Fillable Printable 2015 Form Pw-U - Wisconsin Department Of Revenue

Fillable Printable 2015 Form Pw-U - Wisconsin Department Of Revenue

2015 Form Pw-U - Wisconsin Department Of Revenue

IC-006

18 IfPW-1ledlatewithoutanextension,enternetwithholdingtax .................

19 IfPW-1ledwithextendedduedateandshows–

(90%) (10%)

a Netwithholdingtaxof$500ormore,enterportionofnettaxindicated ..........

b Netwithholdingtaxoflessthan$500,enternettax .........................

20 Enterpaymentsmade(applyrstto18%peryearcolumn) .....................

21 Subtractline20fromline18or19aor19b.Thisisamountduethe15thdayofthe

monththatincludesunextendedduedate(afterendoftaxableyear) .............

22 InterestonunderpaymentfromPartI,line17 ................................

23 Addlines21and22 ....................................................

(18%peryear) (12%peryear)*

24 Interestonamountsonline23to (datePW-1led) .....

25 IfPW-1isledlatewithoutanextensionoraftertheextendedduedate–

a Enterpenaltyof5%ofnettaxdueonyourreturnforeachmonthorfractionthereofthatyourreturnislate,butnotmorethan25%

b Enter$50orapplicablelatefee .........................................................................

26 Addlines24,25a,and25b.EnterthetotalonPW-1,line10 .....................................................

* Note:Seetheinstructionsforline24.

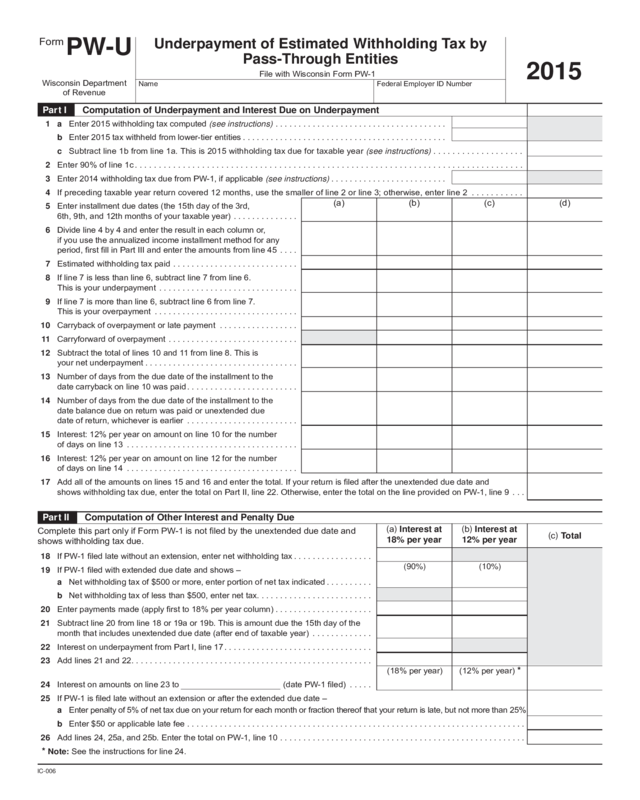

Part II Computation of Other Interest and Penalty Due

CompletethispartonlyifFormPW-1isnotledbytheunextendedduedateand

showswithholdingtaxdue.

(

a

)

Interest at

(

b

)

Interest at

18% per year 12% per year

(

c

)

Total

1 a Enter2015withholdingtaxcomputed(see instructions) .....................................

b Enter2015taxwithheldfromlower-tierentities ............................................

c Subtractline1bfromline1a.Thisis2015withholdingtaxduefortaxableyear(see instructions) ...................

2 Enter90%ofline1c .................................................................................

3 Enter2014withholdingtaxduefromPW-1,ifapplicable(see instructions) .........................

4 Ifprecedingtaxableyearreturncovered12months,usethesmallerofline2orline3;otherwise,enterline2 ...........

5 Enterinstallmentduedates(the15thdayofthe3rd,

6th,9th,and12thmonthsofyourtaxableyear) ..............

6 Divideline4by4andentertheresultineachcolumnor,

ifyouusetheannualizedincomeinstallmentmethodforany

period,rstllinPartIIIandentertheamountsfromline45 ....

7 Estimatedwithholdingtaxpaid ...........................

8 Ifline7islessthanline6,subtractline7fromline6.

Thisisyourunderpayment ..............................

9 Ifline7ismorethanline6,subtractline6fromline7.

Thisisyouroverpayment ...............................

