Fillable Printable 2015 Form 541 - California Fiduciary Income Tax Return

Fillable Printable 2015 Form 541 - California Fiduciary Income Tax Return

2015 Form 541 - California Fiduciary Income Tax Return

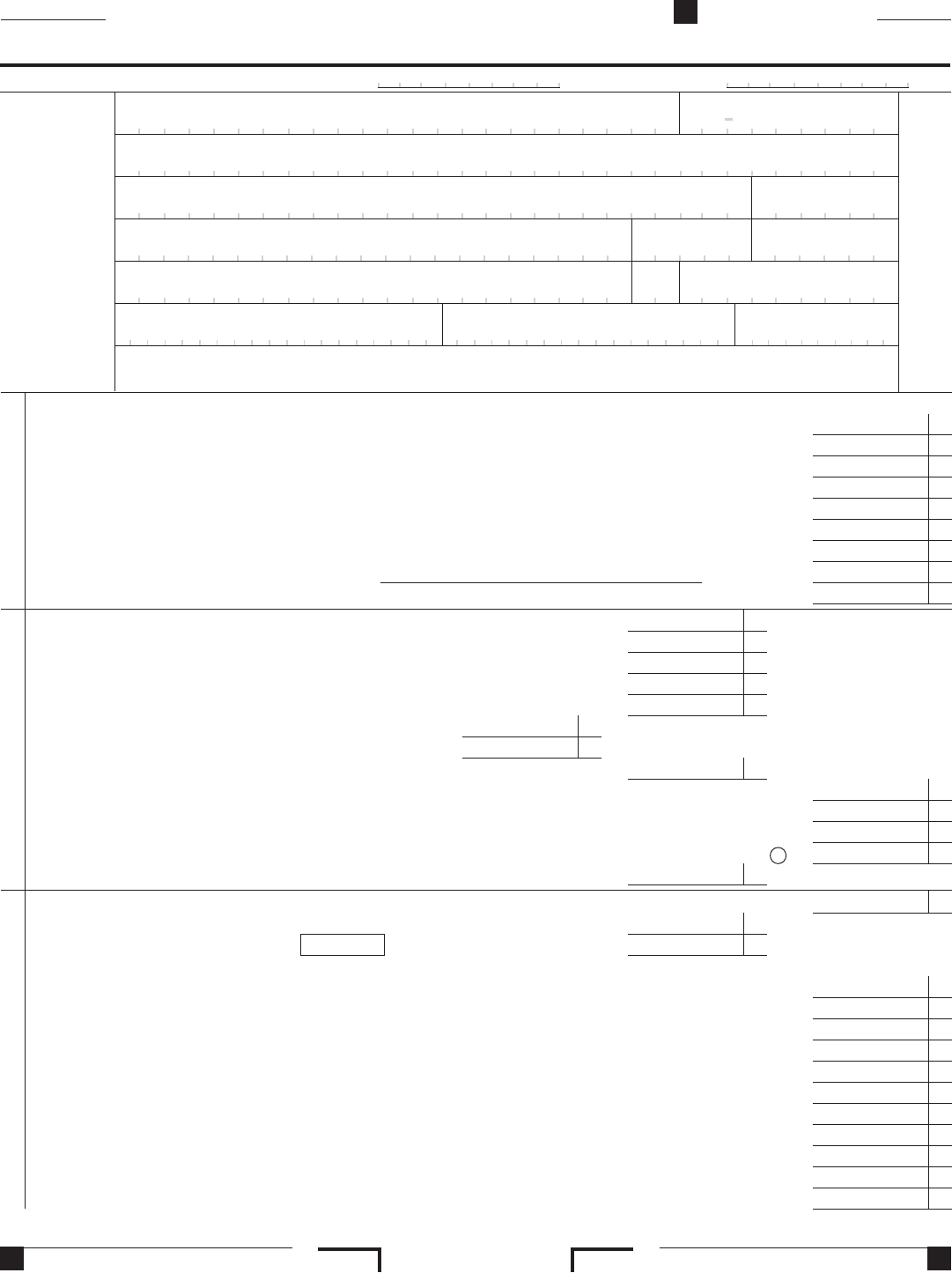

Form 541 C1 2015 Side 1

3161153

California Fiduciary Income Tax Return

FORM

541

T AXABLE YEAR

2015

Name of estate or trust FEIN

, and ending (mm/dd/yyyy) .

