Fillable Printable 2013 Form 3533 - Change Of Address

Fillable Printable 2013 Form 3533 - Change Of Address

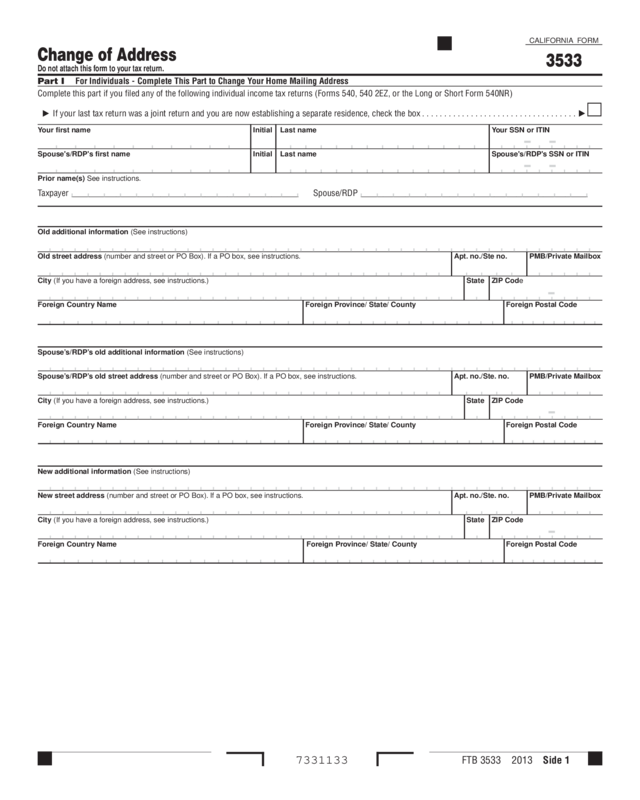

2013 Form 3533 - Change Of Address

7331133 FTB 3533 2013 Side 1

Change of Address

Do not attach this form to your tax return.

CALIFORNIA FORM

3533

Part I For Individuals - Complete This Part to Change Your Home Mailing Address

Complete this part if you filed any of the following individual income tax returns (Forms 540, 540 2EZ, or the Long or Short Form 540NR)

If your last tax return was a joint return and you are now establishing a separate residence, check the box ...................................

Your first name Initial Last name Your SSN or ITIN

Spouse's/RDP's first name Initial Last name Spouse's/RDP's SSN or ITIN

Prior name(s) See instructions.

Taxpayer ___________________________________________________ Spouse/RDP ___________________________________________________

Old additional information (See instructions)

Old street address

(number and street or PO Box). If a PO box, see instructions. Apt. no./Ste no. PMB/Private Mailbox

City (If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name

Foreign Province/ State/ County Foreign Postal Code

Spouse’s/RDP’s old additional information (See instructions)

Spouse’s/RDP’s old street address (number and street or PO Box). If a PO box, see instructions. Apt. no./Ste. no. PMB/Private Mailbox

City (If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name Foreign Province/ State/ County Foreign Postal Code

New additional information (See instructions)

New street address (number and street or PO Box). If a PO box, see instructions. Apt. no./Ste. no. PMB/Private Mailbox

City (If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name Foreign Province/ State/ County Foreign Postal Code

