Fillable Printable 2015 Form 540 - California Resident Income Tax Return

Fillable Printable 2015 Form 540 - California Resident Income Tax Return

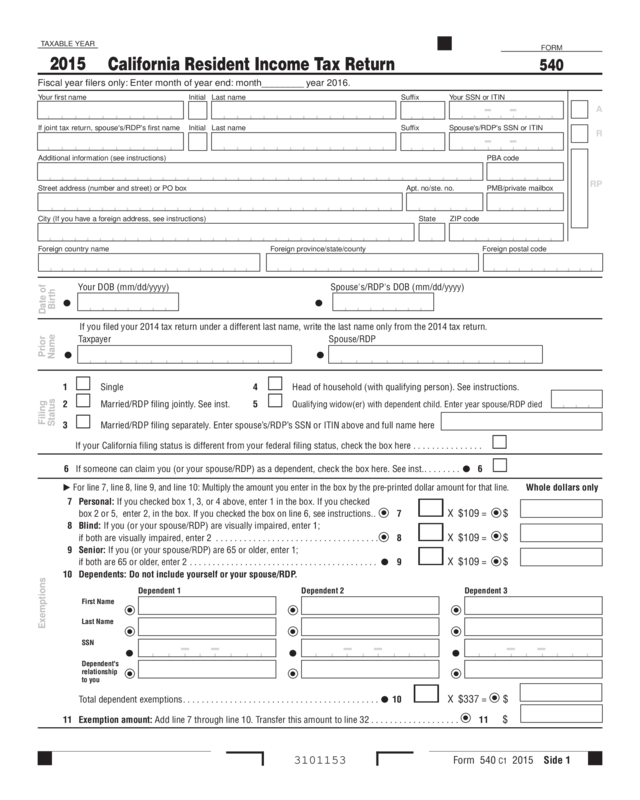

2015 Form 540 - California Resident Income Tax Return

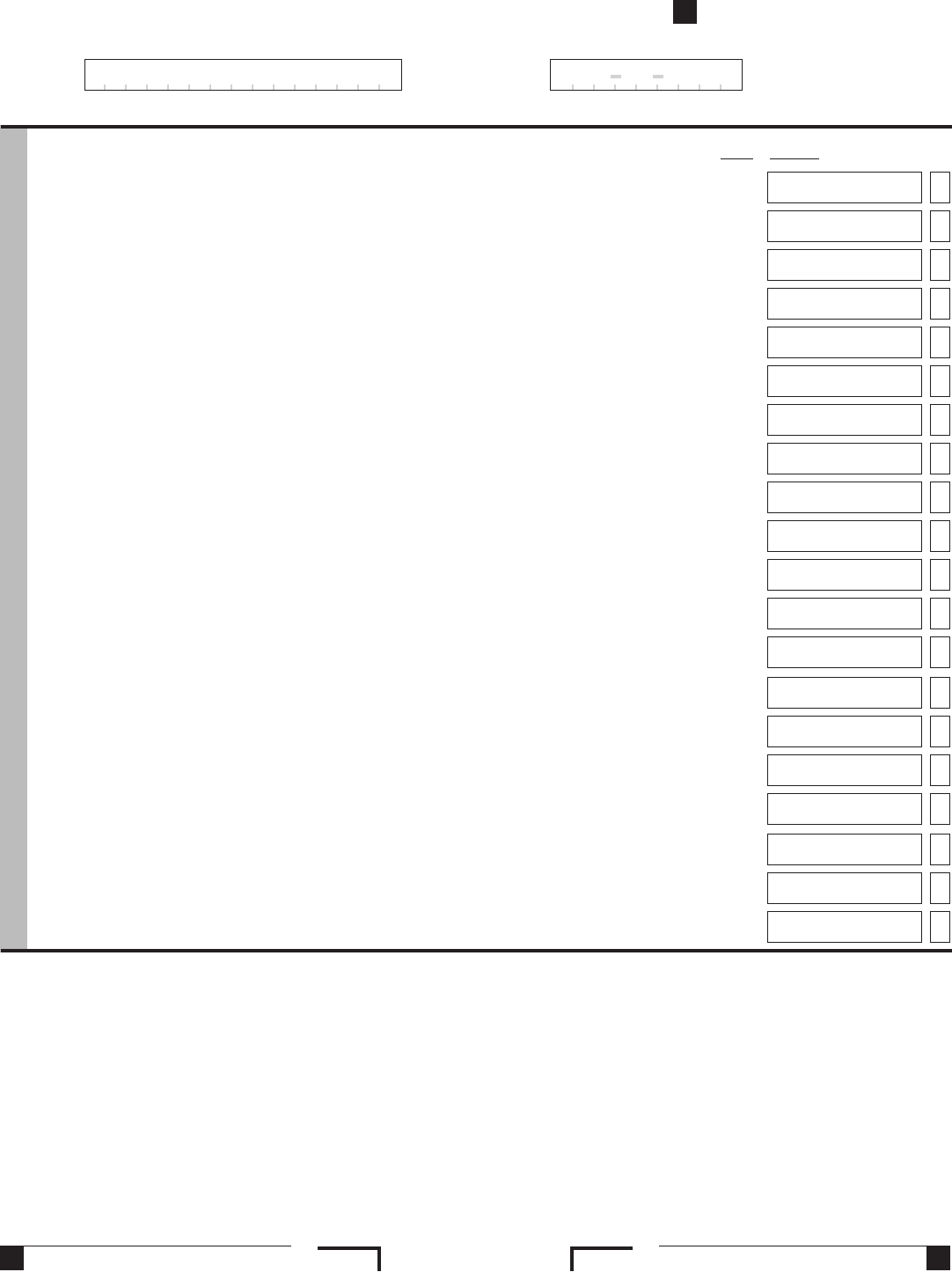

3101153 Form 540 C1 2015 Side 1

California Resident Income Tax Return

FORM

540

Fiscal year filers only: Enter month of year end: month________ year 2016.

A

R

RP

Your first name Initial Last name Suffix Your SSN or ITIN

If joint tax return, spouse's/RDP's first name Initial Last name Suffix Spouse's/RDP's SSN or ITIN

Additional information (see instructions) PBA code

Street address (number and street) or PO box Apt. no/ste. no. PMB/private mailbox

City (If you have a foreign address, see instructions) State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

Date of

Birth

Your DOB (mm/dd/yyyy) Spouse's/RDP's DOB (mm/dd/yyyy)

Prior

Name

If you filed your 2014 tax return under a different last name, write the last name only from the 2014 tax return.

Taxpayer Spouse/RDP

Filing

Status

1 m Single 4 m Head of household (with qualifying person). See instructions.

2 m Married/RDP filing jointly. See inst. 5 m Qualifying widow(er) with dependent child. Enter year spouse/RDP died

3 m Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here

If your California filing status is different from your federal filing status, check the box here ............... m

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst......... 6 m

Exemptions

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line.

Whole dollars only

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked

box 2 or 5, enter 2, in the box. If you checked the box on line 6, see instructions.

. 7

m

X $109 = $

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1;

if both are visually impaired, enter 2

................................... 8

m

X $109 = $

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1;

if both are 65 or older, enter 2

.........................................

9

m

X $109 = $

10 Dependents: Do not include yourself or your spouse/RDP.

Dependent 1 Dependent 2 Dependent 3

Total dependent exemptions.......................................... 10

m

X $337 =

$

11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 ...................

