Fillable Printable 2014 Form Il-1065, Partnership Replacement Tax Return

Fillable Printable 2014 Form Il-1065, Partnership Replacement Tax Return

2014 Form Il-1065, Partnership Replacement Tax Return

Page 1 of 5

IL-1065 (R-12/14)

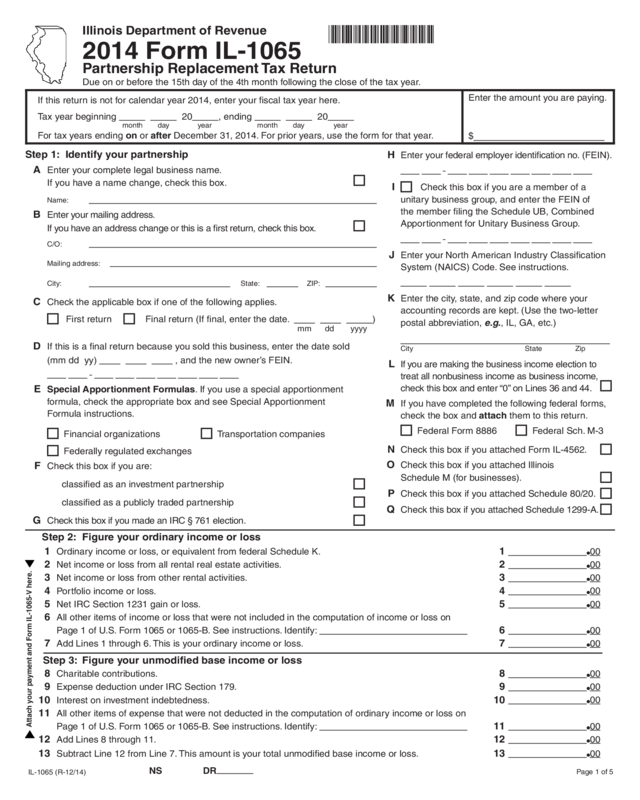

Illinois Department of Revenue

2014 Form IL-1065

Partnership Replacement Tax Return

Due on or before the 15th day of the 4th month following the close of the tax year.

If this return is not for calendar year 2014, enter your fiscal tax year here.

Tax year beginning 20 , ending 20

month day year month day year

For tax years ending on or after December 31, 2014. For prior years, use the form for that year.

Step 1: Identify your partnership

A Enter your complete legal business name.

If you have a name change, check this box.

Name:

B Enter your mailing address.

If you have an address change or this is a first return, check this box.

C/O:

Mailing address:

City: State: ZIP:

C Check the applicable box if one of the following applies.

First return Final return (If final, enter the date. )

mm dd yyyy

D If this is a final return because you sold this business, enter the date sold

(mm dd yy) , and the new owner’s FEIN.

E Special Apportionment Formulas. If you use a special apportionment

formula, check the appropriate box and see Special Apportionment

Formula instructions.

Financial organizations Transportation companies

Federally regulated exchanges

F Check this box if you are:

classified as an investment partnership

classified as a publicly traded partnership

G Check this box if you made an IRC § 761 election.

Step 2: Figure your ordinary income or loss

1 Ordinary income or loss, or equivalent from federal Schedule K. 1

00

2 Net income or loss from all rental real estate activities. 2

00

3 Net income or loss from other rental activities. 3

00

4 Portfolio income or loss. 4

00

5 Net IRC Section 1231 gain or loss. 5

00

6 All other items of income or loss that were not included in the computation of income or loss on

Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify: 6

00

7 Add Lines 1 through 6. This is your ordinary income or loss. 7

00

Step 3: Figure your unmodified base income or loss

8 Charitable contributions. 8

00

9 Expense deduction under IRC Section 179. 9

00

10 Interest on investment indebtedness. 10

00

11 All other items of expense that were not deducted in the computation of ordinary income or loss on

Page 1 of U.S. Form 1065 or 1065-B. See instructions. Identify: 11

00

12 Add Lines 8 through 11. 12

00

13 Subtract Line 12 from Line 7. This amount is your total unmodified base income or loss. 13

00

NS DR

H Enter your federal employer identification no. (FEIN).

I Check this box if you are a member of a

unitary business group, and enter the FEIN of

the member filing the Schedule UB, Combined

Apportionment for Unitary Business Group.

J Enter your North American Industry Classification

System (NAICS) Code. See instructions.

K Enter the city, state, and zip code where your

accounting records are kept. (Use the two-letter

postal abbreviation, e.g., IL, GA, etc.)