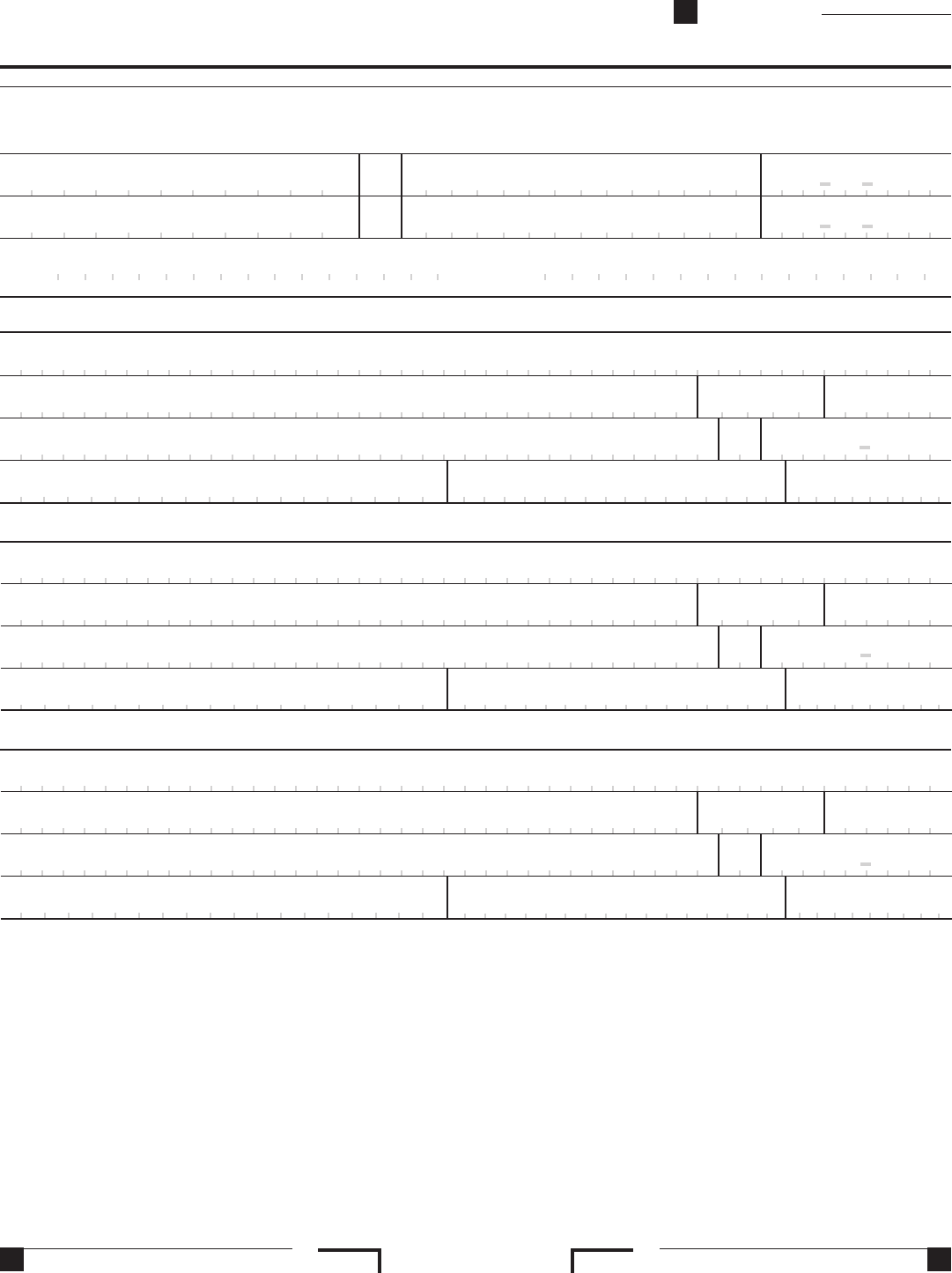

7332133Side 2 FTB 3533 2013

For Privacy Notice, get FTB 1131 ENG/SP.

