Fillable Printable 2016 Form 3531 - California Competes Tax Credit

Fillable Printable 2016 Form 3531 - California Competes Tax Credit

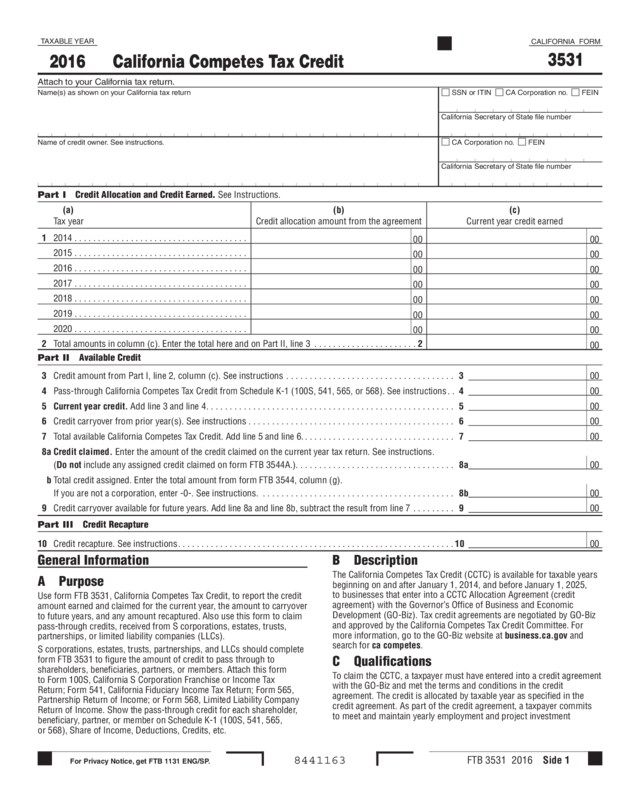

2016 Form 3531 - California Competes Tax Credit

8441163 FTB 3531 2016 Side 1

For Privacy Notice, get FTB 1131 ENG/SP.

California Competes Tax Credit

TAXABLE YEAR

2016

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

CALIFORNIA FORM

3531

General Information

A Purpose

Use form FTB 3531, California Competes Tax Credit, to report the credit

amount earned and claimed for the current year, the amount to carryover

to future years, and any amount recaptured. Also use this form to claim

pass-through credits, received from S corporations, estates, trusts,

partnerships, or limited liability companies (LLCs).

S corporations, estates, trusts, partnerships, and LLCs should complete

form FTB 3531 to figure the amount of credit to pass through to

shareholders, beneficiaries, partners, or members. Attach this form

to Form 100S, California S Corporation Franchise or Income Tax

Return; Form 541, California Fiduciary Income Tax Return; Form 565,

Partnership Return of Income; or Form 568, Limited Liability Company

Return of Income. Show the pass-through credit for each shareholder,

beneficiary, partner, or member on Schedule K-1 (100S, 541, 565,

or 568), Share of Income, Deductions, Credits, etc.

B Description

The California Competes Tax Credit (CCTC) is available for taxable years

beginning on and after January 1, 2014, and before January 1, 2025,

to businesses that enter into a CCTC Allocation Agreement (credit

agreement) with the Governor’s Office of Business and Economic

Development (GO-Biz). Tax credit agreements are negotiated by GO-Biz

and approved by the California Competes Tax Credit Committee. For

more information, go to the GO-Biz website at business.ca.gov and

search for ca competes.

C Qualifications

To claim the CCTC, a taxpayer must have entered into a credit agreement

with the GO-Biz and met the terms and conditions in the credit

agreement. The credit is allocated by taxable year as specified in the

credit agreement. As part of the credit agreement, a taxpayer commits

to meet and maintain yearly employment and project investment

Name of credit owner. See instructions.

CA Corporation no.

FEIN

California Secretary of State file number

Part II Available Credit

3 Credit amount from Part I, line 2, column (c). See instructions .................................... 3 00

4

Pass-through California Competes Tax Credit from Schedule K-1 (100S, 541, 565, or 568). See instructions

..

4 00

5 Current year credit. Add line 3 and line 4..................................................... 5 00

6 Credit carryover from prior year(s). See instructions ............................................ 6 00

7 Total available California Competes Tax Credit. Add line 5 and line 6. ................................ 7 00

8a Credit claimed. Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544A.).................................. 8a 00

b Total credit assigned. Enter the total amount from form FTB 3544, column (g).

If you are not a corporation, enter -0-. See instructions. ......................................... 8b 00

9 Credit carryover available for future years. Add line 8a and line 8b, subtract the result from line 7 ......... 9 00

Part III Credit Recapture

10 Credit recapture. See instructions...........................................................10 00

Part I Credit Allocation and Credit Earned. See Instructions.

(a)

Tax year

(b)

Credit allocation amount from the agreement

(c)

Current year credit earned

1 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00 00

2 Total amounts in column (c). Enter the total here and on Part II, line 3

......................2

00

Page 2 FTB 3531 Instructions 2016

requirements, referred to as “milestones.” If a taxpayer meets the

milestones for a taxable year as specified in the credit agreement, then

the credit for that year is earned and may be claimed on the tax return.

D Limitations

S corporations may claim only 1/3 of the credit against the 1.5%

entity-level tax (3.5% for financial S corporations). The remaining 2/3

must be disregarded and may not be used as carryover. In

addition, S corporations may pass through 100% of the credit to

their shareholders.

