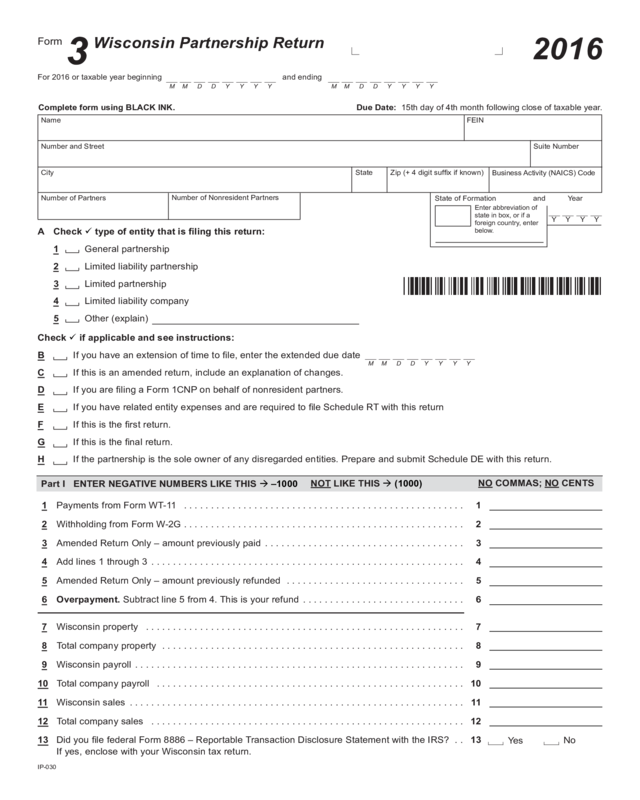

Fillable Printable 2016 Form 3 Wisconsin Partnership Return

Fillable Printable 2016 Form 3 Wisconsin Partnership Return

2016 Form 3 Wisconsin Partnership Return

2016

3

Wisconsin Partnership Return

Form

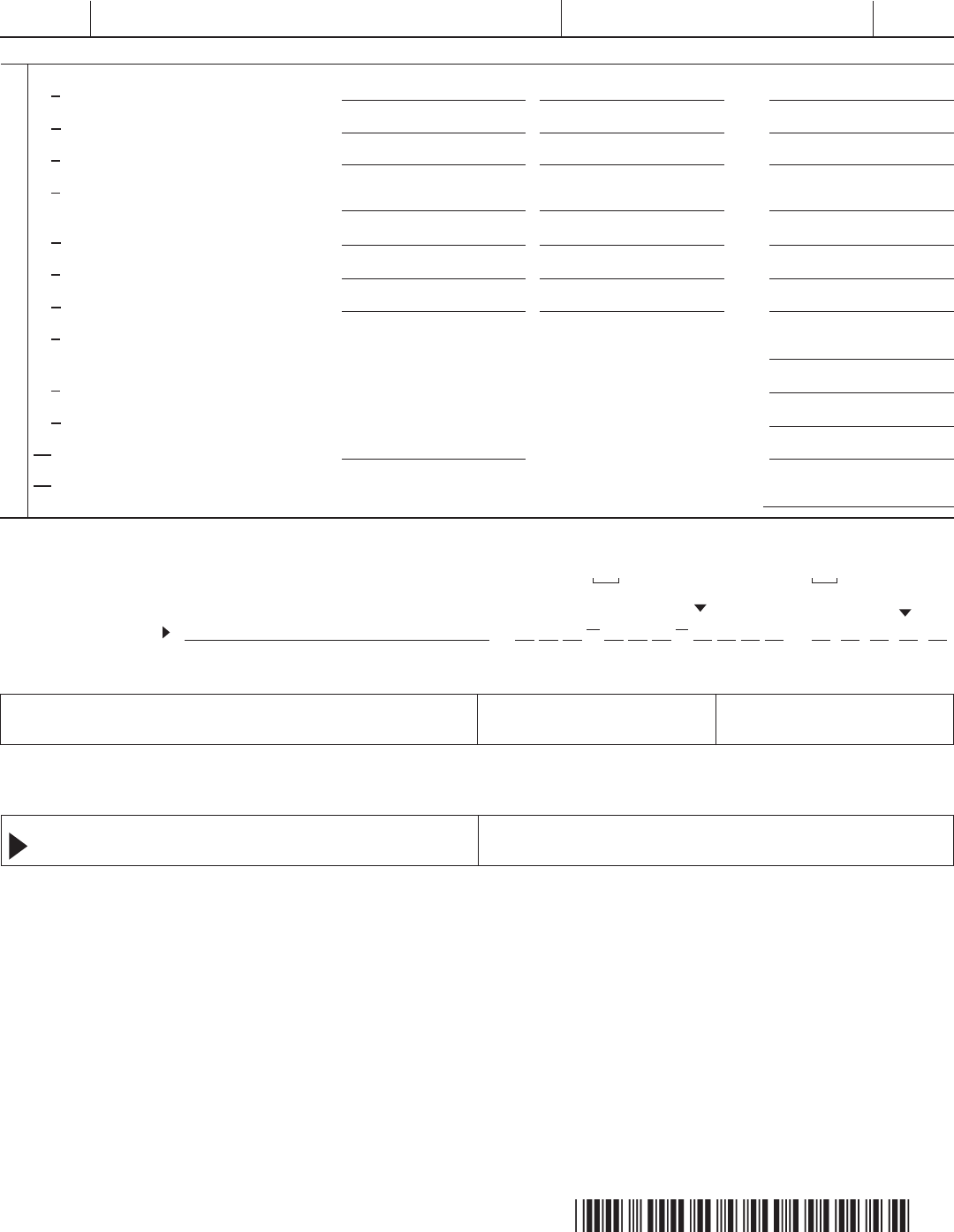

For 2016 or taxable year beginning and ending

M Y Y Y Y M D D M Y Y Y YM D D

A Check type of entity that is ling this return:

1 General partnership

2 Limited liability partnership

3 Limited partnership

4 Limited liability company

5 Other (explain)

Check if applicable and see instructions:

B If you have an extension of time to le, enter the extended due date

C If this is an amended return, include an explanation of changes.

D If you are ling a Form 1CNP on behalf of nonresident partners.

E If you have related entity expenses and are required to le Schedule RT with this return

F If this is the rst return.

G If this is the nal return.

H If the partnership is the sole owner of any disregarded entities. Prepare and submit Schedule DE with this return.

M Y Y Y YM D D

Name FEIN

City

Number and Street

Suite Number

Due Date: 15th day of 4th month following close of taxable year.

Complete form using BLACK INK.

State

Zip (+ 4 digit sufx if known)

Business Activity (NAICS) Code

State of Formation and Year

Enter abbreviation of

state in box, or if a

foreign country, enter

below.

Y

Y Y Y

IP-030

Number of Nonresident Partners

Number of Partners

1 Payments from Form WT-11 .................................................... 1

2 Withholding from Form W-2G .................................................... 2

3 Amended Return Only – amount previously paid ..................................... 3

4 Add lines 1 through 3 .......................................................... 4

5 Amended Return Only – amount previously refunded ................................. 5

6 Overpayment. Subtract line 5 from 4. This is your refund .............................. 6

7 Wisconsin property ........................................................... 7

8 Total company property ........................................................ 8

9 Wisconsin payroll ............................................................. 9

10 Total company payroll ......................................................... 10

11 Wisconsin sales .............................................................. 11

12 Total company sales .......................................................... 12

13 Did you le federal Form 8886 – Reportable Transaction Disclosure Statement with the IRS? . . 13

If yes, enclose with your Wisconsin tax return.

NOT LIKE THIS (1000)

