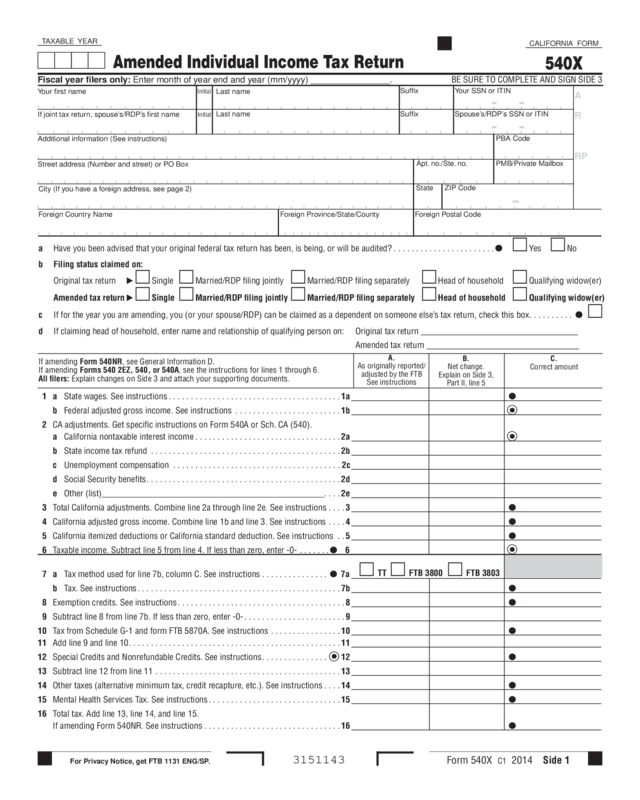

Fillable Printable 2014 Form 540X - Amended Individual Income Tax Return

Fillable Printable 2014 Form 540X - Amended Individual Income Tax Return

2014 Form 540X - Amended Individual Income Tax Return

Form 540X C1 2014 Side 1

For Privacy Notice, get FTB 1131 ENG/SP.

Amended Individual Income Tax Return

CALIFORNIA FORM

540X

3151143

T AXABLE YEAR

Fiscal year filers only: Enter month of year end and year (mm/yyyy) ________________. BE SURE TO COMPLETE AND SIGN SIDE 3

a Have you been advised that your original federal tax return has been, is being, or will be audited? ....................... Yes No

b Filing status claimed on:

Original tax return

Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

Amended tax return Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

c If for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, check this box..........

d If claiming head of household, enter name and relationship of qualifying person on: Original tax return

Amended tax return

C.

Correct amount

B.

Net change.

Explain on Side 3,

Part ll, line 5

A.

As originally reported/

adjusted by the FTB

See instructions

If amending Form 540NR, see General Information D.

If amending Forms 540 2EZ, 540, or 540A, see the instructions for lines 1 through 6.

All filers: Explain changes on Side 3 and attach your supporting documents.

1 a State wages. See instructions .......................................1a

b Federal adjusted gross income. See instructions ........................1b

12

2 CA adjustments. Get specific instructions on Form 540A or Sch. CA (540).

a California nontaxable interest income .................................2a

b State income tax refund ...........................................2b

c Unemployment compensation ......................................2c

d Social Security benefits............................................2d

e Other (list)__________________________________________________....2e

3 Total California adjustments. Combine line 2a through line 2e. See instructions . . . . 3

4 California adjusted gross income. Combine line 1b and line 3. See instructions ....4

5 California itemized deductions or California standard deduction. See instructions ..5

6 Taxable income. Subtract line 5 from line 4. If less than zero, enter -0- ....... 6

7 a Tax method used for line 7b, column C. See instructions ............... 7a

TT FTB 3800 FTB 3803

b Tax. See instructions ..............................................7b

8 Exemption credits. See instructions......................................8

9 Subtract line 8 from line 7b. If less than zero, enter -0- .......................9

10 Tax from Schedule G-1 and form FTB 5870A. See instructions ................10

11 Add line 9 and line 10................................................11

12 Special Credits and Nonrefundable Credits. See instructions...............

13 Subtract line 12 from line 11 ..........................................13

14 Other taxes (alternative minimum tax, credit recapture, etc.). See instructions ....14

15 Mental Health Services Tax. See instructions ..............................15

16 Total tax. Add line 13, line 14, and line 15.

If amending Form 540NR. See instructions ...............................16

Your first name Last name

Initial

If joint tax return, spouse’s/RDP’s first name

Last name

Initial

Spouse’s/RDP’s SSN or ITIN

Your SSN or ITIN

Additional information (See instructions)

