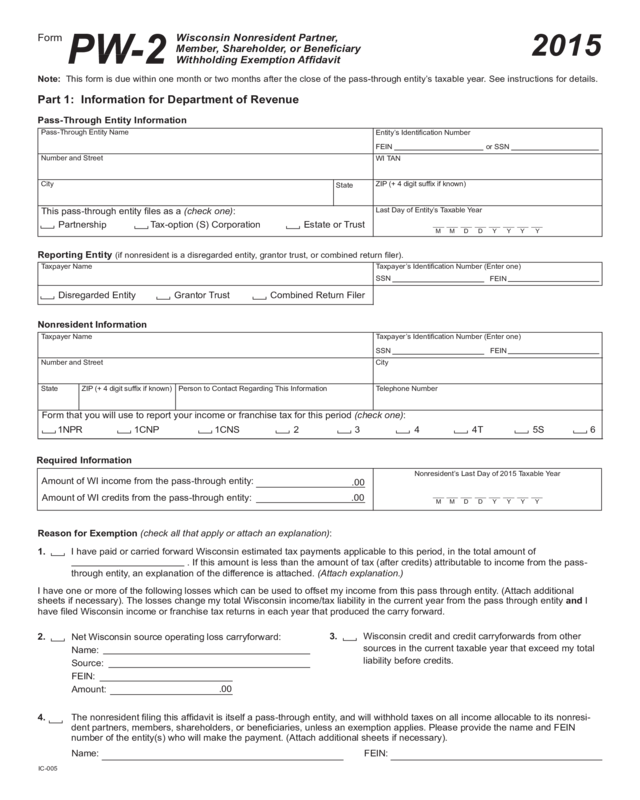

Fillable Printable 2015 Ic-005 Form Pw-2 Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit

Fillable Printable 2015 Ic-005 Form Pw-2 Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit

2015 Ic-005 Form Pw-2 Wisconsin Nonresident Partner, Member, Shareholder, Or Beneficiary Withholding Exemption Affidavit

2015

PW-2

Wisconsin Nonresident Partner,

Member, Shareholder, or Beneciary

Withholding Exemption Afdavit

Form

IC-005

Note: This form is due within one month or two months after the close of the pass-through entity’s taxable year. See instructions for details.

Part 1: Information for Department of Revenue

Pass-Through Entity Information

Pass-Through Entity Name

Number and Street

State

ZIP (+ 4 digit sufx if known)

This pass-through entity les as a (check one):

Entity’s Identication Number

WI TAN

FEIN or SSN

Last Day of Entity’s Taxable Year

M Y Y Y Y

M

D D

Partnership

Tax-option (S) Corporation

Estate or Trust

City

Reporting Entity (if nonresident is a disregarded entity, grantor trust, or combined return ler).

Taxpayer Name

Taxpayer’s Identication Number (Enter one)

FEIN

SSN

Number and Street

State ZIP (+ 4 digit sufx if known)

Form that you will use to report your income or franchise tax for this period (check one):

Nonresident Information

City

Telephone Number

Taxpayer Name

Taxpayer’s Identication Number (Enter one)

FEIN

SSN

Person to Contact Regarding This Information

1NPR 1CNP 1CNS 2 3

4 6

5S

4T

Amount of WI income from the pass-through entity:

Nonresident’s Last Day of 2015 Taxable Year

Amount of WI credits from the pass-through entity:

M

Y Y

Y

Y

M

D

D

.00

.00

Disregarded Entity

Grantor Trust

Combined Return Filer

4. The nonresident ling this afdavit is itself a pass-through entity, and will withhold taxes on all income allocable to its nonresi-

dent partners, members, shareholders, or beneciaries, unless an exemption applies. Please provide the name and FEIN

number of the entity(s) who will make the payment. (Attach additional sheets if necessary).

Reason for Exemption (check all that apply or attach an explanation):

1. I have paid or carried forward Wisconsin estimated tax payments applicable to this period, in the total amount of

. If this amount is less than the amount of tax (after credits) attributable to income from the pass-

through entity, an explanation of the difference is attached. (Attach explanation.)

I have one or more of the following losses which can be used to offset my income from this pass through entity. (Attach additional

sheets if necessary). The losses change my total Wisconsin income/tax liability in the current year from the pass through entity and I

have led Wisconsin income or franchise tax returns in each year that produced the carry forward.

2.

Net Wisconsin source operating loss carryforward:

Name:

Source:

FEIN:

Amount:

.00

3.

Wisconsin credit and credit carryforwards from other

sources in the current taxable year that exceed my total

liability before credits.

