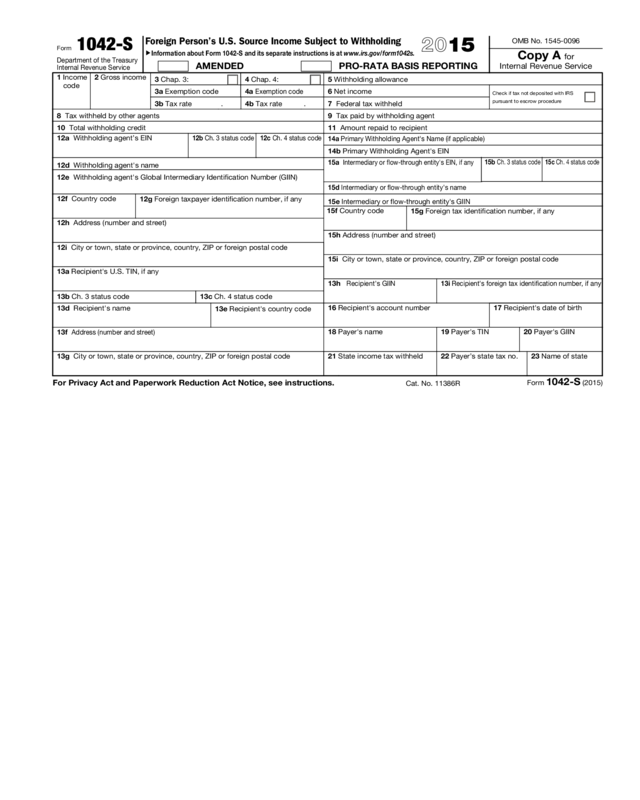

Fillable Printable 2015 Form 1042-S

Fillable Printable 2015 Form 1042-S

2015 Form 1042-S

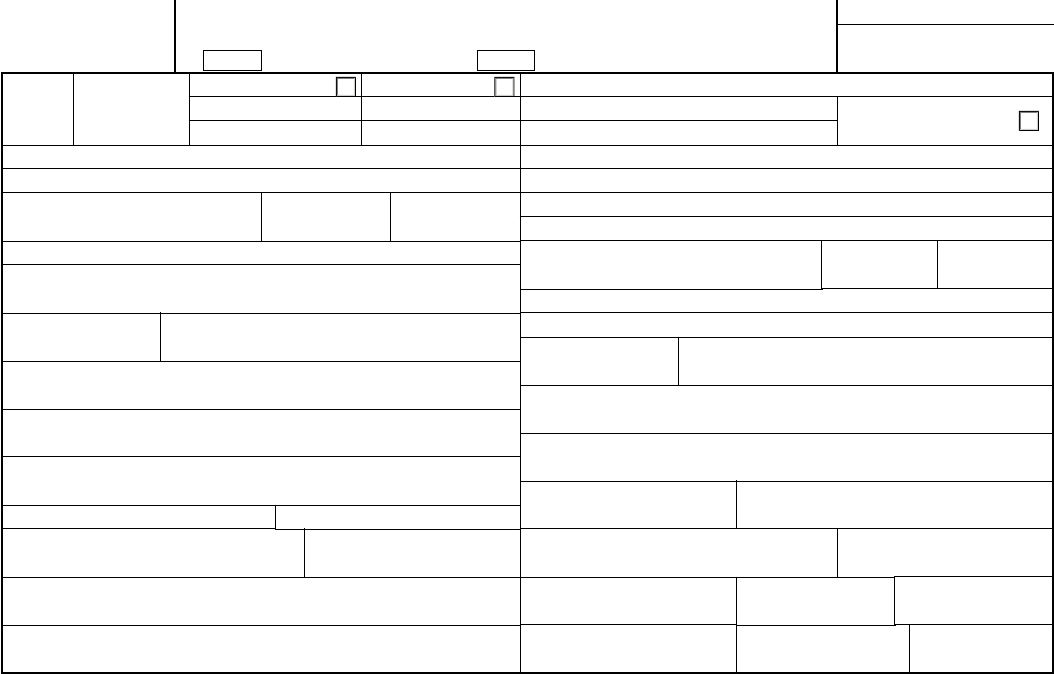

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

▶

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s.

2015

AMENDED PRO-RATA BASIS REPORTING

OMB No. 1545-0096

Copy A for

Internal Revenue Service

1 Income

code

2 Gross income

3 Chap. 3:

3a Exemption code

3b Tax rate .