A

Name and title of all fiduciaries, see instructions

Additional information (see instructions) PBA code

Street address (number and street) or PO box Apt no./suite no. PMB/private mailbox

City (If you have a foreign address, see page 7) State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

For calendar year 2015 or fiscal year beginning (mm/dd/yyyy)

Type of entity.

Check all that apply.

(1) Decedent’s estate

(2) Simple trust

(3) Complex trust

(4) Grantor trust

(5) Bankruptcy estate

– Chapter 7

(6) Bankruptcy estate

– Chapter 11

(7) Pooled income

fund

(8) ESBT

(9) QSST

(10) Apportioning

Trust

Check Initial tax return Final tax return REMIC

applicable boxes:

Amended tax return Change in fiduciary’s name or address

R

RP

00

.....

16

.....

17

.....

18

.....

20a

00

Income

Trusts that have nonresident trustees and/or nonresident beneficiaries must first complete Schedule G on Side 3.

1 Interest income..................................................................................... 1 00

2

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 00

3 Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040) .................................... 3 00

4 Capital gain or (loss). Attach Schedule D (541) .......................................................... 4 00

5 Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E (Form 1040) ................. 5 00

6 Farm income or (loss). Attach federal Schedule F (Form 1040) .............................................. 6 00

7 Ordinary gain or (loss). Attach Schedule D-1 ............................................................ 7 00

8 Other income. See instructions. State nature of income ......... 8 00

9 Total income. Add line 1 through line 8. (Apportioning fiduciaries: Complete Schedule G on Side 3) ................. 9 00

Deductions

10 Interest .................................................................. 10 00

11 Taxes ................................................................... 11 00

12 Fiduciary fees ........................................................... 12 00

13 Charitable deduction. Enter the amount from Side 2, Schedule A, line 5 .............. 13 00

14 Attorney, accountant, and tax return preparer fees................................. 14 00

15 a Other deductions not subject to 2% floor. Attach Schedule.. 15a 00

b

Allowable misc. itemized deductions subject to 2% floor

..... 15b 00

c Total. Add line 15a and line 15b............................................ 15c

16 Total. Add line 10 through line 14 and line 15c. (Apportioning fiduciaries: Complete Schedule G on Side 3)....... 00

17 Adjusted total income (or loss). Subtract line 16 from line 9. Enter here and on Side 3, Schedule B, line 1 ....... 00

18 Income distribution deduction from Side 3, Schedule B, line 15. Attach Schedule K-1 (541) .................. 00

20 a Taxable income of fiduciary. Subtract line 18 from line 17 ........................................... 00

b ESBT taxable income (S-portion only) See instructions ......................... 20b

Tax and Payments

21 a Regular tax ________________; b Other taxes ________________; c QSF tax ________________; d Total...... 21 00

22 Exemption credit. See instructions ............................................. 22 00

23 Credits. Attach worksheet. Enter code and amount ................ 23 00

If more than one credit, see instructions.

24 Total. Add line 22 and line 23 ........................................................................ 24 00

25 Subtract line 24 from line 21. If less than zero, enter -0- ..................................................... 25 00

26 Alternative minimum tax. Attach Schedule P (541) ....................................................... 26 00

27 Mental Health Services Tax. See instructions ............................................................ 27 00

28 Total tax. Add line 25, line 26, and line 27 .............................................................. 28 00

29 California income tax withheld. See instructions ......................................................... 29 00

30 California income tax previously paid. See instructions .................................................... 30 00

31

Withholding Form 592-B and/or 593 .................................................................. 31 00

32 2015 CA estimated tax, amount applied from 2014 tax return, and payment with form FTB 3563.................... 32 00