11 $

First Name

Last Name

SSN

Dependent's

relationship

to you

TAXABLE YEAR

2015

Get instructions for 540 Form

"What's New" for 540 Form

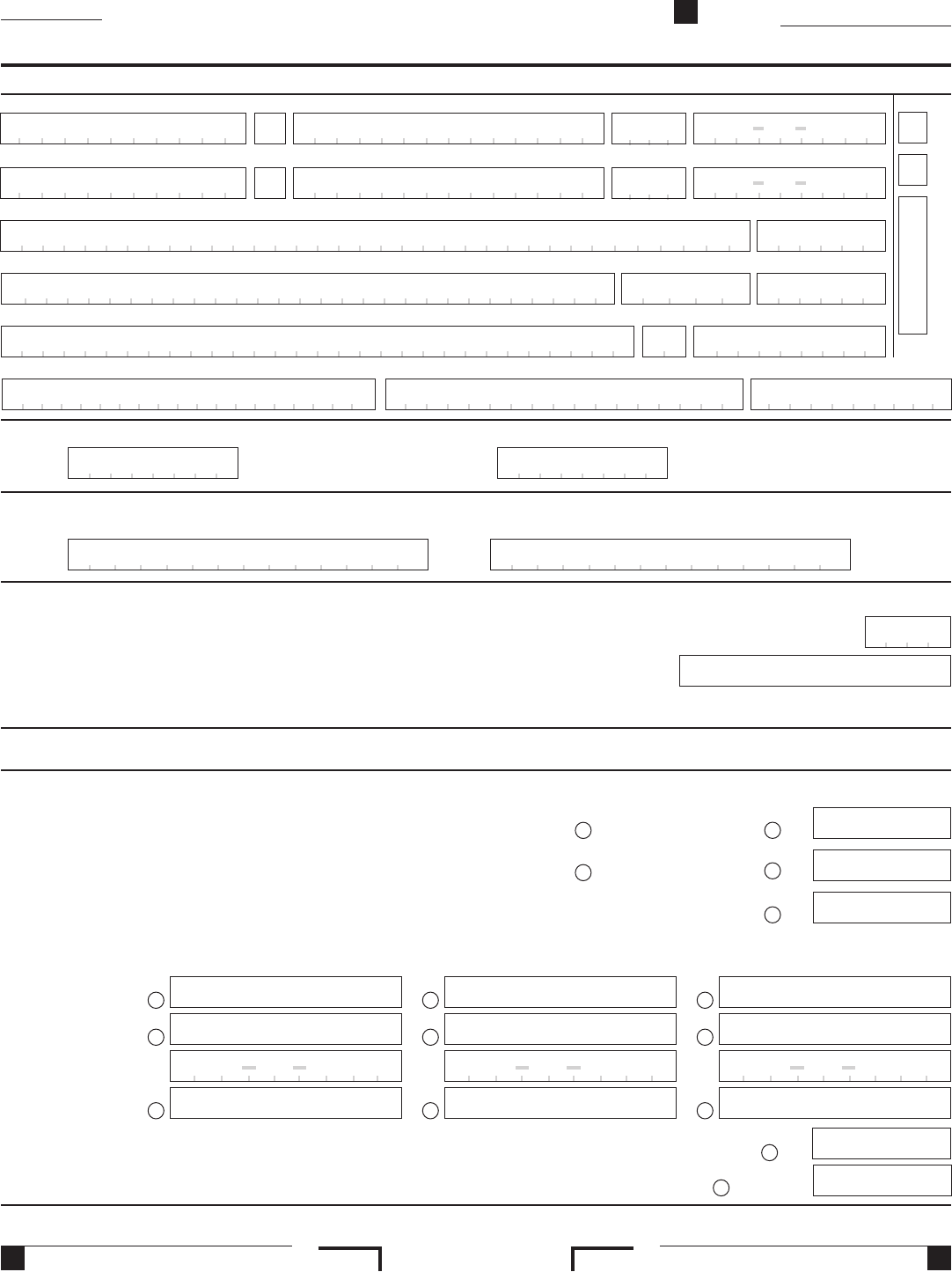

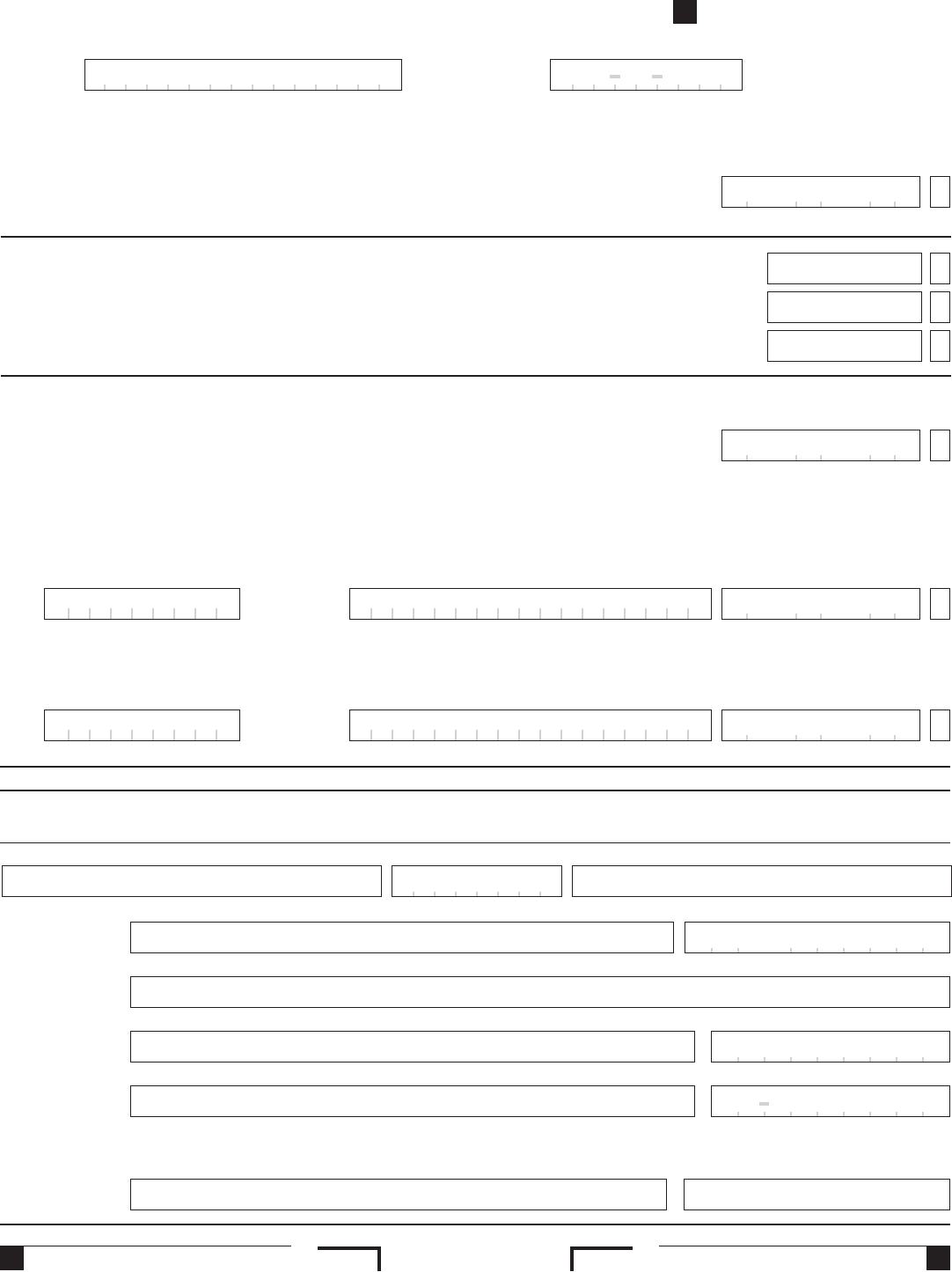

Side 2 Form 540 C1 2015

3102153

12 State wages from your Form(s) W-2, box 16 ....................... 12

13 Enter federal adjusted gross income from Form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 ......

13

..

14

...... 15

...

16

...

17

...

18

...

19

{

... 31

...

32

...

33

...

34

...

35

....

40

...

43

...

44

....

45

....

46

...

47

...

48

.

00

...

61

...

62

... 63

14 California adjustments – subtractions. Enter the amount from Schedule CA (540), line 37, column B

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions ...

16 California adjustments – additions. Enter the amount from Schedule CA (540), line 37, column C ..

17 California adjusted gross income. Combine line 15 and line 16 .............................

18 Enter the Your California itemized deductions from Schedule CA (540), line 44; OR

larger of: Your California standard deduction shown below for your filing status:

• Single or Married/RDP filing separately..............................$4,044

• Married/RDP filing jointly, Head of household, or Qualifying widow(er) .....$8,088

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions .

19 Subtract line 18 from line 17. This is your taxable income. If less than zero, enter -0-...........

Taxable Income

{

Tax

31 Tax. Check the box if from:

m

Tax Table

m

Tax Rate Schedule

m

FTB 3800

m

FTB 3803...........................

32 Exemption credits. Enter the amount from line 11. If your federal AGI is more than $178,706,

see instructions..................................................................

33 Subtract line 32 from line 31. If less than zero, enter -0- ..................................

34 Tax. See instructions. Check the box if from:

m

Schedule G-1

m

FTB 5870A......