4 Chap. 4:

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

Check if tax not deposited with IRS

pursuant to escrow procedure

7 Federal tax withheld

8 Tax withheld by other agents 9 Tax paid by withholding agent

10 Total withholding credit 11 Amount repaid to recipient

12a Withholding agent’s EIN

12b Ch. 3 status code 12c Ch. 4 status code

12d Withholding agent's name

12e Withholding agent's Global Intermediary Identification Number (GIIN)

12f Country code

12g Foreign taxpayer identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient's U.S. TIN, if any

13b Ch. 3 status code

13c Ch. 4 status code

13d Recipient's name

13e Recipient's country code

13f

Address (number and street)

13g City or town, state or province, country, ZIP or foreign postal code

13h

Recipient's GIIN

13i Recipient's foreign tax identification number, if

any

14a Primary Withholding Agent's Name (if applicable)

14b Primary Withholding Agent's EIN

15a

Intermediary or flow-through entity's EIN, if any

15b

Ch. 3 status code 15c Ch. 4 status code

15d Intermediary or flow-through entity's name

15e Intermediary or flow-through entity's GIIN

15f Country code

15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16 Recipient's account number 17 Recipient's date of birth

18 Payer's name

19 Payer's TIN

20 Payer's GIIN

21 State income tax withheld 22 Payer’s state tax no. 23 Name of state

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2015)

