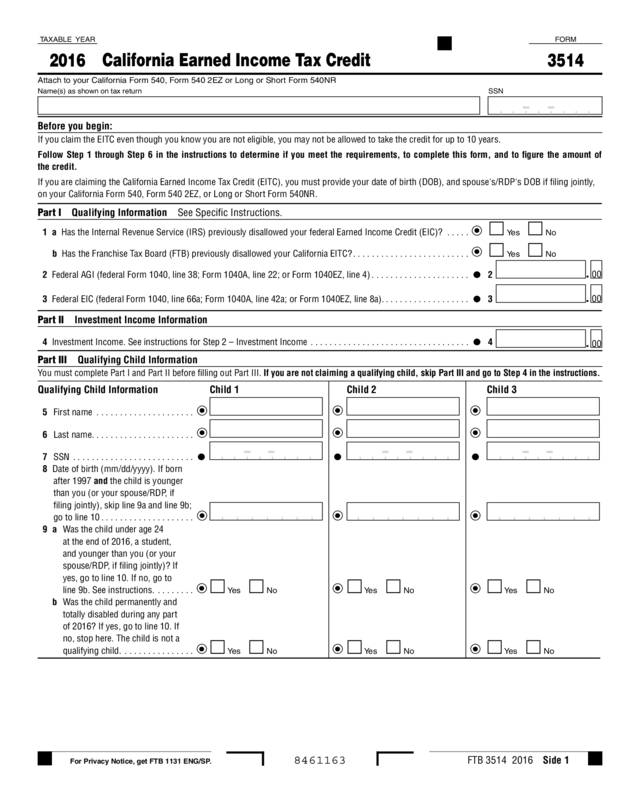

Fillable Printable 2016 Form 3514 California Earned Income Tax Credit

Fillable Printable 2016 Form 3514 California Earned Income Tax Credit

2016 Form 3514 California Earned Income Tax Credit

TAXABLE YEAR

2016

California Earned Income Tax Credit

FORM

3514

Attach to your California Form 540, Form 540 2EZ or Long or Short Form 540NR

Name(s) as shown on tax return SSN

Before you begin:

If you claim the EITC even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years.

Follow Step 1 through Step 6 in the instructions to determine if you meet the requirements, to complete this form, and to figure the amount of

the credit.

If you are claiming the California Earned Income Tax Credit (EITC), you must provide your date of birth (DOB), and spouse's/RDP's DOB if filing jointly,

on your California Form 540, Form 540 2EZ, or Long or Short Form 540NR.

Part I Qualifying Information See Specific Instructions.

1 a Has the Internal Revenue Service (IRS) previously disallowed your federal Earned Income Credit (EIC)? .....

m Ye s

m No

b Has the Franchise Tax Board (FTB) previously disallowed your California EITC? .........................

m Ye s

m No

2 Federal AGI (federal Form 1040, line 38; Form 1040A, line 22; or Form 1040EZ, line 4) .....................

2

.

00

3 Federal EIC (federal Form 1040, line 66a; Form 1040A, line 42a; or Form 1040EZ, line 8a). ..................

3

.

00

Part II Investment Income Information

4 Investment Income. See instructions for Step 2 – Investment Income ..................................

4

.

00

Part III Qualifying Child Information

You must complete Part I and Part II before filling out Part III. If you are not claiming a qualifying child, skip Part III and go to Step 4 in the instructions.

Qualifying Child Information

Child 1 Child 2 Child 3

5 First name .....................

6 Last name......................

7 SSN ..........................

8 Date of birth (mm/dd/yyyy). If born

after 1997 and the child is younger

than you (or your spouse/RDP, if

filing jointly), skip line 9a and line 9b;

go to line 10

....................

9 a Was the child under age 24

at the end of 2016, a student,

and younger than you (or your

spouse/RDP, if filing jointly)? If

yes, go to line 10. If no, go to

line 9b. See instructions.

........

m Ye s m No

m Ye s

m No m Ye s m No

b Was the child permanently and

totally disabled during any part

of 2016? If yes, go to line 10. If

no, stop here. The child is not a

qualifying child.

...............

m Ye s m No

m Ye s

m No m Ye s m No

8461163

For Privacy Notice, get FTB 1131 ENG/SP.