Part I ENTER NEGATIVE NUMBERS LIKE THIS –1000

NO COMMAS; NO CENTS

Yes

No

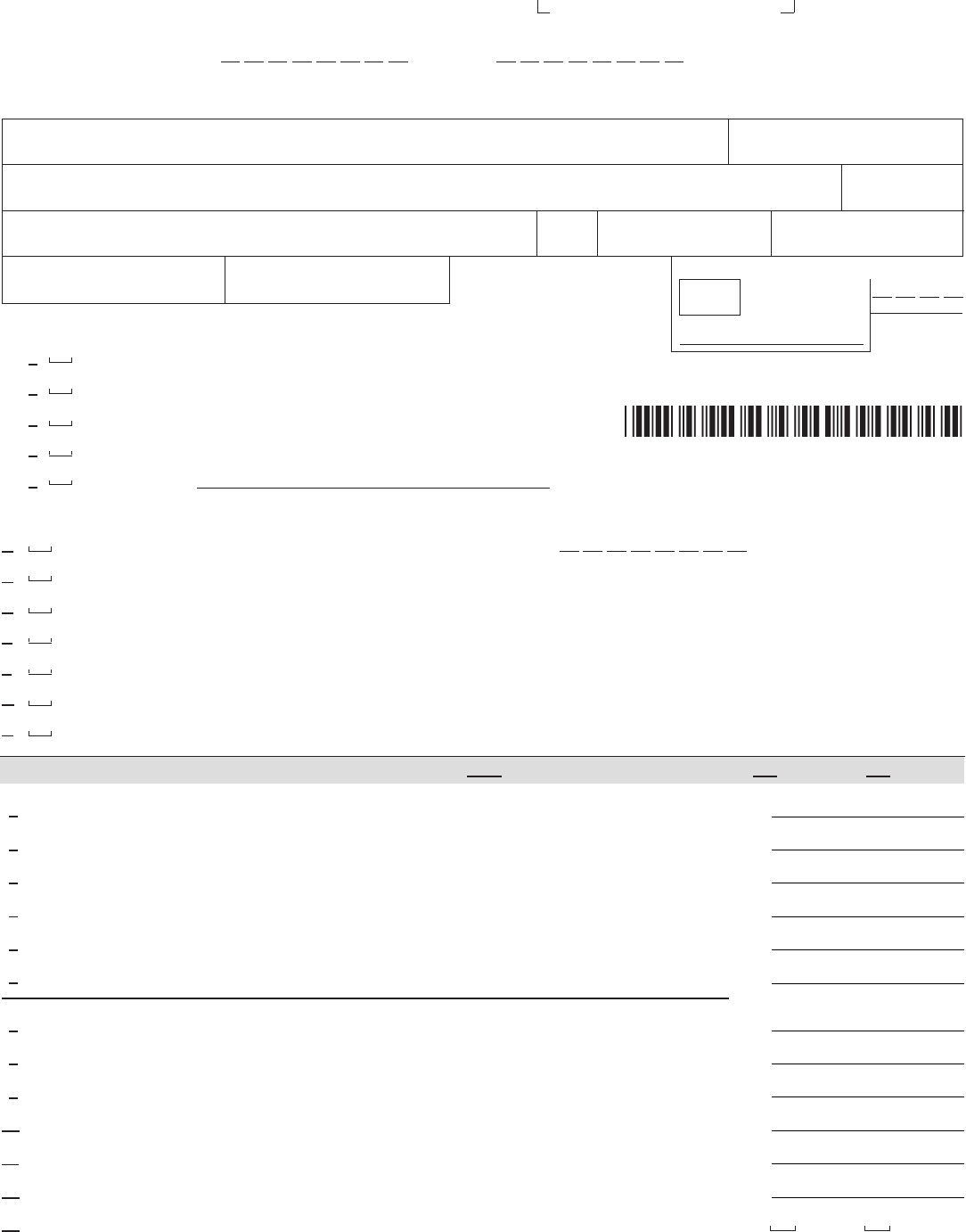

2016 Form 3

Name Page 2 of 5ID Number

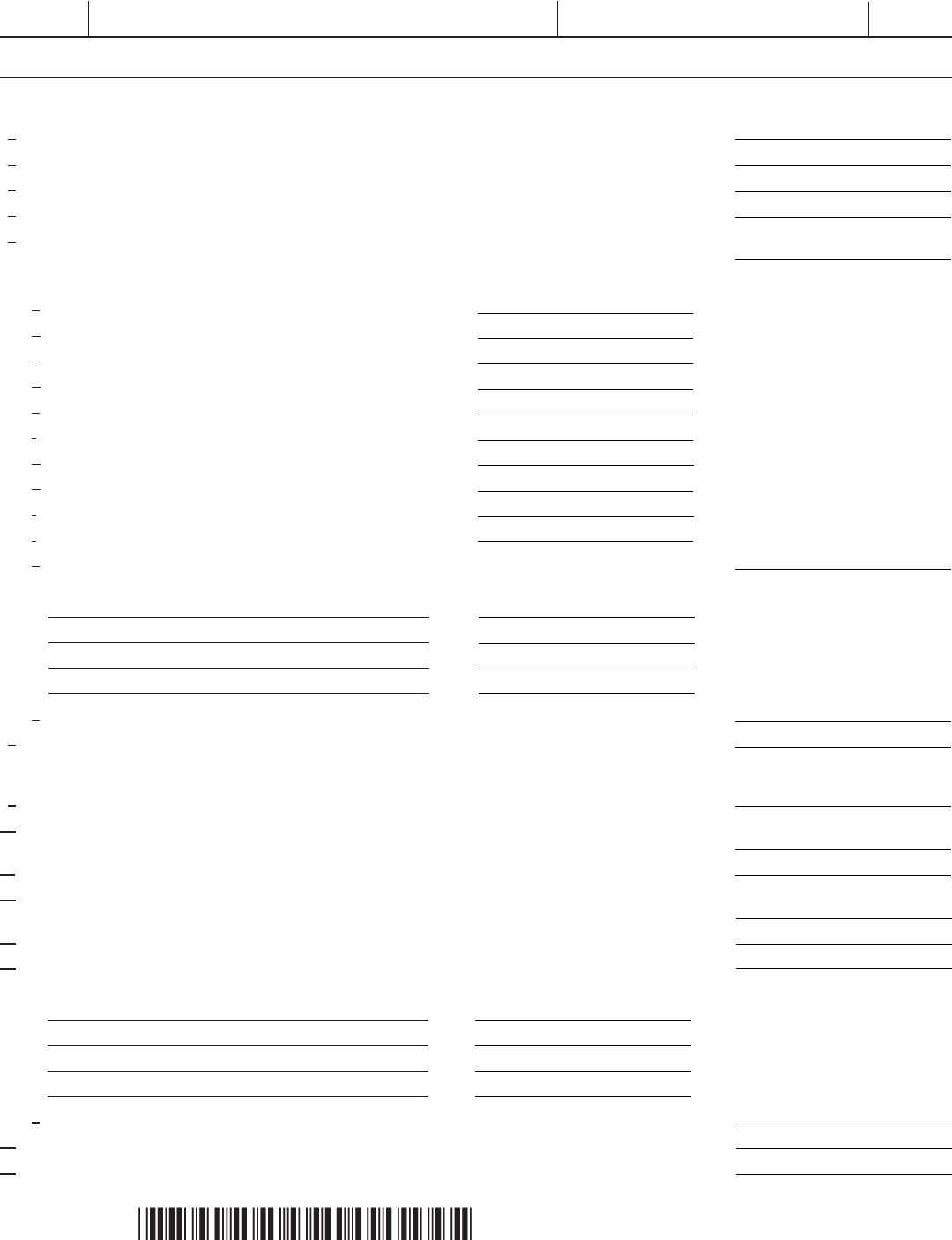

Part II Schedule 3K – Partners’ Distributive Share Items

(a) Distributive share items

(d) Amount under Wis. law

(b) Federal amount

(c) Adjustment

1 Ordinary business income (loss) 1

2 Net rental real estate income

(loss) (attach Form 8825) .... 2

3 Other net rental income (loss)

(attach schedule) ........... 3

4 Guaranteed payments ....... 4

5 Interest income . . . . . . . . . . . . 5

6 Ordinary dividends ......... 6

7 Royalties ................. 7

8 Net short-term capital gain (loss) 8

9 Net long-term capital gain (loss) 9

10 Net section 1231 gain (loss)

(attach Form 4797) . . . . . . . . . 10

11 Other income (loss) (attach

schedule) ................. 11

Income (Loss)

12 Section 179 deduction

(attach Form 4562) . . . . . . . . . 12

13a Contributions .............. 13a

b Investment interest expense . . 13b

c Section 59(e)(2) expenditures

(1) Type

(2) Amount ............... 13c

d Other deductions

(attach schedule) ........... 13d

14 Net earnings (loss) from self

employment ............... 14

Other Deductions

15a Schedule ..........................................................

b Schedule ..........................................................

c Schedule ..........................................................

d Schedule ..........................................................

e Schedule ..........................................................

f Schedule ..........................................................

g Schedule ..........................................................

h Schedule ..........................................................

Credits

i Tax paid to other states (enter

postal abbreviation of state) ... 15i-1 ...................................

15i-2 ...................................

15i-3 ...................................

j Wisconsin tax withheld ......................................................