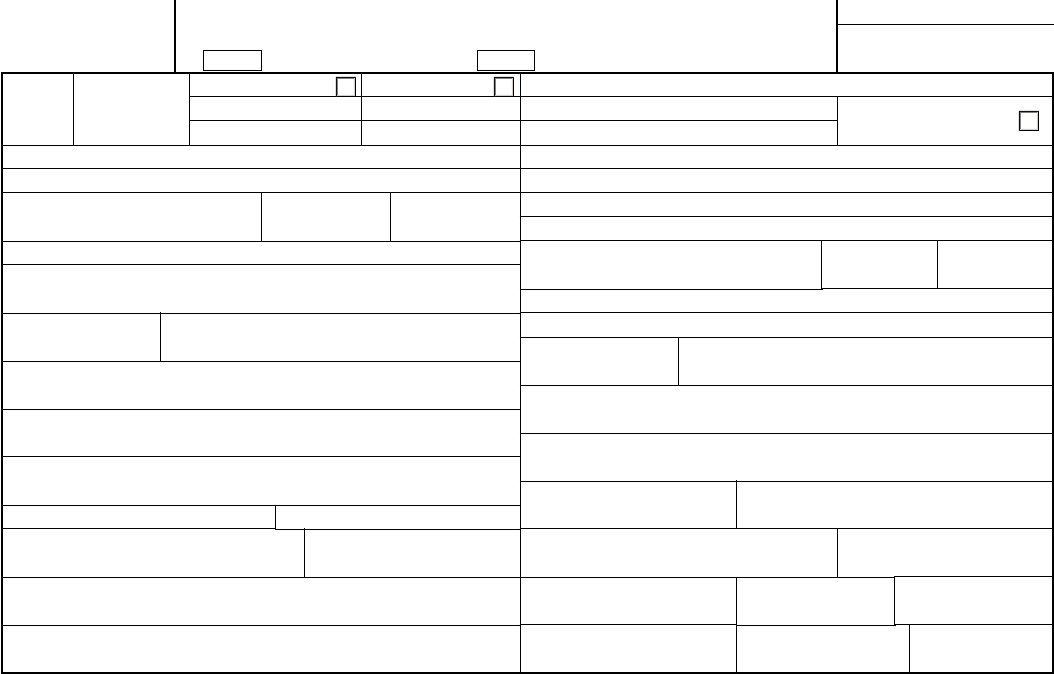

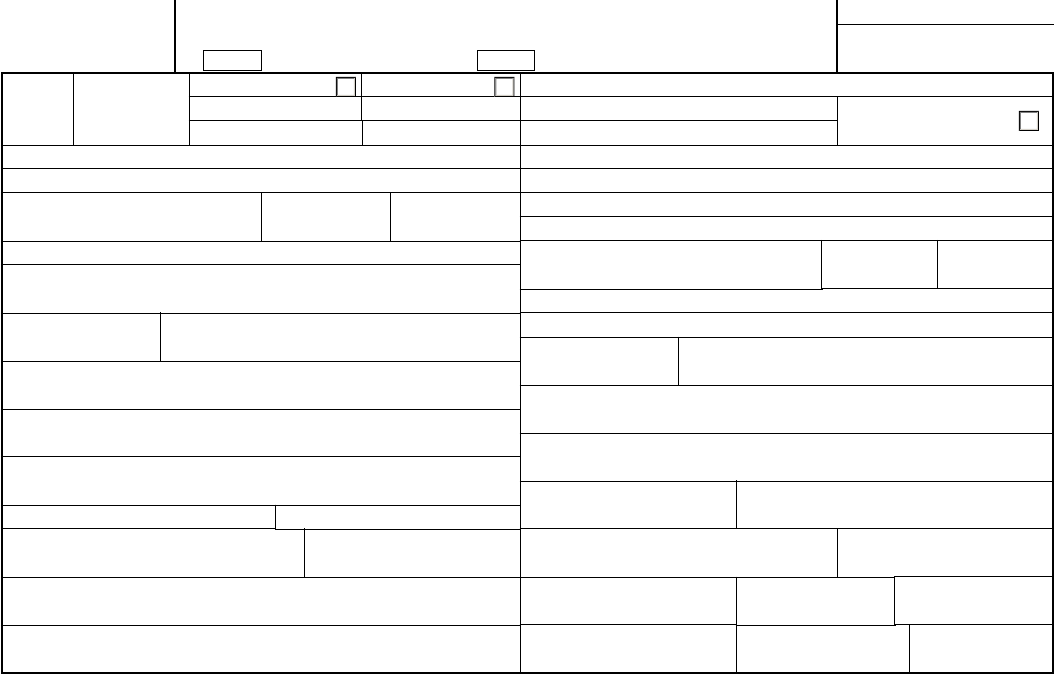

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

▶

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s.

2015

AMENDED PRO-RATA BASIS REPORTING

OMB No. 1545-0096

Copy B

for Recipient

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2015)

1 Income

code

2 Gross income

3 Chap. 3:

3a Exemption code

3b Tax rate .

4 Chap. 4:

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

Check if tax not deposited with IRS

pursuant to escrow procedure

7 Federal tax withheld

8 Tax withheld by other agents 9 Tax paid by withholding agent

10 Total withholding credit 11 Amount repaid to recipient

12a Withholding agent’s EIN

12b Ch. 3 status code 12c Ch. 4 status code

12d Withholding agent's name

12e Withholding agent's Global Intermediary Identification Number (GIIN)

12f Country code

12g Foreign taxpayer identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient's U.S. TIN, if any

13b Ch. 3 status code

13c Ch. 4 status code

13d Recipient's name

13e Recipient's country code

13f

Address (number and street)

13g City or town, state or province, country, ZIP or foreign postal code

13h

Recipient's GIIN

13i Recipient's foreign tax identification number, if

any

14a Primary Withholding Agent's Name (if applicable)

14b Primary Withholding Agent's EIN

15a

Intermediary or flow-through entity's EIN, if any

15b

Ch. 3 status code 15c Ch. 4 status code

15d Intermediary or flow-through entity's name

15e Intermediary or flow-through entity's GIIN

15f Country code

15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16 Recipient's account number 17 Recipient's date of birth

18 Payer's name

19 Payer's TIN

20 Payer's GIIN

21 State income tax withheld 22 Payer’s state tax no. 23 Name of state

U.S. Income Tax Filing Requirements

Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign

corporation with United States income, including income that is effectively connected with the

conduct of a trade or business in the United States, must file a United States income tax

return. However, no return is required to be filed by a nonresident alien individual, nonresident

alien fiduciary, or foreign corporation if such person was not engaged in a trade or business in

the United States at any time during the tax year and if the tax liability of such person was

fully satisfied by the withholding of United States tax at the source. Corporations file Form

1120-F; all others file Form 1040NR (or Form 1040NR-EZ if eligible). You may get the return

forms and instructions at any United States Embassy or consulate or by writing to: Internal

Revenue Service, 1201 N. Mitsubishi Motorway, Bloomington, IL 61705-6613.

En règle générale, tout étranger non-résident, tout organisme fidéicommissaire étranger

non-résident et toute société étrangère percevant un revenu aux Etats-Unis, y compris tout

revenu dérivé, en fait, du fonctionnement d’un commerce ou d’une affaire aux Etats-Unis, doit

produire une déclaration d’impôt sur le revenu auprès des services fiscaux des Etats-Unis.

