Fillable Printable 2015 Form 1040A Or 1040 (Schedule B)

Fillable Printable 2015 Form 1040A Or 1040 (Schedule B)

2015 Form 1040A Or 1040 (Schedule B)

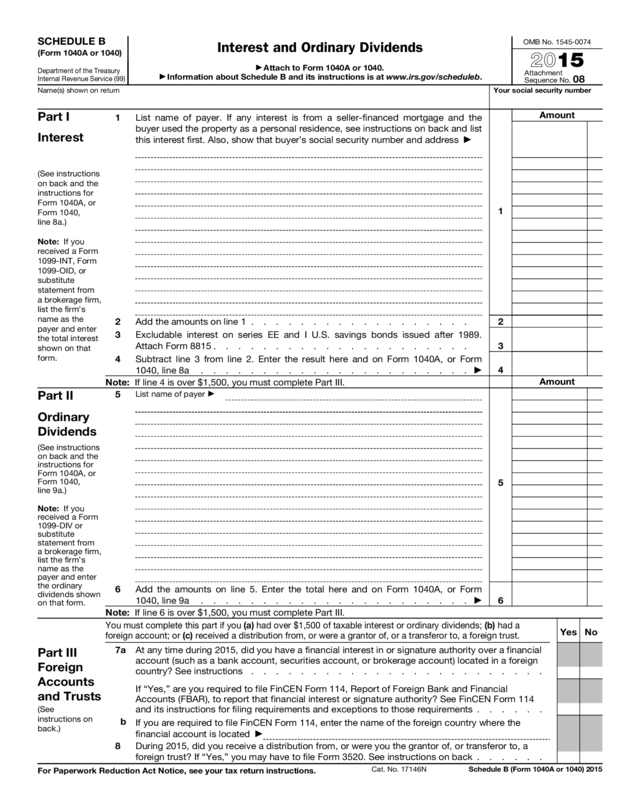

SCHEDULE B

(Form 1040A or 1040)

Department of the Treasury

Internal Revenue Service (99)

Interest and Ordinary Dividends

▶

Attach to Form 1040A or 1040.

▶

Information about Schedule B and its instructions is at www.irs.gov/scheduleb.

OMB No. 1545-0074

2015

Attachment

Sequence No.

08

Name(s) shown on return Your social security number

Part I

Interest

(See instructions

on back and the

instructions for

Form 1040A, or

Form 1040,

line 8a.)

Note: If you

received a Form

1099-INT, Form

1099-OID, or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

payer and enter

the total interest

shown on that

form.

1

List name of payer. If any interest is from a seller-financed mortgage and the

buyer used the property as a personal residence, see instructions on back and list

this interest first. Also, show that buyer’s social security number and address

▶

1

Amount

2 Add the amounts on line 1 . . . . . . . . . . . . . . . . . . 2

3

Excludable interest on series EE and I U.S. savings bonds issued after 1989.

Attach Form 8815 . . . . . . . . . . . . . . . . . . . . .

3

4

Subtract line 3 from line 2. Enter the result here and on Form 1040A, or Form

1040, line 8a . . . . . . . . . . . . . . . . . . . . . .

▶

4

Note: If line 4 is over $1,500, you must complete Part III.

Amount

Part II

Ordinary

Dividends

(See instructions

on back and the

instructions for

Form 1040A, or

Form 1040,

line 9a.)

Note: If you

received a Form

1099-DIV or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

payer and enter

the ordinary

dividends shown

on that form.

5

List name of payer

▶

5

6

Add the amounts on line 5. Enter the total here and on Form 1040A, or Form

1040, line 9a . . . . . . . . . . . . . . . . . . . . . .

▶

6

Note: If line 6 is over $1,500, you must complete Part III.

Part III

Foreign

Accounts

and Trusts

(See

instructions on

back.)

You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a

foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust.

Yes No

7a At any time during 2015, did you have a financial interest in or signature authority over a financial

account (such as a bank account, securities account, or brokerage account) located in a foreign

country? See instructions . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” are you required to file FinCEN Form 114, Report of Foreign Bank and Financial

Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114

and its instructions for filing requirements and exceptions to those requirements . . . . . .

b

If you are required to file FinCEN Form 114, enter the name of the foreign country where the

financial account is located

▶

8 During 2015, did you receive a distribution from, or were you the grantor of, or transferor to, a

foreign trust? If “Yes,” you may have to file Form 3520. See instructions on back . . . . . .

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 17146N Schedule B (Form 1040A or 1040) 2015

Schedule B (Form 1040A or 1040) 2015

Page 2

General Instructions

Section references are to the Internal Revenue Code

unless otherwise noted.