1

2

3

4

5

6

7

8

9

10

11

12

13a

13b

13c

13d

15i-1

15i-2

15j

15i-3

15a

15c

15d

15e

15f

15g

15h

15b

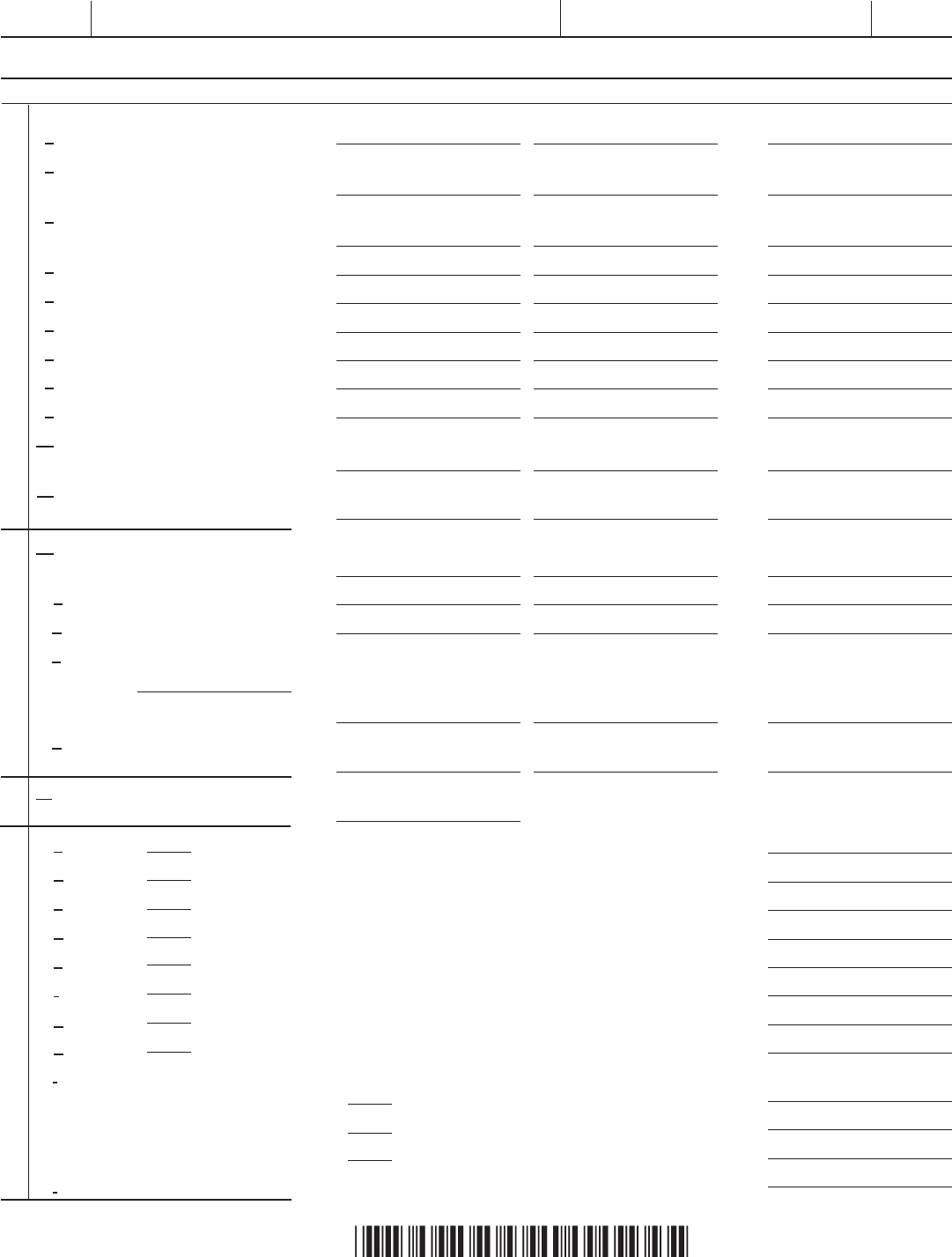

16a Name of country or U.S.

possession . . . . . . . . . . . . . . .

b Gross income from all sources 16b

c Gross income sourced at

partner level .............. 16c

Foreign gross income sourced

at partnership level:

d Passive category . . . . . . . . . . 16d

e General category .......... 16e

f Other (attach statement) .... 16f

Deductions allocated and

apportioned at partner level:

g Interest expense .......... 16g

h Other . . . . . . . . . . . . . . . . . . . 16h

Deductions allocated and

apportioned at partnership level

to foreign source income:

i Passive category . . . . . . . . . . 16i

j General category .......... 16j

k Other (attach statement) .... 16k

l Total foreign taxes (check one):

