Fillable Printable 2015 Form 593-C - Real Estate Withholding Certificate

Fillable Printable 2015 Form 593-C - Real Estate Withholding Certificate

2015 Form 593-C - Real Estate Withholding Certificate

For Privacy Notice, get FTB 1131 ENG/SP.

Seller

or

Transferor

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I will promptly inform

the withholding agent. I understand that I must retain this form in my records for 5 years and that the Franchise Tax Board may review relevant escrow documents to ensure

withholding compliance. Completing this form does not exempt me from filing a California income or franchise tax return to report this sale.

Seller’s/Transferor’s Name and Title Seller’s/Transferor’s Signature Date

Spouse’s/RDP’s Name Spouse’s/RDP’s Signature Date

7131153

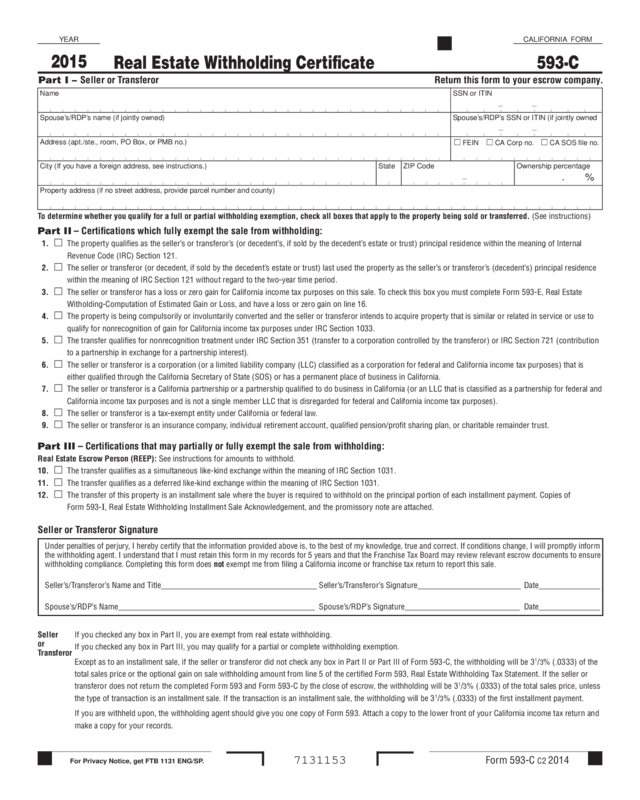

Real Estate Withholding Certificate

YEAR

2015

CALIFORNIA FORM

593-C

To determine whether you qualify for a full or partial withholding exemption, check all boxes that apply to the property being sold or transferred. (See instructions)

Part II – Certifications which fully exempt the sale from withholding:

1. The property qualifies as the seller’s or transferor’s (or decedent’s, if sold by the decedent’s estate or trust) principal residence within the meaning of Internal

Revenue Code (IRC) Section 121.

2. The seller or transferor (or decedent, if sold by the decedent’s estate or trust) last used the property as the seller’s or transferor’s (decedent’s) principal residence

within the meaning of IRC Section 121 without regard to the two-year time period.

3. The seller or transferor has a loss or zero gain for California income tax purposes on this sale. To check this box you must complete Form 593-E, Real Estate

Witholding-Computation of Estimated Gain or Loss, and have a loss or zero gain on line 16.

4. The property is being compulsorily or involuntarily converted and the seller or transferor intends to acquire property that is similar or related in service or use to

qualify for nonrecognition of gain for California income tax purposes under IRC Section 1033.

5. The transfer qualifies for nonrecognition treatment under IRC Section 351 (transfer to a corporation controlled by the transferor) or IRC Section 721 (contribution

to a partnership in exchange for a partnership interest).

6. The seller or transferor is a corporation (or a limited liability company (LLC) classified as a corporation for federal and California income tax purposes) that is

either qualified through the California Secretary of State (SOS) or has a permanent place of business in California.

7. The seller or transferor is a California partnership or a partnership qualified to do business in California (or an LLC that is classified as a partnership for federal and

California income tax purposes and is not a single member LLC that is disregarded for federal and California income tax purposes).

8. The seller or transferor is a tax-exempt entity under California or federal law.

9. The seller or transferor is an insurance company, individual retirement account, qualified pension/profit sharing plan, or charitable remainder trust.

Part III – Certifications that may partially or fully exempt the sale from withholding:

Real Estate Escrow Person (REEP): See instructions for amounts to withhold.