10 Carrybackofoverpaymentorlatepayment .................

11 Carryforwardofoverpayment ............................

12 Subtractthetotaloflines10and11fromline8.Thisis

yournetunderpayment .................................

13 Numberofdaysfromtheduedateoftheinstallmenttothe

datecarrybackonline10waspaid ........................

14 Numberofdaysfromtheduedateoftheinstallmenttothe

datebalancedueonreturnwaspaidorunextendeddue

dateofreturn,whicheverisearlier ........................

15 Interest:12%peryearonamountonline10forthenumber

ofdaysonline13 .....................................

16 Interest:12%peryearonamountonline12forthenumber

ofdaysonline14 .....................................

17 Addalloftheamountsonlines15and16andenterthetotal.Ifyourreturnisledaftertheunextendedduedateand

showswithholdingtaxdue,enterthetotalonPartII,line22.Otherwise,enterthetotalonthelineprovidedonPW-1,line9 ...

Part I Computation of Underpayment and Interest Due on Underpayment

Form

PW-U

Underpayment of Estimated Withholding Tax by

Pass-Through Entities

FilewithWisconsinFormPW-1

2015

WisconsinDepartment

ofRevenue

Name

FederalEmployerIDNumber

(a) (b) (c) (d)

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

Go to Part III

Go to Page 2

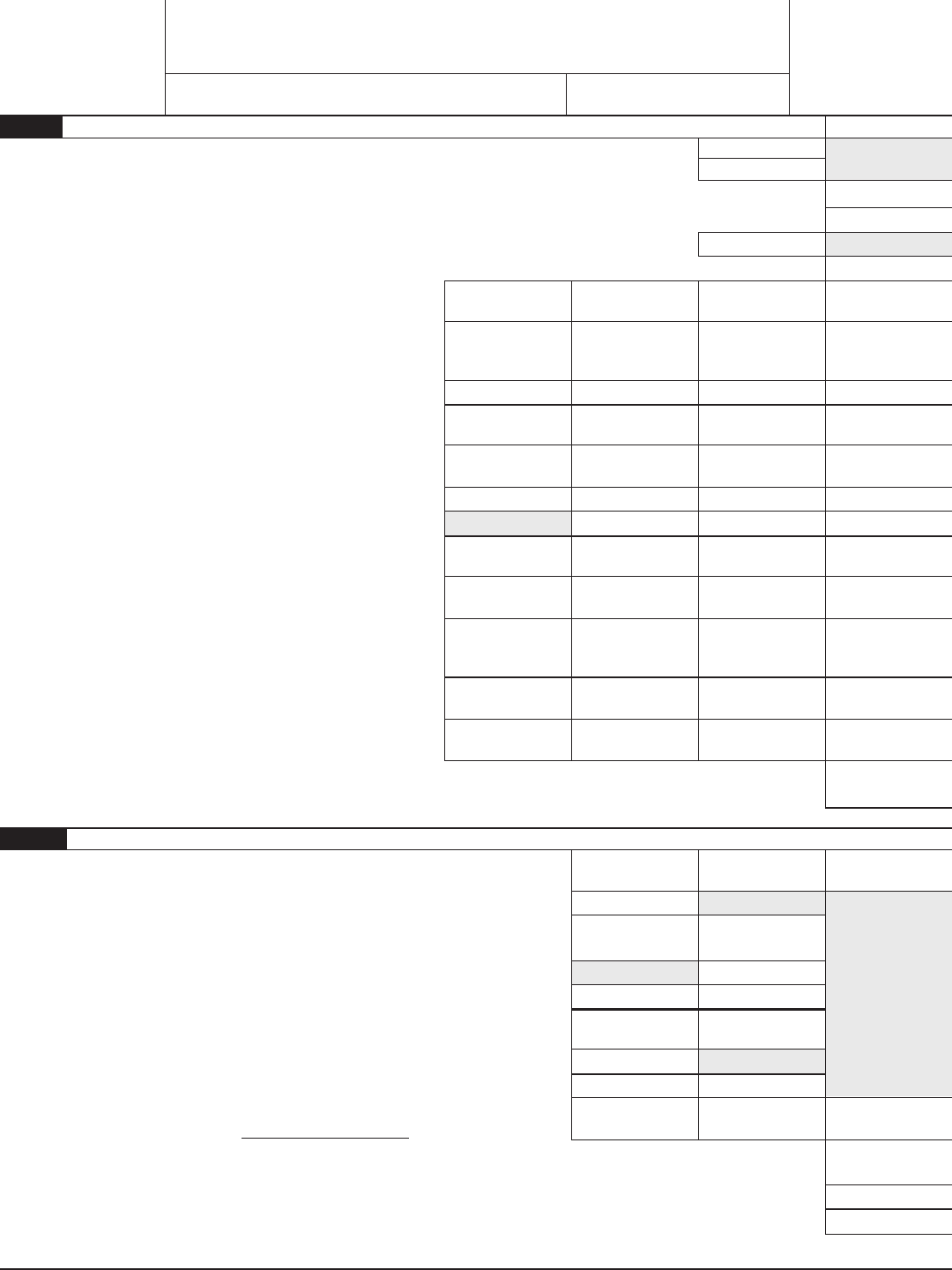

27 EnterWisconsinnetincomeforeachperiod(see instructions) .

28 Annualizationfactor...................................

29 Multiplyline27byline28 ..............................

30 Adjustments(NBLs,etc.–see instructions) ................

