Fillable Printable 2014 Form 10, Underpayment Of Estimated Tax, 150-101-031

Fillable Printable 2014 Form 10, Underpayment Of Estimated Tax, 150-101-031

2014 Form 10, Underpayment Of Estimated Tax, 150-101-031

1

150-101-031 (Rev. 12-14)

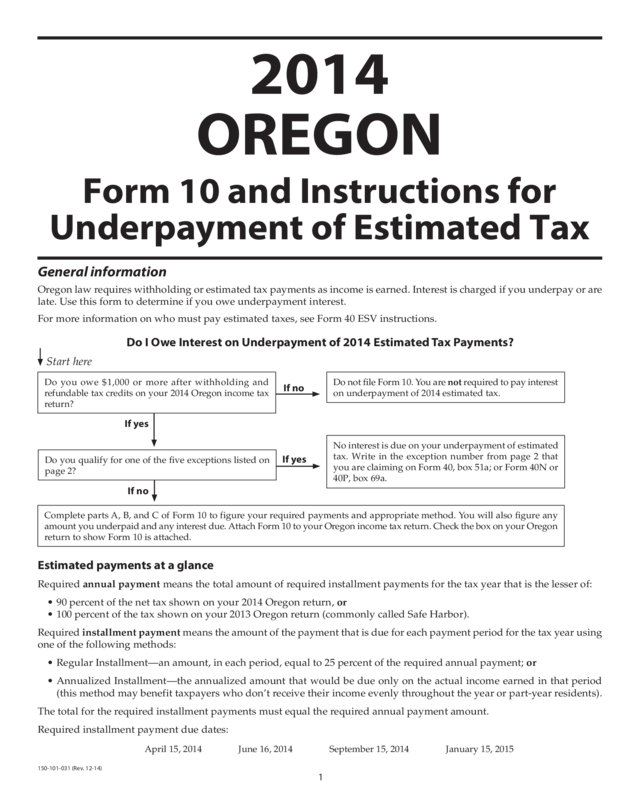

General information

Oregon law requires withholding or estimated tax payments as income is earned. Interest is charged if you underpay or are

late. Use this form to determine if you owe underpayment interest.

For more information on who must pay estimated taxes, see Form 40 ESV instructions.

Do I Owe Interest on Underpayment of 2014 Estimated Tax Payments?

Do you owe $1,000 or more after withholding and

refundable tax credits on your 2014 Oregon income tax

return?

If yes

If yes

If no

Start here

If no

2014

OREGON

Form 10 and Instructions for

Underpayment of Estimated Tax

Do you qualify for one of the five exceptions listed on

page 2?

Do not file Form 10. You are not required to pay interest

on underpayment of 2014 estimated tax.

Complete parts A, B, and C of Form 10 to figure your required payments and appropriate method. You will also figure any

amount you underpaid and any interest due. Attach Form 10 to your Oregon income tax return. Check the box on your Oregon

return to show Form 10 is attached.

No interest is due on your underpayment of estimated

tax. Write in the exception number from page 2 that

you are claiming on Form 40, box 51a; or Form 40N or

40P, box 69a.

Estimated payments at a glance

Required annual payment means the total amount of required installment payments for the tax year that is the lesser of:

• 90 percent of the net tax shown on your 2014 Oregon return, or

• 100 percent of the tax shown on your 2013 Oregon return (commonly called Safe Harbor).

Required installment payment means the amount of the payment that is due for each payment period for the tax year using

one of the following methods:

• Regular Installment—an amount, in each period, equal to 25 percent of the required annual payment; or

• Annualized Installment—the annualized amount that would be due only on the actual income earned in that period

(this method may benefit taxpayers who don’t receive their income evenly throughout the year or part-year residents).

The total for the required installment payments must equal the required annual payment amount.

Required installment payment due dates:

April 15, 2014 June 16, 2014 September 15, 2014 January 15, 2015

2

150-101-031 (Rev. 12-14)

General information

Oregon law requires withholding or estimated tax payments

as income is earned. Interest is charged if you underpay or

are late. Use this form to determine if you owe underpay-

ment interest.

For more information on who must pay estimated taxes, see

Form 40 ESV instructions.

Instructions

These instructions are for lines not fully explained on the form.

Line 1—Claiming an exception

If you qualify for one of the following exceptions, enter the

exception number on Form 40, line 51a; or Form 40N or Form

40P, line 69a; and on line 1 of your Form 10. Keep proof of

the exception with your tax records.

Exception 1—Farmers and commercial fishermen.

If at least two-thirds (66.7 percent) of your 2013 or 2014 total

gross income is from farming or fishing, you don’t have to

pay underpayment interest.

Gross income includes items such as wages, interest, and

dividends. It also includes gross income from rentals, royal-

ties, businesses, farming, fishing, and the sale of property.

When figuring gross income, subtract only the cost of goods

sold. When figuring gross income on the sale of property,

subtract only the adjusted basis or cost.

Farmers. Use the amounts on the following lines of both

your 2013 and 2014 federal income tax returns to determine

your gross income from farming:

• Federal Schedule F, line 9;

• Federal Schedule E, line 42;

• Federal Form 4797, line 20. (Include only sales of livestock

held for drafting, breeding, dairy, or sporting purposes.)