Name: FEIN:

Required Information

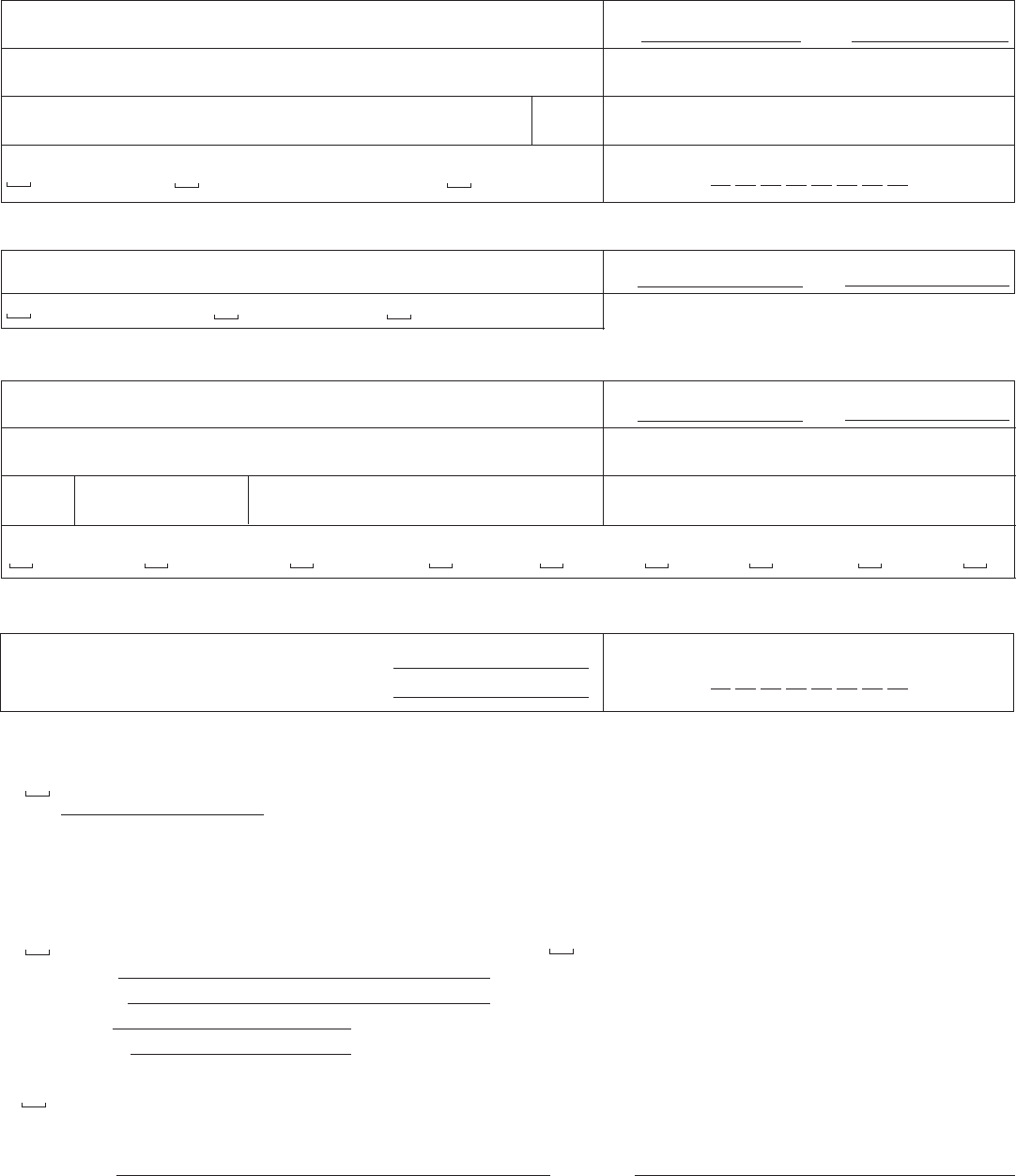

2015

PW-2

Wisconsin Nonresident Partner,

Member, Shareholder, or Beneciary

Withholding Exemption Afdavit

Form

Part 2

Part 2: Information for Department of Revenue and Pass-Through Entity

Agreement to File, Routing, Declaration, and Signature

I, ,asanonresidentpartner,member,shareholder,orbeneciaryofthe

pass-throughentity ,requestthispass-throughentitytobeexemptfrom

theWisconsinincomeorfranchisetaxwithholdingrequirementfoundinsec.71.775,Wis.Stats.,formytaxyearending

.

BysigningthisafdavitIagreetotimelyleaWisconsinincomeorfranchisetaxreturnformytaxyearshownabove.

IagreetobesubjecttothepersonaljurisdictionoftheWisconsinDepartmentofRevenue,theWisconsinTaxAppeals

Commission,andthecourtsofthisstateforthepurposeofdeterminingandcollectinganyWisconsintaxes,including

estimatedtaxpayments,togetherwithanyinterestandpenalties.

The Department will return this form by mail. Enter address information below. Please type or print legibly.

