Fillable Printable 2015 Form 540X - Amended Individual Income Tax Return

Fillable Printable 2015 Form 540X - Amended Individual Income Tax Return

2015 Form 540X - Amended Individual Income Tax Return

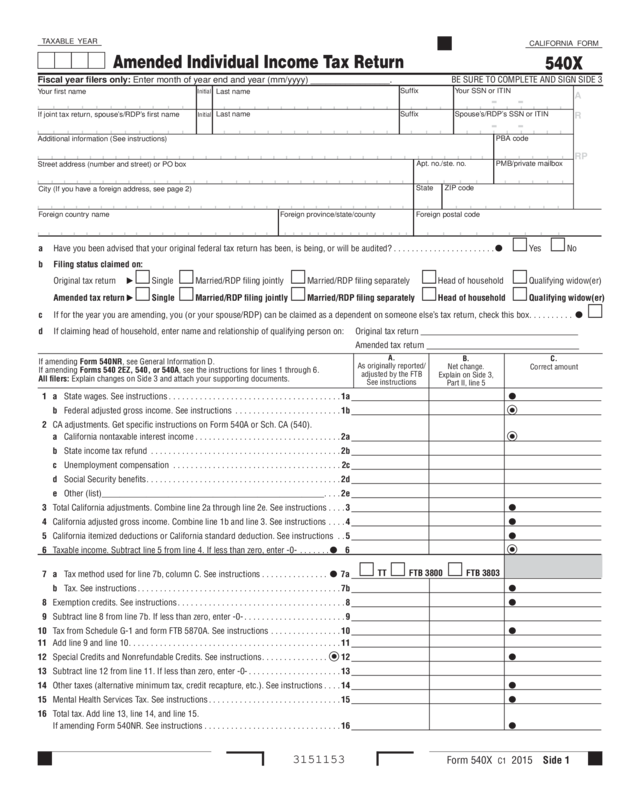

Form 540X C1 2015 Side 1

Amended Individual Income Tax Return

CALIFORNIA FORM

540X

3151153

T AXABLE YEAR

Fiscal year filers only: Enter month of year end and year (mm/yyyy) ________________. BE SURE TO COMPLETE AND SIGN SIDE 3

a Have you been advised that your original federal tax return has been, is being, or will be audited? ....................... Yes No

b Filing status claimed on:

Original tax return

Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

Amended tax return Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

c If for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, check this box..........

d If claiming head of household, enter name and relationship of qualifying person on: Original tax return

Amended tax return

C.

Correct amount

B.

Net change.

Explain on Side 3,

Part ll, line 5

A.

As originally reported/

adjusted by the FTB

See instructions

If amending Form 540NR, see General Information D.

If amending Forms 540 2EZ, 540, or 540A, see the instructions for lines 1 through 6.

All filers: Explain changes on Side 3 and attach your supporting documents.

1 a State wages. See instructions .......................................1a

.....1b

.....2a

.....2b

.....2c

.....2d

_....2e

s . . . . 3

s ....4

ions ..5

.. 6

.. 7a

TT FTB 3800 FTB 3803

.....7b

......8

......9

.....10

.....11

..

12

.....13

b Federal adjusted gross income. See instructions ...................

2 CA adjustments. Get specific instructions on Form 540A or Sch. CA (540).

a California nontaxable interest income ............................

b State income tax refund ......................................

c Unemployment compensation .................................

d Social Security benefits.......................................

e Other (list)_________________________________________________

3 Total California adjustments. Combine line 2a through line 2e. See instruction

4 California adjusted gross income. Combine line 1b and line 3. See instruction

5 California itemized deductions or California standard deduction. See instruct

6 Taxable income. Subtract line 5 from line 4. If less than zero, enter -0- .....

7 a Tax method used for line 7b, column C. See instructions .............

b Tax. See instructions.........................................