Fishermen. Use the amounts on the following lines of both

your 2013 and 2014 federal income tax returns to determine

your gross income from fishing:

• Federal Schedule C, line 5;

• Federal Schedule C-EZ, line 1;

• Federal Schedule E, line 42.

Exception 2—Prior year.

You meet this exception if all of the following are true:

• You were a full-year Oregon resident in 2013; and

• Your net income tax for 2013 was -0- or you were not

required to file a return for 2013; and

• Your tax year was a full 12 months.

Your 2013 net income tax is your Oregon income tax after

tax credits, including refundable tax credits, but before

withholding, estimated tax payments, or payments made

with an extension.

Note: If you were a nonresident or a part-year resident in

2013, you can’t use this exception. However, you may be

able to use the prior year tax to determine your required

annual payment. See Part A instructions on this page.

Exception 3—Retired or disabled AND have a reasonable

cause for the underpayment.

You meet this exception if:

• There was reasonable cause for underpaying your esti-

mated tax, AND

— You retired at age 62 or older during 2013 or 2014, or

— You became disabled during 2013 or 2014.

Reasonable cause will be decided on a case-by-case basis.

The extent of your effort to comply with the law will be con-

sidered. Attach a statement to your Oregon return explaining

the cause to be considered for the exception. Label the state-

ment “Form 10 Attachment” at the top center of the page.

Exception 4—Underpayment due to unusual circumstances.

No interest is due if your underpayment is due to a casualty,

disaster, or other unusual circumstance. Unemployment

does not qualify as an unusual circumstance. Books and

records that are destroyed by fire, flood, or other natural

disaster may qualify as an unusual circumstance. Unusual

circumstances will be determined on a case-by-case basis.

The extent of your effort to comply with the law will be con-

sidered. Attach a statement to your Oregon return explaining

the cause to be considered for the exception. Label the state-

ment “Form 10 Attachment” at the top center of the page.

Exception 5—S corporation shareholders.

No interest is due on underpayment of S corporation income

as a shareholder if:

• The income is for the first year S corporation status is

elected; and

• You’re a nonresident for 2014; or

• You were a part-year resident for 2013.

Contact us to see if you meet this exception.

PART A—Figure your required annual payment

Line 2. Fill in your 2014 net income tax amount from Form

40, line 41; or Form 40N or 40P, line 58.

Line 3. Fill in your total 2014 refundable tax credit amounts

from Form 40, lines 43a, 43b, and lines 44–46; or Form 40N

or 40P, lines 60a, 60b, and lines 62–64.

Line 6. Fill in only your Oregon income tax withheld from

income. Don’t include any estimated tax payments.

Line 8. Enter your 2013 tax after all credits, Form 40, line 41

minus the amounts claimed on line 43 for the wolf depreda-

tion and claim of right credits, minus lines 44–46; or Form

40N or 40P, line 58 minus the amounts claimed on line 60

for the wolf depredation credit and claim of right credit,

minus lines 62–64. If your 2013 tax after credits is less than

zero, enter -0-.

If you didn’t file a return for 2013, or your 2013 tax year was

less than 12 months, don’t complete line 8. Enter the amount

from line 5 on line 9. Note: If you were a part-year resident

3

150-101-031 (Rev. 12-14)

or nonresident in 2013 and you have a tax year of 12 months,

you may use the tax shown on your 2013 Form 40N or 40P,

line 58 minus the amounts claimed on line 60 for the wolf

depredation credit, claim of right credit, minus lines 62–64.

PART B—Figure your required installment

payment

Line 11. Divide line 9 by four and enter the amount in

each column. If you moved into or out of Oregon in 2014, use

the column(s) that correspond to the dates you lived in Oregon.

Divide the amount on line 9 by the number of periods you

were a resident of Oregon. This is your required regular

installment payment for the period.

OR

If you annualized your income using the Annualized Income

Worksheet on the back of Form 10, enter the amounts from

line 31 of the worksheet instead of four equal payments.

These are your required annualized installments. If you

annualize, check box 51b on Form 40, or 69b on Form 40N

or 40P.

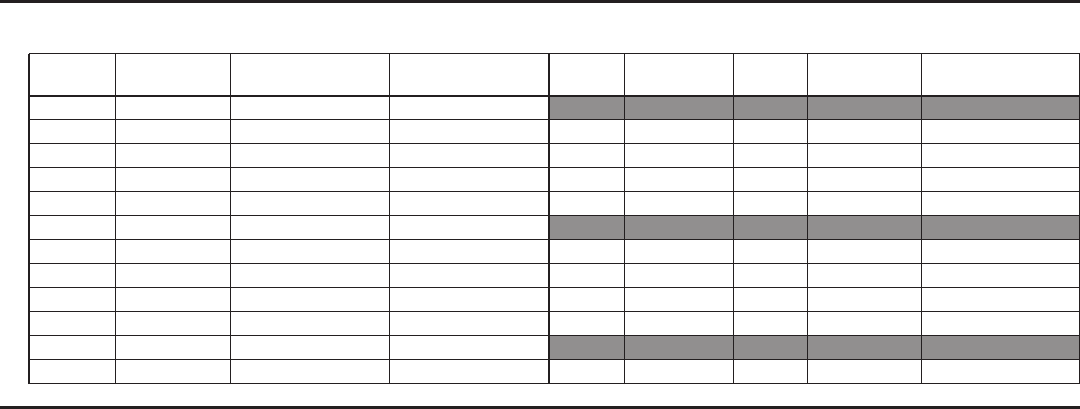

PART C—Figure your interest

Interest is calculated on the balance of tax due (running bal-

ance) between event dates. The required payments due on

April 15, 2014, June 16, 2014, September 15, 2014, and Janu-

ary 15, 2015, increase your running balance. Withholding

and estimated payments decrease your running balance.