Cependant aucune déclaration d’impôt sur le revenu n’est exigée d’un étranger non-résident,

d’un organisme fidéicommissaire étranger non-résident, ou d’une société étrangère s’ils n’ont

pris part à aucun commerce ou affaire aux Etats-Unis à aucun moment pendant l’année

fiscale et si les impôts dont ils sont redevables, ont été entièrement acquittés par une retenue

à la source sur leur salaire. Les sociétés doivent faire leur déclaration d’impôt en remplissant

le formulaire 1120-F; tous les autres redevables doivent remplir le formulaire 1040NR (ou

1040NR-EZ s'ils en remplissent les conditions). On peut se procurer les formulaires de

déclarations d’impôts et les instructions y afférentes dans toutes les Ambassades et tous les

Consulats des Etats-Unis. L’on peut également s’adresser pour tout renseignement à: Internal

Revenue Service, 1201 N. Mitsubishi Motorway, Bloomington, IL 61705-6613.

Por regla general, todo extranjero no residente, todo organismo fideicomisario extranjero

no residente y toda sociedad anónima extranjera que reciba ingresos en los Estados Unidos,

incluyendo ingresos relacionados con la conducción de un negocio o comercio dentro de los

Estados Unidos, deberá presentar una declaración estadounidense de impuestos sobre el

ingreso. Sin embargo, no se requiere declaración alguna a un individuo extranjero, una

sociedad anónima extranjera u organismo fideicomisario extranjero no residente, si tal

persona no ha efectuado comercio o negocio en los Estados Unidos durante el año fiscal y si

la responsabilidad con los impuestos de tal persona ha sido satisfecha plenamente mediante

retención del impuesto de los Estados Unidos en la fuente. Las sociedades anónimas envían

el Formulario 1120-F; todos los demás contribuyentes envían el Formulario 1040NR (o el

Formulario 1040NR-EZ si les corresponde). Se podrá obtener formularios e instrucciones en

cualquier Embajada o Consulado de los Estados Unidos o escribiendo directamente a:

Internal Revenue Service, 1201 N. Mitsubishi Motorway, Bloomington, IL 61705-6613.

Im allgemeinen muss jede ausländische Einzelperson, jeder ausländische Bevollmächtigte

und jede ausländische Gesellschaft mit Einkommen in den Vereinigten Staaten,

einschliesslich des Einkommens, welches direkt mit der Ausübung von Handel oder Gewerbe

innerhalb der Staaten verbunden ist, eine Einkommensteuererklärung der Vereinigten Staaten

abgeben. Eine Erklärung, muss jedoch nicht von Ausländern, ausländischen Bevollmächtigten

oder ausländischen Gesellschaften in den Vereinigten Staaten eingereicht werden, falls eine

solche Person während des Steuerjahres kein Gewerbe oder Handel in den Vereinigten

Staaten ausgeübt hat und die Steuerschuld durch Einbehaltung der Steuern der Vereinigten

Staaten durch die Einkommensquelle abgegolten ist. Gesellschaften reichen den Vordruck

1120-F ein; alle anderen reichen das Formblatt 1040NR (oder wenn passend das Formblatt

1040NR-EZ) ein. Einkommensteuererklärungen und Instruktionen können bei den Botschaften

und Konsulaten der Vereiningten Staaten eingeholt werden. Um weitere Informationen wende

man sich bitte an: Internal Revenue Service, 1201 N. Mitsubishi Motorway, Bloomington, IL

61705-6613.

Explanation of Codes

Box 1. Income code.

Code

Types of Income

Interest

01 Interest paid by U.S. obligors—general

02 Interest paid on real property mortgages

03 Interest paid to controlling foreign corporations

04 Interest paid by foreign corporations

05 Interest on tax-free covenant bonds

22

Interest paid on deposit with a foreign branch of a domestic corporation or partnership

29

Deposit Interest

30 Original issue discount (OID)

31 Short-term OID

33 Substitute payment—interest

51

Interest paid on certain actively traded or publicly offered securities

1

06

Dividends paid by U.S. corporations—general

07 Dividends qualifying for direct dividend rate

08 Dividends paid by foreign corporations

21

Gross income—Capital gain dividend

34 Substitute payment—dividends

40

Other dividend equivalents under IRC section 871(m) (formerly 871(l))

52

Dividends paid on certain actively traded or publicly offered securities

1

53

Substitute payments-dividends from certain actively traded or publicly

offered securities

1

09 Capital gains

10

Industrial royalties

Other

11

Motion picture or television copyright royalties

12

Other royalties (for example, copyright, recording, publishing)

13

Royalties paid on certain publicly offered securities

1

Real property income and natural resources royalties14

Dividend

See back of Copy C for additional codes

1

This code should only be used

if the income paid is described in Regulations section 1.1441-6(c)(2) and withholding agent has reduced the rate of withholding under an income tax treaty without the

recipient providing a U.S. or foreign TIN.