8 Exemption credits. See instructions................................

9 Subtract line 8 from line 7b. If less than zero, enter -0- .................

10 Tax from Schedule G-1 and form FTB 5870A. See instructions ...........

11 Add line 9 and line 10...........................................

12 Special Credits and Nonrefundable Credits. See instructions.............

13 Subtract line 12 from line 11. If less than zero, enter -0-................

14 Other taxes (alternative minimum tax, credit recapture, etc.). See instructions ....14

15 Mental Health Services Tax. See instructions..............................15

16 Total tax. Add line 13, line 14, and line 15.

If amending Form 540NR. See instructions ...............................16

Your first name Last name

Initial

If joint tax return, spouse’s/RDP’s first name

Last name

Initial

Spouse’s/RDP’s SSN or ITIN

Your SSN or ITIN

Additional information (See instructions)

Street address (number and street) or PO box

City (If you have a foreign address, see page 2)

Foreign country name Foreign province/state/county Foreign postal code

Apt. no./ste. no. PMB/private mailbox

State ZIP code

A

R

RP

PBA code

Suffix

Suffix

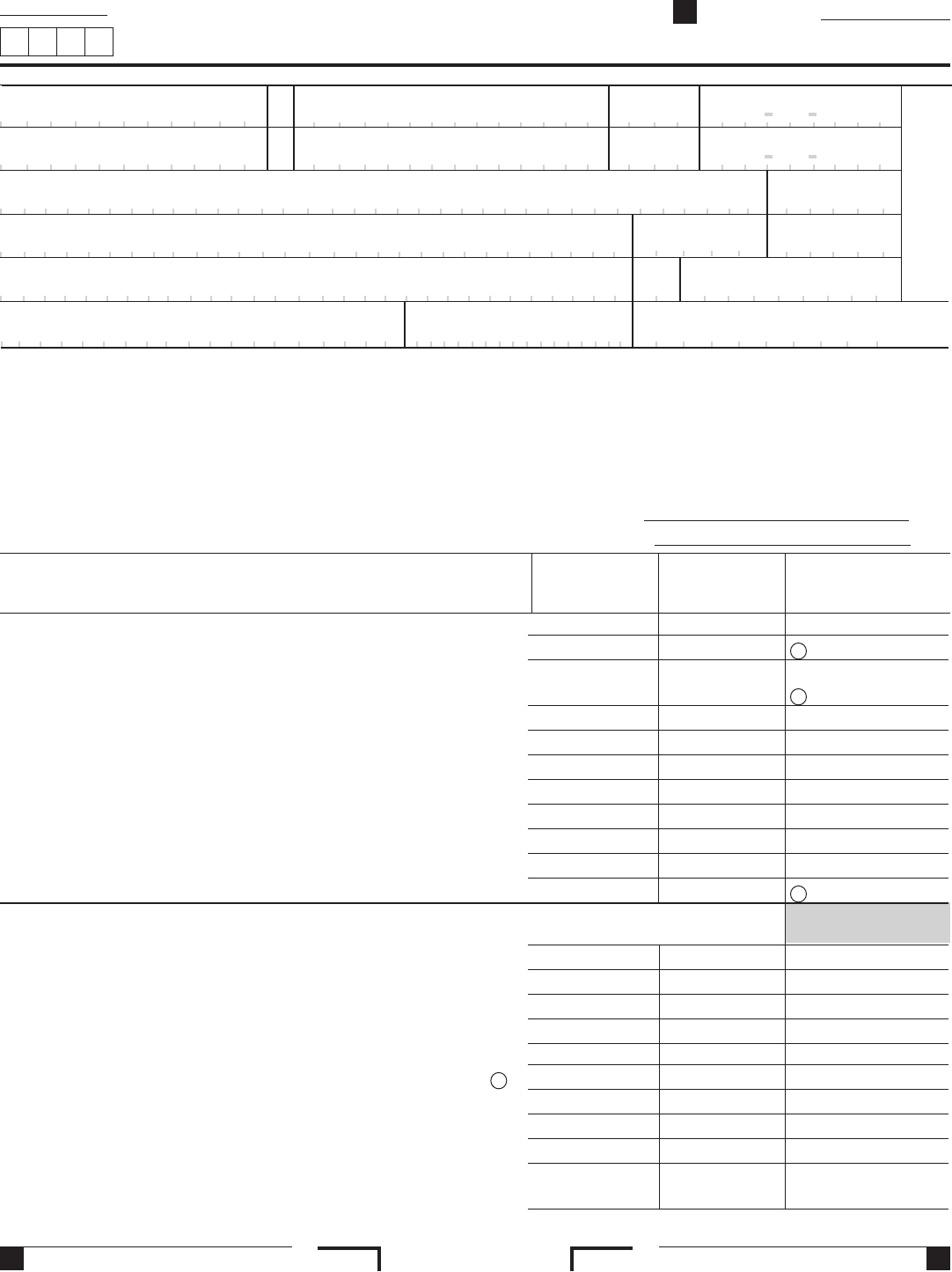

Side 2 Form 540X C1 2015 3152153

Your name: Your SSN or ITIN:

_________________ 24 $

....25

ot include penalties and interest. ............... 26

........................................