Underpayment interest accrues until the balance is paid in

full or April 15, 2015, whichever is earlier. Interest will con-

tinue to accrue on any tax due after April 15, 2015, and will

be computed separately.

Date and amount columns

Lines 12, 17, 22, and 28. Enter your required payments from

line 11 in the Amount column for each corresponding period.

If the required payment is zero, enter -0-.

Lines 13, 18, 23, and 29. Fill in one quarter of the Oregon

income tax withheld from your income. Enter the figure

in the Amount column for the four withholding payment

dates. If you did not have any withholding during that

period, enter -0-. Withholding is considered to be paid in

equal amounts on the required payment dates (usually four),

unless you prove otherwise.

Lines 14, 15, and 16. Enter the dates and amounts of any

estimated payments you made before June 16, 2014, in date

order. All payments made on or before April 15, 2014, can be

added together and entered on line 14.

Lines 19, 20, and 21. Enter the dates and amounts of any

estimated payments you made from June 16, 2014, through

September 14, 2014, in date order.

Lines 24, 25, and 26. Enter the dates and amounts of any

estimated payments you made from September 15, 2014,

through January 14, 2015, in date order.

Lines 30, 31, and 32. Enter the dates and amounts of any esti-

mated payments you made from January 15, 2015, through

April 14, 2015, in date order.

Running balance column

Running balance is the amount of tax due at any given time

during the year. Start on line 12 and work your way down.

The required payments on lines 12, 17, 22, and 28 increase

your running balance. Withholding and estimated payments

on the other lines decrease your running balance. If there is

no withholding payment for the period, your running bal-

ance will be the same as shown on the required payment line.

The rate change on line 27 has no effect on your running bal-

ance. Your running balance can be positive, negative, or zero.

Example 1: Catelyn has a required payment of $5,000 every

period. Her total withholding is $14,000 for 2014 ($3,500 each

period). Catelyn made estimated tax payments of $2,500 on

May 16, 2014, and July 15, 2014, and $3,000 on August 15,

2014. Catelyn’s running balance as of September 15, 2014, is

negative $3,500.

No. of Monthly No. of Daily Interest

Date Event Amount Running balance months rate days rate due

12. 4/15/14 Req. pymt. $5,000.00 $5,000.00

13. 4/15/14 Withholding $3,500.00 $1,500.00 0.003333 0.000110

14. 5/16/14 Payment $2,500.00 ($1,000.00) 0.003333 0.000110

15. Payment 0.003333 0.000110

16. Payment 0.003333 0.000110

17. 6/16/14 Req. pymt. $5,000.00 $4,000.00

18. 6/16/14 Withholding $3,500.00 $500.00 0.003333 0.000110

19. 7/15/14 Payment $2,500.00 ($2,000.00) 0.003333 0.000110

20. 8/15/14 Payment $3,000.00 ($5,000.00) 0.003333 0.000110

21. Payment 0.003333 0.000110

22. 9/15/14 Req. pymt. $5,000.00 $0.00

23. 9/15/14 Withholding $3,500.00 ($3,500.00) 0.003333 0.000110

Example 1. Date, amount, and running balance columns

4

150-101-031 (Rev. 12-14)

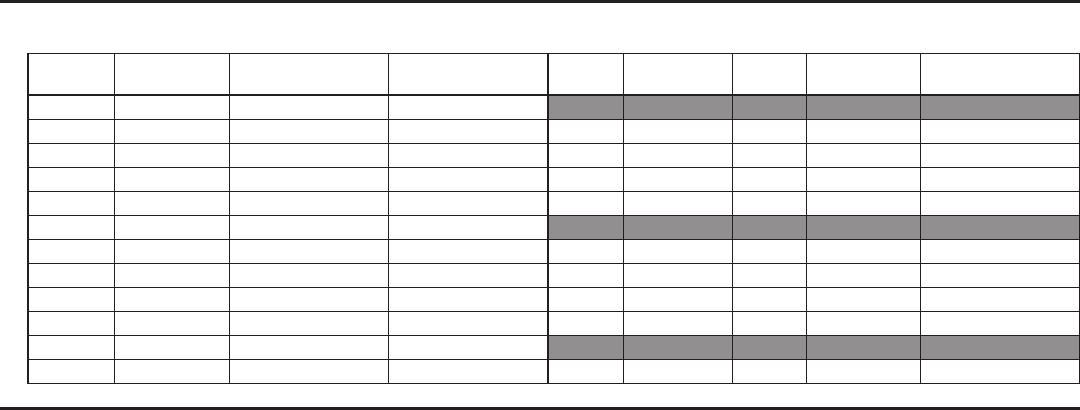

Months and days columns

Count the number of full months and days between the first

event that creates a positive running balance and the next

event that changes your running balance. You will not count

the number of days between required payments and with-

holding payments because they are on the same day. Enter

the months and days in the same row as your first event.