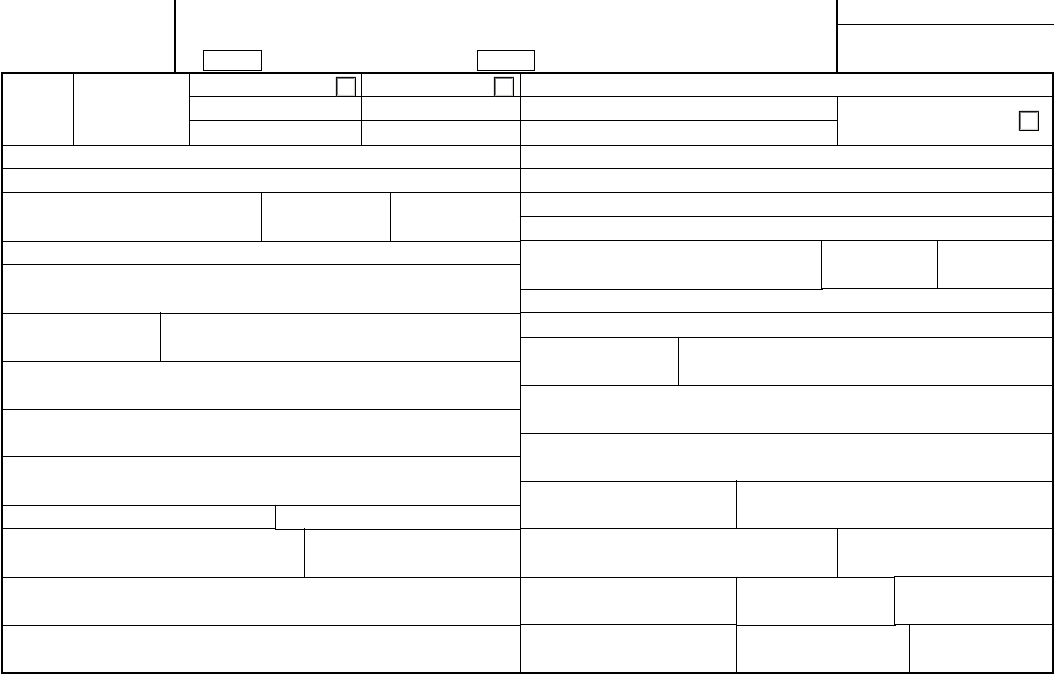

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

▶

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s.

2015

AMENDED PRO-RATA BASIS REPORTING

OMB No. 1545-0096

Copy C for Recipient

Attach to any Federal tax return you file

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2015)

1 Income

code

2 Gross income

3 Chap. 3:

3a Exemption code

3b Tax rate .

4 Chap. 4:

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

Check if tax not deposited with IRS

pursuant to escrow procedure

7 Federal tax withheld

8 Tax withheld by other agents 9 Tax paid by withholding agent

10 Total withholding credit 11 Amount repaid to recipient

12a Withholding agent’s EIN

12b Ch. 3 status code 12c Ch. 4 status code

12d Withholding agent's name

12e Withholding agent's Global Intermediary Identification Number (GIIN)

12f Country code

12g Foreign taxpayer identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient's U.S. TIN, if any

13b Ch. 3 status code

13c Ch. 4 status code

13d Recipient's name

13e Recipient's country code

13f

Address (number and street)

13g City or town, state or province, country, ZIP or foreign postal code

13h

Recipient's GIIN

13i Recipient's foreign tax identification number, if

any

14a Primary Withholding Agent's Name (if applicable)

14b Primary Withholding Agent's EIN

15a

Intermediary or flow-through entity's EIN, if any

15b

Ch. 3 status code 15c Ch. 4 status code

15d Intermediary or flow-through entity's name

15e Intermediary or flow-through entity's GIIN

15f Country code

15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16 Recipient's account number 17 Recipient's date of birth

18 Payer's name

19 Payer's TIN

20 Payer's GIIN

21 State income tax withheld 22 Payer’s state tax no. 23 Name of state

Explanation of Codes (continued)