10. The transfer qualifies as a simultaneous like-kind exchange within the meaning of IRC Section 1031.

11. The transfer qualifies as a deferred like-kind exchange within the meaning of IRC Section 1031.

12. The transfer of this property is an installment sale where the buyer is required to withhold on the principal portion of each installment payment. Copies of

Form 593-I, Real Estate Withholding Installment Sale Acknowledgement, and the promissory note are attached.

Seller or Transferor Signature

Part I – Seller or Transferor

Return this form to your escrow company.

Form 593-C C2 2014

If you checked any box in Part II, you are exempt from real estate withholding.

If you checked any box in Part III, you may qualify for a partial or complete withholding exemption.

Except as to an installment sale, if the seller or transferor did not check any box in Part II or Part III of Form 593-C, the withholding will be 3

1

/3% (.0333) of the

total sales price or the optional gain on sale withholding amount from line 5 of the certified Form 593, Real Estate Withholding Tax Statement. If the seller or

transferor does not return the completed Form 593 and Form 593-C by the close of escrow, the withholding will be 3

1

/3% (.0333) of the total sales price, unless

the type of transaction is an installment sale. If the transaction is an installment sale, the withholding will be 3

1

/3% (.0333) of the first installment payment.

If you are withheld upon, the withholding agent should give you one copy of Form 593. Attach a copy to the lower front of your California income tax return and

make a copy for your records.

- -

- -

Name

SSN or ITIN

Spouse’s/RDP’s name (if jointly owned)

Spouse’s/RDP’s SSN or ITIN (if jointly owned

Address (apt./ste., room, PO Box, or PMB no.)

FEIN CA Corp no. CA SOS file no.

City (If you have a foreign address, see instructions.) State

ZIP Code Ownership percentage

. %

Property address (if no street address, provide parcel number and county)

-

Page 4 Form 593-C/Form 593-E Booklet 2014

2015 Instructions for Form 593-C

Real Estate Withholding Certificate

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

In general, for taxable years beginning on or after January 1, 2010, California

law conforms to the Internal Revenue Code (IRC) as of January 1, 2009.

However, there are continuing differences between California and federal

law. When California conforms to federal tax law changes, we do not always

adopt all of the changes made at the federal level. For more information, go

to ftb.ca.gov and search for conformity. Additional information can be found

in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the

instructions for California Schedule CA (540 or 540NR), and the Business

Entity tax booklets.

Like-Kind Exchanges – For taxable years beginning on or after January 1,

2014, California requires taxpayers who exchange property located in

California for like-kind property located outside of California, and meet all of

the requirements of the IRC Section 1031, to file an annual information return

with the Franchise Tax Board (FTB). For more information, get form FTB 3840,

California Like-Kind Exchanges, or go to ftb.ca.gov and search for like kind.

Purpose

Use Form 593-C, Real Estate Withholding Certificate, to determine whether

you qualify for a full or partial withholding exemption.

Qualifying for an exemption from withholding or being withheld upon does

not relieve you of your obligation to file a California income tax return and pay

any tax due on the sale of California real estate.

You may be assessed penalties if:

•

You do not file a tax return.

• You file your tax return late.

• The amount of withholding does not satisfy your tax liability.

The seller or transferor must submit this form before the close of escrow to

prevent withholding on the transaction. After escrow has closed, amounts

withheld may be recovered only by claiming the withholding as a credit on the

appropriate year’s tax return.

How to Claim the Withholding

To claim the withholding credit, report the sale or transfer as required and

enter the amount from line 5 of Form 593, Real Estate Withholding Tax

Statement, on your California tax returns as real estate and other withholding

from Form(s) 592-B or 593. Claim your withholding credit on one of the

following:

•

Form 540, California Resident Income Tax Return

• Form 540NR Long, California Nonresident or Part-Year Resident Income

Tax Return

•

Form 541, California Fiduciary Income Tax Return

• Form 100, California Corporation Franchise or Income Tax Return

• Form 100S, California S Corporation Franchise or Income Tax Return

• Form 100W, California Corporation Franchise or Income Tax Return –

Water’s-Edge Filers

•

Form 109, California Exempt Organization Business Income Tax Return

• Form 565, Partnership Return of Income

• Form 568, Limited Liability Company Return of Income

Specific Instructions

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB”

first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country,

Province/ Region, and Postal Code. Follow the country’s practice for entering

the postal code. Do not abbreviate the country’s name.

Part I – Seller or Transferor

Enter the name, tax identification number, and address of the seller or other

transferor. If the seller or transferor does not provide a tax identification

number, then Form 593-C is void, and withholding is required.

