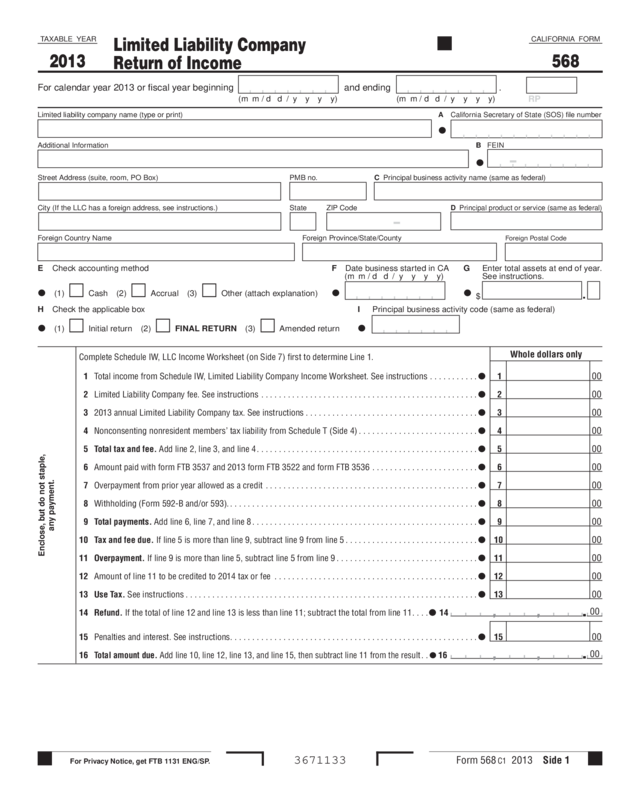

Fillable Printable 2013 Form 568 - Limited Liability Company Return Of Income

Fillable Printable 2013 Form 568 - Limited Liability Company Return Of Income

2013 Form 568 - Limited Liability Company Return Of Income

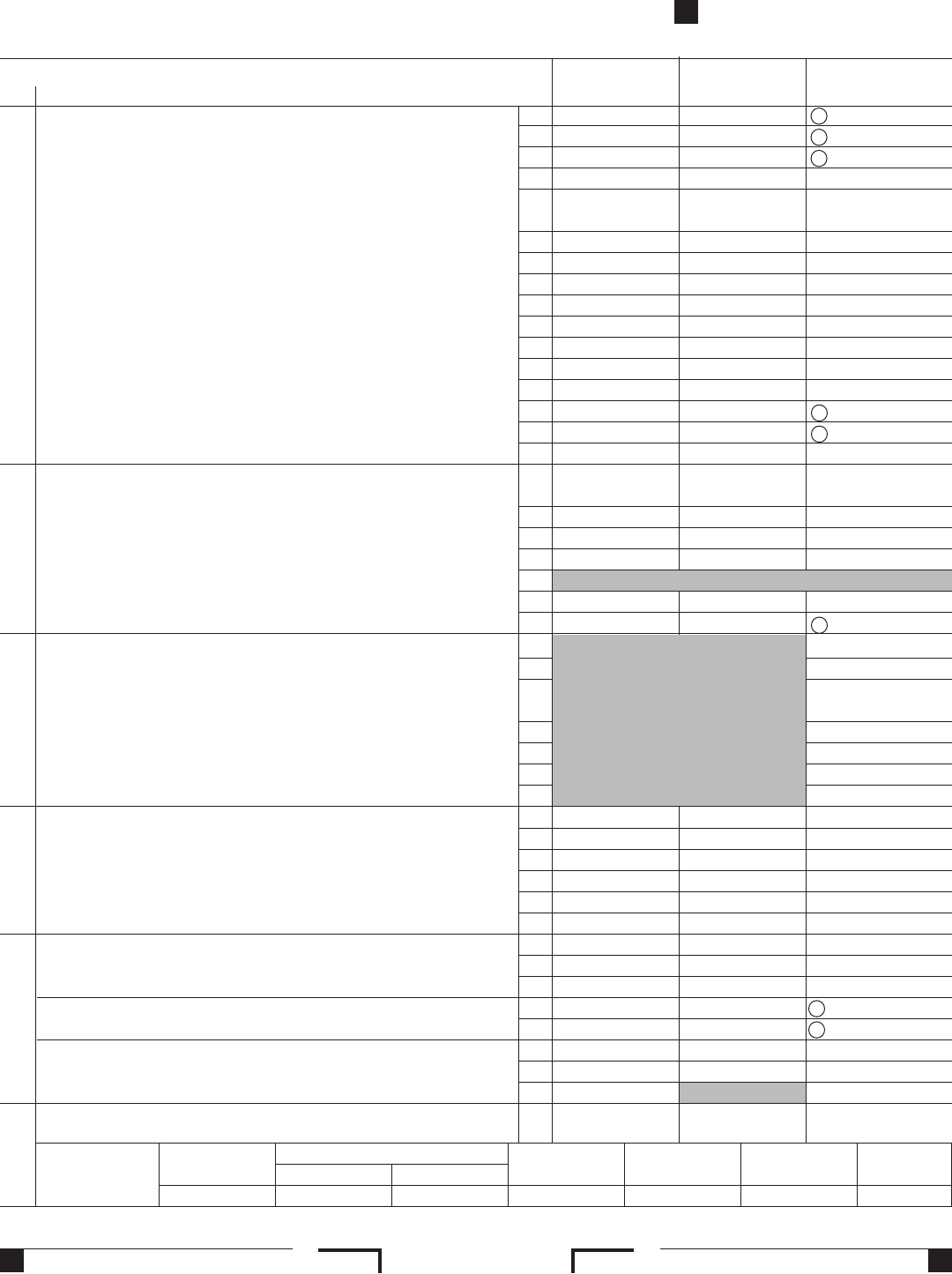

Form 568 C1 2013 Side 1

For Privacy Notice, get FTB 1131 ENG/

SP.

Limited Liability Company

Return of Income

TAXABLE YEAR

2013

CALIFORNIA FORM

568

3671133

For calendar year 2013 or fiscal year beginning and ending .

