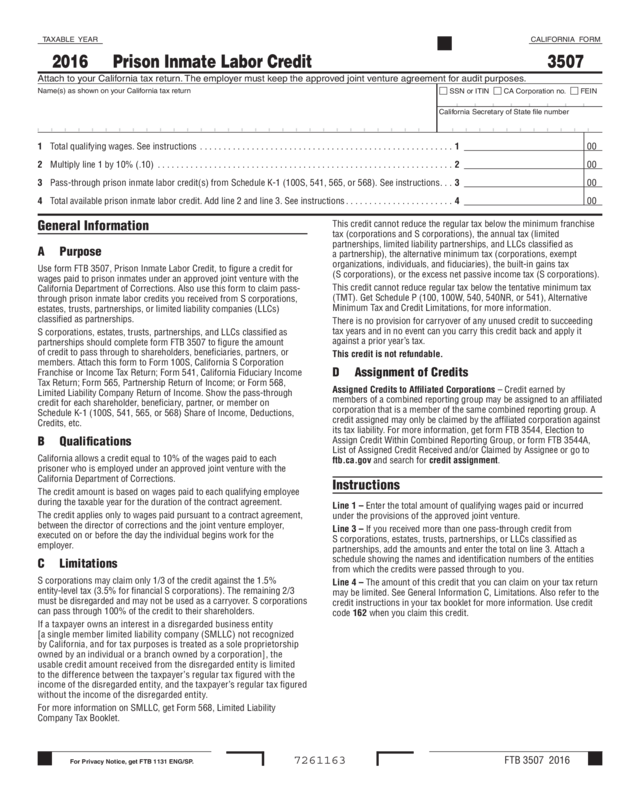

Fillable Printable 2016 Form 3507 - Prison Inmate Labor Credit

Fillable Printable 2016 Form 3507 - Prison Inmate Labor Credit

2016 Form 3507 - Prison Inmate Labor Credit

FTB 3507 2016For Privacy Notice, get FTB 1131 ENG/SP.

General Information

A Purpose

Use form FTB 3507, Prison Inmate Labor Credit, to figure a credit for

wages paid to prison inmates under an approved joint venture with the

California Department of Corrections. Also use this form to claim pass-

through prison inmate labor credits you received from S corporations,

estates, trusts, partnerships, or limited liability companies (LLCs)

classified as partnerships.

S corporations, estates, trusts, partnerships, and LLCs classified as

partnerships should complete form FTB 3507 to figure the amount

of credit to pass through to shareholders, beneficiaries, partners, or

members. Attach this form to Form 100S, California S Corporation

Franchise or Income Tax Return; Form 541, California Fiduciary Income

Tax Return; Form 565, Partnership Return of Income; or Form 568,

Limited Liability Company Return of Income. Show the pass-through

credit for each shareholder, beneficiary, partner, or member on

Schedule K-1 (100S, 541, 565, or 568) Share of Income, Deductions,

Credits, etc.

B Qualifications

California allows a credit equal to 10% of the wages paid to each

prisoner who is employed under an approved joint venture with the

California Department of Corrections.

The credit amount is based on wages paid to each qualifying employee

during the taxable year for the duration of the contract agreement.

The credit applies only to wages paid pursuant to a contract agreement,

between the director of corrections and the joint venture employer,

executed on or before the day the individual begins work for the

employer.

C Limitations

S corporations may claim only 1/3 of the credit against the 1.5%

entity-level tax (3.5% for financial S corporations). The remaining 2/3

must be disregarded and may not be used as a carryover. S corporations

can pass through 100% of the credit to their shareholders.

If a taxpayer owns an interest in a disregarded business entity

[a single member limited liability company (SMLLC) not recognized

by California, and for tax purposes is treated as a sole proprietorship

owned by an individual or a branch owned by a corporation], the

usable credit amount received from the disregarded entity is limited

to the difference between the taxpayer’s regular tax figured with the

income of the disregarded entity, and the taxpayer’s regular tax figured

without the income of the disregarded entity.

For more information on SMLLC, get Form 568, Limited Liability

Company Tax Booklet.

This credit cannot reduce the regular tax below the minimum franchise

tax (corporations and S corporations), the annual tax (limited

partnerships, limited liability partnerships, and LLCs classified as

a partnership), the alternative minimum tax (corporations, exempt

organizations, individuals, and fiduciaries), the built-in gains tax

(S corporations), or the excess net passive income tax (S corporations).

This credit cannot reduce regular tax below the tentative minimum tax

(TMT). Get Schedule P (100, 100W, 540, 540NR, or 541), Alternative

Minimum Tax and Credit Limitations, for more information.

There is no provision for carryover of any unused credit to succeeding

tax years and in no event can you carry this credit back and apply it

against a prior year’s tax.

This credit is not refundable.

D Assignment of Credits

Assigned Credits to Affiliated Corporations – Credit earned by

members of a combined reporting group may be assigned to an affiliated

corporation that is a member of the same combined reporting group. A

credit assigned may only be claimed by the affiliated corporation against

its tax liability. For more information, get form FTB 3544, Election to

Assign Credit Within Combined Reporting Group, or form FTB 3544A,

List of Assigned Credit Received and/or Claimed by Assignee or go to

ftb.ca.gov and search for credit assignment.

Instructions

Line 1 – Enter the total amount of qualifying wages paid or incurred

under the provisions of the approved joint venture.

Line 3 – If you received more than one pass-through credit from

S corporations, estates, trusts, partnerships, or LLCs classified as

partnerships, add the amounts and enter the total on line 3. Attach a

schedule showing the names and identification numbers of the entities

from which the credits were passed through to you.

Line 4 – The amount of this credit that you can claim on your tax return

may be limited. See General Information C, Limitations. Also refer to the

credit instructions in your tax booklet for more information. Use credit

code 162 when you claim this credit.

Prison Inmate Labor Credit

TAXABLE YEAR

2016

CALIFORNIA FORM

3507

7261163

Attach to your California tax return. The employer must keep the approved joint venture agreement for audit purposes.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

1 Total qualifying wages. See instructions ...................................................... 1 00

2 Multiply line 1 by 10% (.10) ............................................................... 2 00

3 Pass-through prison inmate labor credit(s) from Schedule K-1 (100S, 541, 565, or 568). See instructions... 3 00

4 Total available prison inmate labor credit. Add line 2 and line 3. See instructions ....................... 4 00