Street address (Number and street) or PO Box

City (If you have a foreign address, see page 2)

Foreign Country Name Foreign Province/State/County Foreign Postal Code

Apt. no./Ste. no. PMB/Private Mailbox

State ZIP Code

A

R

RP

PBA Code

Suffix

Suffix

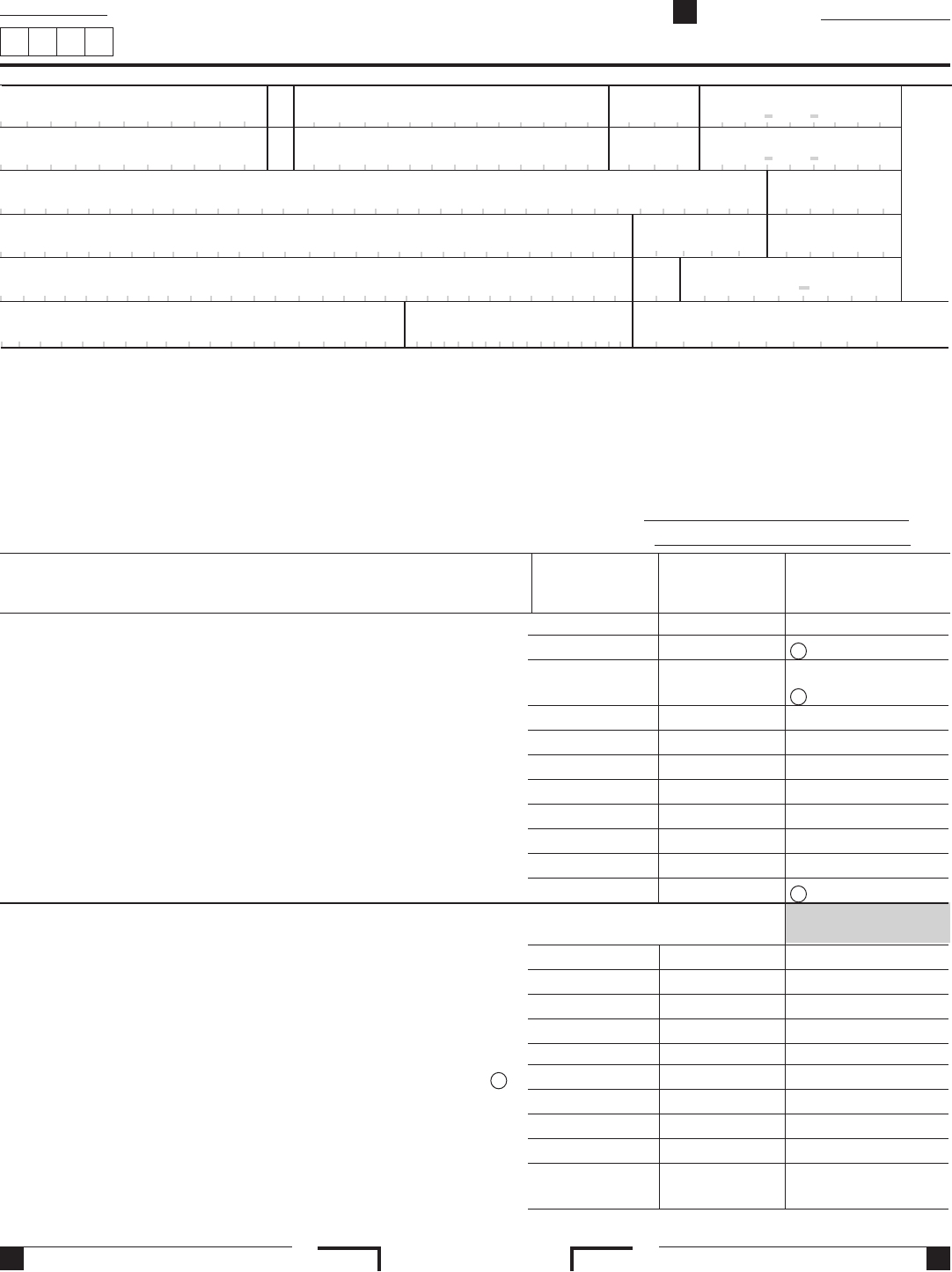

Side 2 Form 540X C1 2014

Your name: Your SSN or ITIN:

17 California income tax withheld. See instructions ...........................17

18 Real estate and other withholding (Form(s) 592-B or 593). See instructions .....18

19 Excess California SDI (or VPDI) withheld. See instructions ................

19

20 Estimated tax payments and other payments. See instructions .............

20

21

Refundable Credits. See instructions

. ....................................21

22 __________________________________

- -

23 __________________________________

- -

24 $ ___________________

25 Tax paid with original tax return plus additional tax paid after it was filed. Do not include penalties and interest. ...............

25

26 Total payments. Add lines 17, 18, 19, 20, 21, and 25 of column C..................................................

26

27 Overpaid tax, if any, as shown on original tax return or as previously adjusted by the FTB. See instructions ..................

27

28 Subtract line 27 from line 26. If line 27 is more than line 26. See instructions ........................................

28

29 Use tax payments as shown on original tax return. See instructions .................................................

29

30 Voluntary contributions as shown on original tax return. See instructions ............................................

30

31 Subtract line 29 and line 30 from line 28 .....................................................................

31

32 AMOUNT YOU OWE. If line 16, column C is more than line 31, enter the difference

and see instructions....................................................................

32

,

,

.

00

33 Penalties/Interest. See instructions: Penalties 33a______________________ Interest 33b______________________________ 33c

34 REFUND. If line 16, column C is less than line 31, enter the difference. See instructions ...............

34

,

,

.

00

Part I Nonresidents or Part-Year Residents Only

Attach and enter the amounts from your revised Short or Long Form 540NR and Schedule CA (540NR). Your amended tax return cannot be processed without

this information.