(m m / d d / y y y y) (m m / d d / y y y y)

Limited liability company name (type or print)

A California Secretary of State (SOS) file number

Additional Information B FEIN

Street Address (suite, room, PO Box) PMB no. C Principal business activity name (same as federal)

City (If the LLC has a foreign address, see instructions.) State ZIP Code

D Principal product or service (same as federal)

Foreign Country Name Foreign Province/State/County Foreign Postal Code

E Check accounting method F Date business started in CA G Enter total assets at end of year.

(m m / d d / y y y y) See instructions.

(1)

m

Cash (2)

m

Accrual (3)

m

Other (attach explanation)

$

H Check the applicable box I Principal business activity code (same as federal)

(1)

m

Initial return (2)

m

FINAL RETURN (3)

m

Amended return

.

Enclose, but do not staple,

any payment.

1 Total income from Schedule IW, Limited Liability Company Income Worksheet. See instructions ........... 1 00

2 Limited Liability Company fee. See instructions ................................................. 2 00

3 2013 annual Limited Liability Company tax. See instructions ....................................... 3 00

4 Nonconsenting nonresident members’ tax liability from Schedule T (Side 4) ........................... 4 00

5 Total tax and fee. Add line 2, line 3, and line 4 .................................................. 5 00

6 Amount paid with form FTB 3537 and 2013 form FTB 3522 and form FTB 3536 ........................ 6 00

7 Overpayment from prior year allowed as a credit ................................................ 7 00

8 Withholding (Form 592-B and/or 593). ........................................................ 8 00

9 Total payments. Add line 6, line 7, and line 8 ................................................... 9 00

10 Tax and fee due. If line 5 is more than line 9, subtract line 9 from line 5 .............................. 10 00

11 Overpayment. If line 9 is more than line 5, subtract line 5 from line 9 ................................ 11 00

12 Amount of line 11 to be credited to 2014 tax or fee .............................................. 12 00

13 Use Tax. See instructions .................................................................. 13 00

14 Refund. If the total of line 12 and line 13 is less than line 11; subtract the total from line 11 .... 14

15 Penalties and interest. See instructions ........................................................ 15 00

16

Total amount due. Add line 10, line 12, line 13, and line 15, then subtract line 11 from the resul

t .. 16

Whole dollars only

.

,

,

00

.

,

,

00

Complete Schedule IW, LLC Income Worksheet (on Side 7) first to determine Line 1.