33 Total payments. Add line 29, line 30, line 31, and line 32 ..................................................... 33 00

34 Use tax. See instructions ........................................................................... 34 00

Get 541 Booklet to see the instructions for the 541 Form

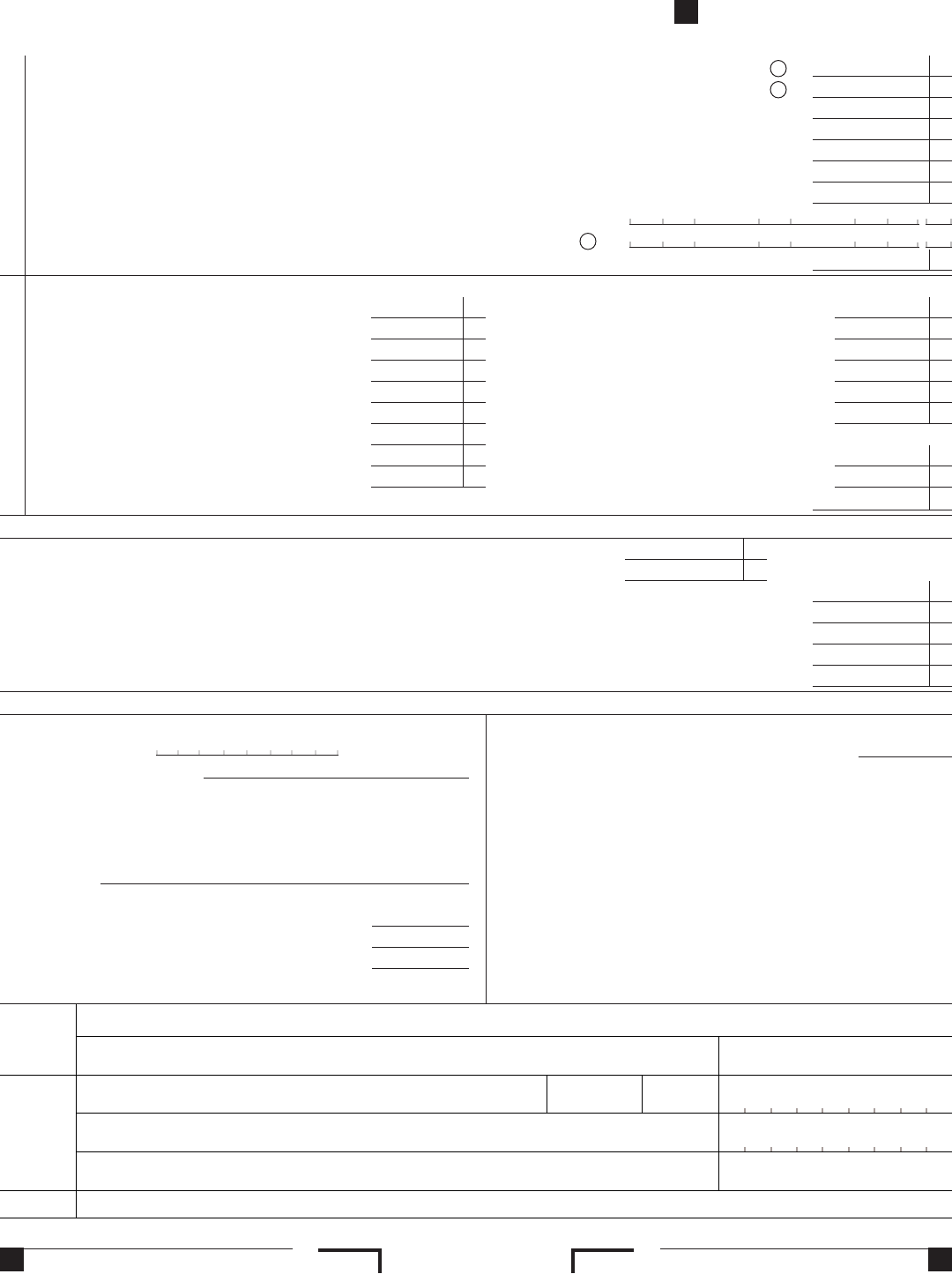

Side 2 Form 541 C1 2015

3162153

Sign

Here

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of trustee or officer representing fiduciary

X

Date

Paid

Preparer’s

Use Only

Preparer’s signature

X

Date Check if self-

employed

PTIN

Firm’s name (or yours, if self-employed) and address.