FTB 3514 2016

Side 1

Get instructions for 3514

8462163

8462163

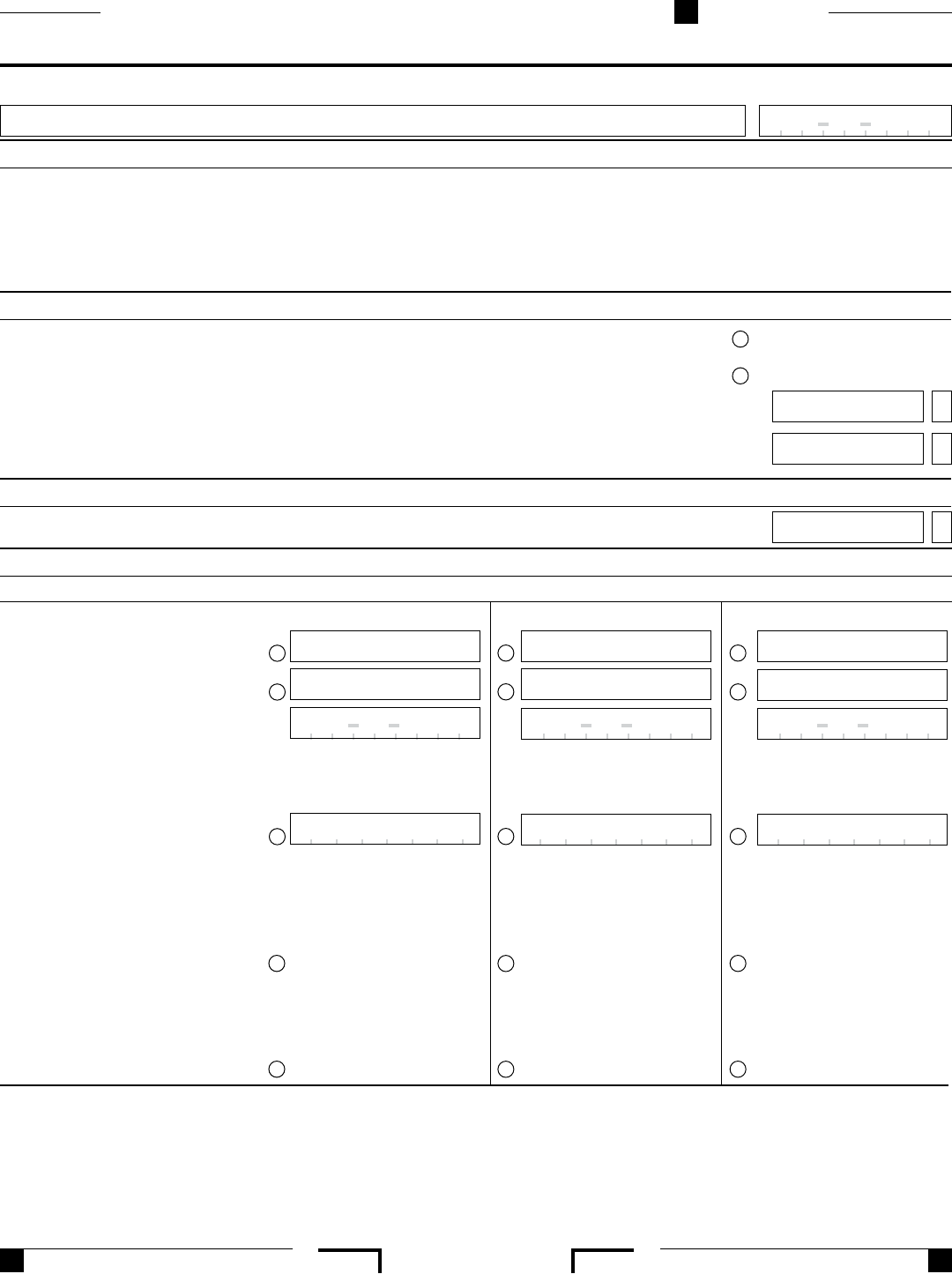

Child 1

Child 2

Child 3

10 Child’s relationship to you.

See instructions.

................

11 Number of days child lived with you

in California during 2016.

Do not enter more than 366 days.

See instructions.

................

12 a. Child’s physical address during

2016 (number, street, and apt.

no./ste. no.). See instructions.

...

b. City........................

c. State.......................

d. ZIP code....................

Part IV California Earned Income

13 Wages, salaries, tips, and other employee compensation, subject to California withholding. See instructions....

13

.

00

14 Prison inmate wages. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

.

00

15 Pension or annuity from a nonqualified deferred compensation plan or a nongovernmental IRC Section 457 plan.

See instructions.