RP

Get 568 Booklet to see the instructions for the 568 Form

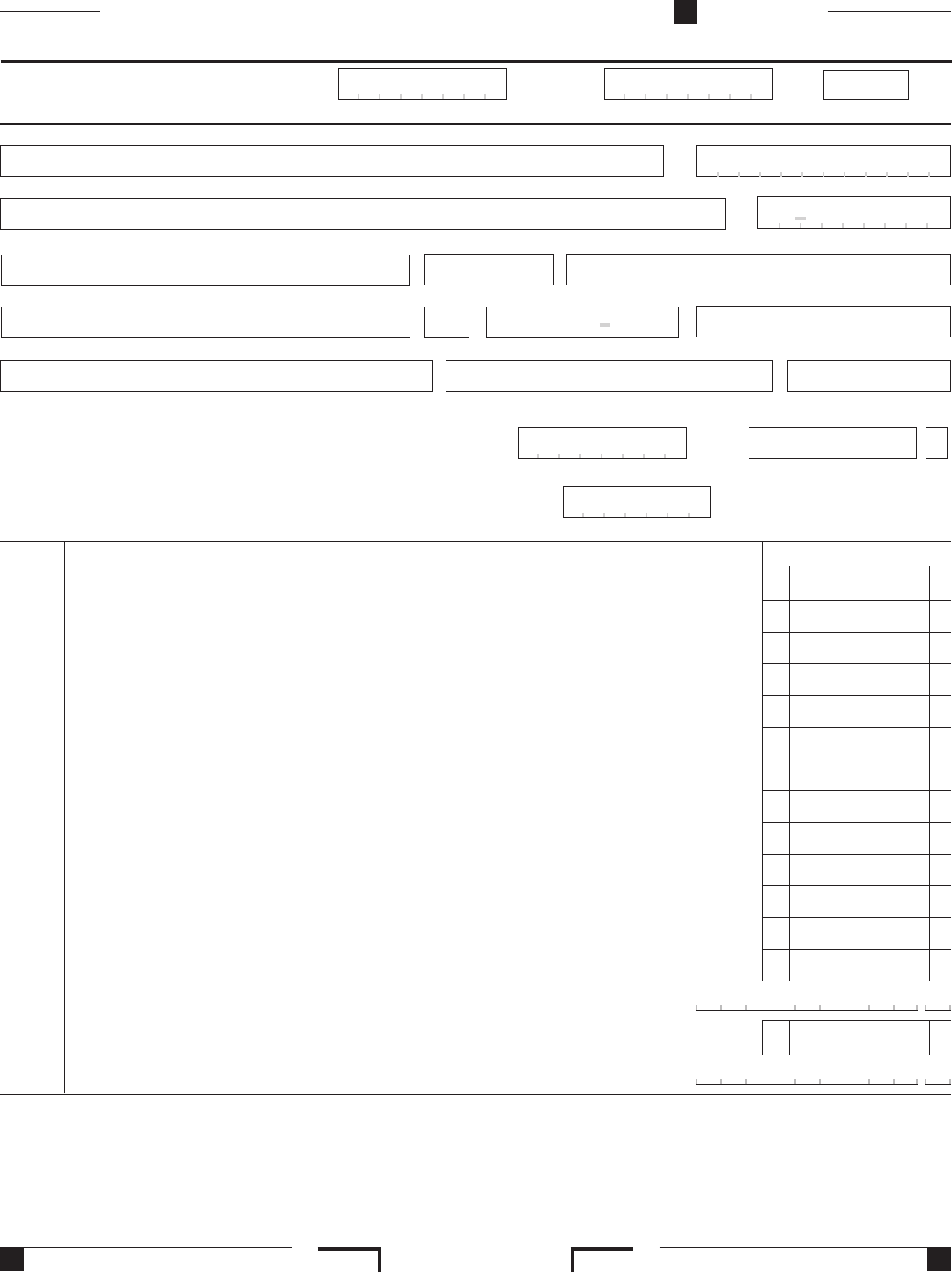

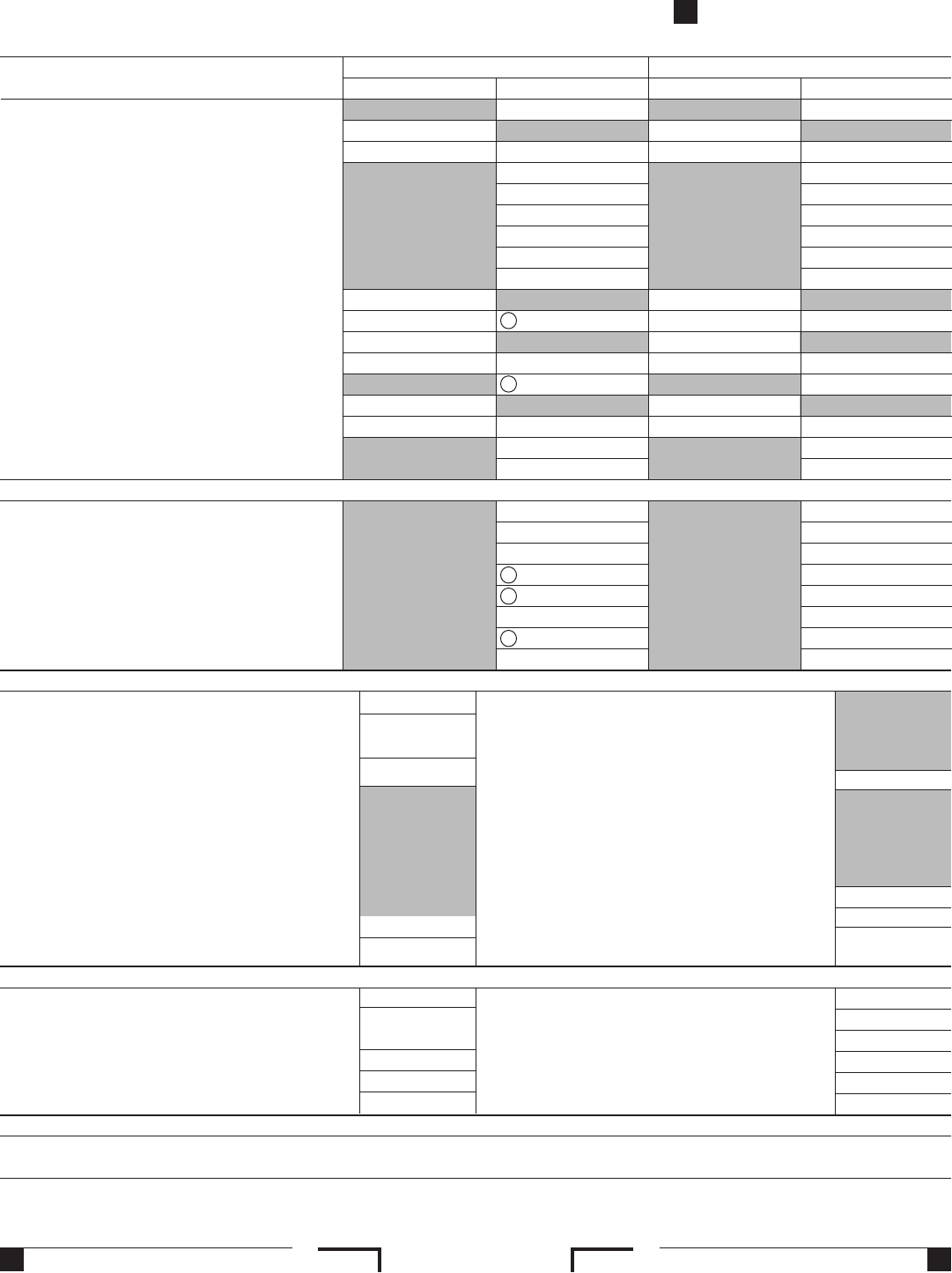

Side 2 Form 568 C1 2013

J Enter the maximum number of members in the LLC at any time during the year. For multiple member LLCs, attach a

California Schedule K-1 (568) for each of these members .........................................................

K Is this LLC an investment partnership? See General Information O .................................................. m Yes m No

L (1) Is this LLC apportioning or allocating income to California using Schedule R?...................................... m Yes m No

(2)

If “No,” was this LLC registered in California without earning any income sourced in this state during the taxable year? ....

m Yes m No

M Was there a distribution of property or a transfer (for example, by sale or death) of an LLC interest during the taxable year? ..... m Yes m No

O (1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this

LLC or any legal entity in which the LLC holds a controlling or majority interest that owned California real property

(i.e., land, buildings), leased such property for a term of 35 years or more, or leased such property from a government

agency for any term?.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . m Yes m No

(2) During this taxable year, did this LLC acquire control or majority ownership (more than a 50% interest) in another legal

entity that owned California real property (i.e., land, buildings), leased such property for a term of 35 years or more,

or leased such property from a government agency for any term?

............................................... m Yes m No

(3) During this taxable year, has more than 50% of the LLC’s ownership interests cumulatively transferred in one or more

transactions after an interest in California real property (i.e., land, buildings) was transferred to it that was excluded

from property tax reassessment under Revenue and Taxation Code Section 62(a)(2) and it was not reported on a

previous year’s tax return?

............................................................................. m Yes m No

(Yes requires filing of statement, penalties may apply– see instructions.)

P (1) Does the LLC have any foreign (non-U.S.) nonresident members?............................................... m Yes m No

(2) Does the LLC have any domestic (non-foreign) nonresident members?........................................... m Yes m No

(3) Were Form 592, Form 592-A, Form 592-B , and Form 592-F filed for these members? ............................... m Yes m No

Q Are any members in this LLC also LLCs or partnerships? ......................................................... m Yes m No

R Is this LLC under audit by the IRS or has it been audited in a prior year? ............................................. m Yes m No

S Is this LLC a member or partner in another multiple member LLC or partnership? ...................................... m Yes m No

If “Yes,” complete Schedule EO, Part I.