Note: If you choose to provide a copy of Form 593-C to the buyer, delete the

seller’s or transferor’s tax identification number on the buyer’s copy.

If the seller or transferor is an individual, enter the social security number

(SSN) or individual taxpayer identification number (ITIN). If the sellers or

transferors are spouses/registered domestic partners (RDPs) and plan to

file a joint return, enter the name and SSN or ITIN for each spouse/RDP.

Otherwise, do not enter information for more than one seller or transferor.

Instead, complete a separate Form 593-C for each seller or transferor.

If you do not have an SSN because you are a nonresident or a resident alien

for federal tax purposes, and the Internal Revenue Service (IRS) issued you

an ITIN, enter the ITIN in the space provided for the SSN.

An ITIN is a tax processing number issued by the IRS to individuals who have

a federal tax filing requirement and do not qualify for an SSN. It is a nine-digit

number that always starts with the number 9.

If the seller or transferor is a business, enter the business name in the

business name field along with the federal employer identification number

(FEIN), CA Corporation number (CA Corp no.), or CA Secretary of State (CA

SOS) file number.

If the seller or transferor is a grantor trust, enter the grantor’s individual

name and SSN. For tax purposes, the grantor trust is disregarded for tax

purposes and the individual seller or transferor must report the sale and claim

the withholding on their individual tax return. If the trust was a grantor trust

that became irrevocable upon the grantor’s death, enter the name of the trust

and the trust’s FEIN. Do not enter the decedent’s or trustee’s name or SSN.

If the seller or transferor is a non-grantor trust, enter the name of the trust

and the trust’s FEIN. Do not enter trustee information.

If the seller or transferor is a single member limited liability company

(SMLLC)

, enter the name and tax identification number of the single member.

For all other non-individual sellers or transferors, enter the FEIN, CA Corp no.,

or CA SOS file number.

Ownership Percentage

Enter your ownership percentage rounded to two decimal places (e.g. 66.67%).

If you are on the title for incidental purposes and you have no financial

ownership, enter 0.00 and skip to Seller or Transferor Signature. You will not

be withheld upon.

Examples of sellers or transferors who are on title for incidental purposes are:

•

Co-signers on title (e.g., parents co-signed to help their child qualify for

the loan).

• Family members on title to receive property upon the owner’s death.

Property Address

Enter the address (or parcel number and county) of the CA real property

transferred.

Part II – Certifications That Fully Exempt

Withholding

Line 1 – Principal Residence

To qualify as your principal residence under IRC Section 121, you (or the

decedent) generally must have owned and lived in the property as your main

home for at least two years during the five-year period ending on the date

of sale. Military and Foreign Service, get FTB Pub. 1032, Tax Information for

Military Personnel.

You can have only one main home at a time. If you have two homes and live

in both of them, the main home is the one you lived in most of the time.

There are exceptions to the two-year rule if the primary reason you are selling

the home is for a change in the place of employment, health, or unforeseen

circumstances such as death, divorce or termination of registered domestic

partnership, or loss of job, etc. For more information about what qualifies

as your principal residence or exceptions to the two-year rule, get federal

Publication 523, Selling Your Home. To get federal publications, go to irs.gov,

or call 800.829.3676.

If only a portion of the property qualifies as your principal residence, a second

Form 593-C will need to be completed to certify an exemption on the portion

not used as a principal residence.

The allocation method should be the same as the seller or transferor used to

determine depreciation.

Form 593-C/Form 593-E Booklet 2014 Page 5

Line 2 – Property last used as your principal residence

If the property was last used as the seller’s, transferor’s, or decedent’s

principal residence within the meaning of IRC Section 121 without regard

to the two-year time period, no withholding is required. If the last use of

the property was as a vacation home, second home, or rental, you do not

qualify for the exemption. You must have lived in the property as your main

home.

If you have two homes and live in both of them, the main home is the one

you lived in most of the time.

Line 3 – Loss or Zero Gain

You have a loss or zero gain for California income tax purposes when the

amount realized is less than or equal to your adjusted basis. You must

complete Form 593-E, Real Estate Withholding – Computation of Estimated

Gain or Loss, and have a loss or zero gain on line 16 to certify that the

transaction is fully exempt from withholding.

You may not certify that you have a net loss or zero gain just because you

do not receive any proceeds from the sale or because you feel you are

selling the property for less than what it is worth.

Line 4 – Involuntary Conversion

The property is being involuntarily or compulsorily converted when both of

the following apply:

•

The California real property is transferred because it was (or threatened

to be) seized, destroyed, or condemned within the meaning of IRC

Section 1033.

