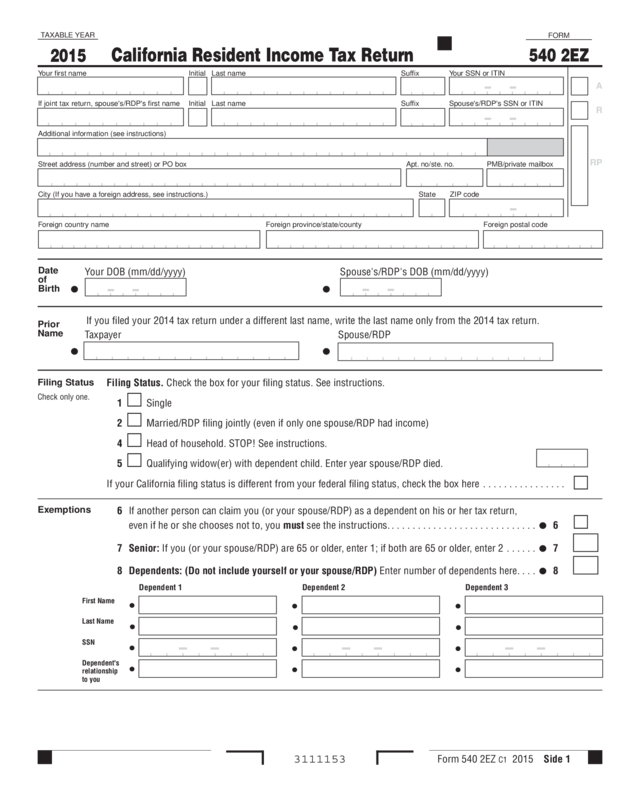

Fillable Printable 2015 California Resident Income Tax Return - Form 540 2Ez

Fillable Printable 2015 California Resident Income Tax Return - Form 540 2Ez

2015 California Resident Income Tax Return - Form 540 2Ez

FORM

2015

California Resident Income Tax Return

540 2EZ

Your first name Initial Last name Suffix Your SSN or ITIN

If joint tax return, spouse's/RDP's first name Initial Last name Suffix Spouse's/RDP's SSN or ITIN

Additional information (see instructions)

Street address (number and street) or PO box Apt. no/ste. no. PMB/private mailbox

City (If you have a foreign address, see instructions.) State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

Date

of

Birth

Your DOB (mm/dd/yyyy) Spouse's/RDP's DOB (mm/dd/yyyy)

Prior

Name

If you filed your 2014 tax return under a different last name, write the last name only from the 2014 tax return.

Taxpayer Spouse/RDP

Filing Status

Check only one.

Filing Status. Check the box for your filing status. See instructions.

1 Singlem

2 Married/RDP filing jointly (even if only one spouse/RDP had income)m

m

m

4 Head of household. STOP! See instructions.

5 Qualifying widow(er) with dependent child. Enter year spouse/RDP died.

If your California filing status is different from your federal filing status, check the box here ................

m

Exemptions

6 If another person can claim you (or your spouse/RDP) as a dependent on his or her tax return,

even if he or she chooses not to, you must see the instructions. ............................ 6 m

