if your home was located on more than one acre of land and was notpartofafarm;see Schedule 1, page 3.

Check here if your home was located on more than one acre of land and was part of a farm.

Checkhereifyourhomewasusedforpurposesotherthanpersonalorfarmusewhileyoulivedtherein2012;see Schedule 2, page 3.

CheckhereifyoureceivedWisconsinWorks(W2)paymentsorcountyreliefduring2012;see Schedule 3, page 3.

Taxes and/or Rent

See pages 11 to 14.

Don’t delay your refund: ATTACH2012taxbill(s)(orclosingstatement)and/ororiginalrentcerticate(s).

ATTACH ownership document (if the tax bill lists names other than yours). See page 12.

.00

.00

.00

.00

.00

.00

Credit Computation

16 Fill in the

smaller

of (a) amount on line 15 or (b) $1,460 ................................ 16

17 Usingtheamountonline12c,llintheappropriateamountfromTable A (page 17) ........... 17

18 Subtract line 17 from line 16 (if line 17 is more than line 16, ll in 0;nocreditisallowable) .... 18

19 Homesteadcredit–Usingtheamountonline18,llinthecreditfromTable B (page 18) ....... 19

.00

.00

.00

.00

IfyouleaWisconsinincometaxreturn,attachthisclaimbehindForm1,1A,or1NPR.Fillin

yourhomesteadcredit(line19)online32ofForm1A;line47ofForm1;orline72ofForm1NPR.

(IflingForm1orForm1NPR,ATTACH a complete copy of your federal income tax return and

schedules.)YoucannotleFormWI-Zwithahomesteadcreditclaim.

Claimant’s signature Spouse’s signature Date Daytime phone number

Mail to:

Wisconsin Department of Revenue

PO Box 34

Madison WI 53786-0001

Under penalties of law, I declare this homestead credit claim and all attachments are true, correct, and complete to the best of my knowledge and belief.

Sign

Here

DON’TlethisclaimUNLESSa

rentcerticateorpropertytaxbill

(or closing statement) is included.