City State Zip

L If you are making the business income election to

treat all nonbusiness income as business income,

check this box and enter “0” on Lines 36 and 44.

M If you have completed the following federal forms,

check the box and attach them to this return.

Federal Form 8886 Federal Sch. M-3

N Check this box if you attached Form IL-4562.

O Check this box if you attached Illinois

Schedule M (for businesses).

P Check this box if you attached Schedule 80/20.

Q Check this box if you attached Schedule 1299-A.

Enter the amount you are paying.

$

Attach your payment and Form IL-1065-V here.

*432401110*

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Page 2 of 5

IL-1065 (R-12/14)

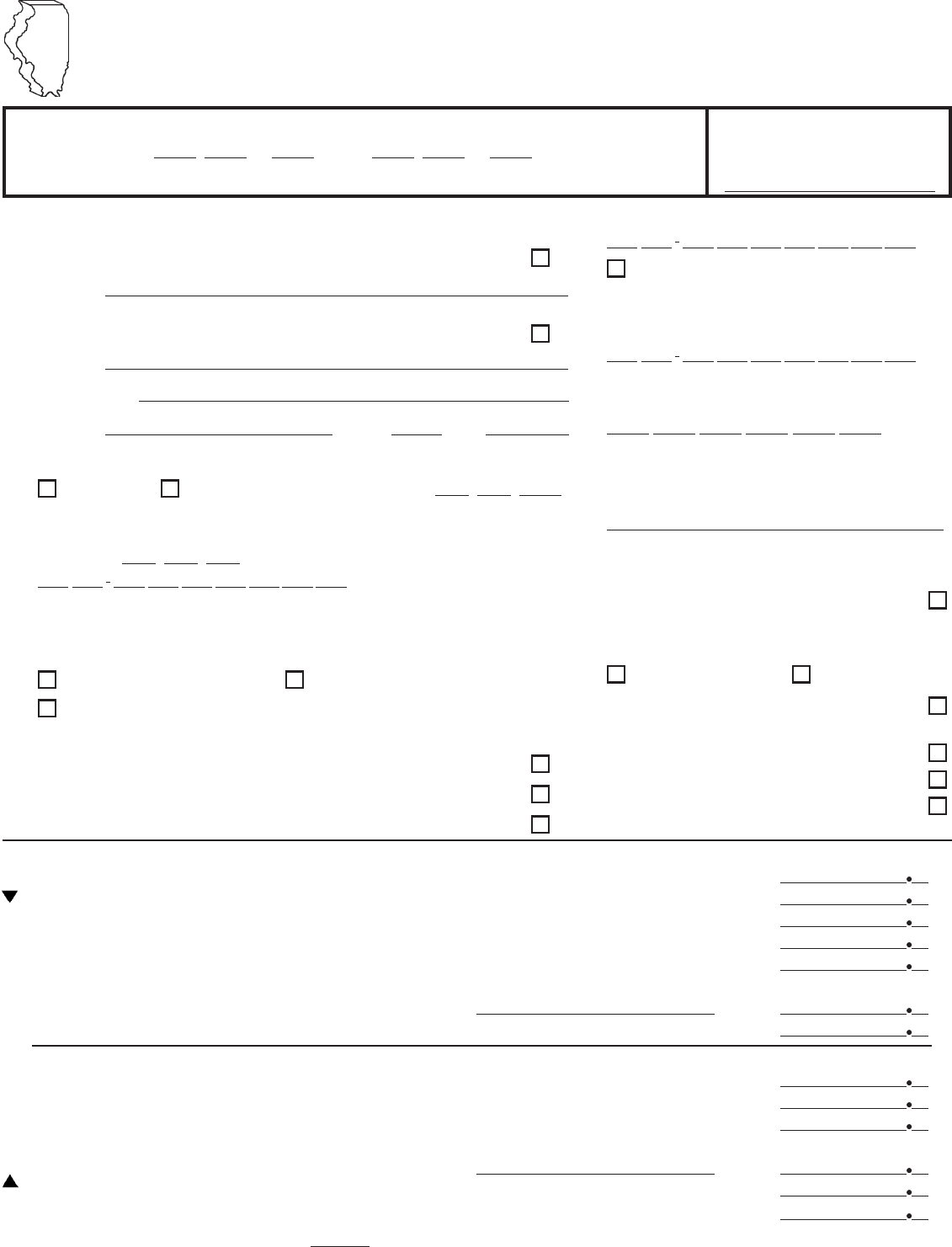

Step 4: Figure your income or loss

14 Enter your unmodified base income or loss from Line 13. 14

00

15 State, municipal, and other interest income excluded from Line 14. 15

00

16 Illinois replacement tax deducted in arriving at Line 14. 16

00

17 Illinois Special Depreciation addition. Attach Form IL-4562. 17

00

18 Related-party expenses addition. Attach Schedule 80/20. 18

00

19 Distributive share of additions. Attach Schedule(s) K-1-P or K-1-T. 19

00

20 Guaranteed payments to partners from U.S. Form 1065 or 1065-B. 20

00

21 The amount of loss distributable to a partner subject to replacement tax.

Attach Schedule B. 21

00

22 Other additions. Attach Illinois Schedule M (for businesses). 22

00

23 Add Lines 14 through 22. This amount is your income or loss. 23

00

Step 5: Figure your base income or loss

24 Interest income from U.S. Treasury obligations or other exempt federal obligations. 24

00

25 August 1,1969, valuation limitation amount. Attach Schedule F. 25

00

26 Personal service income or reasonable allowance for compensation of partners.

26

00

27 Share of income distributable to a partner subject to replacement tax. Attach Schedule B. 27

00