T Is this LLC a publicly traded partnership as defined in IRC Section 469(k)(2)? ............................................m Yes m No

U (1) Is this LLC a business entity disregarded for tax purposes? .................................................... m Yes m No

(2)

If “Yes,” see instructions and complete Side 1, Side 2, Side 3, Schedule B, Side 5, and Side 7, if applicable. Are there

credits or credit carryovers attributable to the disregarded entity? ............................................... m Yes m No

(3) If “Yes” to U(1), does the disregarded entity have total income derived from or attributable to California that is less than

the LLC’s total income from all sources?......................................................................m Yes m No

V Has the LLC included a Reportable Transaction, or Listed Transaction within this return?

(See instructions for definitions). If “Yes,” complete and attach federal Form 8886 for each transaction. ..................... m Yes m No

W Did this LLC file the Federal Schedule M-3 (federal Form 1065)? ................................................... m Yes m No

3672133

(continued on Side 3)

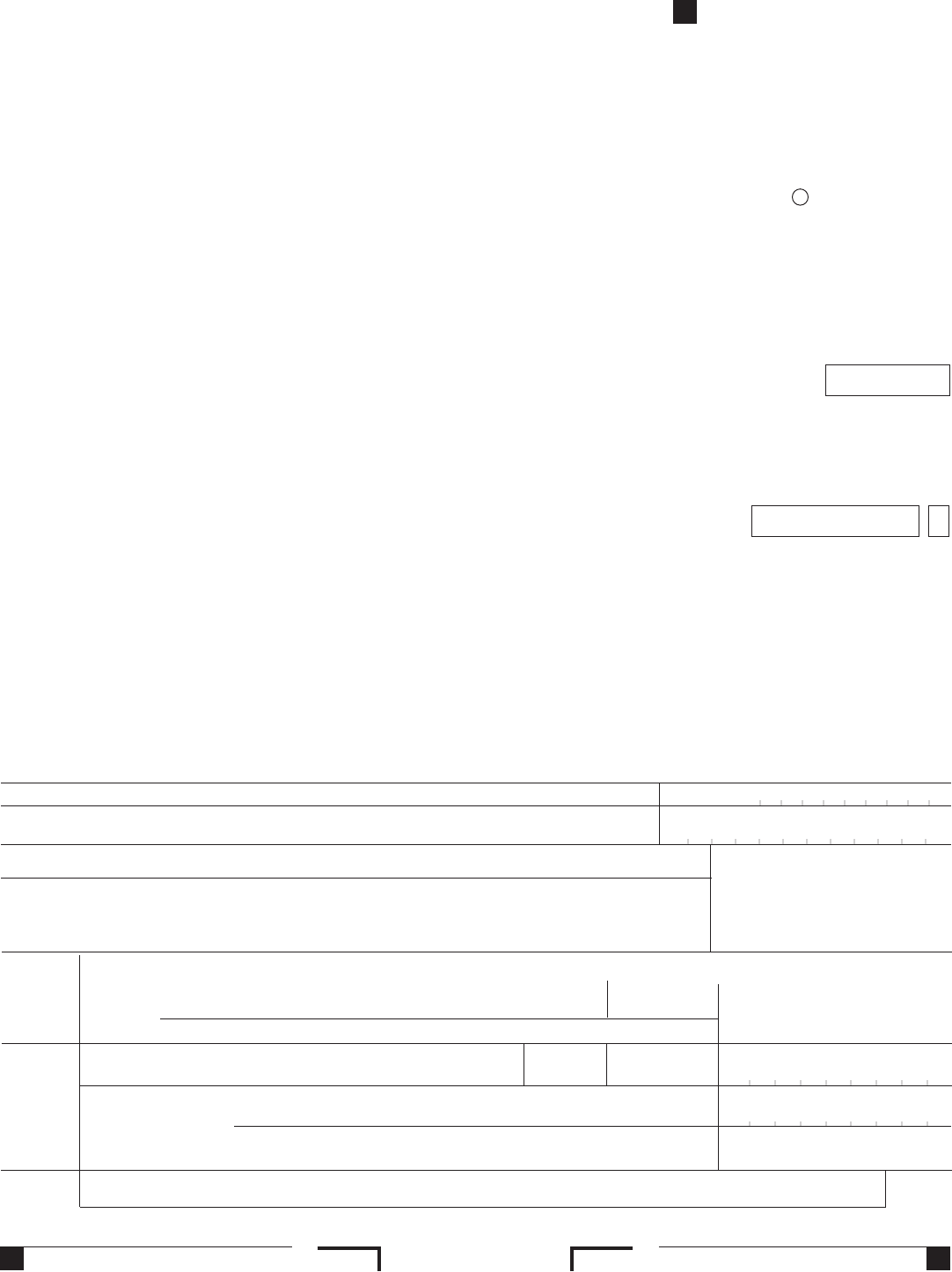

Form 568 C1 2013 Side 3

3673133

X Is this LLC a direct owner of an entity that filed a federal Schedule M-3? ............................................. m Yes m No

Y Does the LLC have a beneficial interest in a trust or is it a grantor of a Trust?.......................................... m Yes m No

If “Yes,” attach schedule of trusts and federal identification numbers.

Z Does this LLC own an interest in a business entity disregarded for tax purposes?.......................................

m Yes m No

If “Yes,” complete Schedule EO, Part II.

AA Is any member of the LLC related (as defined in IRC Section 267(c)(4)) to any other member of the LLC? ................... m Yes m No

BB

Is any member of the LLC a trust for the benefit of any person related (as defined in IRC Section 267(c)(4))

to any other member? .................................................................................... m Yes m No

CC

(1) Is the LLC deferring any income from the disposition of assets? (see instructions).................................. m Yes m No

(2) If “Yes,” enter the year of asset disposition.................................................................