Continue entering the number of full months and days

between events down the column until you reach the last

event that affects your running balance. Count the number of

full months and days between the last event in your column

and April 15, 2015. Underpayment interest is not calculated

past April 15, 2015, the due date of the return.

If the running balance is negative or zero, do not calculate

the number of days between the day the running balance

becomes negative or zero and the next event.

Example 2: Using the information on page 3, Catelyn does

not calculate the number of days between her first required

payment and first withholding payment. The department

recognizes her required payment and withholding on the

same day. There is one full month and one day between

Catelyn’s first withholding payment and first estimated tax

payment. Catelyn will enter “1” in the month column on line

13 and “1” in the days column on line 13.

Example 3: Using the information on page 3, Catelyn’s

estimated tax payment on May 16, 2014, creates a negative

running balance on line 14. Because she has met the required

payments to date, she will not owe further underpayment

interest this period. It is not necessary for her to calculate the

number of days between her estimated tax payment and her

required payment on June 16, 2014.

Interest column

To calculate your interest, multiply your positive running

balance by the number of full months and the monthly rate.

Add to this your positive running balance multiplied by the

number of days and the daily rate. Do not calculate interest

on a negative or zero running balance.

Example 4: On line 13, Catelyn has a running balance of

$1,500 for one month and one day. The interest that accrues

during this period totals $5.17 ([1,500 × 1 × 0.003333] + [1,500

× 1 × 0.000110]). Catelyn later has a balance of $500 for 29

days. The interest that accrues during that period totals $1.60

(500 x 29 x 0.000110).

Line 34. Add the amounts in the interest column. Round to

the nearest whole dollar and enter here and on Form 40, line

51; or Form 40N or Form 40P, line 69.

No. of Monthly No. of Daily Interest

Date Event Amount Running balance months rate days rate due

12. 4/15/14 Req. pymt. $5,000.00 $5,000.00

13. 4/15/14 Withholding $3,500.00 $1,500.00 1 0.003333 1 0.000110 5.17

14. 5/16/14 Payment $2,500.00 ($1,000.00) – 0.003333 – 0.000110

15. Payment 0.003333 0.000110

16. Payment 0.003333 0.000110

17. 6/16/14 Req. pymt. $5,000.00 $4,000.00

18. 6/16/14 Withholding $3,500.00 $500.00 – 0.003333 29 0.000110 1.60

19. 7/15/14 Payment $2,500.00 ($2,000.00) – 0.003333 – 0.000110

20. 8/15/14 Payment $3,000.00 ($5,000.00) – 0.003333 – 0.000110

21. Payment 0.003333 0.000110

22. 9/15/14 Req. pymt. $5,000.00 $0.00

23. 9/15/14 Withholding $3,500.00 ($3,500.00) – 0.003333 – 0.000110

Examples 2, 3, and 4. Months, days, and interest columns

5

150-101-031 (Rev. 12-14)

Instructions for Annualized Income

Worksheet (Form 10, page 2)

Note: Are you using the Annualized Income Worksheet to

compute your 2015 estimated tax payments? If so, see page

6 for further instructions.

Part-year residents. If you moved into or out of Oregon dur-

ing the year, use only the columns that include the dates you

lived in Oregon. You must multiply your Oregon tax (line

18), exemption credit (line 19), and prorated credits (line 20)

by your Oregon percentage.

Nonresidents. You must multiply your federal tax subtrac-

tion (line 9), itemized deductions or standard deduction (line

11 or 14), exemption credit (line 19), and prorated credits

(line 20) by your Oregon percentage.

Line 1. Enter your adjusted gross income (AGI) (Form 40, line

8; Form 40N, line 30S; or Form 40P, line 30F) received during

the period shown at the top of each column.

Example 1: Carley received wages for the entire year of 2014.

Three months’ wages belong in column A, five months in

column B, eight months in column C, and all 12 months in

column D. She also received a lump-sum distribution of

$25,000 from her IRA on July 18, 2014. Carley includes the

total amount of the distribution in columns C and D only.

If Carley received the lump-sum distribution on April 25,

2014, instead, she includes it in columns B, C, and D.

Line 2. Enter the amount of Oregon additions (Form 40, line

11; Forms 40N or 40P, line 34S) claimed during the period

shown at the top of each column.

Example 2: Payton has an Oregon addition of $6,000 for

California bond interest received in September 2014. Payton

enters the $6,000 in column D. If she received the interest at

$500 a month, she would enter $1,500 (for three months) in

column A, $2,500 (for five months) in column B, $4,000 (for

eight months) in column C, and all $6,000 (for 12 months)

in column D.

Line 6. Enter the amount of Oregon subtractions (Form

40, line 19; Forms 40N or 40P, line 37S) claimed during the

period shown at the top of each column, less the federal tax

liability subtraction.

Line 9. Compute your federal tax subtraction on your annual-

ized income using the Federal Tax Subtraction Worksheet below.

Do not use this worksheet if your federal adjusted gross

income is more than $125,000 (filing status of single/married

filing separately) or $250,000 (filing status of married filing

jointly or head of household). Use the worksheet in the 2014

Form 40 instructions, page 14.