28 River Edge Redevelopment Zone Dividend subtraction. Attach Schedule 1299-A. 28

00

29 High Impact Business Dividend subtraction. Attach Schedule 1299-A. 29

00

30 Illinois Special Depreciation subtraction. Attach Form IL-4562. 30

00

31 Related-party expenses subtraction. Attach Schedule 80/20. 31

00

32 Distributive share of subtractions. Attach Schedule(s) K-1-P or K-1-T. 32

00

33 Other subtractions. Attach Schedule M (for businesses). 33

00

34 Total subtractions. Add Lines 24 through 33. 34

00

35 Base income or loss. Subtract Line 34 from Line 23. 35

00

Step 6: Figure your income allocable to Illinois (Complete only if you checked the box on Line B, above.)

36 Nonbusiness income or loss. Attach Schedule NB. 36

00

37 Trust, estate, and non-unitary partnership business income or loss included in Line 35. 37

00

38 Add Lines 36 and 37. 38

00

39 Business income or loss. Subtract Line 38 from Line 35. 39

00

40 Total sales everywhere. This amount cannot be negative. 40

00

41 Total sales inside Illinois. This amount cannot be negative. 41

00

42 Apportionment factor. Divide Line 41 by Line 40 (carry to six decimal places). 42

43 Business income or loss apportionable to Illinois. Multiply Line 39 by Line 42. 43

00

44 Nonbusiness income or loss allocable to Illinois. Attach Schedule NB. 44

00

45 Trust, estate, and non-unitary partnership business income or loss apportionable to Illinois. 45

00

46 Base income or loss allocable to Illinois. Add Lines 43 through 45. 46

00

*432402110*

A If the amount on Line 35 is derived inside Illinois only, check this box and enter the amount from Step 5, Line 35

on Step 7, Line 47. You may not complete Step 6. (You must leave Step 6, Lines 36 through 46 blank.)

B If any portion of the amount on Line 35 is derived outside Illinois, check this box and complete all lines of Step 6.

See instructions. (If you are a unitary filer, you must complete Lines 40 through 42.)

Page 3 of 5

IL-1065 (R-12/14)