If a taxpayer owns an interest in a disregarded business entity [a single

member limited liability company (SMLLC) not recognized by California,

and for tax purposes is treated as a sole proprietorship owned by an

individual or a branch owned by a corporation] the credit amount a

taxpayer receives from the disregarded entity that can be utilized is

limited to the difference between the taxpayer’s regular tax figured with

the income of the disregarded entity, and the taxpayer’s regular tax

figured without the income of the disregarded entity.

For more information on SMLLC, get Form 568, Limited Liability

Company Tax Booklet.

This credit cannot reduce the minimum franchise tax (corporations and

S corporations), the annual tax (limited partnerships, limited liability

partnerships, and LLCs classified as a partnership), the alternative

minimum tax (corporations, exempt organizations, individuals, and

fiduciaries), the built-in gains tax (S corporations), or the excess net

passive income tax (S corporations).

If a C corporation had unused credit carryovers when it elected

S corporation status, the carryovers were reduced to 1/3 and transferred

to the S corporation. The remaining 2/3 were disregarded. The allowable

carryovers may be used to offset the 1.5% tax on net income in

accordance with the respective carryover rules. These C corporation

carryovers may not be passed through to shareholders. For more

information, get Schedule C (100S), S Corporation Tax Credits.

This credit can reduce regular tax below the tentative minimum tax

(TMT). Get Schedule P (100, 100W, 540, 540NR, or 541), Alternative

Minimum Tax and Credit Limitations, for more information.

This credit is not refundable.

E Assignment of Credits

Assigned Credits to Affiliated Corporations – Credit earned by

members of a combined reporting group may be assigned to an affiliated

corporation that is a member of the same combined reporting group. A

credit assigned may only be claimed by the affiliated corporation against

its tax liability. For more information, get form FTB 3544, Election to

Assign Credit Within Combined Reporting Group, or form FTB 3544A,

List of Assigned Credit Received and/or Claimed by Assignee, or go to

ftb.ca.gov and search for credit assignment.

F Carryover

If the available credit exceeds the current year tax liability, the unused

credit may be carried over for up to six years or until the credit is

exhausted, whichever occurs first.

In no event can the credit be carried

back and applied against a prior year’s tax. If you have a carryover, retain

all records that document this credit and carryover used in prior years.

The Franchise Tax Board may require access to these records.

Specific Line Instructions

Name of credit owner – Enter the name of the credit owner or the name

of the entity that generated the tax credit. Also, enter the CA Corporation

no., FEIN, or the California Secretary of State file number of the credit

owner in the space provided. If the name shown on the California return

is the same name as the credit owner, enter “same”.

If you are only claiming a credit that was allocated to you from a

Schedule K-1 (100S, 541, 565 or 568), skip to Part II, line 4 and do not

enter any information in Part I and in Part II, line 3.

Part I Credit Allocation and Credit Earned

Line 1, column (b) – Enter the amount of credit allocated for each year

from your credit agreement. (See your credit agreement, “Exhibit A

Milestones” for the tax credit allocation amounts.)

Line 1, column (c) – For the current taxable year, enter the amount

of the credit for the year(s) that you met the milestones. (See your

credit agreement for further details on meeting milestones and earning

credits.)

Line 2 – Total amounts in column (c). Enter the total here and on Part II,

line 3.

Part II Available Credit

S corporation, Estate, Trust, Partnership, or LLC

Allocate the line 5 credit to each shareholder, beneficiary, partner, or

member in the same way that income and loss are divided.

Line 3 – Enter the credit amount from Part I, line 2, column (c).

Line 4 – Pass-through California Competes Tax Credit

If you received more than one pass-through credit from S corporations,

estates, trusts, partnerships, or LLCs, add the amounts and enter the

total on line 4. Attach a schedule of the pass-through entities showing

their names, identification numbers, and credit amounts.

Line 6 – Credit carryover from prior years

Enter the amount of credit carryover from prior years on line 6.

Line 8a – Credit claimed

Do not include assigned credits claimed on form FTB 3544A.

This amount may be less than the amount on line 7 if your credit

is limited by your tax liability. For more information, see General

Information D, Limitations and refer to the credit instructions in your tax

booklet. Use credit code 233 when you claim this credit.

Line 8b – Total credit assigned

Corporations that assign credit to other corporations within combined

reporting group must complete form FTB 3544. Enter the total amount

of credit assigned from form FTB 3544, column (g) on this line.

Part III Credit Recapture

Line 10 – Credit recapture

If a credit amount was recaptured, the taxpayer would have received

notification from GO-Biz of the amount and the taxable year of the

recapture. See the “Recapture” section of your credit agreement for

further details.

Enter the total recapture here and on one of the following California tax

returns or schedules:

• Form 100, Schedule J, line 5.

• Form 100S, Schedule J, line 5 and Schedule K-1 (100S), line 17d.

• Form 100W, Schedule J, line 5.

• Form 109, Schedule K, line 4.

• Form 540, line 63.

• Long Form 540NR, line 73.

• Form 541, line 37 and Schedule K-1 (541), line 14d.

• Form 565, Schedule K, line 20c and Schedule K-1 (565), line 20c.

• Form 568, Schedule K, line 20c and Schedule K-1 (568), line 20c.