FEIN

Telephone

( )

May the FTB discuss this tax return with the preparer shown above (see instructions)?......................... Yes No

...

35

...

36

...

37

...

38

...

39

...

40

. . . . . . . . . . . . . . . 41 00

,

,

00

.

..... 42

43...

5F attached

Tax and Payments

35 Payments balance. If line 33 is more than line 34, subtract line 34 from line 33 .............................. 00

36 Use tax balance. If line 34 is more than line 33, subtract line 33 from line 34 ................................ 00

37 Tax Due. If line 28 is more than line 35, subtract line 35 from line 28 ...................................... 00

38 Overpaid tax. If line 35 is more than line 28, subtract line 28 from line 35................................... 00

39 Amount on line 38 to be credited to 2016 estimated tax ................................................ 00

40 Amount of overpaid tax available this year. Subtract line 39 from line 38.................................... 00

41 Total voluntary contributions from line 61 below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42 Refund or no amount due. See instructions ................................

,

,

00

.

43 Amount due. See instructions ...........................................

44 Underpayment of estimated tax. Check the box: FTB 5805 attached FTB 580 . See instructions. ..... 44 00

Voluntary Contributions

Code Amount Code Amount

Alzheimer’s Disease/Related Disorders Fund....... 401 00 School Supplies for Homeless Children Fund ....... 422 00

Rare and Endangered Species Preservation Program 403 00 Protect Our Coast and Oceans Fund .............. 424 00

CA Breast Cancer Research Fund ............... 405 00 Keep Arts in Schools Fund ..................... 425 00

CA Firefighters’ Memorial Fund ................. 406 00 California Senior Legislature Fund ............... 427 00

Emergency Food For Families Fund.............. 407 00 Habitat For Humanity Fund ..................... 428 00

CA Peace Officer Memorial Foundation Fund....... 408 00 California Sexual Violence Victim Services Fund..... 429 00

CA Sea Otter Fund ........................... 410 00 State Children's Trust Fund for the Prevention of

CA Cancer Research Fund ..................... 413 00

Child Abuse...............................

430 00

Child Victims of Human Trafficking Fund.......... 419 00

Prevention of Animal Homelessness & Cruelty Fund. ..

431 00

61 Total voluntary contributions. Add line 401 through line 431. Enter here and on line 41, above..................... 61 00

Schedule A Charitable Deduction. Do not complete for a simple trust or a pooled income fund. See instructions.

1 a Amounts paid for charitable purposes from gross income.............................. 1a 00

b

Amounts permanently set aside for charitable purposes from gross income. See instructions .

1b 00

c Total. Add line 1a and line 1b .............................................................................. 1c 00

2 Tax-exempt income allocable to charitable contributions. See instructions............................................. 2 00

3 Subtract line 2 from line 1c ................................................................................. 3 00

4 Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes................... 4 00

5 Charitable deduction. Add line 3 and line 4. Enter here and on Side 1, line 13 ......................................... 5 00

Other Information.

1 Date trust was created or, if an estate, date of decedent's de

a

(mm/dd/yyyy)

ath: 4

If this is the final tax return of an estate, enter date of

court order, if applicable, authorizing the final distribution

..

b Name of Grantor(s) of Trust 5 Did the estate or trust receive tax-exempt income? ...... Yes No

(attach an additional sheet if necessary) If “Yes,” attach computation of the allocation of expenses.