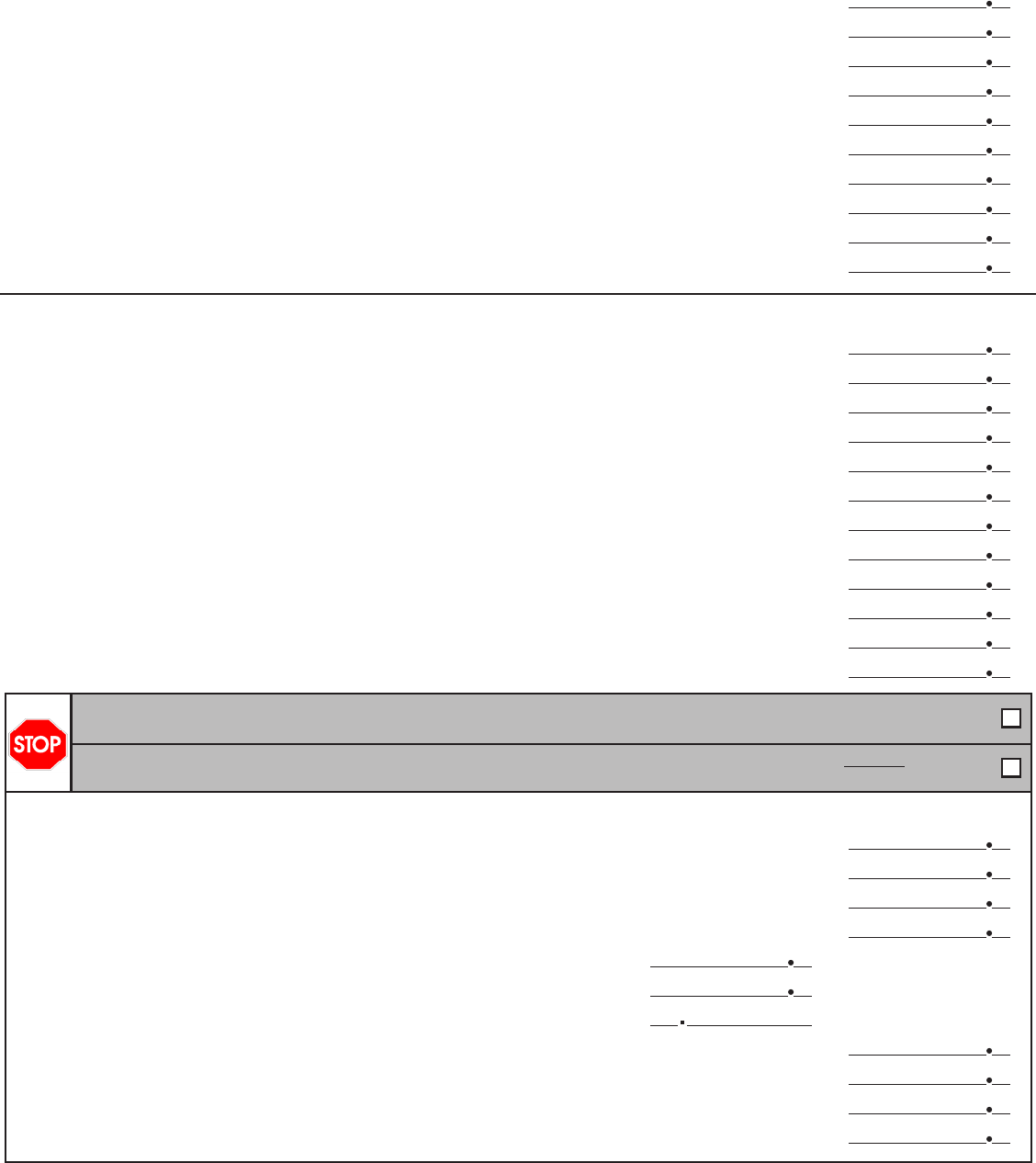

Step 7: Figure your net income

47 Base income or net loss from Step 5, Line 35, or Step 6, Line 46. 47

00

48 Illinois net loss deduction. Attach Schedule NLD. If Line 47 is zero or a negative amount, enter “0”. 48

00

49 Income after NLD. Subtract Line 48 from Line 47. 49

00

50 Enter the amount from Step 5, Line 35. 50

00

51 Divide Line 47 by Line 50. (This figure cannot be greater than “1”.) 51

52 Exemption allowance. Multiply Line 51 by $1,000. (Short-year filers, see instructions.) 52

00

53 Net income. Subtract Line 52 from Line 49. 53

00

Step 8: Figure your net replacement tax and pass-through withholding payments

54 Replacement tax. Multiply Line 53 by 1.5% (.015). 54

00

55 Recapture of investment credits. Attach Schedule 4255. 55

00

56 Replacement tax before investment credits. Add Lines 54 and 55. 56

00

57 Investment credits. Attach Form IL-477. 57

00

58 Net replacement tax. Subtract Line 57 from Line 56. Enter “0” if this is a negative amount. 58

00

59 Pass-through withholding payments you reported on behalf of your members. Enter the amount from

Schedule B, Step 1, Line 8. Attach Schedule B. 59

00

60 Total net replacement tax and pass-through withholding payments. Add Line 58 and Line 59. 60

00

Step 9: Figure your refund or balance due

61 Payments.

a Credit from prior year overpayments. 61a

00

b Form IL-505-B (extension) payment. 61b

00

c Pass-through withholding payments. Attach Schedule(s) K-1-P or K-1-T. 61c

00

d Gambling withholding. Attach Form(s) W-2G. 61d

00

e Form IL-516-I prepayments. 61e

00

f Form IL-516-B prepayments. 61f

00

62 Total payments. Add Lines 61a through 61f. 62

00

63 Overpayment. If Line 62 is greater than Line 60, subtract Line 60 from Line 62. 63

00

64 Amount to be credited to a subsequent period. See instructions. 64

00

65 Refund. Subtract Line 64 from Line 63. This is the amount to be refunded. 65

00

66 Complete to direct deposit your refund

Routing Number

Checking or

Savings

Account Number

67 Tax Due. If Line 60 is greater than Line 62, subtract Line 62 from Line 60. This is the amount you owe. 67

00

If you owe tax on Line 67, complete a payment voucher, Form IL-1065-V, make your check payable to

“Illinois Department of Revenue” and attach them to the first page of this form.

Enter the amount of your payment on the top of Page 1 in the space provided.

Step 10: Sign here

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Check this box if the Department

may discuss this return with the

preparer shown in this step.

Signature of partner

Signature of preparer

Preparer’s firm name (or yours, if self-employed) Address Phone

Date

Date

Title

Preparer’s Social Security number or firm’s FEIN

Phone

( )

( )

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

If a payment is not enclosed,

mail this return to:

If a payment is enclosed,

mail this return to:

Illinois Department of Revenue Illinois Department of Revenue

P.O. Box 19031 P.O. Box 19053

Springfield, IL 62794-9031

Springfield, IL 62794-9053

*432403110*

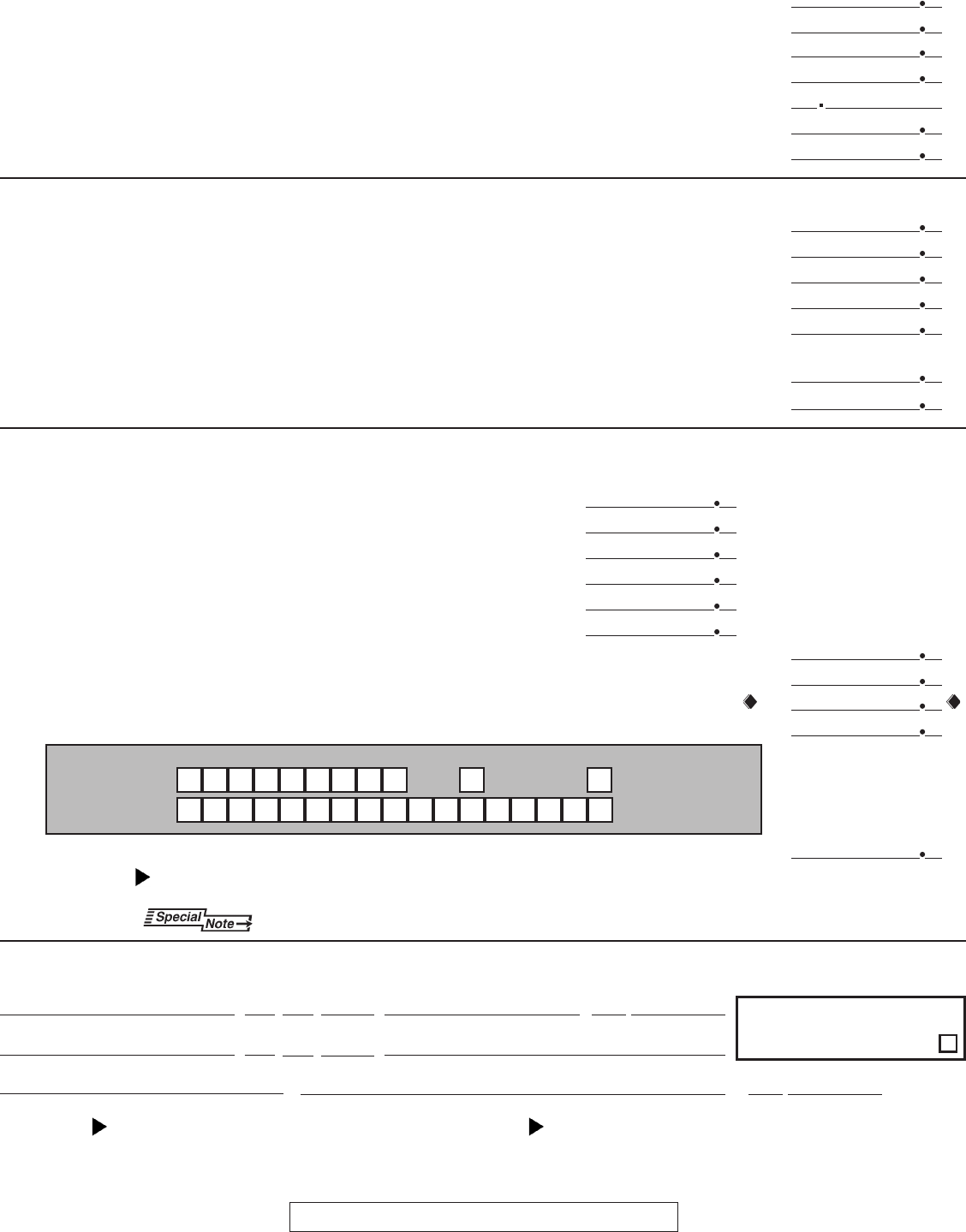

Illinois Department of Revenue

Year ending

2014 Schedule B Partners’ or Shareholders’ Identification

Attach to your Form IL-1065 or Form IL-1120-ST.

Month Year

Enter your name as shown on your Form IL-1065 or Form IL-1120-ST. Enter your federal employer identification number (FEIN).

Read this information first

• You must read the Schedule B instructions and complete Schedule(s) K-1-P and Schedule(s) K-1-P(3) (or Schedule(s) K-1-P(3)-FY) before completing this schedule.

• You must complete Step 2 of Schedule B and provide all the required information for your partners and shareholders before completing Step 1 of Schedule B.

Failure to follow these instructions may result in a delay in processing your return, further correspondence, and you may be required to submit further information to support your filing.

Step 1: Provide the following total amounts

Complete this step only after you have completed Schedule(s) K-1-P, Schedule(s) K-1-P(3) (or Schedule(s) K-1-P(3)-FY), and Schedule B, Step 2. You will use the amounts from those

schedules when completing this step.

Totals for resident and nonresident partners and shareholders

1 Enter the total of all nonbusiness income or loss you reported on Schedule(s) K-1-P for your members. See instructions. 1

2 Enter the total of all income and replacement tax credits you reported on Schedule(s) K-1-P for your members. See instructions. 2

3 Add the amounts shown on Schedule B, Step 2, Column E for all partners or shareholders on all pages for which you have entered a

check mark in Column D. Enter the total here. See instructions. 3

Totals for nonresident partners and shareholders only

4 Enter the total pass-through withholding you reported on all pages of your Schedule B, Step 2, Column J for your nonresident individual

and estate members. See instructions. 4