STOP

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

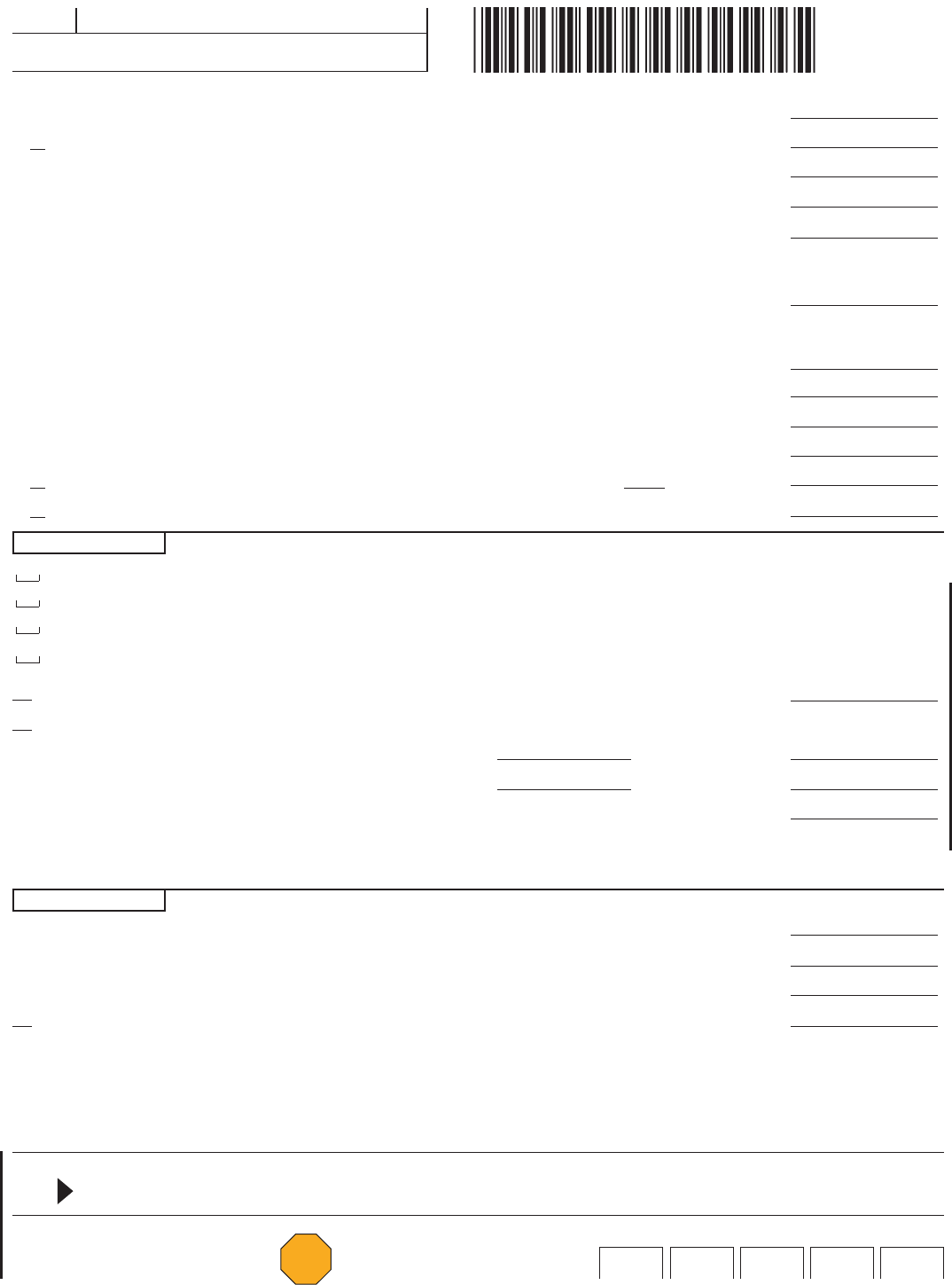

For Department Use Only

C

( )

SSN

Name

Go to Page 3

Schedule 1

Schedule 2

Note

Homeowners Age 65 or Older – The Property Tax Deferral Loan Program provides loans to help individuals age 65

or older pay their property taxes. Qualified applicants may participate even if they receive homestead credit. For

more information, contact the Wisconsin Housing and Economic Development Authority at (608) 266-7884 (Madison),

(414) 227-4039 (Milwaukee), or 1-800-755-7835.

Taxes/Rent Reduction – Wisconsin Works (W2) or County Relief Recipients

Schedule 3

Name(s) shown on Schedule H Your social security number

2012

H Page 3 of 3

Complete this schedule if, for any month of 2012, you

received a) Wisconsin Works (W2) payments of any amount,

or b) county relief payments of $400 or more. If you received

these payments for all 12 months of 2012, do not complete

ScheduleH;youdonotqualifyforhomesteadcredit.

Example: You received Wisconsin Works payments for

4 months in 2012. Rent paid for 2012 was $4,500, and heat

was included.

Line

2 20% of rent paid ($4,500 x . 20) ............ $900

4 Monthly rent ($900 ÷ 12) ................. $475

5 Number of months no Wisconsin Works

received .............................. 8

6 Reduced rent ($75 x 8 months) ............ $600

In this example, $600 would be lled in on line 15 of

Schedule H.

1 Homeowners–llinthenet2012

property taxes on your homestead or the

amount from line 3 of Schedule 2 ......

2 Renters – if heat wasincluded,llin

20% (.20), or if heat was not included,

llin25%(.25),ofrentfromline13a

oftherentcerticate(s)orline3of

Schedule 2 ........................

3 Addline1andline2;llinthesmaller of

a) the total of lines 1 and 2, or b) $1,460

4 Divide line 3 by 12 ...................

5 Number of months in 2012 for which you

did not receive a) any Wisconsin Works

(W2) payments, or b) county relief

payments of $400 or more ............

6 Multiply line 4 by line 5. Fill in here and

online15ofScheduleH.Donotllin

line 13 or 14 .......................

Note: Include this page as part of Schedule H only if Schedule 1, 2, and/or 3 is completed.

I-016bi

• Homeowners: Complete this schedule if your home was

on more than one acre of land and was not part of a farm

(asdenedonpage6oftheinstructions).Claimonlythe

property taxes on one acre of land and the buildings on it.

• Renters: If your home was on more than one acre of land

and was not part of a farm, do not complete Schedule 1, but

see exception 4 under “Exceptions: Homeowners and/or

Renters” (page 14) for instructions.

• Donot complete this schedule if your home was part of a

farm. You may claim the property taxes on up to 120 acres

of land adjoining your home and all improvements on those

120 acres.

• Ifyouwishtouseadifferentmethodtoprorateyourproperty

taxes, attach to Schedule H your computation of allowable

property taxes.

1 Assessed value of land (from tax bill) ....

2 Number of acres of land ..............

3 Divide line 1 by line 2 ................

4 Assessed value of improvements

(from tax bill) .......................

5 Add line 3 and line 4 .................

6 Add line 1 and line 4 (total assessed value)

7 Divide line 5 by line 6 ................

8 Net 2012 property taxes (see instructions

for line 13 of Schedule H, on pages 11 to 14)

9 Multiply line 8 by line 7. Fill in here and

on line 13 of Schedule H or line 1 of

Schedule 2 or 3 below ...............

Allowable Taxes – Home on More Than One Acre of Land

Allowable Taxes/Rent – Home Used Partly for Purposes Other Than Farm or Personal Use

• Completethisscheduleifyourhomestead(asdenedon

page 5 of the instructions) was not part of a farm but was

used partly for purposes other than personal use while

you lived there in 2012. Only the personal portion of your

property taxes/rent may be claimed.

• “Otheruses”includepartbusinessorrentalusewherea

deduction is allowed or allowable for tax purposes, and

a separate unit occupied by others rent free. See para-

graph 3 under “Exceptions: Homeowners and/or Renters”

(page 13) for examples and additional information.

1 Net 2012 property taxes/rent or

amount from line 9 of Schedule 1

(see pages 11 to 14) ................

2 Percentage of homestead used

solely for personal purposes ..........

3 Multiply line 1 by line 2. Fill in here and

on line 13, 14a, or 14c of Schedule H,

or on line 1 or 2 of Schedule 3 below ....

Return to Page 2

Return to Page 1