Other

15 Pensions, annuities, alimony, and/or insurance premiums

16 Scholarship or fellowship grants

17 Compensation for independent personal services

2

18 Compensation for dependent personal services

2

19 Compensation for teaching

2

20 Compensation during studying and training

2

23 Gross income—Other

24 Real estate investment trust (REIT) distributions of capital gains

25 Trust distributions subject to IRC section 1445

26

Unsevered growing crops and timber distributions by a trust subject

to IRC section 1445

27 Publicly traded partnership distributions subject to IRC section 1446

28 Gambling winnings

3

32 Notional principal contract income

4

35 Substitute payment—other

36 Capital gains distributions

37 Return of capital

38

Eligible deferred compensation items subject to IRC section 877A(d)(1)

39

Distributions from a nongrantor trust subject to IRC section 877A(f)(1)

41

Guarantee of indebtedness

42 Earnings as an artist or athlete—no central withholding agreement

5

43 Earnings as an artist or athlete—central withholding agreement

5

44 Specified Federal procurement payments

50 Income previously reported under escrow procedure

6

54

Other income

Boxes 3a and 4a. Exemption code (applies if the tax rate entered in boxes 3b and 4b is 00.00).

Code Authority for Exemption

Chapter 3

01

Effectively connected income

02 Exempt under IRC (other than portfolio interest)

03 Income is not from U.S. sources

04 Exempt under tax treaty

05 Portfolio interest exempt under IRC

06 QI that assumes primary withholding responsibility

07 WFP or WFT

08 U.S. branch treated as U.S. Person

09 Territory FI treated as U.S. Person

10 QI represents that income is exempt

11 QSL that assumes primary withholding responsibility

12 Payee subjected to chapter 4 withholding

Chapter 4

13 Grandfathered payment

14 Effectively connected income

15 Payee not subject to chapter 4 withholding

16 Excluded nonfinancial payment

17 Foreign Entity that assumes primary withholding responsibility

18

U.S. Payees—of participating FFI or registered deemed-compliant FFI

19

Exempt from withholding under IGA

7

20 Dormant account

8

21

Excluded payment on offshore obligation

22

Excluded payments on Collateral

9

Code

Type of Recipient, Withholding Agent, or Intermediary

Chapter 3 Status Codes

01 U.S. Withholding Agent—FI

02 U.S. Withholding Agent—Other

03 Territory FI—treated as U.S. Person

04 Territory FI—not treated as U.S. Person

05 U.S. branch—treated as U.S. Person

06 U.S. branch—not treated as U.S. Person

U.S. branch—ECI presumption applied

07

08 Partnership other than Withholding Foreign Partnership

09 Withholding Foreign Partnership

See back of Copy D for additional codes

2

If compensation that otherwise would be covered under Income Codes 17 through 20 is directly attributable to the recipient’s occupation as an artist or athlete, use Income Code 42 or 43 instead.

3

Subject to 30% withholding rate unless the recipient is from one of the treaty countries listed under Gambling winnings (Income Code 28) in Pub. 515.

4

Use appropriate Interest Income Code for embedded interest in a notional principal contract.

5

If Income Code 42 or 43 is used, Recipient Code 22 (artist or athlete) should be used instead of Recipient Code 16 (individual), 15 (corporation), or 08 (partnership other than withholding foreign partnership).

6

Use only to report gross income the tax for which is being deposited in the current year because such tax was previously escrowed for chapters 3 and 4 and the withholding agent previously

reported the gross income in a prior year and checked the box to report the tax as not deposited under the escrow procedure. See the instructions to this form for further explanation.

7

Use only to report a U.S. reportable account or non-consenting U.S. account that is receiving a payment subject to chapter 3 withholding.

8

Use only if applying the escrow procedure for dormant accounts under Regulations section 1.1471-4(b)(6). If tax was withheld and deposited under chapter 3, do not check the “tax not deposited

with IRS pursuant to escrow procedure” box. You must instead check box 3 and complete box 3b.

9

This code should only be used if the income paid is not subject to withholding under chapter 4 pursuant to Regulations section 1.1473-1(a)(4)(vii).

