Fillable Printable 2014 Form Il-941, Illinois Withholding Income Tax Return

Fillable Printable 2014 Form Il-941, Illinois Withholding Income Tax Return

2014 Form Il-941, Illinois Withholding Income Tax Return

Illinois Department of Revenue

Form IL-941 2014

Illinois Withholding Income Tax Return

Quarterly filers: File only one IL-941 return per quarter. Make your payments using IL-501.

Step 2: Tell us about your W-2 forms and your business

A Write the total number of W-2 forms you were required to issue for the entire year.

(Quarterly filers — Only complete this line when you file your 4th quarter or final return.) A __________________

B If your business has permanently stopped withholding because it has closed or you no longer

pay Illinois wages, check the box and write the date you stopped paying wages. B __ __ / __ __ / 2014

Step 3: Tell us about the amount subject to withholding

1 Write the total amount subject to Illinois withholding tax this reporting period, including payroll,

compensation, and other amounts. See instructions. 1 __________________

Step 4: Tell us about the amount withheld

2 Write the amount of Illinois Income Tax actually withheld for this reporting period. 2 __________________

Step 5: Tell us about your payments and credits

3 Write the total amount of withholding payments you have made for this

period. This includes all IL-501 payments (electronic and paper coupons). 3 ________________

4 Write the amount of credit carried forward from your previous Form IL-941. 4 ________________

5 Write the total amount of credits you have received through DCEO. 5 ________________

6 Add Lines 3, 4, and 5 and write the total amount here. 6 __________________

Step 6: Figure your credit or the amount you owe

7 If Line 2 is greater than Line 6, subtract Line 6 from Line 2. This is your remaining

balance due. Make your payment electronically (semi-weekly payers must pay electronically)

or make your remittance payable to “Illinois Department of Revenue.” 7 __________________

8 If Line 2 is less than Line 6, subtract Line 2 from Line 6. Claim this amount on your next Form IL-941. 8 __________________

Step 7: Sign here

Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete.

___________________________________(____)________________ __ __ / __ __ / __ __ __ __

Signature Daytime telephone number Month Day Year

___________________________________(____)________________ __ __ / __ __ / __ __ __ __

Signature of Preparer Daytime telephone number Month Day Year

NS DR____

Mail to: ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19052

SPRINGFIELD IL 62794-9052

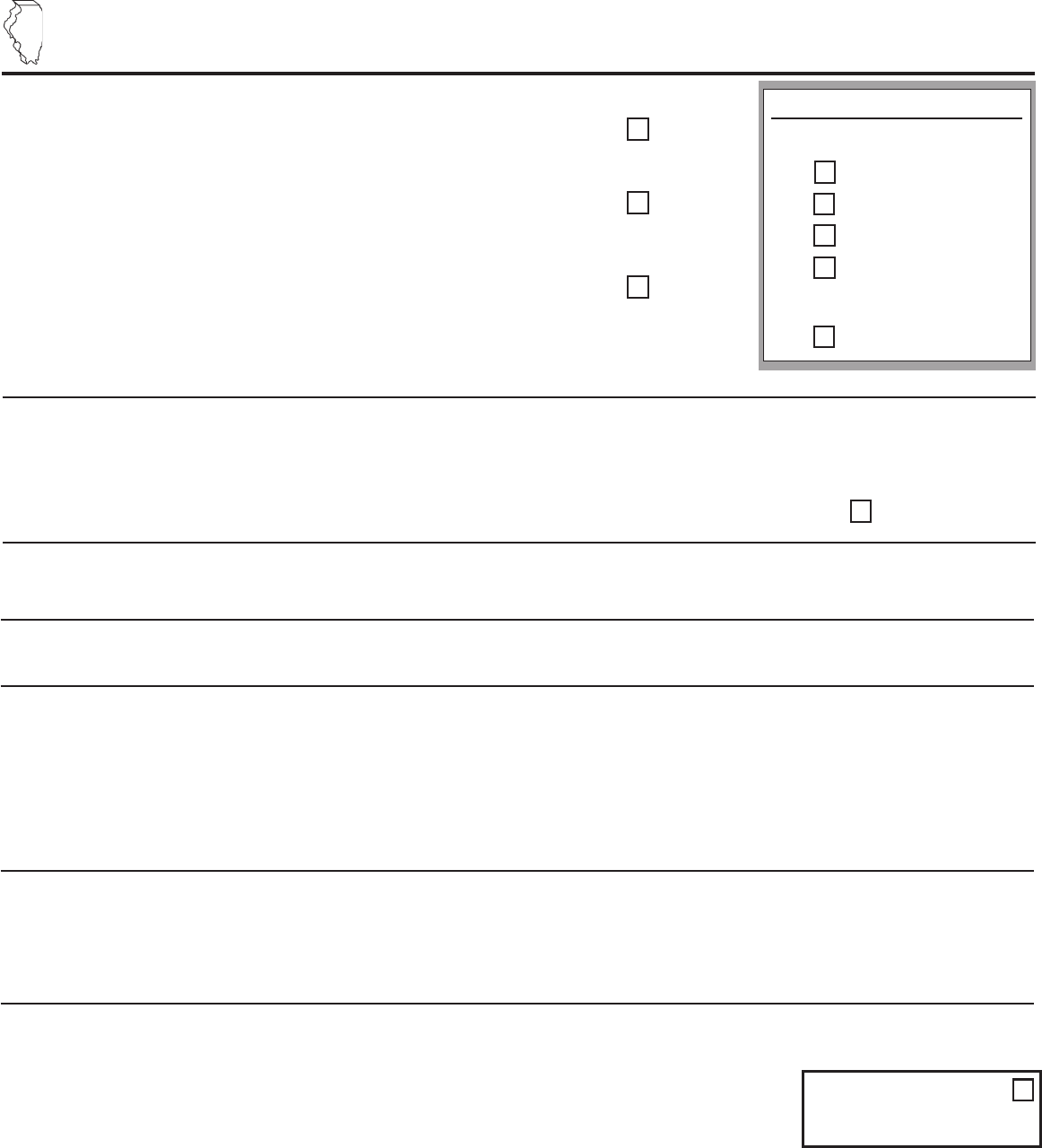

Reporting Period

If you are a quarterly filer:

Check the quarter you are reporting.

1st (January, February, March)

2nd (April, May, June)

3rd (July, August, September)

4th

(October, November, December)

If you are an annual filer:

Check the box if you are not required to file quarterly.

January — December

Month Day

IL-941 (R-12/13)

Check this

box if your

business

name has

changed.

Check this

box if your

address

has

changed.

Check this

box if this is

your first

return.

Check this box if we may

discuss this return with the

preparer shown in this step.

*IL-941*

Step 1: Provide your information

___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Federal employer identification number (FEIN)

Seq. number

____________________________________________________________

Business name

____________________________________________________________

C/O

____________________________________________________________

Mailing address

______________________________ _______ __________________

City State ZIP

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

0 0 0

Reset

Print