7 Senior If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2: ...... 7

8 Dependents: (Do not include yourself or your spouse/RDP) Enter number of dependents here .... 8

Dependent 1 Dependent 2 Dependent 3

A

R

RP

TAXABLE YEAR

First Name

Last Name

SSN

Dependent's

relationship

to you

Form 540 2EZ C1 2015 Side 13111153

Check for Errors

Print Form

Reset Form

Help

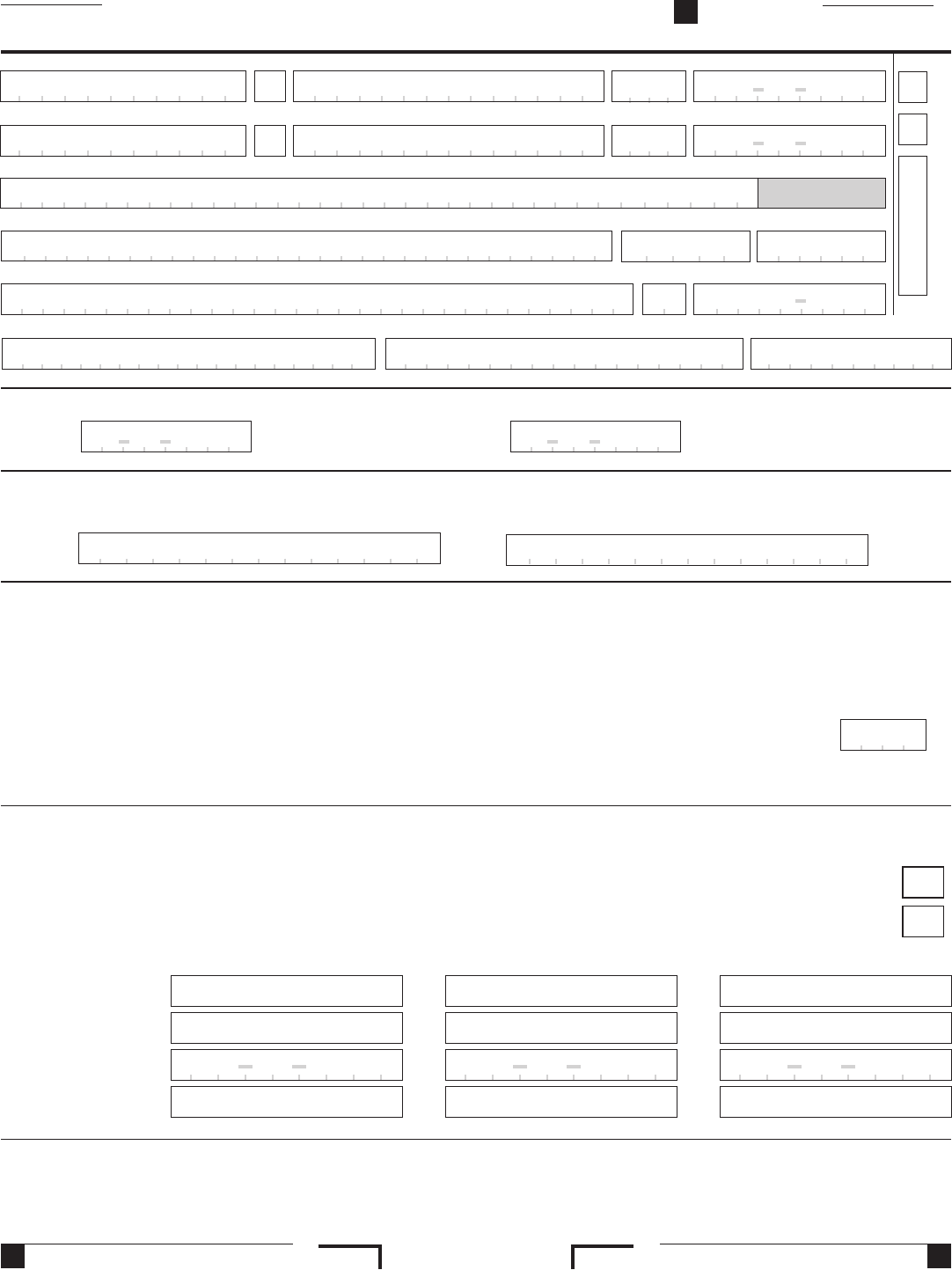

Side 2 Form 540 2EZ C1 2015 3112153

Your name: Your SSN or ITIN:

Taxable

Income and

Credits

Whole dollars only

9 Total wages (federal Form W-2, box 16). See instructions. .................

.

.

.

9

10

11

12

..........

.........

.......

...................................................

.........................

.

..............................

.........................

......... ...............................

17

8

19

20

21

22

23

24

1.....

....... ..........

...... ..

......... ....

10 Total interest income (Form 1099-INT, box 1). See instructions. ..

11 Total dividend income (Form 1099-DIV, box 1a). See instructions. .

12

Total pension income . See instructions. Taxable amount.

13 Total capital gains distributions from mutual funds (Form 1099-DIV, box 2a).

See instructions

13

1616 Add line 9, line 10, line 11, line 12, and line 13..

17

Using the 2EZ Table for your filing status, enter the tax for the amount on line 16

.