Future Developments

For the latest information about developments

related to Schedule B (Form 1040A or 1040) and its

instructions, such as legislation enacted after they

were published, go to www.irs.gov/scheduleb.

Purpose of Form

Use Schedule B if any of the following applies.

• You had over $1,500 of taxable interest or ordinary

dividends.

• You received interest from a seller-financed

mortgage and the buyer used the property as a

personal residence.

• You have accrued interest from a bond.

• You are reporting original issue discount (OID) in

an amount less than the amount shown on Form

1099-OID.

• You are reducing your interest income on a bond

by the amount of amortizable bond premium.

• You are claiming the exclusion of interest from

series EE or I U.S. savings bonds issued after 1989.

• You received interest or ordinary dividends as a

nominee.

• You had a financial interest in, or signature

authority over, a financial account in a foreign

country or you received a distribution from, or were

a grantor of, or transferor to, a foreign trust. Part III

of the schedule has questions about foreign

accounts and trusts.

Specific Instructions

TIP

You can list more than one payer on

each entry space for lines 1 and 5, but

be sure to clearly show the amount paid

next to the payer's name. Add the

separate amounts paid by the payers

listed on an entry space and enter the total in the

“Amount” column. If you still need more space, attach

separate statements that are the same size as the

printed schedule. Use the same format as lines 1 and

5, but show your totals on Schedule B. Be sure to put

your name and social security number (SSN) on the

statements and attach them at the end of your return.

Part I. Interest

Line 1. Report on line 1 all of your taxable interest.

Taxable interest generally should be shown on your

Forms 1099-INT, Forms 1099-OID, or substitute

statements. Include interest from series EE, H, HH,

and I U.S. savings bonds. Also include any accrued

market discount that is includible in income. List

each payer’s name and show the amount. Do not

report on this line any tax-exempt interest from box

8 or box 9 of Form 1099-INT. Instead, report the

amount from box 8 on line 8b of Form 1040A or

1040. If an amount is shown in box 9 of Form

1099-INT, you generally must report it on line 12 of

Form 6251. See the Instructions for Form 6251 for

more details. For more information on market

discount and other investment income see Pub. 550.

Seller-financed mortgages. If you sold your

home or other property and the buyer used the

property as a personal residence, list first any

interest the buyer paid you on a mortgage or other

form of seller financing. Be sure to show the buyer’s

name, address, and SSN. You must also let the

buyer know your SSN. If you do not show the

buyer’s name, address, and SSN, or let the buyer

know your SSN, you may have to pay a $50 penalty.

Nominees. If you received a Form 1099-INT that

includes interest you received as a nominee (that is, in

your name, but the interest actually belongs to

someone else), report the total on line 1. Do this even

if you later distributed some or all of this income to

others. Under your last entry on line 1, put a subtotal

of all interest listed on line 1. Below this subtotal, enter

"Nominee Distribution" and show the total interest you

received as a nominee. Subtract this amount from the

subtotal and enter the result on line 2.

TIP

If you received interest as a nominee,

you must give the actual owner a Form

1099-INT unless the owner is your

spouse. You must also file a Form 1096

and a Form 1099-INT with the IRS. For

more details, see the General Instructions for Certain

Information Returns and the Instructions for Forms

1099-INT and 1099-OID.

Accrued interest. When you buy bonds between

interest payment dates and pay accrued interest to

the seller, this interest is taxable to the seller. If you

received a Form 1099 for interest as a purchaser of a

bond with accrued interest, follow the rules earlier

under Nominees to see how to report the accrued

interest. But identify the amount to be subtracted as

“Accrued Interest.”

Original issue discount (OID). If you are reporting

OID in an amount less than the amount shown on

Form 1099-OID, follow the rules earlier under

Nominees to see how to report the OID. But identify

the amount to be subtracted as “OID Adjustment.”

Amortizable bond premium. If you are reducing your

interest income on a bond by the amount of amortizable

bond premium, follow the rules earlier under Nominees

to see how to report the interest. But identify the amount

to be subtracted as “ABP Adjustment.”

Line 3. If, during 2015, you cashed series EE or I

U.S. savings bonds issued after 1989 and you paid

qualified higher education expenses for yourself,

your spouse, or your dependents, you may be able

to exclude part or all of the interest on those bonds.

See Form 8815 for details.

Part II. Ordinary Dividends

TIP

You may have to file Form 5471 if, in

2015, you were an officer or director of

a foreign corporation. You may also

have to file Form 5471 if, in 2015, you

owned 10% or more of the total

(a) value of a foreign corporation’s stock, or (b)

combined voting power of all classes of a foreign

corporation’s stock with voting rights. For details,

see Form 5471 and its instructions.