31 Combinelines29and30.Thisisannualizedincome .........

32 Multiply line 31 by your applicable tax rate. This is annualized gross tax ....

33 Enteryournonrefundablecredits ........................

34 Subtractline33fromline32.Ifzeroorless,enterzero .......

35 Enteryourrefundablecredits(excludingestimatedtaxpaid) .....

36 Subtractline35fromline34.Ifzeroorless,enterzero.

Thisisannualizednetwithholdingtax ....................

37 Applicablepercentage ................................

38 Multiplyline36byline37 ..............................

39 Enterthecombinedamountsofline45fromallprecedingcolumns

40 Subtractline39fromline38.Ifzeroorless,enterzero .......

41 DividePart1,line4,by4andentertheresultineachcolumn ..

42 Entertheamountfromline44fortheprecedingcolumn ......

43 Addlines41and42andenterthetotal ...................

44 Ifline43ismorethanline40,subtractline40fromline43.

Otherwise,enterzero .................................

45 Enterthesmallerofline40or43hereandonPart1,line6 ...

Page2of2

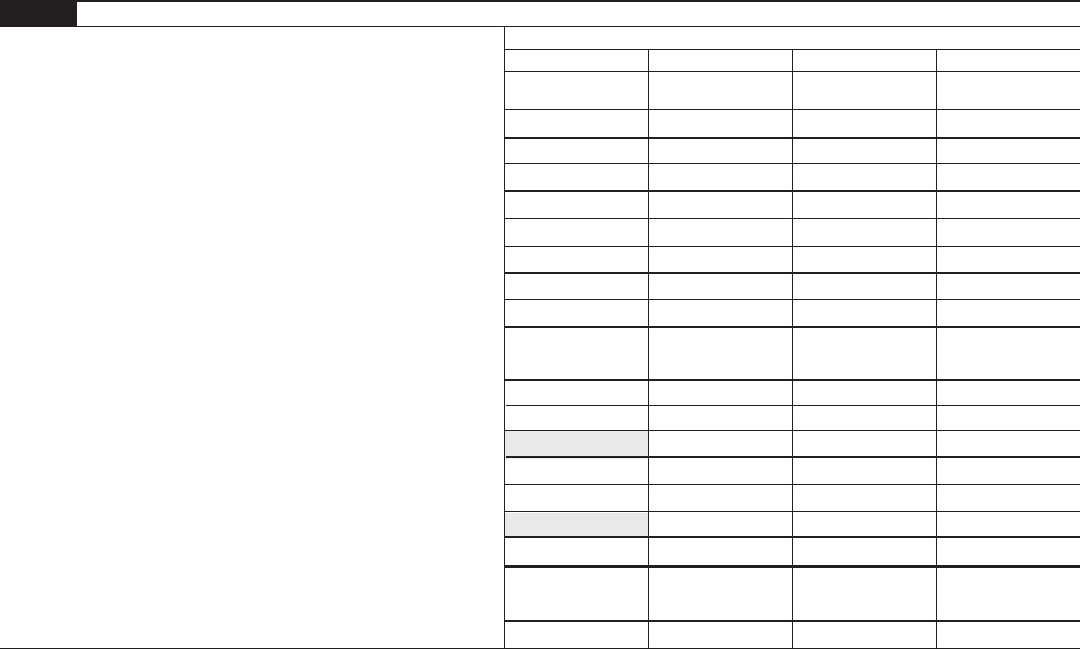

Purpose of Form PW-U–Pass-throughentitiesuseFormPW-Utodeter-

mineiftheyaresubjecttointerestforunderpaymentofestimatedwithholding

taxand,ifso,theamountofinterest.Apass-throughentitymusthavemade

estimatedwithholdingtaxpaymentsifthetotalofitswithholdingtaxforits

taxableyearbeginningin2015is$500ormore.FormPW-Uisalsoused

tocomputebothextensionanddelinquentinterestwheneverthewithhold-

ingtaxdueispaidaftertheendoftheunextendedduedateofthePW-1.