5 Enter the total pass-through withholding you reported on all pages of your Schedule B, Step 2, Column J for your nonresident partnership

and S corporation members. See instructions. 5

6 Enter the total pass-through withholding you reported on all pages of your Schedule B, Step 2, Column J for your nonresident trust

members. See instructions. 6

7 Enter the total pass-through withholding you reported on all pages of your Schedule B, Step 2, Column J for your nonresident

C corporation members. See instructions. 7

8 Add Line 4 through Line 7. This is the total pass-through withholding reported on behalf of all your nonresident partners and shareholders.

This amount should match the total amount from Schedule B, Step 2, Column J for all nonresident partners or shareholders on all pages.

Enter the total here and on Form IL-1065, Line 59, or Form IL-1120-ST, Line 58. See instructions. 8

Attach all pages of Schedule B, Step 2 behind this page.

IL Attachment no. 1

*430801110*

Schedule B front (R-12/14)Page 4 of 5

Illinois Department of Revenue

2014 Schedule B

Enter your name as shown on your Form IL-1065 or Form IL-1120-ST.

Enter your federal employer identification number (FEIN).

Step 2: Identify your partners or shareholders (See instructions before completing.)

A B C D E F G H I J

Name Partner Subject to Illinois Member’s Excluded from Share of Illinois Pass-through Pass-through

Address 1 or SSN replacement distributable amount pass-through income subject withholding Distributable withholding

Address 2 Shareholder or tax or an of base withholding to pass-through before share of payment

City, State, ZIP type FEIN ESOP income or loss payments withholding credits credits amount

1

2

3

4

5

6

If you have more members than space provided, attach additional copies of this page as necessary.

(If Column F is blank, complete Column G through Column J. Otherwise, enter zero

in Column G through Column J.)

Schedule B back (R-12/14) Page 5 of 5

*430802110*

Reset

Print