Paid Accrued ..... 16l

m Reduction in taxes available for

credit (attach statement) .... 16m

n Other foreign tax information

(attach statement) ......... 16n

17a Post-1986 depreciation

adjustment . . . . . . . . . . . . . . . 17a

b Adjusted gain or loss . . . . . . . 17b

c Depletion (other than oil and gas) 17c

d Oil, gas, and geothermal

properties – gross income . . . 17d

e Oil, gas, and geothermal

properties – deductions . . . . . 17e

f Other AMT items

(attach schedule) ......... 17f

Foreign Transactions

Alternative Minimum Tax

(AMT) Items

16a

16c

16d

16e

16f

16g

16h

16b

16i

16j

16k

16l

16m

16n

17a

17b

17c

17d

17e

17f

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

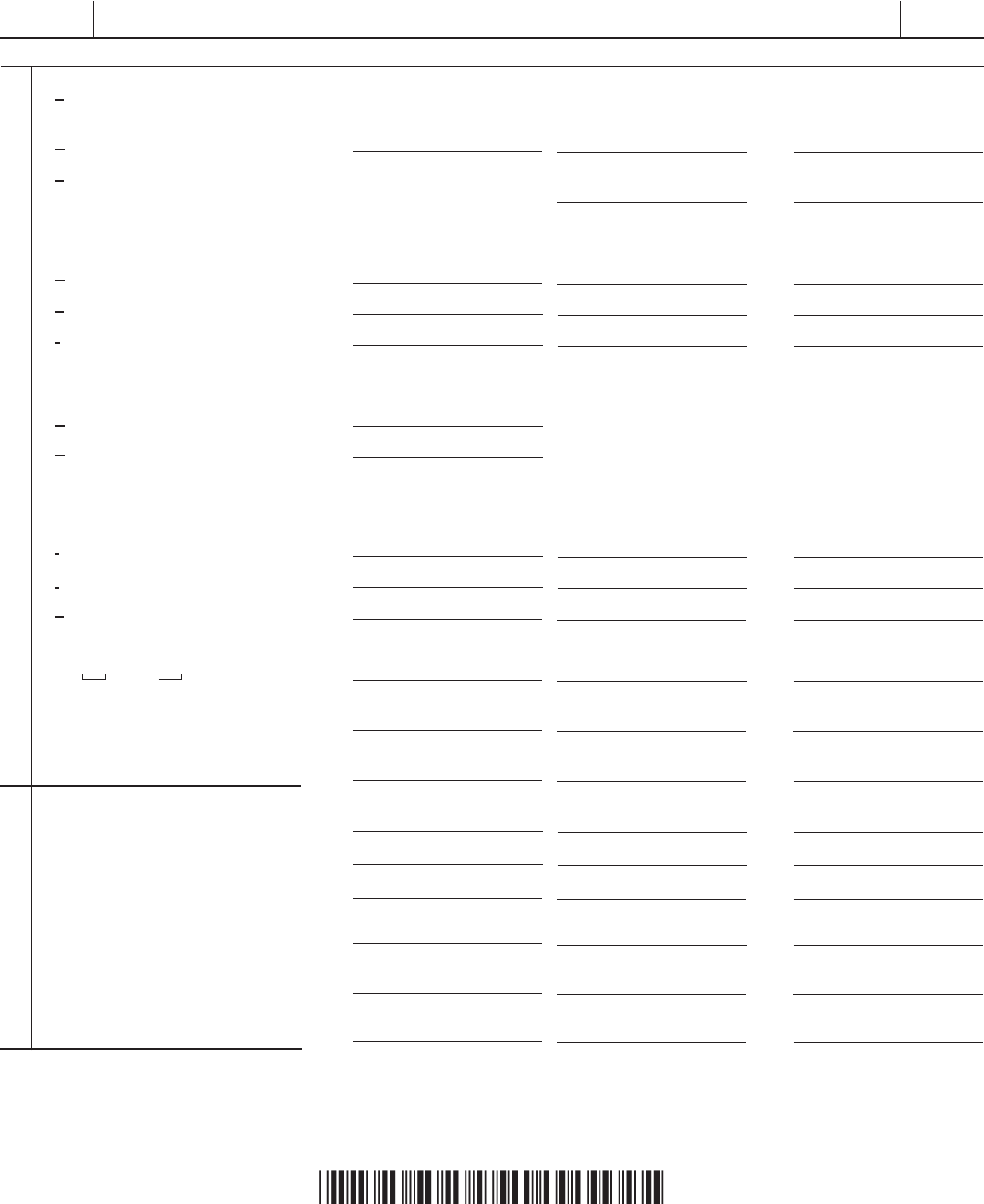

(a) Distributive share items

(d) Amount under Wis. law

(b) Federal amount

(c) Adjustment

2016 Form 3

Name Page 3 of 5ID Number

(a) Distributive share items

(d) Amount under Wis. law(b) Federal amount (c) Adjustment

2016 Form 3

Name Page 4 of 5ID Number

18a Tax-exempt interest income .. 18a

b Other tax-exempt income .... 18b

c Nondeductible expenses .... 18c

19a Distributions of cash and

marketable securities ....... 19a

b Distributions of other property 19b

20a Investment income ......... 20a

b Investment expenses ....... 20b

c Other items and amounts

(attach schedule) ...........................................................

21a Related entity expense addback ................................................

b Related entity expense allowable ...............................................

22 Income (loss) (see instructions) 22 .....................

23 Gross income (before deducting

expenses) from all activities ...................................................

Other

18a

18c

19a

19b

20a

20b

20c

18b

21a

21b

22

23

Third

Party

Designee

Person to contact concerning this return:

Date

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Signature of General Partner Signature of Preparer

Date

Phone #: Fax #:

If you are not ling electronically, paper clip (don’t staple or bind) a copy of your federal Form 1065, any

accompanying schedules, and Schedules 3K-1.

File electronically through the Federal/State E-Filing Program, or

Mail to: Wisconsin Department of Revenue

If partnership completed Part I .......... PO Box 8908, Madison, WI 53708-8908

If partnership only completed Part II...... PO Box 8965, Madison, WI 53708-8965

Print

Designee’s

Name

Do you want to allow another person to discuss this return with the department? Yes Complete the following. No

Personal Identication

Number (PIN)

Phone Number

Additions:

1 State taxes accrued or paid ........................................................... 1