Number and Street

State

To Attention of

City

ZIP Code

Company Name (if applicable)

Send Parts 1 and 2 of this form to the Wisconsin Department of Revenue at:

Fax: (Use cover page provided with instructions)

Mail: Wisconsin Department of Revenue

BTS/PTE, Mail Stop 3-107

PO Box 8958

Madison, WI 53708-8958

The Department will return Part 2 of Form PW-2 to you within approximately 30 days of receiving it. If the Department has

approved Form PW-2, provide this page to the pass-through entity. The pass-through entity must keep a copy of this page

for its records as documentation showing why it did not pay withholding tax on your behalf.

Approval by Department of Revenue

Approved for 2015 Taxable Year

Date

Reviewer’s Initials

Not Approved

Ideclarethattheinformationprovidedinthisafdavitiscompleteandaccurate,andthatImeetallrequirementsoftheexemption

checkedinPart1.IunderstandthattheDepartmentwillreturnPart2ofthisformtome.Ifurtherunderstandthatapprovalofthis

afdavitdoesnotconstituteanauditbytheDepartment,andthattheDepartment’sdeterminationregardingapprovalofthisafdavit

may not be appealed.

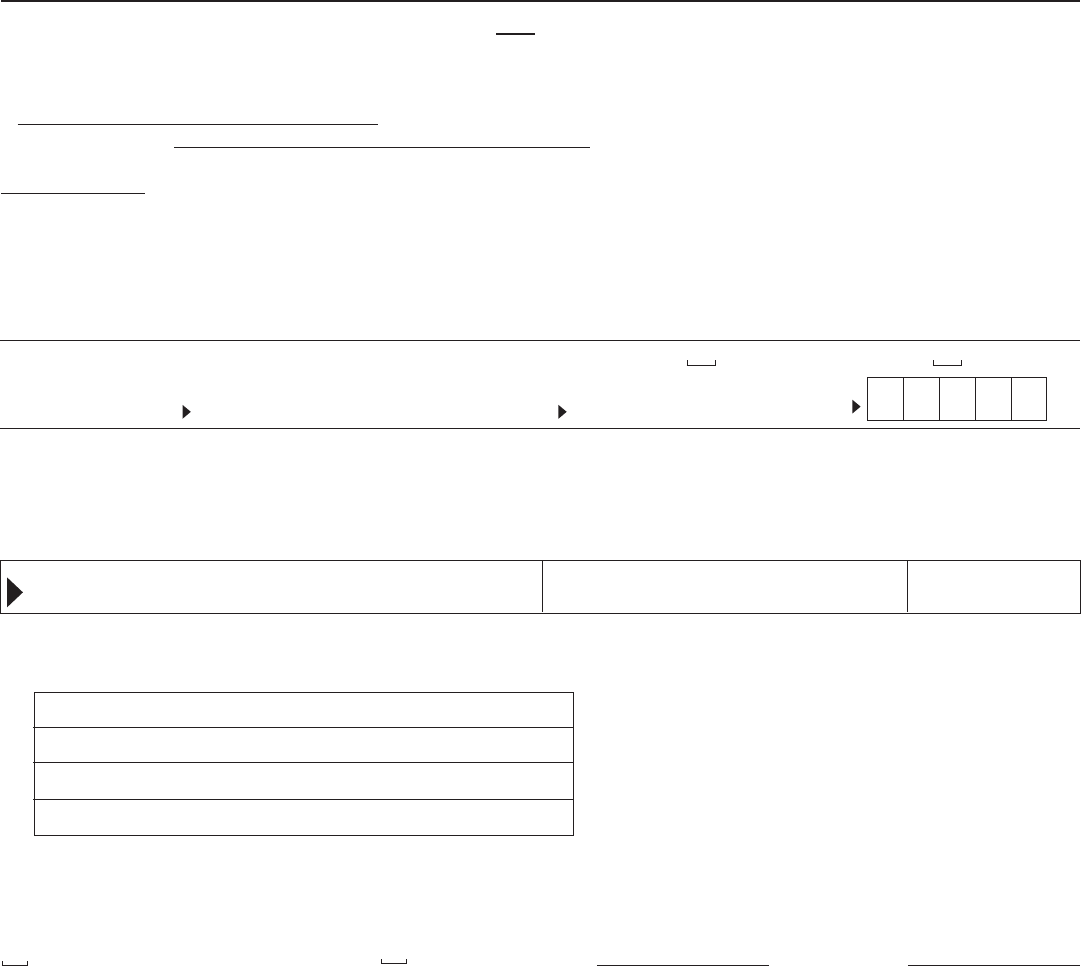

Taxpayer’s Signature DateTitle (if applicable)

Third

Party

Designee

Designee’s

name

Phone

no. ( )

Personal

identication

number (PIN)

Do you want to allow another person to discuss this return with the department? Yes Complete the following. No