2 a If an estate, was decedent a California resident?....... Yes No 6 Is this tax return for a short taxable year?.............. Yes No

b Was decedent married at date of death? ............. Yes No 7 Has the estate or trust included a Reportable Transaction,

c If “Yes,” enter surviving spouse’s/RDP’s social security number (or ITIN) or Listed Transaction within this tax return? ............ Yes No

and name: If “Yes,” complete and attach federal Form 8886.

3 If an estate, enter fair market value (FMV) of: 8 Does this trust have a beneficial interest in a trust or is it

a Decedent’s assets at date of death ................. a grantor of another trust? Attach schedule of trusts

b Assets located in California ....................... and federal IDs. ............................... Yes No

c Assets located outside California................... 9 During the year did the estate or trust defer any income

Note: Income of final year is taxable to beneficiaries. from the disposition of assets?

................... Yes No

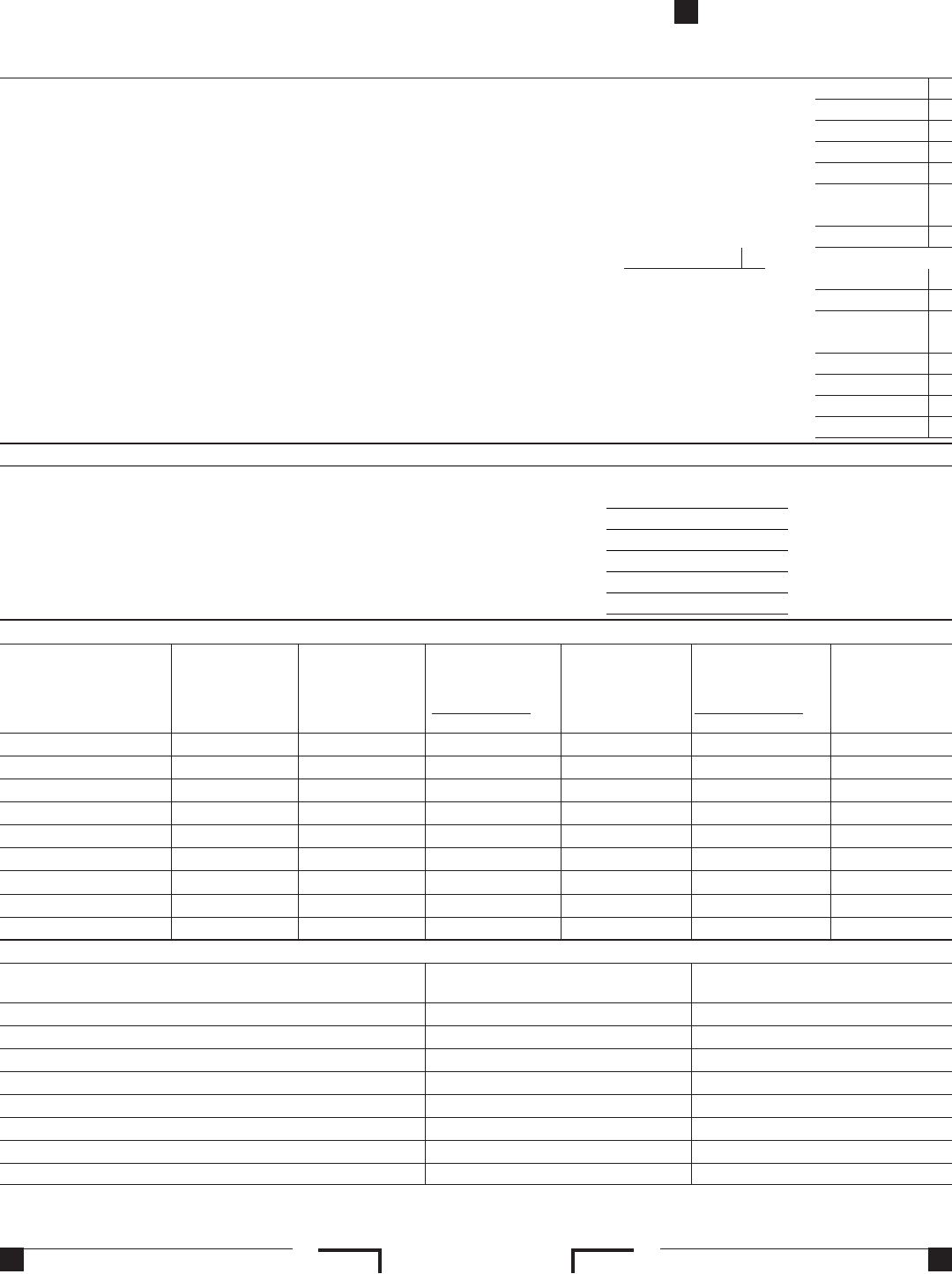

Form 541 C1 2015 Side 3

3163153

Schedule B Income Distribution Deduction.

1 Adjusted total income. Enter amount from Side 1, line 17 ......................................................... 1 00

2 Adjusted tax-exempt interest and nontaxable gain from installment sale of small business stock. See instructions.............. 2 00

3 Net gain shown on Schedule D (541), line 9, column (a). If net loss, enter -0-. See instructions ............................ 3 00

4 Enter amount from Schedule A, line 4......................................................................... 4 00

5 Enter capital gain included on Schedule A, line 1c ............................................................... 5 00

6 If the amount on Side 1, line 4 is a gain, enter the amount here as a negative number.

If the amount on Side 1, line 4 is a loss, enter the loss as a positive number

........................................... 6 00

7 Distributable net income. Combine line 1 through line 6........................................................... 7 00

8 Income for the taxable year determined under the governing instrument (accounting income) .... 8 00

9 Income required to be distributed currently (IRC Section 651) ...................................................... 9 00

10 Other amounts paid, credited, or otherwise required to be distributed (IRC Section 661) ................................. 10 00