Line 5. Report on line 5 all of your ordinary

dividends. This amount should be shown in box 1a

of your Forms 1099-DIV or substitute statements.

List each payer’s name and show the amount.

Nominees. If you received a Form 1099-DIV that

includes ordinary dividends you received as a

nominee (that is, in your name, but the ordinary

dividends actually belong to someone else), report

the total on line 5. Do this even if you later

distributed some or all of this income to others.

Under your last entry on line 5, put a subtotal of all

ordinary dividends listed on line 5. Below this

subtotal, enter “Nominee Distribution” and show the

total ordinary dividends you received as a nominee.

Subtract this amount from the subtotal and enter the

result on line 6.

TIP

If you received dividends as a nominee,

you must give the actual owner a Form

1099-DIV unless the owner is your spouse.

You must also file a Form 1096 and a Form

1099-DIV with the IRS. For more

details, see the General Instructions for Certain

Information Returns and the Instructions for Form

1099-DIV.

Part III. Foreign Accounts and

Trusts

TIP

Regardless of whether you are required

to file FinCEN Form 114 (FBAR), you

may be required to file Form 8938,

Statement of Specified Foreign

Financial Assets, with your income tax

return. Failure to file Form 8938 may result in

penalties and extension of the statute of limitations.

See www.irs.gov/form8938 for more information.

Line 7a–Question 1. Check the “Yes” box if at any

time during 2015 you had a financial interest in or

signature authority over a financial account located

in a foreign country. See the definitions that follow.

Check the “Yes” box even if you are not required to

file FinCEN Form 114, Report of Foreign Bank and

Financial Accounts (FBAR).

Financial account. A financial account includes,

but is not limited to, a securities, brokerage, savings,

demand, checking, deposit, time deposit, or other

account maintained with a financial institution (or

other person performing the services of a financial

institution). A financial account also includes a

commodity futures or options account, an insurance

policy with a cash value (such as a whole life

insurance policy), an annuity policy with a cash

value, and shares in a mutual fund or similar pooled

fund (that is, a fund that is available to the general

public with a regular net asset value determination

and regular redemptions).

Financial account located in a foreign country.

A financial account is located in a foreign country if

the account is physically located outside of the

United States. For example, an account maintained

with a branch of a United States bank that is

physically located outside of the United States is a

foreign financial account. An account maintained

with a branch of a foreign bank that is physically

located in the United States is not a foreign financial

account.

Signature authority. Signature authority is the

authority of an individual (alone or in conjunction

with another individual) to control the disposition of

assets held in a foreign financial account by direct

communication (whether in writing or otherwise) to

the bank or other financial institution that maintains

the financial account. See the FinCEN Form 114

instructions for exceptions. Do not consider the

exceptions relating to signature authority in

answering Question 1 on line 7a.

Other definitions. For definitions of “financial

interest,” “United States,” and other relevant terms,

see the instructions for FinCEN Form 114.

Line 7a–Question 2. See FinCEN Form 114 and its

instructions to determine whether you must file the

form. Check the “Yes” box if you are required to file

the form; check the “No” box if you are not required

to file the form.

If you checked the “Yes” box to Question 2 on line

7a, FinCEN Form 114 must be electronically filed

with the Financial Crimes Enforcement Network

(FinCEN) at the following website: http://bsaefiling.

fincen.treas.gov/main.html. Do not attach FinCEN

Form 114 to your tax return. To be considered

timely, FinCEN Form 114 must be received by June

30, 2016.

▲

!

CAUTION

If you are required to file FinCEN Form

114 but do not properly do so, you may

have to pay a civil penalty up to

$10,000. A person who willfully fails to

report an account or provide account

identifying information may be subject to a civil

penalty equal to the greater of $100,000 or 50

percent of the balance in the account at the time of

the violation. Willful violations may also be subject to

criminal penalties.

Line 7b. If you are required to file FinCEN Form 114,

enter the name of the foreign country or countries in

the space provided on line 7b. Attach a separate

statement if you need more space.

Line 8. If you received a distribution from a foreign

trust, you must provide additional information. For

this purpose, a loan of cash or marketable securities

generally is considered to be a distribution. See

Form 3520 for details.

If you were the grantor of, or transferor to, a

foreign trust that existed during 2015, you may have

to file Form 3520.

Do not attach Form 3520 to Form 1040. Instead,

file it at the address shown in its instructions.

If you were treated as the owner of a foreign trust

under the grantor trust rules, you are also

responsible for ensuring that the foreign trust files

Form 3520-A. Form 3520-A is due on March 15,

2016, for a calendar year trust. See the instructions

for Form 3520-A for more details.