If you are filing Form 40N, multiply your federal tax sub-

traction by your Oregon percentage from Form 40N, line 39.

Line 11. Enter only the amount of your net Oregon itemized

deductions claimed for the period shown at the top of each column.

Example 3: Generally, home mortgage interest is a deduction

paid evenly throughout the year. Three months of home

mortgage interest belong in column A (January, February,

and March), five months in column B, eight months in col-

umn C, and all 12 months of interest in column D.

Example 4: Medical expenses claimed as medical deductions

generally are not incurred evenly throughout the tax year.

For example, Jill made deductible payments on a hospital

bill in 2014. She made a payment of $990 in April, another

of $1,995 in June, and the final payment of $2,271 in October.

(All amounts are after the federal AGI limitation.) Jill will

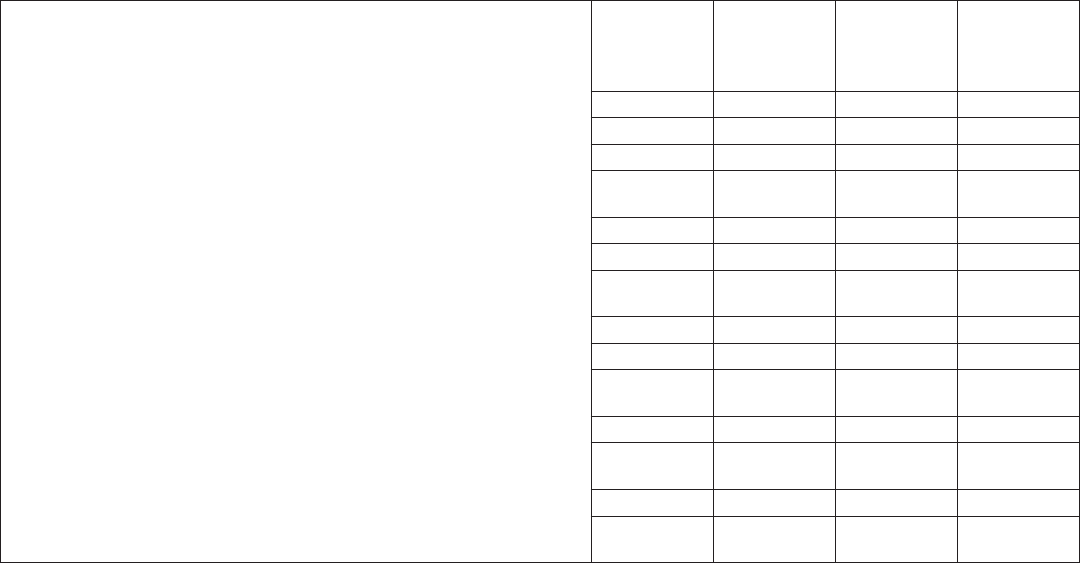

Federal Tax Subtraction Worksheet (line 9 )

(A)

Jan 1

to

Mar 31

(B)

Jan 1

to

May 31

(C)

Jan 1

to

Aug 31

(D)

Jan 1

to

Dec 31

1. Enter the amount of your federal AGI for each period .................. 1

2. Annualization multiplier ...................................................................2

4 2.4 1.5 1

3. Multiply line 1 by line 2 ......................................................................3

4. Actual federal itemized deductions for each period.

If you do not itemize, skip to line 7 of this worksheet ...................4

5. Annualization multiplier ...................................................................5

4 2.4 1.5 1

6. Multiply line 4 by line 5 ......................................................................6

7. Enter the full amount of your 2014 federal standard

deduction in each column ..................................................................7

8. Enter line 6 or line 7, whichever is larger ......................................... 8

( ) ( ) ( ) ( )

9. Line 3 minus line 8 .............................................................................. 9

10. 2014 federal exemption amount (Form 1040, line 42,

or Form 1040A, line 26) ....................................................................10

( ) ( ) ( ) ( )

11. Annualized federal taxable income. Line 9 minus line 10 ........... 11

12. Federal tax on line 11 amount for each

period (use the federal tax tables) ...................................................12

13. Enter $6,350 ($3,175 if filing separately) in each column .............13

14. Enter the smaller of line 12 or 13. Also enter this amount in

each column on line 9 of the Annualized Income Worksheet .....14

6

150-101-031 (Rev. 12-14)

enter the $990 payment in column B. The April payment plus

the June $1,995 payment (totaling $2,985) will go in column

C. In column D, she will enter $5,256, the total deductible

amount of all three payments.

Line 14. If you are married/RDP filing separately and your

spouse/RDP itemizes deductions, the amount on this line is

-0-. You must itemize your deductions.

Line 18. Use the tax tables or tax rate chart in your 2014

Oregon income tax booklet. Line 17 is your annualized

Oregon taxable income for each column.

Line 20. Enter credit amounts that apply only to each period.

Example 5: Sam installed a residential alternative energy

device on September 4. He qualifies for a credit of $160. Sam

includes $160 in column D only.

Estimating your 2015 tax payments

You can use the Annualized Income Worksheet as a guide

to compute your 2015 annualized estimated tax payments.

Follow the instructions provided for the worksheet. When

completing the worksheet, be sure to use the 2015 figures for

the Oregon exemption credit, federal tax subtraction, and

tax rate charts. You can find these in our publication, Oregon

2015 Instructions for Estimated Income Tax and Form 40-ESV

Payment Voucher. To order, call the following numbers.