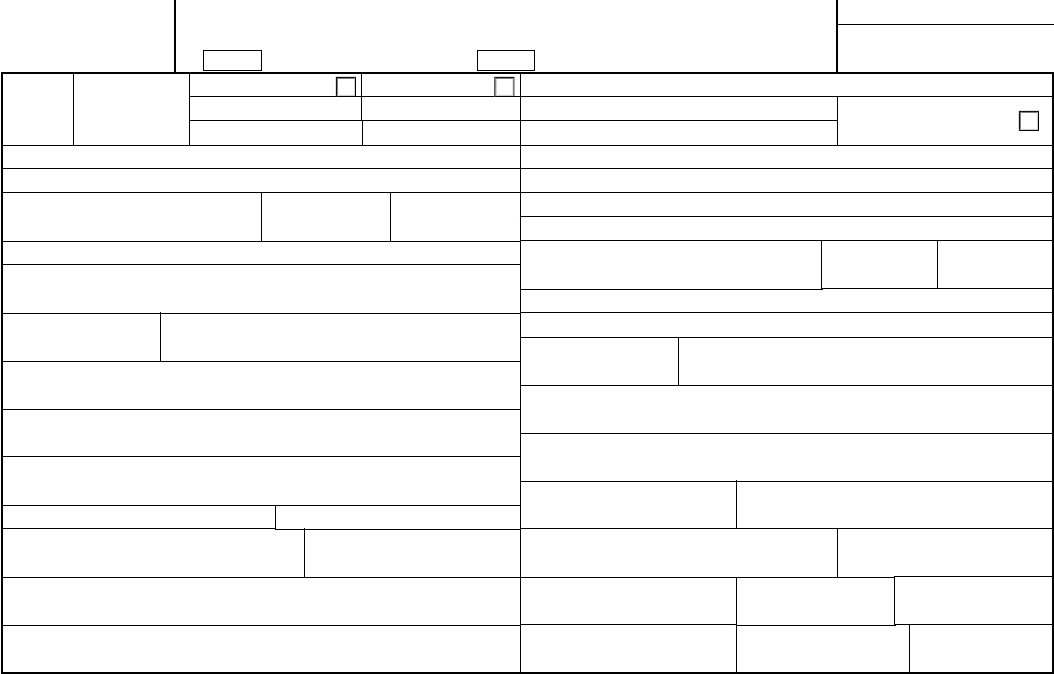

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

▶

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s.

2015

AMENDED PRO-RATA BASIS REPORTING

OMB No. 1545-0096

Copy D for Recipient

Attach to any state tax return you file

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2015)

1 Income

code

2 Gross income

3 Chap. 3:

3a Exemption code

3b Tax rate .

4 Chap. 4:

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

Check if tax not deposited with IRS

pursuant to escrow procedure

7 Federal tax withheld

8 Tax withheld by other agents 9 Tax paid by withholding agent

10 Total withholding credit 11 Amount repaid to recipient

12a Withholding agent’s EIN

12b Ch. 3 status code 12c Ch. 4 status code

12d Withholding agent's name

12e Withholding agent's Global Intermediary Identification Number (GIIN)

12f Country code

12g Foreign taxpayer identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient's U.S. TIN, if any

13b Ch. 3 status code

13c Ch. 4 status code

13d Recipient's name

13e Recipient's country code

13f

Address (number and street)

13g City or town, state or province, country, ZIP or foreign postal code

13h

Recipient's GIIN

13i Recipient's foreign tax identification number, if

any

14a Primary Withholding Agent's Name (if applicable)

14b Primary Withholding Agent's EIN

15a

Intermediary or flow-through entity's EIN, if any

15b

Ch. 3 status code 15c Ch. 4 status code

15d Intermediary or flow-through entity's name

15e Intermediary or flow-through entity's GIIN

15f Country code

15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16 Recipient's account number 17 Recipient's date of birth

18 Payer's name

19 Payer's TIN

20 Payer's GIIN

21 State income tax withheld 22 Payer’s state tax no. 23 Name of state

Explanation of Codes (continued)