27

by the FTB. See instructions ..................

28

........................................

29

.........................................

30

.........................................

31

........................................

32

ence

.

19

.

20

....21

-

22 __________________________________ 23 _________________

25

California Earned Income Tax Credit (EITC). See instructions

. ..............

26 Tax paid with original tax return plus additional tax paid after it was filed. Do n

27 Total payments. Add lines 17, 18, 19, 20, 21, 25, and 26 of column C.......

28 Overpaid tax, if any, as shown on original tax return or as previously adjusted

29 Subtract line 28 from line 27. If line 28 is more than line 27. See instructions

30 Use tax payments as shown on original tax return. See instructions ........

31 Voluntary contributions as shown on original tax return. See instructions ...

32 Subtract line 30 and line 31 from line 29 .............................

33 AMOUNT YOU OWE. If line 16, column C is more than line 32, enter the differ

and see instructions.................................................................... 33

34 Penalties/Interest. See instructions: Penalties 34a______________________ Interest 34b______________________________ 34c

35 REFUND. If line 16, column C is less than line 32, enter the difference. See instructions ............... 35

Part I Nonresidents or Part-Year Residents Only

Attach and enter the amounts from your revised Short or Long Form 540NR and Schedule CA (540NR). Your amended tax return cannot be processed without

this information.

1 Exemption amount ....................................................................................

1

..

2

..

3

..

4

..

5

..

6

..

7

..

8

..

9

..

10

2 Federal adjusted gross income ........................................................................

3 Adjusted gross income from all sources .................................................................

4 Itemized deductions or standard deduction ...............................................................

5 California adjusted gross income .......................................................................

6 Tax from Schedule G-1 and form FTB 5870A ..............................................................

7 Special credits and nonrefundable renter’s credit...........................................................

8 Alternative minimum tax .............................................................................

9 Mental Health Services Tax ...........................................................................

10 Other taxes and credit recapture .......................................................................

.

,

,

00

.

,

,

00

17 California income tax withheld. See instructions ...........................17

18 Withholding (Form 592-B and/or 593). See instructions .....................18

19 Excess California SDI (or VPDI) withheld. See instructions ...............

20 Estimated tax payments and other payments. See instructions ............

21

Refundable Credits. See instructions

. ................................

Child and Dependent Care Expenses Credit (CDCE)