When completing the Annualized Income Worksheet, line

25, enter all previous 2015 estimated tax payments in col-

umns B, C, and D. Do not complete the worksheet past line

26. This is your required estimated tax payment for each

period of 2015. Questions? See the following numbers to call.

Have questions? Need help?

General tax information ...................... www.oregon.gov/dor

Salem ................................................................. 503-378-4988

Toll-free from an Oregon prefix ..................1-800-356-4222

Asistencia en español:

En Salem o fuera de Oregon .......................... 503-378-4988

Gratis de prefijo de Oregon ........................1-800-356-4222

TTY (hearing or speech impaired; machine only):

Salem area or outside Oregon ....................... 503-945-8617

Toll-free from an Oregon prefix ..................1-800-886-7204

Americans with Disabilities Act (ADA): Call one of the help

numbers above for information in alternative formats.

150-101-031 (Rev. 12-14)

7

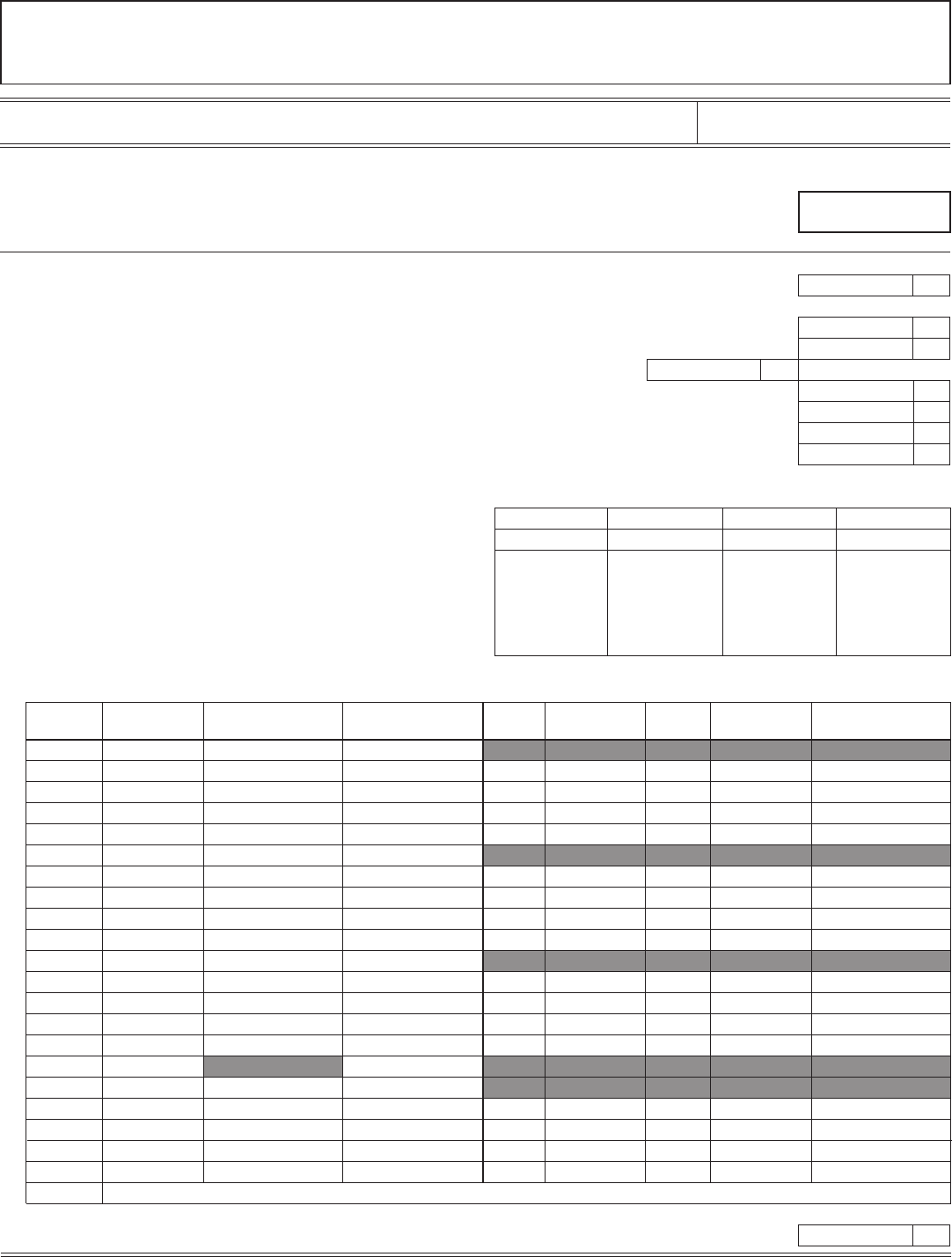

EXCEPTION TO PAYING INTEREST

1. I am claiming an exception to the imposition of estimated payment interest because I qualified

for relief under ORS 316.573 or 316.587. Write in the exception number you are claiming here

and on Form 40, box 51a; or Form 40N or Form 40P, box 69a ........................................................................ 1