11 Total distributions. Add line 9 and line 10. If the result is greater than line 8, see federal Form 1041, Schedule B, line 11.........

instructions to see if you must complete Schedule J (541)......................................................... 11 00

12 Enter the total amount of tax-exempt income included on line 11.................................................... 12 00

13 Tentative income distribution deduction. Subtract line 12 from line 11................................................ 13 00

14 Tentative income distribution deduction. Subtract line 2 from line 7.................................................. 14 00

15 Income distribution deduction. Enter the smaller of line 13 or line 14 here and on Side 1, line 18 .......................... 15 00

Schedule G California Source Income and Deduction Apportionment. Complete line 1a through line 1f before Part II.

Part I:

If a trust, enter the number of:

1 a California resident trustees ...................................................

b Nonresident trustees ........................................................

c Total number of trustees (line a plus line b) ......................................

d California resident beneficiaries................................................

e Nonresident beneficiaries ....................................................

f Total number of beneficiaries (line d plus line e) ...................................

Part II: Income Allocation. Complete column A through column F. Enter the amounts from lines 1-9, column F, on Form 541, Side 1, lines 1-9.

Type of Income

(A)

California Source

Income

(B)

Non-California

Source Income

(C)

Apportioned

Income

# CA Trustees X B

# Total Trustees

(D)

Remaining

Non-California

Source Income

Col. B – Col. C

(E)

Apportioned

Income

# CA Beneficiaries X D

# Total Beneficiaries

(F)

Income

Reportable to

California

(Col. A+C+E)

1 Interest

2 Dividends

3 Business income

4 Capital gain

5 Rents, royalties, etc.

6 Farm income

7 Ordinary gain

8 Other income

9 Total income

Deduction Allocation. Complete column G and column H. Enter the amounts from lines 10-15b, Column H, on Form 541, Side 1, lines 10-15b.

Type of Deduction

(G)

Total Deductions

(H)

Amounts Allocable To California

10 Interest

11 Taxes

12 Fiduciary fees

13 Charitable deduction

14 Attorney, accountant, and tax return preparer fees

15 a Other deduction not subject to 2% floor

b Allowable misc. itemized deductions subject to 2% floor

16 Total deductions