35 Add line 33 and line 34............................................................

Special Credits

40 Nonrefundable Child and Dependent Care Expenses Credit. See instructions. ..................

43 Enter credit name code and amount

44 Enter credit name code and amount

45 To claim more than two credits, see instructions. Attach Schedule P (540)....................

46 Nonrefundable renter’s credit. See instructions .........................................

47 Add line 40 through line 46. These are your total credits ..................................

48 Subtract line 47 from line 35. If less than zero, enter -0- ..................................

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

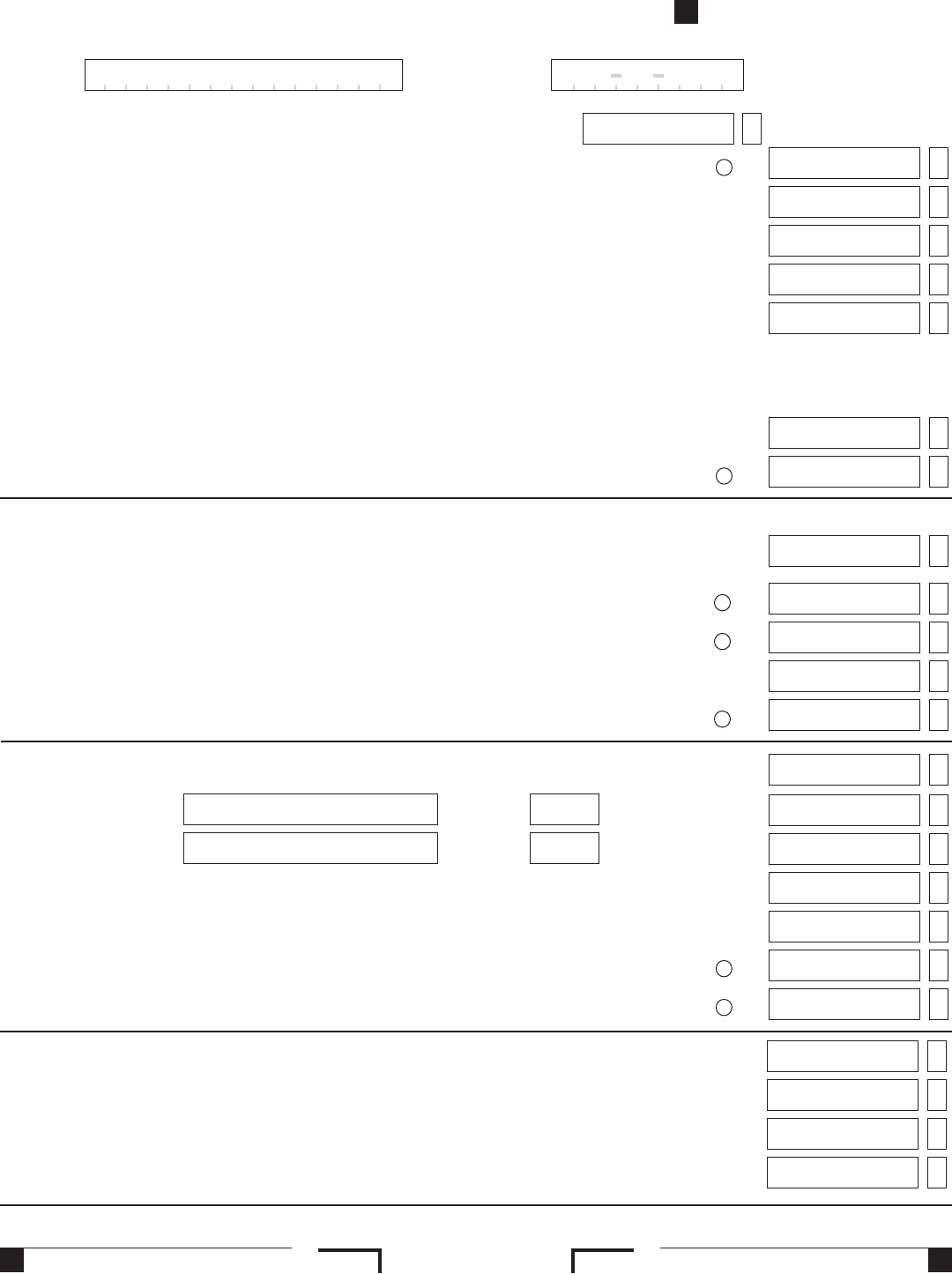

Your name: Your SSN or ITIN:

Other T axes

61 Alternative minimum tax. Attach Schedule P (540) .......................................

62 Mental Health Services Tax. See instructions ............................................

63 Other taxes and credit recapture. See instructions........................................

64 Add line 48, line 61, line 62, and line 63. This is your total tax.................................. 64

.