2014

FORM

10

Underpayment of

Oregon Estimated Tax

File with your 2014 Oregon individual income tax return

Name

Social Security number

– –

Exception No._______

PART A—Figure your required annual payment

2. 2014 net income tax from Form 40, line 41; or Form 40N or Form 40P, line 58 ............................................... 2

3. 2014 refundable tax credit amounts you claimed on Form 40, wolf depredation, claim of right and lines 44–46;

or Form 40N or Form 40P, wolf depredation, claim of right and lines 62–64 ..........................................................3

4. Line 2 minus line 3

............................................................................................................................................. 4

5. Multiply line 4 by 90% (0.90) ............................................................................................ 5

6. 2014 Oregon income tax withheld from income ................................................................................................ 6

7. Line 4 minus line 6. If less than $1,000, stop here! You do not owe underpayment interest .......................... 7

8. Enter your 2013 Oregon tax after all credits (include refundable). You must have filed an Oregon return ........ 8

9. Required annual payment. Enter the smaller of line 5 or line 8 ....................................................................... 9

Note: If line 6 is equal to or more than line 9, stop here! You do not owe underpayment interest. Attach this form to your return.

.00

.00

.00

.00

.00

.00

.00

.00

A

April 15, 2014

B

June 16, 2014

C

Sept. 15, 2014

D

Jan. 15, 2015

PART B—Figure your required installment payment

10. Payment period due date ............................................................ 10

11. Divide the amount on line 9 by four and enter the amount

in each column, or if you use the Annualized Income

Worksheet on the back of this form, enter the amounts

from line 31 here (see instructions), and check box 51b on

Form 40 or 69b on Form 40N or 40P .......................................... 11

PART C — Figure your interest (See page 3 of the instructions)

No. of Monthly No. of Daily Interest

Date Event Amount Running balance months rate days rate due

12.

4/15/14 Req. pymt. . .

13. 4/15/14 Withholding . . 0.003333 0.000110 .

14. Payment . . 0.003333 0.000110 .

15. Payment . . 0.003333 0.000110 .

16. Payment . . 0.003333 0.000110 .

17. 6/16/14 Req. pymt. . .

18. 6/16/14 Withholding . . 0.003333 0.000110 .

19. Payment . . 0.003333 0.000110 .

20. Payment . . 0.003333 0.000110 .

21. Payment . . 0.003333 0.000110 .

22. 9/15/14 Req. pymt. . .

23. 9/15/14 Withholding . . 0.003333 0.000110 .

24. Payment . . 0.003333 0.000110 .

25. Payment . . 0.003333 0.000110 .

26. Payment . . 0.003333 0.000110 .

27. 1/15/15 Rate chg. .

28. 1/15/15 Req. pymt. . .

29. 1/15/15 Withholding . . 0.003333 0.000110 .

30. Payment . . 0.003333 0.000110 .

31. Payment . . 0.003333 0.000110 .

32. Payment . . 0.003333 0.000110 .

33. 4/15/15 — Do not calculate interest after April 15, 2015 —

34. Total interest due. Add the amounts in the interest column. Round to the nearest

whole dollar and enter here and on Form 40, line 51; or Form 40N or Form 40P, line 69 .............................. 34

.00

Clear Form

150-101-031 (Rev. 12-14)