Caution: If you checked the box on line 6, STOP. See instructions for

completing the Dependent Tax Worksheet

18 Senior exemption: See instructions. If you are 65 or older and entered 1 in the

box on line 7, enter $109. If you entered 2 in the box on line 7, enter $218

19 Nonrefundable renter’s credit. See instructions..

20 Credits. Add line 18 and line 19

21 Tax. Subtract line 20 from line 17. If zero or less, enter -0-

22 Total tax withheld (federal Form W-2, box 17 or Form 1099-R, box 12)

23 Earned Income Tax Credit (EITC). See instructions for FTB 3514

24 Total payments. Add line 22 and line 23 ...............................

Enclose, but do

not staple, any

payment.

Use T ax

25 Use tax. This is not a total line. See instructions.... 25

26 Payments balance. If line 24 is more than line 25, subtract line 25 from line 24 .

26

27 Use Tax balance. If line 25 is more than line 24, subtract line 24 from line 25

27..

Overpaid

Tax/

Tax Due

.

28 Overpaid tax. If line 26 is more than line 21, subtract line 21 from line 26...... 28

29 Tax due. If line 26 is less than line 21, subtract line 26 from line 21.

See instructions

............................................... ....

29

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

,

,

,

,

,

,

,

,

,

,

,

.

00

,

.

00

,

.

00

,

.

00

,

This space reserved for 2D barcode

.