00

.

00

.

00

.

00

Form 540 C1 2015 Side 33103153

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

Payments

71 California income tax withheld. See instructions ............................................ 71

72 2015 CA estimated tax and other payments. See instructions .................................. 72

73 Withholding (Form 592-B and/or 593). See instructions ...................................... 73

74 Excess SDI (or VPDI) withheld. See instructions ............................................ 74

75

Earned Income Tax Credit (EITC) ........................................................ 75

........

76

........

92

........

93

........

94

.........

95

.........

96

........

97

.

00

76 Add lines 71 through 75. These are your total payments. See instructions ...............

Overpaid T ax/

Tax Due

92 Payments balance. If line 76 is more than line 91, subtract line 91 from line 76............

93 Use Tax balance. If line 91 is more than line 76, subtract line 76 from line 91.............

94 Overpaid tax. If line 92 is more than line 64, subtract line 64 from line 92................

95 Amount of line 94 you want applied to your 2016 estimated tax .......................

96 Overpaid tax available this year. Subtract line 95 from line 94 .........................

97 Tax due. If line 92 is less than line 64, subtract line 92 from line 64. ....................

Your name: Your SSN or ITIN:

This space reserved for 2D barcode

This space reserved for 2D barcode

Use

Tax

91 Use Tax. This is not a total line. See instructions ................... 91

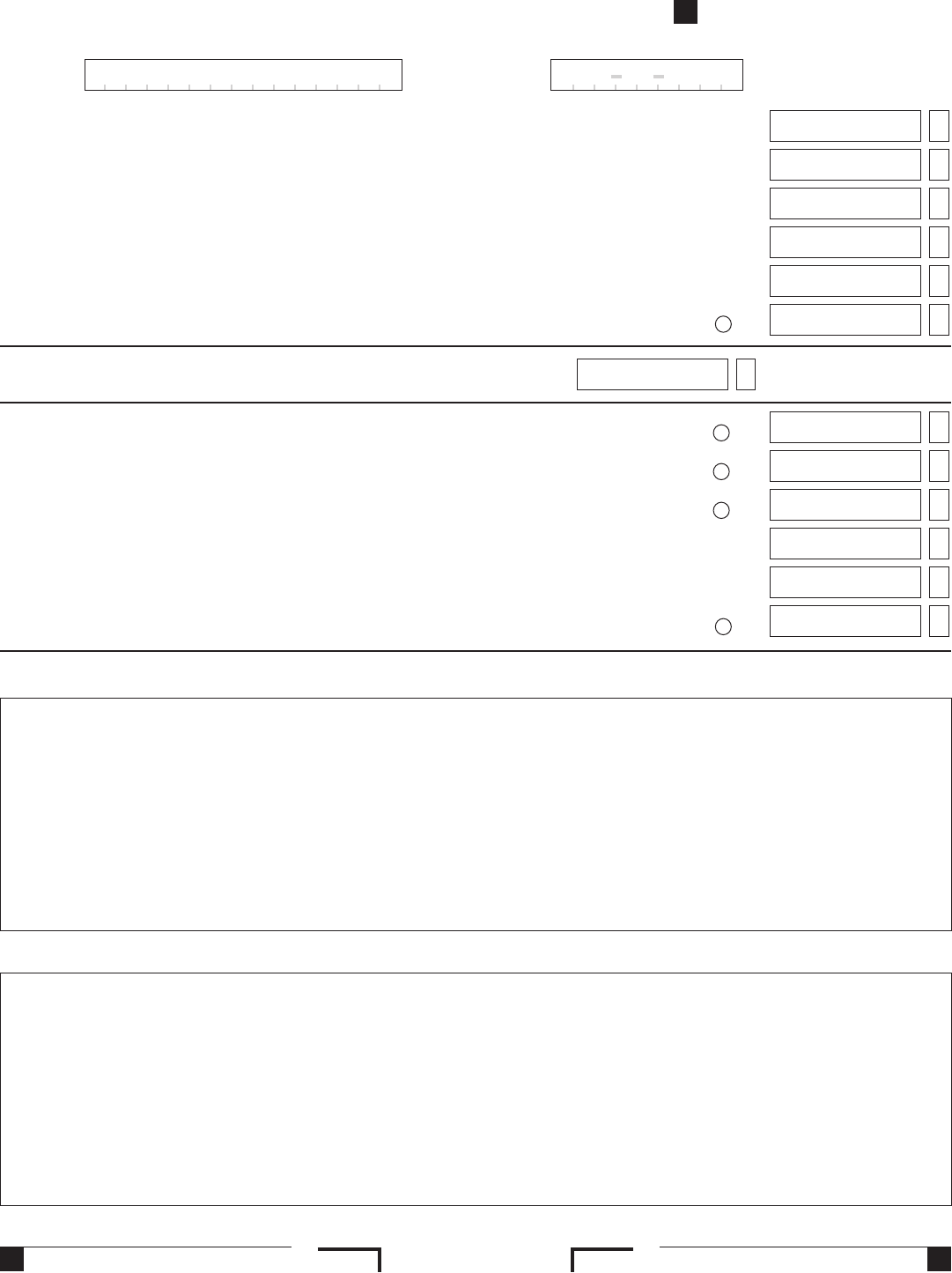

Side 4 Form 540 C1 2015 3104153Side 4 Form 540 C1 2015

Contributions

Code Amount

California Seniors Special Fund. See instructions

.........................................

400

Alzheimer’s Disease/Related Disorders Fund

............................................

401

Rare and Endangered Species Preservation Program

......................................

403

California Breast Cancer Research Fund

................................................

405

California Firefighters’ Memorial Fund

.................................................

406

Emergency Food for Families Fund

....................................................

407

California Peace Officer Memorial Foundation Fund

.......................................

408

California Sea Otter Fund

...........................................................

410

California Cancer Research Fund

.....................................................

413

Child Victims of Human Trafficking Fund

...............................................

419

School Supplies for Homeless Children Fund

............................................

422

State Parks Protection Fund/Parks Pass Purchase

........................................

423

Protect Our Coast and Oceans Fund