8

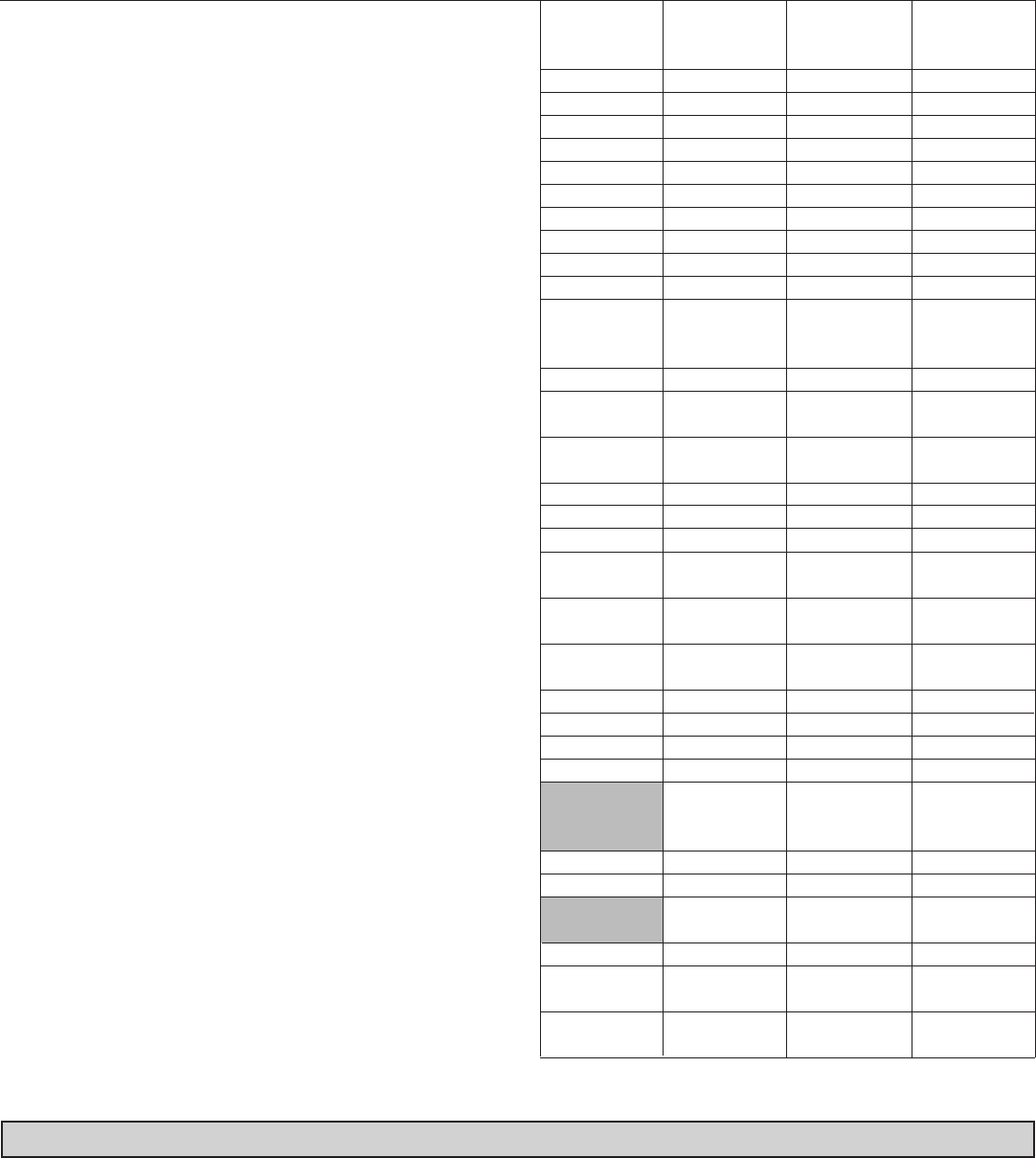

1. Enter your adjusted gross income for each period

(see instructions) .......................................................................... 1

2. Oregon additions for each period (see instructions) .................... 2

3. Add lines 1 and 2 .......................................................................... 3

4. Annualization multiplier ................................................................ 4

5. Annualized Oregon income. Multiply line 3 by line 4 .................... 5

6. Oregon subtractions for each period (except federal tax) ............ 6

7. Annualization multiplier ................................................................ 7

8 Annualized Oregon subtractions. Multiply line 6 by line 7 ............8

9. Federal tax from the worksheet on page 5 of the instructions ..... 9

10. Total subtractions. Add lines 8 and 9 ......................................... 10

11. Enter your net Oregon itemized deductions for each

period. If you do not itemize, enter -0- and skip to line 14

(see instructions) ........................................................................ 11

12. Annualization multiplier .............................................................. 12

13. Annualized net Oregon itemized deductions.

Multiply line 11 by line 12 ........................................................... 13

14. In each column, enter the full amount of your Oregon

standard deduction .................................................................... 14

15. Enter line 13 or 14, whichever is larger ...................................... 15

16. Total deductions. Add lines 10 and 15 ....................................... 16

17. Annualized Oregon taxable income. Line 5 minus line 16 .......... 17

18. Oregon tax for the amount on line 17 (see tax tables or

tax rate chart in the 2014 tax booklet) ........................................ 18

19. Exemption credit (not annualized) from Form 40, line 33;

Form 40N, line 54; or Form 40P, line 53 ..................................... 19

20. Enter the credits for each period. Do not include

exemption credits (see instructions) ........................................... 20

21. Total credits. Add lines 19 and 20 .............................................. 21

22. Net annualized income tax. Line 18 minus line 21 ..................... 22

23. Percentage that applies for each period .................................... 23

24. Multiply line 22 by line 23 ........................................................... 24

25. Enter the sum of all amounts from the prior columns of

line 31 below (i.e., column A, line 31 amount goes in

column B, line 25) ....................................................................... 25

26. Line 24 minus line 25. If less than zero, enter -0- ...................... 26

27. *Divide line 9, Part A, by four and enter results in each column ... 27

28. Enter the amount from the previous column of line 30 below

(i.e., column A, line 30 amount goes in column B, line 28) ......... 28

29. Add lines 27 and 28 .................................................................... 29

30. If line 29 is more than line 26, line 29 minus line 26.

If line 29 is less than line 26, enter -0- ....................................... 30

31. Enter the smaller of line 26 or line 29 here and on Part B,

line 11 (see front of the form). Go to line 1 in next column ........ 31

4 2.4 1.5 1

4 2.4 1.5 1

( ) ( ) ( ) ( )

( ) ( ) ( ) ( )

22.5% 45% 67.5% 90%

2014 Form 10 Page 2

Annualized Income Worksheet

Read the instructions on page 5 before completing this worksheet. Note: Start with column A. Work down the column,

and complete lines 1 through 31 before going on to columns B, C, and D.

File this form with your 2014 Oregon Individual Income Tax Return

Have questions? See page 6 of the instructions for numbers to call.

* If you are a part-year filer, divide by the number of periods you resided in Oregon, if less than 4. (See instructions for Part B, line 11.)

( ) ( ) ( )

14 2.4 1.5

A

1/1/14

to

3/31/14

B

1/1/14

to

5/31/14

C

1/1/14

to

8/31/14

D

1/1/14

to

12/31/14