DD Is the LLC reporting previously deferred Income from:

(see instructions) .................................... m Installment Sale m IRC §1031 m IRC §1033 m Other

EE (1) Did this LLC generate a New Jobs Credit?.................................................................. m Yes m No

(2) If “Yes,” enter the generated amount............................................................

FF “Doing business as” name. See instructions:................ _____________________________________________________________________

GG (1) Has this LLC operated as another entity type such as a corporation, S corporation, General Partnership,

Limited Partnership, or Sole Proprietorship in the previous five (5) years? ........................................ m Yes m No

(2) If “Yes”, provide prior FEIN(s) if different, business name(s), and entity type(s) for prior returns

filed with the FTB and/or IRS (see instructions): _________________________________________________________________________________

HH (1) Has this LLC previously operated outside California? ......................................................... m Yes m No

(2) Is this the first year of doing business in California?.......................................................... m Yes m No

(continued from Side 2)

.

00

Single Member LLC Information and Consent — Complete only if the LLC is disregarded.

Sole Owner’s name (as shown on owner’s return)

Street Address, City, State, and ZIP Code

Member’s Consent Statement: I consent to the jurisdiction of the State of California to tax my LLC income and agree to file returns and pay tax

as may be required by the Franchise Tax Board.

Signature

Date Title

Federal TIN/SSN

FEIN/CA Corp no./CA SOS File no.

Return filed with the FTB by the Owner

m (1) Form 540 m (5) Form 541

m (2) Form 100 m (6) Form 100S

m (3) Form 565 m (7) Form 568

m (4) Other _________________

Telephone

( )

Sign

Here

Paid

Preparer’s

Use Only

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature

of officer

Officer’s email address (optional)

PTIN

Firm’s name (or yours,

if self-employed)

and address

Paid

preparer’s

signature

Telephone

( )

Date

Check if

self-employed

m

FEIN

-

May the FTB discuss this return with the preparer shown above (see instructions)?.......... mYes m No

Date

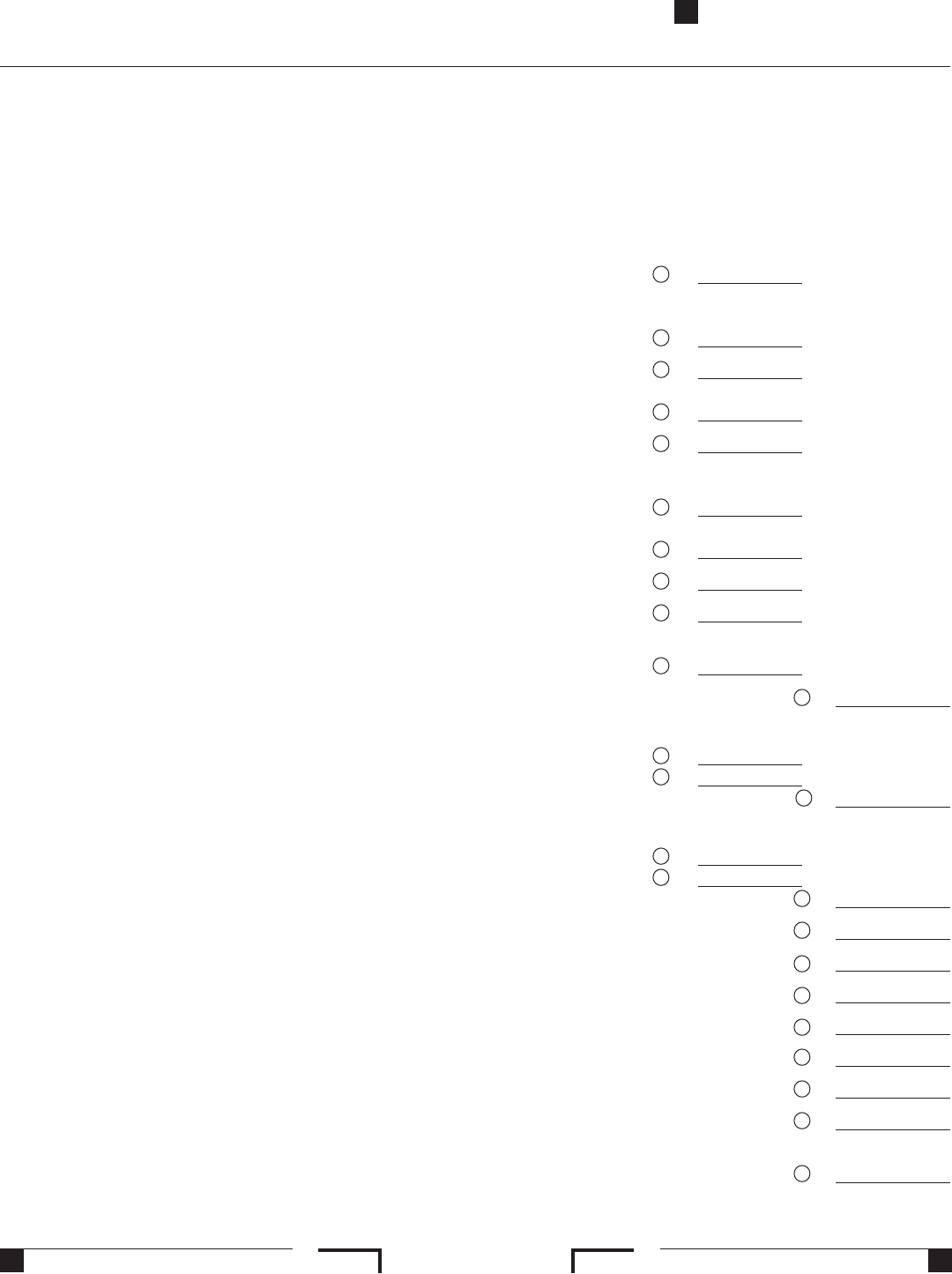

Side 4 Form 568 C1 2013

Schedule A Cost of Goods Sold

1

Inventory at beginning of year .......................................................................... 1 00

2

Purchases less cost of items withdrawn for personal use ..................................................... 2 00

3

Cost of labor ........................................................................................ 3 00