00

,

Check for Errors

Print Form

Reset Form

Help

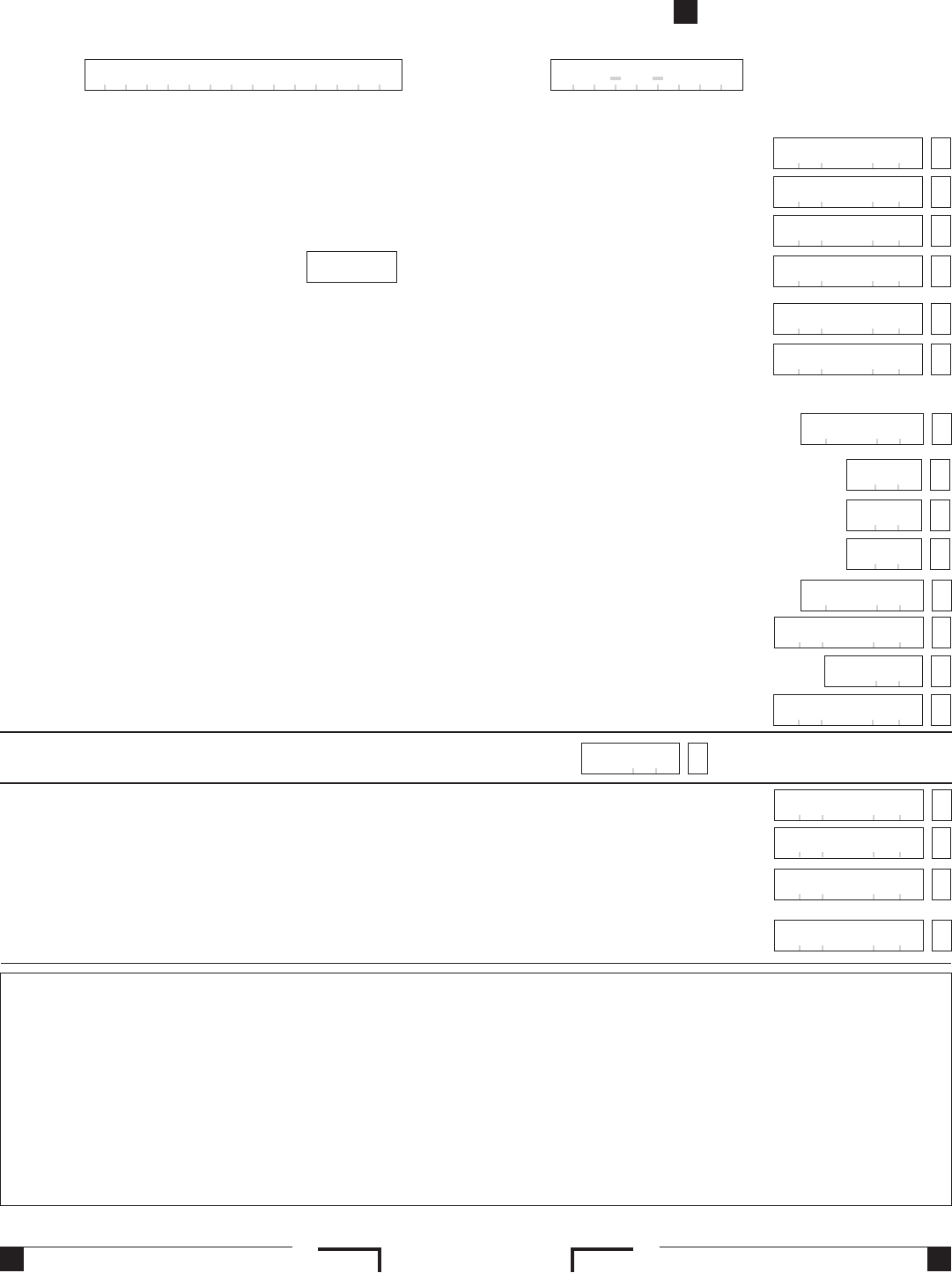

Your name: Your SSN or ITIN:

Voluntary Contributions

Code Amount

California Seniors Special Fund. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

400

.

401

.

403

.

405

.

406

.

407

.

408

.

00

.

00

.

00

.

00

.

00

.

00

.

00

Alzheimer’s Disease/Related Disorders Fund........................................

Rare and Endangered Species Preservation Program .................................

California Breast Cancer Research Fund ...........................................

California Firefighters’ Memorial Fund.............................................

Emergency Food for Families Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

California Peace Officer Memorial Foundation Fund

..................................

California Sea Otter Fund........................................................

410

.

413

.

419

.

422

.

423

.

424

.

425

.

427

.

.

.

.

428

429

430

431

. 30......

......

......

......

......

......

......

......

......

......

......

...

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

California Cancer Research Fund.................................................

Child Victims of Human Trafficking Fund.....................................

School Supplies for Homeless Children Fund .................................

State Parks Protection Fund/Parks Pass Purchase .............................

Protect Our Coast and Oceans Fund ........................................

Keep Arts in Schools Fund ...............................................

California Senior Legislature Fund..........................................

Habitat for Humanity Fund................................................

...............................

.....................

............................

....