• The seller or transferor intends to acquire property that is similar or

related in service or use in order to be eligible for nonrecognition of gain

for California income tax purposes.

Get federal Publication 544, Sales and Other Dispositions of Assets, for

more information about involuntary conversions.

Line 5 – Non-recognition Under IRC Section 351 or 721

The transfer must qualify for nonrecognition treatment under IRC

Section 351 (transferring to a corporation controlled by transferor) or IRC

Section 721 (contributing to a partnership in exchange for a partnership

interest).

Line 6 – Corporation

A corporation has a permanent place of business in this state when it

is organized and existing under the laws of this state or it has qualified

through the CA SOS to transact intrastate business. A corporation not

qualified to transact intrastate business (such as a corporation engaged

exclusively in interstate commerce) will be considered as having a

permanent place of business in this state only if it maintains an office in this

state that is permanently staffed by its employees after the sale.

S corporations must withhold on nonresident S corporation shareholders.

Get FTB Pub. 1017, Resident and Nonresident Withholding Guidelines, for

more information.

Line 7 – Partnership or Limited Liability Company (LLC)

Partnerships and LLCs are required to withhold on nonresident partners and

members. For more information, get FTB Pub.1017.

Withholding is not required if the title to the property transferred is recorded

in the name of a California partnership or it is qualified to do business in

California.

Withholding is not required if the title to the property transferred is in the

name of an LLC, and the LLC meets both of the following:

•

It is classified as a partnership for federal and California income tax

purposes.

• It is not a SMLLC that is disregarded for federal and California income

tax purposes.

If the LLC meets these conditions, the LLC must still withhold on

nonresident members. Get FTB Pub. 1017 for more information.

If the SMLLC is classified as a corporation for federal and California income

tax purposes, then the seller or transferor is considered a corporation for

withholding purposes. Refer to Line 6.

If the LLC is an SMLLC that is disregarded for federal and California income

tax purposes, then that single member is considered the seller or transferor

and title to the property is considered to be in the name of the single

member for withholding purposes.

When completing Form 593-C as the single member of a disregarded LLC,

write on the bottom of the form that the information on the form is for the

single member of the LLC, so the Real Estate Escrow Person (REEP) will

understand why it is different from the recorded title holder.