4 Additional IRC Section 263A costs. Attach schedule ......................................................... 4 00

5

Other costs. Attach schedule ........................................................................... 5 00

6

Total. Add line 1 through line 5 ......................................................................... 6 00

7

Inventory at end of year ............................................................................... 7 00

8

Cost of goods sold. Subtract line 7 from line 6. Enter here and on Schedule B, line 2 ................................ 8 00

9

a Check all methods used for valuing closing inventory:

(1) m Cost (2) m Lower of cost or market as described in Treas. Reg. Section 1.471-4 (3) m Write down of “subnormal” goods as

described in Treas. Reg. Section 1.471-2(c) (4) m Other. Specify method used and attach explanation ___________________________

b Check this box if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 ........ m

c Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to the LLC? ..................... m Yes m No

d Was there any change (other than for IRC Section 263A purposes) in determining quantities, cost, or valuations between opening

and closing inventory? If “Yes,” attach explanation

................................................................... m Yes m No

Schedule B Income and Deductions

Caution: Include only trade or business income and expenses on line 1a through line 22 below. See the instructions for more information.

IncomeDeductions

Total the amount of tax due. Enter the total here and on Side 1, line 4. If less than zero enter -0- ....................................________________

3674133

1 a Gross receipts or sales $ ____________ b Less returns and allowances $ ____________ .....c Balance 1c 00

2 Cost of goods sold (Schedule A, line 8)....................................................... 2 00

3 GROSS PROFIT. Subtract line 2 from line 1c................................................... 3 00

4 Total ordinary income from other LLCs, partnerships, and fiduciaries. Attach schedule .................. 4 00

5 Total ordinary loss from other LLCs, partnerships, and fiduciaries. Attach schedule..................... 5 00

6 Total farm profit. Attach federal Schedule F (Form 1040) ......................................... 6 00

7 Total farm loss. Attach federal Schedule F (Form 1040) .......................................... 7 00

8 Total gains included on Schedule D-1, Part II, line 17 (gain only)................................... 8 00

9 Total losses included on Schedule D-1, Part II, line 17 (loss only) .................................. 9 00

10 Other income. Attach schedule ............................................................. 10 00

11 Other loss. Attach schedule................................................................ 11 00

12 Total income (loss). Combine line 3 through line 11 ............................................ 12 00

13 Salaries and wages (other than to members) .................................................... 13 00

14 Guaranteed payments to members .......................................................... 14 00

15 Bad debts ............................................................................. 15 00

16 Deductible interest expense not claimed elsewhere on return...................................... 16 00

17 a Depreciation and amortization. Attach form FTB 3885L $ _________________

b Less depreciation reported on Schedule A and elsewhere on return $ _________________ .... c Balance 17c 00

18 Depletion. Do not deduct oil and gas depletion ................................................... 18 00

19 Retirement plans, etc. ...................................................................... 19 00

20 Employee benefit programs.................................................................. 20 00

21 Other deductions. Attach schedule .......................................................... 21 00

22 Total deductions. Add line 13 through line 21.................................................. 22 00

23 Ordinary income (loss) from trade or business activities. Subtract line 22 from line 12 .................. 23 00

Schedule T Nonconsenting Nonresident Members’ Tax Liability. Attach additional sheets if necessary.

(a)

Member’s name

(b)

SSN, ITIN,

or FEIN

(c)

Distributive

share of income

(d)

Tax

rate

(e)

Member’s

total tax due

(see instructions)

(f)

Amount withheld by this

LLC on this member –

reported on Form 592-B

(g)