2 Related entity expenses (from Schedule RT, Part I) .......................................... 2

3 Expenses related to nontaxable income ................................................... 3

4 Basis, section 179, depreciation, amortization difference (attach schedule) ....................... 4

5 Amount by which the federal basis of assets disposed of exceeds the Wisconsin basis

(attach schedule) .................................................................... 5

6 Total additions for certain credits computed:

a Business development credit ......................... 6a

b Community rehabilitation program credit ................ 6b

c Development zones credits .......................... 6c

d Economic development tax credit ..................... 6d

e Enterprise zone jobs credit .......................... 6e

f Jobs tax credit .................................... 6f

g Manufacturing and agriculture credit (computed in 2015) ... 6g

h Manufacturing investment credit ...................... 6h

i Research credits .................................. 6i

j Technology zone credit ............................. 6j

k Total credits (add lines 6a through 6j) ................................................ 6k

7 Other additions:

a 7a

b 7b

c 7c

d 7d

e Total other additions (add lines 7a through 7d) .......................................... 7e

8 Total additions (add lines 1 through 5 and 6k and 7e) .................................... 8

Subtractions:

9 Related entity expenses eligible for subtraction (from Schedule RT, Part II) ...................... 9

10 Income from related entities whose expenses were disallowed (obtain Schedule RT-1 from

related entity and submit with your return) ............................................... 10

11 Basis, section 179, depreciation/amortization of assets (attach schedule) ....................... 11

12 Amount by which the Wisconsin basis of assets disposed of exceeds the federal basis

(attach schedule) ................................................................... 12

13 Federal work opportunity credit wages ................................................... 13

14 Federal research credit expenses ...................................................... 14

15 Other subtractions:

a 15a

b 15b

c 15c

d 15d

e Total other subtractions (add lines 15a through 15d) ..................................... 15e

16 Total subtractions (add lines 9 through 14 and 15e) ..................................... 16

17 Total adjustment. (Subtract line 16 from line 8. See instructions) .......................... 17

2016 Form 3

Name Page 5 of 5ID Number

Part III Schedule 3K - Partner’s Share of Additions and Subtractions NO COMMAS; NO CENTS