Part I–Computeanyunderpaymentofrequiredinstallmentsandtheamount

ofinterestdueinPartI.

Requiredinstallmentsarebasedonthesmallerof(1)90%of2015Wisconsin

net tax, (2) 100% of 2014 Wisconsin net tax, provided the 2014 return

coveredanentire12-monthperiod,or(3)90%ofthe2015Wisconsinnet

taxguredbyannualizingincome.

Line 1a – 1c.

Line1a.EntertheamountfromFormPW-1,line1.

Line1b.EntertheamountfromFormPW-1,line3.

Line1c.No underpayment interestisrequired if thepass-throughentity

meetsanyoftwocertainthresholds:(i)Ifline1c.islessthan$500,enter

zeroandgotoPartII,ifapplicable;(ii)Ifline1c.islessthan$5,000,the

pass-throughentityhadnowithholdingtaxliabilityfortheprecedingtaxable

year,andtheprecedingtaxableyearcovered12months,enterzeroand

gotoPartII,ifapplicable.

Line 3. Ifthepass-throughentityhadawithholdingtaxliabilityin2014,enter

theamountfrom2014PW-1(line1-line3).

Line 10.Completeline10onlyifyouhaveanoverpaymentonline9forone

ormoreinstallmentperiods.Theoverpaymentmaybecarriedbacktoprior

installmentperiodsandoffsetagainstanunderpaymentforsuchperiods.

Ifyouuseoverpaymentsfrommorethanoneinstallmentperiodtooffset

anunderpaymentofoneperiod,llinseparatelyonline10eachcarryback

usedtooffsettheunderpayment.

Line 11.Anyoverpayment remainingafter completingline 10shouldbe

carriedforwardtothenextperiod.

Lines 13 through 17.Completetheselinestodeterminetheamountof

interestdueontheunderpayment.Completelines13and15onlywhenan

overpaymentorlatepaymentiscarriedbackonline10.Ifyouapplymore

than one paymenttoagiveninstallment,attachastatementshowing a

separatecomputationforeachpayment.

IfyoudonothaveabalanceduebytheunextendedduedateofFormPW-1

(21/2monthsafterthecloseofatax-option(S)corporation’staxableyear

or31/2monthsafterthecloseofapartnership’s,limitedliabilitycompany

treatedasapartnership’s,trust’s,orestate’staxableyear),entertheamount

fromline17onFormPW-1.Otherwise,entertheamountfromline17on

PartII,line22,andcompletetherestofPartII.

Part II–CompletePartIIonlyifyourreturnisnotledbytheunextended

duedateandshowsabalancedue.

Line 20. Enterestimatedwithholdingtaxpaymentsmadeandwithholding

taxwithheldfromlower-tierentities.

Line 24.The12%interestappliestothetaxonline23,column(b),only

fortheextensionperiods.The18%interestappliestothesumonline23,

column(a),fromtheunextendedduedatetothedatethereturnisled.The

18%interestalsoappliestothetaxonline23,column(b),fromtheextended

duedatetothedatethereturnled.Entertotalinterestfromcolumns(a)

and(b)oncolumn(c).

Line 25a.

The “net tax due” is the total tax and economic development

surchargelessanyallowablecredits,withholding,andestimatedpayments

madebytheduedate,includingextensions,ofthereturn.

Part III–Ifyoucomputeoneormoreinstallmentsundertheannualized

incomeinstallmentmethod,completePartIIIandentertheamountsfrom

line45 onPart I,line 6.See sectionTax2.89,WisconsinAdministrative

Code,ifthetaxableyearcoverslessthan12months.

Lines 27 and 30.Donotincludeonline27itemswhichremainconstantfrom

periodtoperiod,suchasnetbusinesslosscarryforwardsandamortization

ofadjustmentsforchangesinmethodofaccounting.Instead,enterthese

itemsonline30,columns(a)through(d),intotal.

Part III Annualized Income Installment Method Worksheet

Fillinthisworksheetonlyifcomputingrequiredinstallmentsusingthe

annualizedincomeinstallmentmethod.Completeonecolumnthrough

line45beforecompletingthenextcolumn.

(

a

)

First2months

(

b

)

First5months

(

c

)

First8months

(

d

)

First11months

Annualization Period

6 2.4 1.5 1.091

22.5% 45% 67.5% 90%

2015FormPW-U

Return to Page 1