Member’s

net tax due

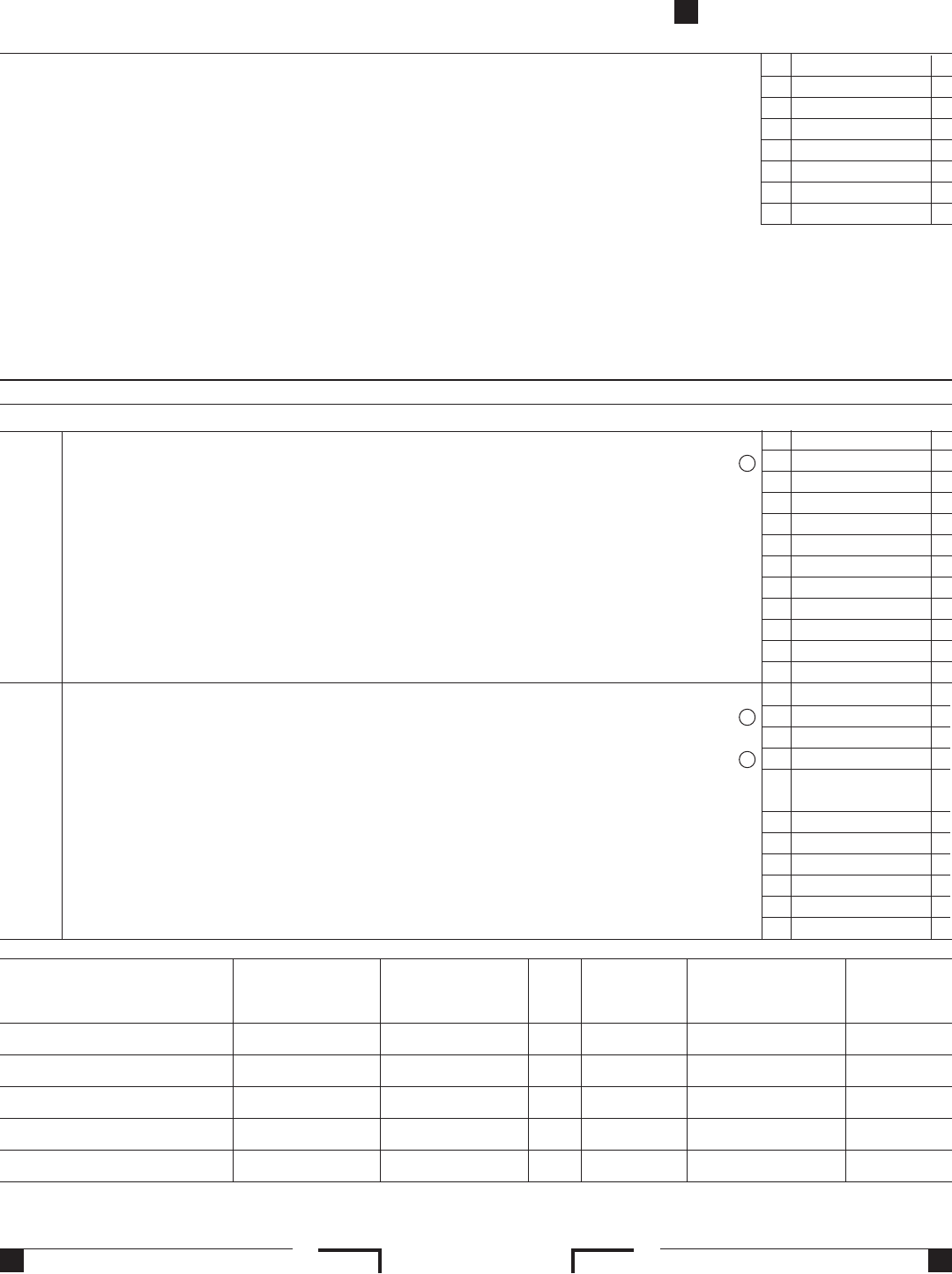

Schedule K Members’ Shares of Income, Deductions, Credits, etc.

(a) (b) (c) (d)

Distributive share items Amounts from California Total amounts using

federal K (1065) adjustments California law

1 Ordinary income (loss) from trade or business activities .................. 1

2 Net income (loss) from rental real estate activities. Attach federal Form 8825..... 2

3 a Gross income (loss) from other rental activities.................... 3a

b Less expenses. Attach schedule................................ 3b

c

Net income (loss) from other rental activities. Subtract line 3b

from line 3a

............................................... 3c

4 Guaranteed payments to members ................................ 4

5 Interest income ............................................... 5

6 Dividends.................................................... 6

7 Royalties .................................................... 7

8 Net short-term capital gain (loss). Attach Schedule D (568) ............. 8

9 Net long-term capital gain (loss). Attach Schedule D (568).............. 9

10 a Total Gain under IRC Section 1231 (other than due to casualty or theft)... 10a

b Total Loss under IRC Section 1231 (other than due to casualty or theft)... 10b

11 a Other portfolio income (loss). Attach schedule. ................... 11a

b Total other income. Attach schedule............................. 11b

c Total other loss. Attach schedule ............................... 11c

b Analysis (a) (b) Individual (c) (d) (e) (f)

of members: Corporate i. Active ii. Passive Partnership Exempt Organization Nominee/Other LLC

Members

Income (Loss)DeductionsCredits

Alternative Minimum

Tax (AMT) Items

Other Information

Analysis

12 Expense deduction for recovery property (IRC Section 179 and R&TC

Sections 17267.2 and 17268). Attach schedule

..................... 12

13 a Charitable contributions. See instructions. Attach schedule........... 13a

b Investment interest expense ...................................... 13b

c 1 Total expenditures to which IRC Section 59(e) election may apply. ...... 13c1

2 Type of expenditures _________________________________________ 13c2

d Deductions related to portfolio income .............................. 13d

e Other deductions. Attach schedule ................................. 13e

15 a Withholding on LLC allocated to all members ........................ 15a

b Low-income housing credit ...................................... 15b

c Credits other than the credit shown on line 15b related to rental real

estate activities. Attach schedule .................................. 15c

d Credits related to other rental activities. Attach schedule ................ 15d

e Nonconsenting nonresident members’ tax paid by LLC ................. 15e

f Other credits. Attach schedule .................................... 15f

g New Jobs Credit ............................................... 15g

17 a Depreciation adjustment on property placed in service after 1986 . . . . . . . . . 17a

b Adjusted gain or loss ........................................... 17b

c Depletion (other than oil and gas).................................. 17c

d Gross income from oil, gas, and geothermal properties ................. 17d

e Deductions allocable to oil, gas, and geothermal properties.............. 17e

f Other alternative minimum tax items. Attach schedule .................. 17f

18 a Tax-exempt interest income ...................................... 18a

b Other tax-exempt income ........................................ 18b

c Nondeductible expenses ......................................... 18c

19 a Distributions of money (cash and marketable securities) ................ 19a

b Distribution of property other than money ........................... 19b

20 a Investment income ............................................. 20a

b Investment expenses ........................................... 20b

c Other information. See instructions ................................ 20c

21 a Total distributive income/payment items. Combine lines 1, 2, and 3c through 11c.

From the result, subtract the sum of lines 12 through 13e. ................. 21a

Form 568 C1 2013 Side 53675133

Side 6 Form 568 C1 2013

Schedule L Balance Sheets. See the instructions for Schedule L, before completing

Schedules L, M-1, and M-2.

Beginning of taxable year End of taxable year

Assets (a) (b) (c) (d)

1 Cash......................................

2 a Trade notes and accounts receivable ..........

b Less allowance for bad debts................

3 Inventories.................................

4 U.S. government obligations ...................

5 Tax-exempt securities ........................

6 Other current assets. Attach schedule . . . . . . . . . . . .

7 Mortgage and real estate loans .................

8 Other investments. Attach schedule..............

9 a Buildings and other depreciable assets ........

b Less accumulated depreciation ..............

10 a Depletable assets .........................

b Less accumulated depletion.................

11 Land (net of any amortization)..................

12 a Intangible assets (amortizable only)...........

b Less accumulated amortization ..............

13 Other assets. Attach schedule ..................

14 Total assets ................................

Liabilities and Capital

15 Accounts payable............................

16 Mortgages, notes, bonds payable in less than 1 year

17 Other current liabilities. Attach schedule ..........

18 All nonrecourse loans ........................

19 Mortgages, notes, bonds payable in 1 year or more .

20 Other liabilities. Attach schedule ................

21 Members’ capital accounts ....................

22 Total liabilities and capital .....................

Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return. Use total amount under California law. See instructions.