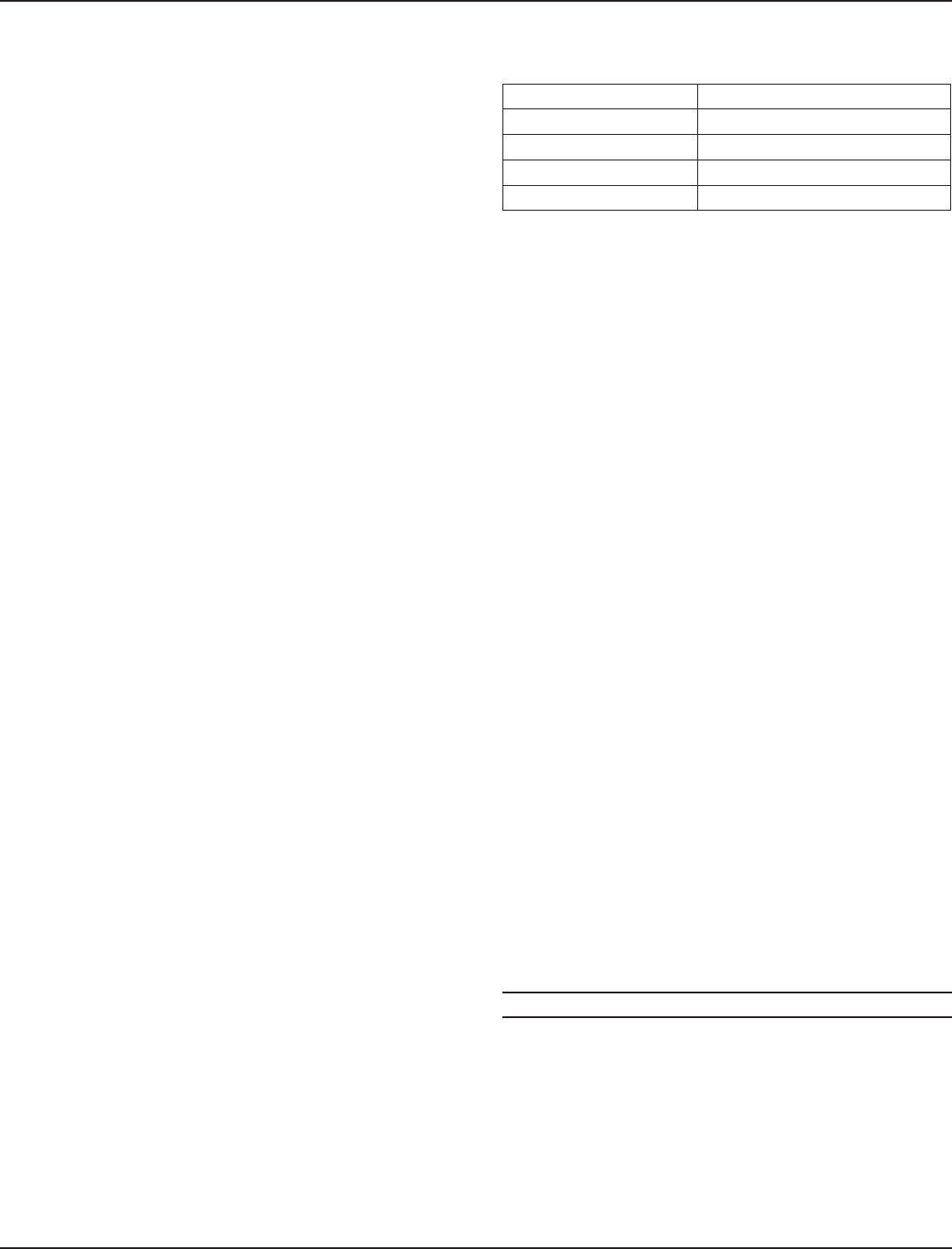

If the single member is: Complete Form 593-C using:

An individual The individual’s information

A corporation The corporation’s information

A partnership The partnership’s information

An LLC The single member’s information

Line 8 – Tax-Exempt Entity

Withholding is not required if the seller or transferor is tax-exempt under

either California or federal law (e.g., religious, charitable, educational, not

for profit organizations, etc.).

Line 9 – Insurance Company, Individual Retirement Account, Qualified

Pension or Profit-Sharing Plan, or Charitable Remainder Trust

Withholding is not required when the seller or transferor is an insurance

company, individual retirement account, qualified pension or profit-sharing

plan, or a charitable remainder trust.

Part III – Certifications That May Partially or

Fully Exempt the Sale From Withholding

Complete Part III only if you did not meet any of the exemptions in Part II.

Line 10 – Simultaneous Exchange

If the California real property is part of a simultaneous like-kind exchange

within the meaning of IRC Section 1031, the transfer is exempt from

withholding. However, if the seller or transferor receives money or other

property (in addition to property that is a part of the like-kind exchange)

exceeding $1,500 from the sale, the withholding agent must withhold.

Line 11 – Deferred Exchange

If the California real property is part of a deferred like-kind exchange within

the meaning of IRC Section 1031, the sale is exempt from withholding at

the time of the initial transfer. However, if the seller or transferor receives

money or other property (in addition to property that is a part of the

like-kind exchange) exceeding $1,500 from the sale, the withholding agent

must withhold.

The intermediary or accommodator must withhold on all cash or cash

equivalent (boot) it distributes to the seller or transferor if the amount

exceeds $1,500.

If the exchange does not take place or if the exchange does not qualify

for nonrecognition treatment, the intermediary or accommodator must

withhold 3

1

/3% (.0333) of the total sales price.

Line 12 – Installment Sale

The withholding agent is required to report as an installment sale if

the transaction is structured as an installment sale as evidenced by

a promissory note. The withholding agent is required to withhold

3

1

/3% (.0333) of the first installment payment.

The buyer is required to withhold on the principal portion of each

subsequent installment payment if the sale is structured as an installment

sale.

When the withholding amount on the first installment principal payment

is sent to the FTB, the FTB must also receive a completed Form 593-I,

Real Estate Withholding Installment Sale Acknowledgement, a completed

Form 593, and a copy of the promissory note.

Seller or Transferor Signature

You must sign this form and return it to your REEP by the close of escrow

for it to be valid. Otherwise, the withholding agent must withhold the

full 3

1

/3% (.0333) of the total sales price or the optional gain on sale

withholding amount from line 5 of Form 593 that is certified by the seller or

transferor.

Penalty – Any seller or transferor who, for the purpose of avoiding the

withholding requirements, knowingly executes a false certificate is liable for

a penalty of $1,000 or 20% of the required withholding amount, whichever

is greater.