Complete this part if you filed any of the following business, estate or trust income tax returns (Forms 100, 100S, 100W, 109, 199, 541,

565, or 568)

California corporation number California Secretary of State file number FEIN

Business, Estate, or Trust name

Old additional information

(See instructions)

Old mailing address (suite, room or PO Box). If a PO box, see instructions. PMB/Private Mailbox

City

(If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name Foreign Province/ State/ County Foreign Postal Code

New additional information (See instructions)

New mailing address (suite, room or PO Box,). If a PO box, see instructions. PMB/Private Mailbox

City

(If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name Foreign Province/ State/ County Foreign Postal Code

New business additional information (See instructions)

New business location address

(suite, room or PO Box). If a PO box, see instructions. PMB/Private Mailbox

City

(If you have a foreign address, see instructions.) State ZIP Code

Foreign Country Name Foreign Province/ State/ County Foreign Postal Code

Part II For Businesses, Exempt Organizations, Estates and Trust - Complete This Part to Change Your Business Mailing Address or Business Location

Address

Sign

Here

Part III Signature

Daytime telephone number of person to contact

Your signature Date (mm-dd-yyyy)

If joint tax return, spouse’s/RDP’s signature Date (mm-dd-yyyy)

If Part II is completed, provide signature of owner, officer, or representative Date (mm-dd-yyyy)

Title

( )

Include Side 1 and Side 2 when mailing in this form.

FTB 3533 Instructions 2013

Instructions for Form FTB 3533

Change of Address

General Information

For purposes of California income tax, references to a spouse,

husband, or wife also refer to a California registered domestic partner

(RDP), unless otherwise specified. When we use the initials RDP they

refer to both a California registered domestic “partner” and a California

registered domestic “partnership,” as applicable. For more information

on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic

Partners.

Purpose

Use form FTB 3533, Change of Address, to change your home or

business mailing address or your business location. This address

change will be used for future correspondence. Generally, complete

only one form FTB 3533 to change your home or business address. If

this change also affects the mailing address for your children who filed

separate tax returns, complete a separate form FTB 3533 for each child.

If you are a representative filing for the taxpayer, attach a copy of your

form FTB 3520, Power of Attorney, to this form and write “copy” at the

top of this form.

You may also go to ftb.ca.gov and search for myftb account (individuals

only) or call 800.852.5711 to change your address. If you change your

address online or by phone, you do not need to file this form.

Part I Home Mailing Address

Complete Part I only if you file any of the following individual income tax

returns: Forms 540, 540 2EZ, or the Long or Short Form 540NR.

Part II Business Mailing Address or Business

Location Address

Complete Part II only if you file any of the following business, estate or

trust income tax returns: Forms 100, 100S, 100W, 109, 199, 541, 565,

or 568.

Name and Address

If you complete Part I, enter your first name, middle initial, last name,

social security number (SSN) or individual taxpayer identification

number (ITIN), and address in the spaces provided. If joint tax return,

enter the name and SSN of your spouse/RDP.

If you complete Part II, enter the business, estate, or trust name and

address. Enter a California corporation number or California Secretary

of State File Number and federal employer identification number

(FEIN).

Prior Name(s)

If you or your spouse/RDP changed your name because of marriage,

divorce, etc., enter the prior last name only in the “Prior name(s)” field

in Part I.

Additional Information

If you complete Part I, use the Additional Information field for

“In‑Care‑Of” name or other supplemental address information only.

If you complete Part II, use the Additional Information field for owner,

representative, or attention name or supplemental address information

only.

PO Box

If your post office does not deliver mail to your street address, show

your PO box number instead of your street address.

Foreign Address

If you have a foreign address enter the city, foreign country name,

foreign province/state/county name, and foreign postal code in the

appropriate boxes. Do not abbreviate the foreign country name. Follow

the country’s practice for entering the province/state/county name and

foreign postal code.

Part III Signature

If you complete Part I, you must sign in the space provided. If you filed a

joint tax return, your spouse/RDP must also sign.

If you complete Part II, the owner, officer, or a representative must sign

and enter their title. An officer is the president, vice president, treasurer,

chief accounting officer, etc. A representative is a person who maintains

a valid power of attorney to handle tax matters.

Where to File

Mail this form to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0002

If you moved after you filed your tax return and you are expecting

a refund, notify the post office serving your old address to assist in

forwarding your check to the new address.