...................................................

424

Keep Arts in Schools Fund

..........................................................

425

California Senior Legislature Fund

....................................................

427

Habitat for Humanity Fund

..........................................................

428

California Sexual Violence Victim Services Fund

.........................................

429

State Children’s Trust Fund for the Prevention of Child Abuse

...............................

430

Prevention of Animal Homelessness & Cruelty Fund

......................................

431

110 Add code 400 through code 431. This is your total contribution .............................

110

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

.

00

Your name: Your SSN or ITIN:

Form 540 C1 2015 Side 53105153

111 AMOUNT YOU OWE. If you do not have an amount on line 96, add line 93, line 97, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001 ......................................... 111

Pay online – Go to ftb.ca.gov for more information.

Amount

You Owe

Interest and

Penalties

112 Interest, late return penalties, and late payment penalties.......................................112 00

113 Underpayment of estimated tax. Check the box: m FTB 5805 attached m FTB 5805F attached

113

114 Total amount due. See instructions. Enclose, but do not staple, any payment .......................114

Your email address (optional). Enter only one email address. Daytime phone number (optional)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if self-employed) PTIN

Firm’s address FEIN

Do you want to allow another person to discuss this tax return with us? See instructions..... m Y es m No

Print Third Party Designee’s Name Telephone Number

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov

and search for privacy notice. To request this notice by mail, call 800.852.5711. Under penalties of perjury, I declare that I have examined this tax return,

including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign

Here

It is unlawful

to forge a

spouse’s/RDP’s

signature.

Joint tax return?

(See instructions)

115 REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 96. See instructions.

Mail to: FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0001 ........................................ 115

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions.

Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Type

Routing number m Checking Account number 116 Direct deposit amount

m Savings

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Type

Routing number m Checking Account number 117 Direct deposit amount

m Savings

Refund and Direct Deposit

.

00

.

00

.

00

.

00

,

,

.

00

,

,

.

00

,

,

.

00

,

,

( )

( )

Your name: Your SSN or ITIN:

Your signature Date Spouse’s/RDP’s signature (if a joint tax return, both must sign)

X X