10 Trust other than Withholding Foreign Trust

11 Withholding Foreign Trust

12 Qualified Intermediary

13

Qualified Securities Lender—Qualified Intermediary

14 Qualified Securities Lender—Other

15 Corporation

16 Individual

17 Estate

18 Private Foundation

19 Government or International Organization

20 Tax Exempt Organization (Section 501(c) entities)

21 Unknown Recipient

22 Artist or Athlete

23 Pension

24 Foreign Central Bank of Issue

25 Nonqualified Intermediary

26 Hybrid entity making Treaty Claim

Pooled Reporting Codes

10

27 Withholding Rate Pool—General

28 Withholding Rate Pool—Exempt Organization

29 PAI Withholding Rate Pool—General

30

PAI Withholding Rate Pool—Exempt Organization

31 Agency Withholding Rate Pool—General

32 Agency Withholding Rate Pool—Exempt Organization

33 Joint account withholding rate pool

Chapter 4 Status Codes

01 U.S. Withholding Agent—FI

02 U.S. Withholding Agent—Other

03

Territory FI—not treated as U.S. Person

04 Territory FI—treated as U.S. Person

05 Participating FFI—Other

06 Participating FFI—Reporting Model 2 FFI

07 Registered Deemed-Compliant FFI—Reporting Model 1 FFI

08 Registered Deemed-Compliant FFI—Sponsored Entity

09 Registered Deemed-Compliant FFI—Other

10 Certified Deemed-Compliant FFI—Other

11

Certified Deemed-Compliant FFI—FFI with Low Value Accounts

12

Certified Deemed-Compliant FFI—Non-Registering Local Bank

13

Certified Deemed-Compliant FFI—Sponsored Entity

14

Certified Deemed-Compliant FFI—Investment Advisor or Investment Manager

15 Nonparticipating FFI

16 Owner-Documented FFI

17 Limited Branch treated as Nonparticipating FFI

18 Limited FFI treated as Nonparticipating FFI

19 Passive NFFE identifying Substantial U.S. Owners

20 Passive NFFE with no Substantial U.S. Owners

21 Publicly Traded NFFE or Affiliate of Publicly Traded NFFE

22

Active NFFE

23

Individual

24

Section 501(c) Entities

25

Excepted Territory NFFE

26

Excepted NFFE — Other

27

Exempt Beneficial Owner

28

Entity Wholly Owned by Exempt Beneficial Owners

29

Unknown Recipient

30

Recalcitrant Account Holder

31

Nonreporting IGA FFI

32

Direct reporting NFFE

33

U.S. reportable account

34

Non-consenting U.S. account

35

Sponsored direct reporting NFFE

36

Excepted Inter-affiliate FFI

37

Undocumented Preexisting Obligation

38

U.S. Branch—ECI presumption applied

39

Account Holder of Excluded Financial Account

11

40

Passive NFFE reported by FFI

12

41 NFFE subject to 1472 withholding

Pooled Reporting Codes

42 Recalcitrant Pool—No U.S. Indicia

43 Recalcitrant Pool—U.S. Indicia

44 Recalcitrant Pool—Dormant Account

45 Recalcitrant Pool—U.S. Persons

46 Recalcitrant Pool—Passive NFFEs

47 Nonparticipating FFI Pool

48 U.S. Payees Pool

49

QI-Recalcitrant Pool—GeneraI

13

10

These codes should only be used by a QI, QSL, WP, or WT.

11

This code should only be used if income is paid to an account that is excluded from the definition of financial account under Regulations section 1.1471-5(b)(2) or under Annex II of the applicable Model 1 IGA or Model 2 IGA.

12

This code should only be used when the withholding agent has received a certification on the FFI withholding statement of a participating FFI or registered deemed-compliant FFI that maintains the account that the FFI

has reported the account held by the passive NFFE as a U.S. account (or U.S. reportable account) under it's FATCA requirements. The withholding agent must report the name and GIIN of such FFA in box 15d and 15e.

13

This code should only be used by a withholding agent that is reporting a payment (or portion of a payment) made to a QI with respect to the QI's recalcitrant account holders.

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

▶

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s.

2015

AMENDED PRO-RATA BASIS REPORTING

OMB No. 1545-0096

Copy E

for Withholding Agent

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2015)

1 Income

code

2 Gross income

3 Chap. 3:

3a Exemption code

3b Tax rate .

4 Chap. 4:

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

Check if tax not deposited with IRS

pursuant to escrow procedure

7 Federal tax withheld

8 Tax withheld by other agents 9 Tax paid by withholding agent

10 Total withholding credit 11 Amount repaid to recipient

12a Withholding agent’s EIN

12b Ch. 3 status code 12c Ch. 4 status code

12d Withholding agent's name

12e Withholding agent's Global Intermediary Identification Number (GIIN)

12f Country code

12g Foreign taxpayer identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient's U.S. TIN, if any

13b Ch. 3 status code

13c Ch. 4 status code

13d Recipient's name

13e Recipient's country code

13f

Address (number and street)

13g City or town, state or province, country, ZIP or foreign postal code

13h

Recipient's GIIN

13i Recipient's foreign tax identification number, if

any

14a Primary Withholding Agent's Name (if applicable)

14b Primary Withholding Agent's EIN

15a

Intermediary or flow-through entity's EIN, if any

15b

Ch. 3 status code 15c Ch. 4 status code

15d Intermediary or flow-through entity's name

15e Intermediary or flow-through entity's GIIN

15f Country code

15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16 Recipient's account number 17 Recipient's date of birth

18 Payer's name

19 Payer's TIN

20 Payer's GIIN

21 State income tax withheld 22 Payer’s state tax no. 23 Name of state