1 Exemption amount ....................................................................................

1

2 Federal adjusted gross income ..........................................................................

2

3 Adjusted gross income from all sources ...................................................................

3

4 Itemized deductions or standard deduction .................................................................

4

5 California adjusted gross income .........................................................................

5

6 Tax from Schedule G-1 and form FTB 5870A ................................................................

6

7 Special credits and nonrefundable renter’s credit.............................................................

7

8 Alternative minimum tax ...............................................................................

8

9 Mental Health Services Tax (taxable years 2005 and after) .....................................................

9

10 Other taxes and credit recapture .........................................................................

10

3152143

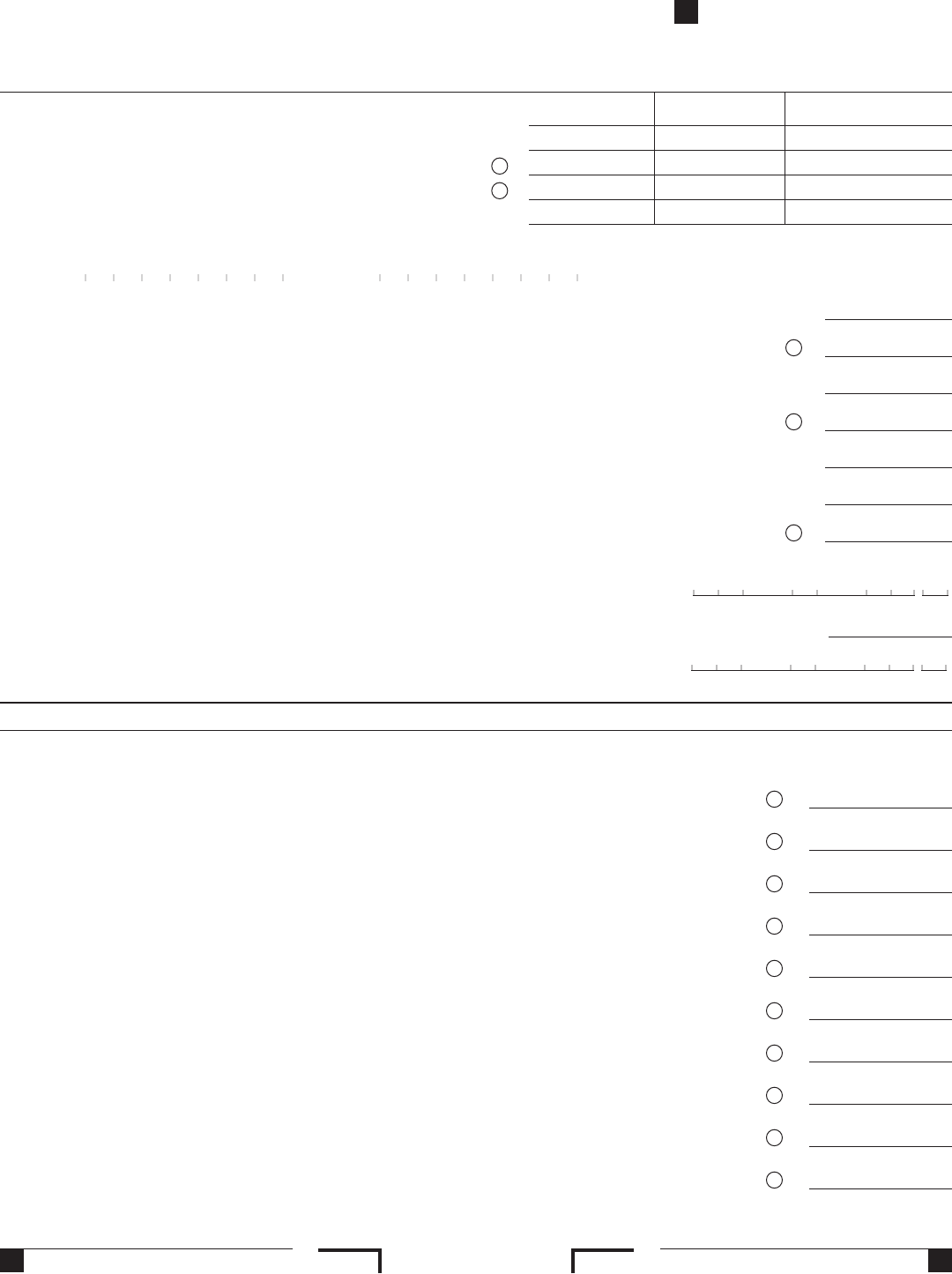

Form 540X C1 2014 Side 3

Your name: Your SSN or ITIN:

Where to File

Form 540X

Do not file a duplicate amended tax return unless one is requested. This may cause a delay in processing your amended tax return and any claim for refund.

If you are due a refund, have no amount due, or paid electronically,

mail your tax return to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001

If you owe, mail your return and check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001

Under penalties of perjury, I declare that I have filed an original tax return and I have examined this amended tax return, including accompanying

schedules and statements, and to the best of my knowledge and belief, this amended tax return is true, correct, and complete.

Sign

Here

I

t is unlawful

to forge a

spouse’s/RDP’s

signature.

( )

Your signature Date Spouse’s/RDP’s signature (if a joint tax return, both must sign)

X X

Your email address (optional). Enter only one email address. Daytime phone number (optional)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if self-employed) PTIN

Firm’s address FEIN

3153143

Part II Explanation of Changes

1 Enter name(s) and address as shown on original return below (if same as shown on this tax return, write “Same”). If changing from

separate tax returns to a joint tax return, enter names and addresses from original tax returns._________________________________________________

_______________________________________________________________________________________________________________________

2 Are you filing this Form 540X to report a final federal determination? ....................................................... Yes No

If “Yes,” attach a copy of the final federal determination and all supporting schedules and data.

3 Have you been advised that your original California tax return has been, is being, or will be audited? .............................. Yes No

4 Did you file an amended tax return with the Internal Revenue Service on a similar basis? See General Information E ...............

Yes No

5 Explanation and Attachments. Explain your changes below. If needed, attach a separate sheet that includes your name and SSN or ITIN.

Explain in detail each change made. Include:

• Item being changed.

• Amount previously reported and corrected amount.

• Reason the change was needed.

Attach:

• Revised California tax return including all forms and schedules.

• Federal tax return and schedules if you made changes.

• Supporting documents, such as corrected W-2s, 1099s, K-1s, etc.

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________