California Sexual Violence Victim Services Fund

State Children’s Trust Fund for the Prevention of Child Abuse

Prevention of Animal Homelessness & Cruelty Fund

30 Add amounts in code 400 through code 431. These are your total contributions

Form 540 2EZ C1 2015 Side 33113153

Check for Errors

Print Form

Reset Form

Help

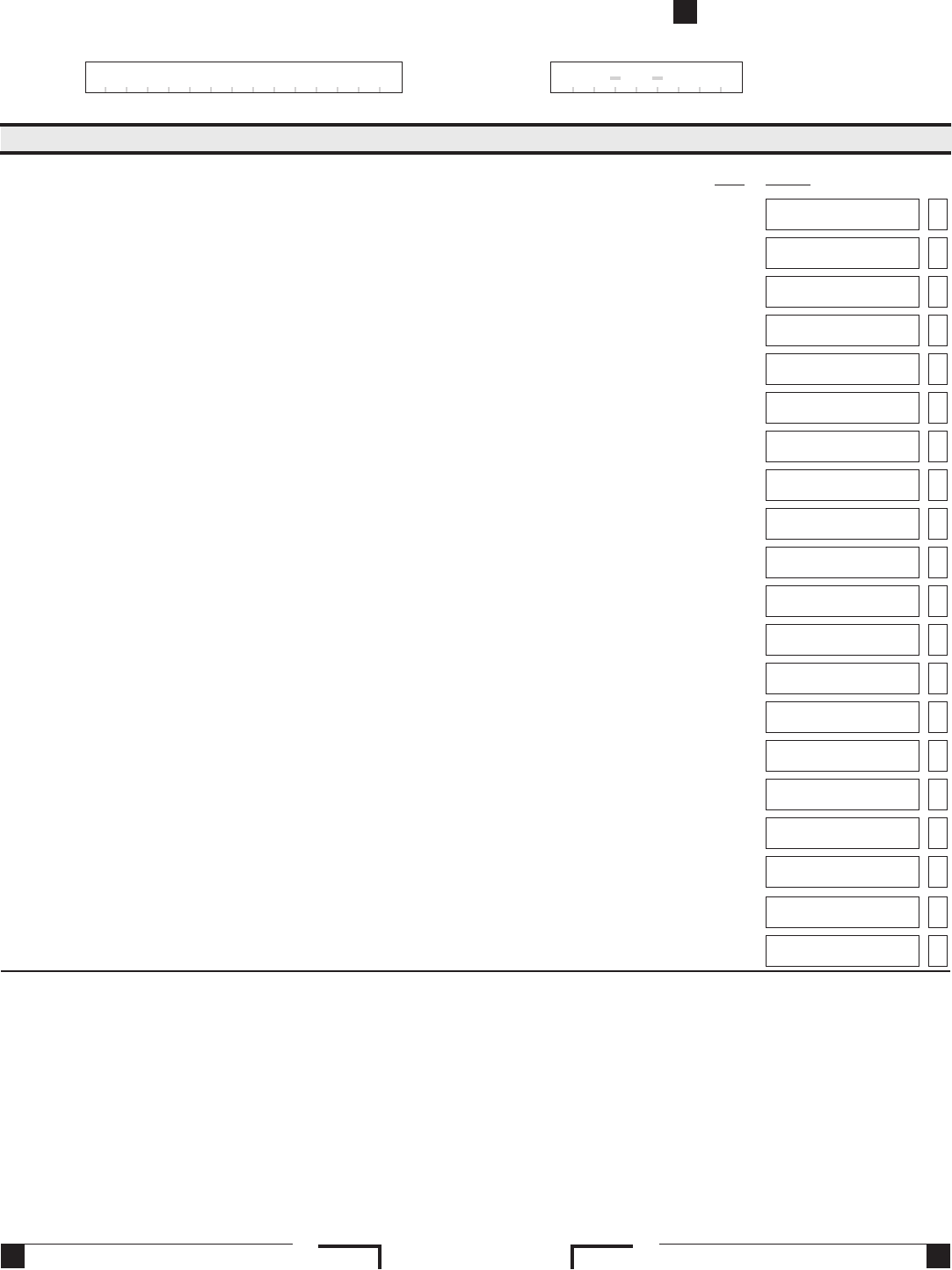

Your name: Your SSN or ITIN:

Amount

You Owe

31 AMOUNT YOU OWE. Add line 27, line 29, and line 30. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001

Pay online – Go to ftb.ca.gov for more information.

................................... 31

...................................

Direct

Deposit

(Refund

Only)

32 REFUND OR NO AMOUNT DUE. Subtract line 30 from line 28. See instructions.

Mail to: FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0001 32

Fill in the information to authorize direct deposit of your refund into one or two accounts.

Do not attach a voided check or a deposit slip. Have you verified the routing and

account numbers? Use whole dollars only.

All or the following amount of my refund (line 32) is authorized for direct deposit into the

account shown below:

Routing number m

Type

Checking

Savings

Account number

Direct deposit amount

33

m

The remaining amount of my refund (line 32) is authorized for direct deposit into the account shown below:

Routing number m

m

Type

Checking

Savings

Account number

Direct deposit amount

34

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information on this tax return is true, correct, and complete.

.

00

,

.

00

,

.

00

,

.

00

,

Sign

Here

It is unlawful

to forge a

spouse’s/RDP’s

signature.

Joint tax return?

See instructions.

Your signature Date Spouse’s/RDP’s signature (if a joint tax return, both must sign)

Your email address (optional). Enter only one email address. Daytime phone number (optional)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if self-employed) PTIN

Firm’s address FEIN

Do you want to allow another person to discuss this tax return with us? See instructions. .... m Yes Nom

Print Third Party Designee’s Name Telephone Number

( )

( )

X X

Side 4 Form 540 2EZ C1 2015 3114153

Check for Errors

Print Form

Reset Form

Help