..........................................................................

15

.

00

16

California Earned Income. Subtract line 14 and line 15 from line 13 ..................................

16

.

00

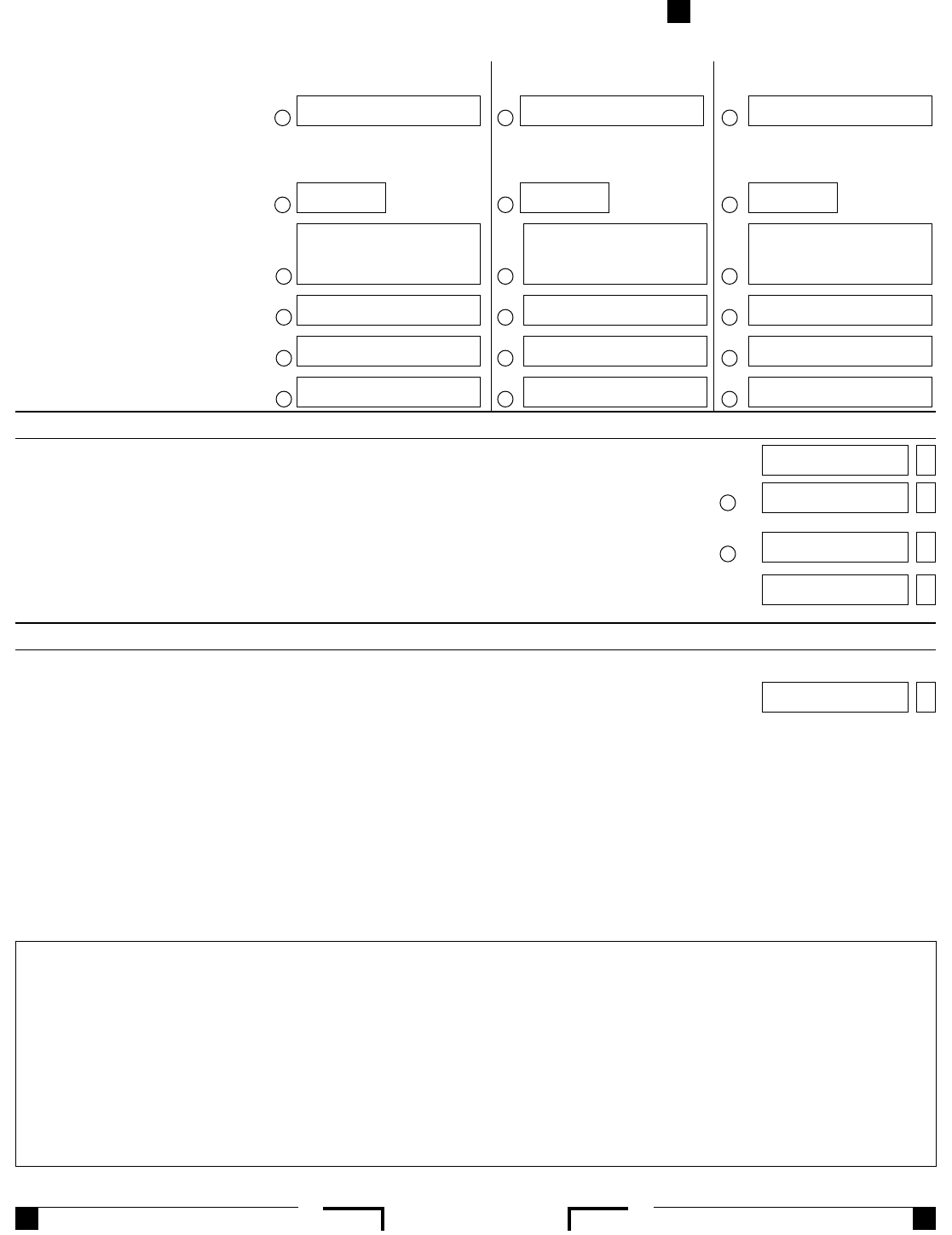

Part V California Earned Income Tax Credit (Complete Step 6 in the instructions.)

17 California EITC. Enter amount from California Earned Income Tax Credit Worksheet, Part III, line 6.

This amount should also be entered on Form 540, line 75; Form 540NR Long, Line 85; Form 540NR Short,

Line 85; or Form 540 2EZ, Line 23

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

.

00

This space reserved for 2D barcode

Side 2 FTB 3514 2016