- - -

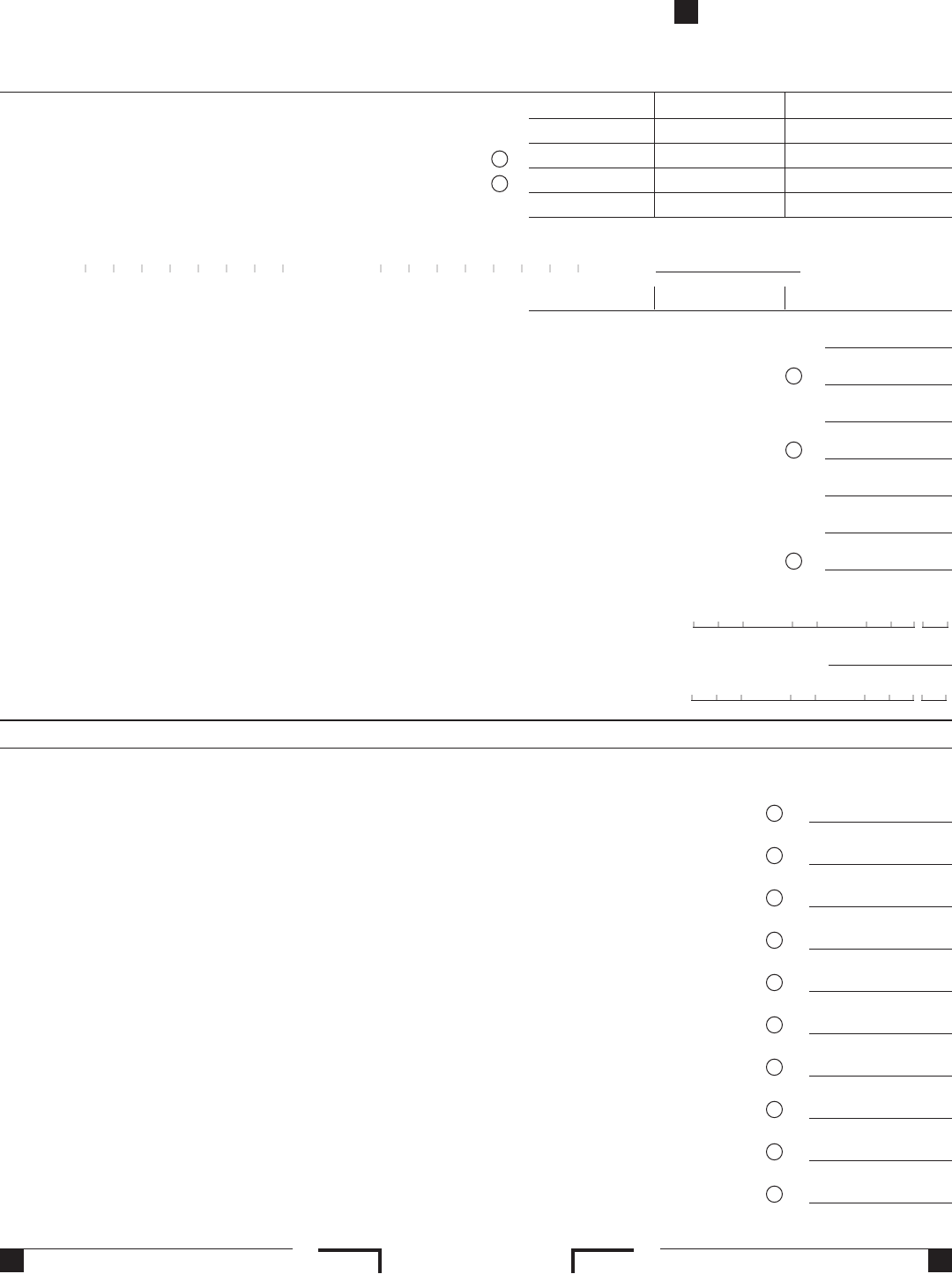

Form 540X C1 2015 Side 3

Your name: Your SSN or ITIN:

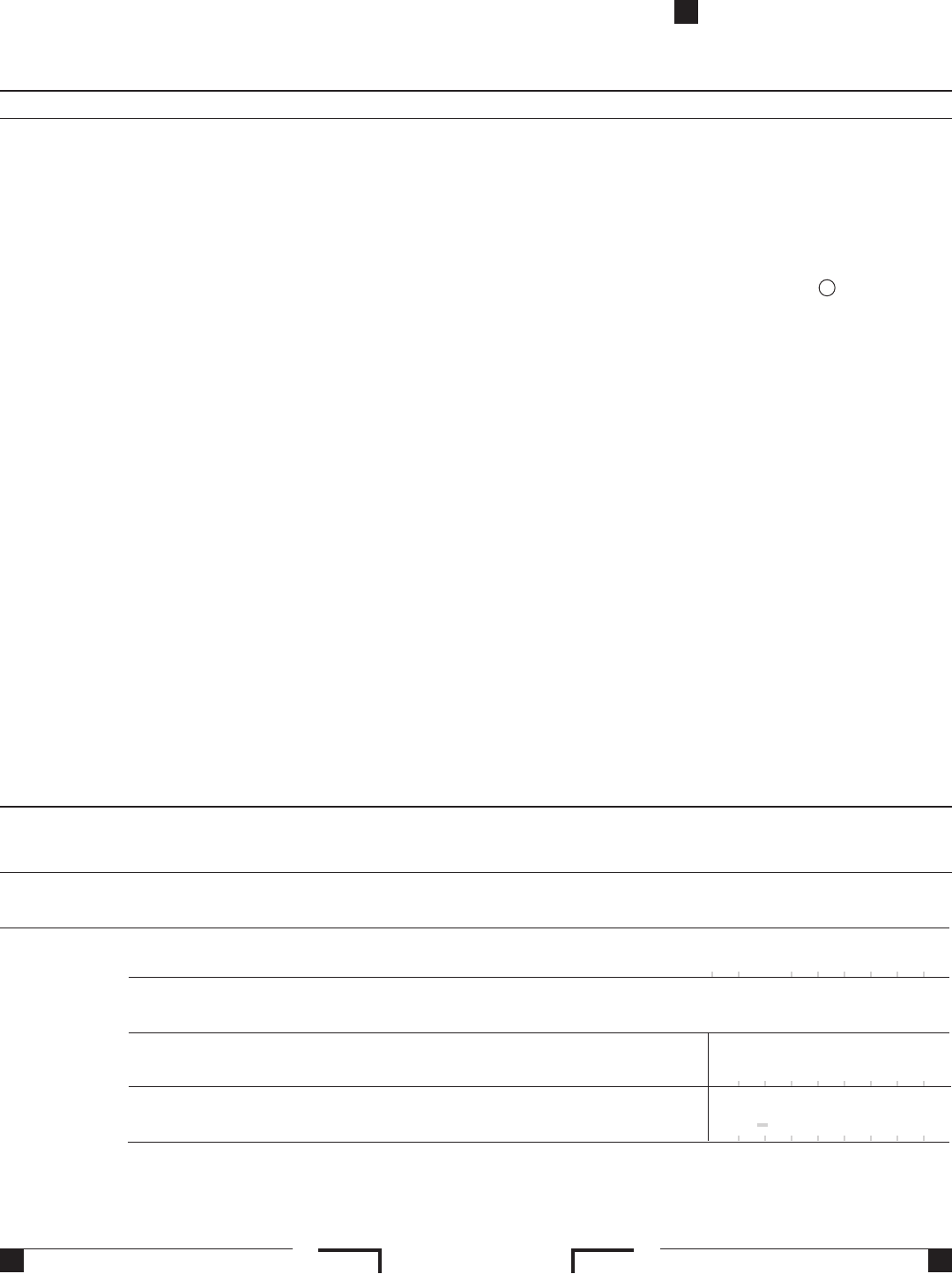

Where to File

Form 540X

Do not file a duplicate amended tax return unless one is requested. This may cause a delay in processing your amended tax return and any claim for refund.

If you are due a refund, have no amount due, or paid electronically,

mail your tax return to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001

If you owe, mail your return and check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov

and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have filed an original tax return and I have examined this amended tax return, including accompanying

schedules and statements, and to the best of my knowledge and belief, this amended tax return is true, correct, and complete.

Sign

Here

I

t is unlawful

to forge a

spouse’s/RDP’s

signature.

( )

Your signature Date Spouse’s/RDP’s signature (if a joint tax return, both must sign)

X X

Your email address (optional). Enter only one email address. Daytime phone number (optional)

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if self-employed) PTIN

Firm’s address FEIN

3153153

Part II Explanation of Changes

1 Enter name(s) and address as shown on original return below (if same as shown on this tax return, write “Same”). If changing from

separate tax returns to a joint tax return, enter names and addresses from original tax returns._________________________________________________

_______________________________________________________________________________________________________________________

2 Are you filing this Form 540X to report a final federal determination? ....................................................... Yes No

If “Yes,” attach a copy of the final federal determination and all supporting schedules and data.

3 Have you been advised that your original California tax return has been, is being, or will be audited? ..............................

...

ITIN.

Yes No

4 Did you file an amended tax return with the Internal Revenue Service on a similar basis? See General Information E ............ Yes No

5 Explanation and Attachments. Explain your changes below. If needed, attach a separate sheet that includes your name and SSN or

Explain in detail each change made. Include:

• Item being changed.

• Amount previously reported and corrected amount.

• Reason the change was needed.

Attach:

• Revised California tax return including all forms and schedules.

• Federal tax return and schedules if you made changes.

• Supporting documents, such as corrected W-2s, 1099s, K-1s, etc.

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________