( ) ( )

( ) ( )

( ) ( )

( ) ( )

1 Net income (loss) per books ......................

2 Income included on Schedule K, line 1 through

line 11c, not recorded on books this year. Itemize

...

3 Guaranteed payments (other than health insurance)....

4 Expenses recorded on books this year not included

on Schedule K, line 1 through line 13e. Itemize:

a Depreciation ..............$ ______________

b Travel and entertainment ....$ ______________

c Annual LLC tax ............$ ______________

d Other....................$ ______________

e Total. Add line 4a through 4d .................

5 Total of line 1 through line 4e .....................

6 Income recorded on books this year not included

on Schedule K, line 1 through line 11c. Itemize:

a Tax-exempt interest ........$ ______________

b Other ...................$ ______________

c Total. Add line 6a and line 6b ................

7 Deductions included on Schedule K, line 1 through

line 13e, not charged against book income this year.

Itemize:

a Depreciation ..............$ ______________

b Other ...................$ ______________

c Total. Add line 7a and line 7b ................

8 Total. Add line 6c and line 7c. ....................

9 Income (loss) (Schedule K, line 21a). Subtract

line 8 from line 5

..............................

1 Balance at beginning of year .....................

2 Capital contributed during year

a Cash ...................................

b Property ................................

3 Net income (loss) per books .....................

4 Other increases. Itemize ......................

5 Total of line 1 through line 4 .....................

6 Distributions: a Cash.......................

b Property....................

7 Other decreases. Itemize......................

8 Total of line 6 and line 7 ........................

9 Balance at end of year. Subtract line 8 from line 5.....

Schedule M-2 Analysis of Members’ Capital Accounts. Use California amounts.

3676133

Schedule O Amounts from Liquidation used to Capitalize a Limited Liability Company. (Complete only if initial return box is checked on Side 1, Question H).

Name of entity liquidated (if more than one, attach a schedule) _____________________________________________________________________________

Type of entity: m (1) C Corporation m (2) S Corporation m (3) Partnership m (4) Limited Partnership m (5) Sole Proprietor m (6) Farmer

Entity identification number(s) FEIN __________________ SSN or ITIN __________________ Corporation _________________ CA SOS_______________

Amount of liquidation gains recognized to capitalize the LLC .......................................................... ___________________

Form 568 C1 2013 Side 7

Schedule IW Limited Liability Company (LLC) Income Worksheet

Enter your California income amounts on the worksheet. All amounts entered must be assigned for California law differences. Use only amounts that are from

sources derived from or attributable to California when completing lines 1-17 of this worksheet. If your business is both within and outside of California, see

Schedule IW instructions to assign the correct amounts to California. If the LLC is wholly within California, the total income amount is assigned to California and

is entered beginning with line 1a. If the single member LLC (SMLLC) does not meet the 3 million criteria for filing Schedule B (568) and Schedule K (568), the

SMLLC is still required to complete Schedule IW. Disregarded entities that do not meet the filing requirements to complete Schedule B or Schedule K should prepare

Schedule IW by entering the California amounts attributable to the disregarded entity from the member’s federal Schedule B, C, E, F (Form 1040), or additional

schedules associated with other activities. Do not enter amounts on this worksheet that have already been reported by another LLC to determine its fee.

See instructions on page 13 of the Form 568 Booklet for more information on how to complete Schedule IW.

1 a Total California income from Form 568, Schedule B, line 3. See instructions .................... 1a

b Enter the California cost of goods sold from Form 568, Schedule B, line 2 and from federal

Schedule F (Form 1040) (plus California adjustments) associated with the receipts assigned to

California on line 1a

................................................................ 1b

2 a Gross California income of disregarded entities not included in lines 1 and 8 through 16 .......... 2a

b Enter the cost of goods sold of disregarded entities associated with the receipts assigned to

California on line 2a

................................................................ 2b

3 a LLC’s distributive share of ordinary income from pass-through entities ........................ 3a

b Enter the LLC’s distributive share of cost of goods sold from other pass-through entities

associated with the receipt assigned to California on line 3a (see Schedule K-1s (565),

Table 3, line 1a)

................................................................... 3b

c Enter the LLC’s distributive share of deductions from other pass-through entities associated with

the receipt assigned to California on line 3a (see Schedule K-1s (565), Table 3, line 1b)

........... 3c

4 Add gross farm income from federal Schedule F (Form 1040). Use California amounts . . . . . . . . . . . . . . . 4

5 Enter the total of other income (not loss) from Form 568, Schedule B, line 10 ...................... 5

6 Enter the ordinary gains (not losses) and the recapture income from California Schedule D-1,

Part II, line 17

....................................................................... 6

7 Add line 1a through line 6 ................................................................................ 7

8 California rental real estate

a Enter the total gross rents from federal Form 8825, line 18a ................................ 8a

b Enter the total gross rents from all Schedule K-1s (565), Table 3, line 2 ........................ 8b

c Add line 8a and line 8b ................................................................................ 8c

9 Other California rentals.

a Enter the amount from Schedule K (568), line 3a ......................................... 9a

b Enter the amount from all Schedule K-1s (565), Table 3, line 3. .............................. 9b

c Add lines 9a and 9b ................................................................................... 9c

10

California interest. Enter the amount from Form 568, Schedule K, line 5............................................. 10

11

California dividends. Enter the amount from Form 568, Schedule K, line 6 ........................................... 11

12

California royalties. Enter the amount from Form 568, Schedule K, line 7 ............................................ 12

13

California capital gains. Enter the capital gains (not losses) included in Schedule D (568). .............................. 13

14

California 1231 gains. Enter the amount of total gains (not losses) from Form 568, Schedule K, line 10a ................... 14

15

Other California portfolio income (not loss). Enter the amount from Form 568 Schedule K, line 11a ....................... 15

16

Other California income (not loss) not included in line 5. Enter the amount from Form 568, Schedule K, line 11b ............ 16

17

Total California income. Add lines 7, 8c, 9c, 10, 11, 12, 13, 14, 15, and 16. Line 17 may not be a negative number.

Enter here and on Form 568, Side 1, Line 1. If less than zero enter -0-

.............................................. 17

3677133