Fillable Printable 2016 Form 590 - Withholding Exemption Certificate

Fillable Printable 2016 Form 590 - Withholding Exemption Certificate

2016 Form 590 - Withholding Exemption Certificate

Form 590 C2 2015

7061163

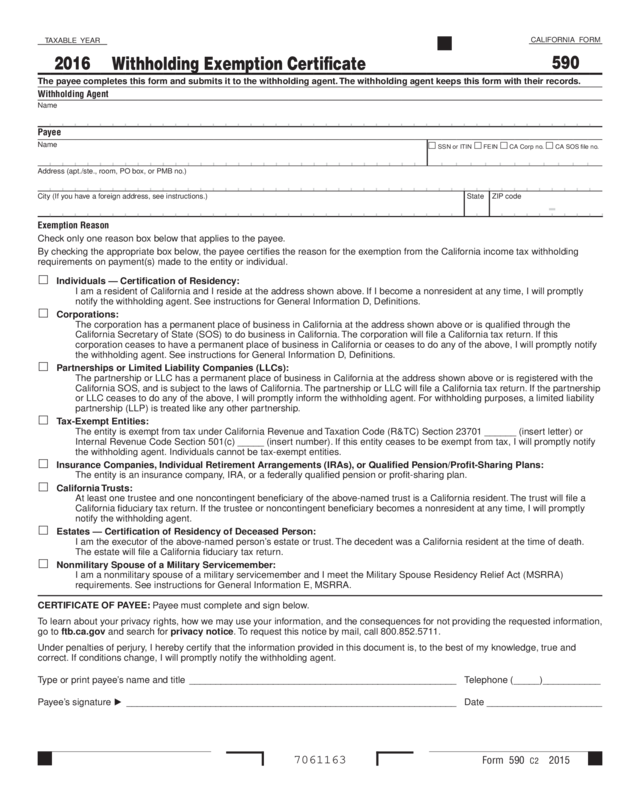

Withholding Exemption Certificate

T AXABLE YEAR

2016

CALIFORNIA FORM

590

Exemption Reason

Check only one reason box below that applies to the payee.

By checking the appropriate box below, the payee certifies the reason for the exemption from the California income tax withholding

requirements on payment(s) made to the entity or individual.

Individuals — Certification of Residency:

I am a resident of California and I reside at the address shown above. If I become a nonresident at any time, I will promptly

notify the withholding agent. See instructions for General Information D, Definitions.

Corporations:

The corporation has a permanent place of business in California at the address shown above or is qualified through the

California Secretary of State (SOS) to do business in California. The corporation will file a California tax return. If this

corporation ceases to have a permanent place of business in California or ceases to do any of the above, I will promptly notify

the withholding agent. See instructions for General Information D, Definitions.

Partnerships or Limited Liability Companies (LLCs):

The partnership or LLC has a permanent place of business in California at the address shown above or is registered with the

California SOS, and is subject to the laws of California. The partnership or LLC will file a California tax return. If the partnership

or LLC ceases to do any of the above, I will promptly inform the withholding agent. For withholding purposes, a limited liability

partnership (LLP) is treated like any other partnership.

Tax-Exempt Entities:

The entity is exempt from tax under California Revenue and Taxation Code (R&TC) Section 23701 ______ (insert letter) or

Internal Revenue Code Section 501(c) _____ (insert number). If this entity ceases to be exempt from tax, I will promptly notify

the withholding agent.

Individuals cannot be tax-exempt entities.

Insurance Companies, Individual Retirement Arrangements (IRAs), or Qualified Pension/Profit-Sharing Plans:

The entity is an insurance company, IRA, or a federally qualified pension or profit-sharing plan.

California T rusts:

At least one trustee and one noncontingent beneficiary of the above-named trust is a California resident. The trust will file a

California fiduciary tax return. If the trustee or noncontingent beneficiary becomes a nonresident at any time, I will promptly

notify the withholding agent.

Estates — Certification of Residency of Deceased Person:

I am the executor of the above-named person’s estate or trust. The decedent was a California resident at the time of death.

The estate will file a California fiduciary tax return.

Nonmilitary Spouse of a Military Servicemember:

I am a nonmilitary spouse of a military servicemember and I meet the Military Spouse Residency Relief Act (MSRRA)

requirements. See instructions for General Information E, MSRRA.

CERTIFICATE OF PAYEE: Payee must complete and sign below.

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information,

go to ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I hereby certify that the information provided in this document is, to the best of my knowledge, true and

correct. If conditions change, I will promptly notify the withholding agent.

Type or print payee’s name and title

___________________________________________________ Telephone (_____)___________

Payee’s signature _______________________________________________________________ Date ______________________

The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

Withholding Agent

Name

Payee

Name

SSN or ITIN FEIN CA Corp no. CA SOS file no.

Address (apt./ste., room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.) State ZIP code

Form 590 Instructions 2015 Page 1

2016 Instructions for Form 590

Withholding Exemption Certificate

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

Registered Domestic Partners (RDP) – For

purposes of California income tax, references

to a spouse, husband, or wife also refer to a

Registered Domestic Partner (RDP) unless

otherwise specified. For more information on

RDPs, get FTB Pub. 737, Tax Information for

Registered Domestic Partners.

A Purpose

Use Form 590, Withholding Exemption

Certificate, to certify an exemption from

nonresident withholding.

Form 590 does not apply to payments of

backup withholding. For more information,

go to ftb.ca.gov and search for backup

withholding.

Form 590 does not apply to payments for

wages to employees. Wage withholding is

administered by the California Employment

Development Department (EDD). For more

information, go to edd.ca.gov or call

888.745.3886.

Do not use Form 590 to certify an exemption

from withholding if you are a Seller of

California real estate. Sellers of California

real estate use Form 593-C, Real Estate

Withholding Certificate, to claim an exemption

from the real estate withholding requirement.

The following are excluded from withholding

and completing this form:

•

The United States and any of its agencies or

instrumentalities.

•

A state, a possession of the United States,

the District of Columbia, or any of its

political subdivisions or instrumentalities.

•

A foreign government or any of its political

subdivisions, agencies, or instrumentalities.

B Income Subject to

Withholding

California Revenue and Taxation Code (R&TC)

Section 18662 requires withholding of income

or franchise tax on payments of California

source income made to nonresidents of

California.

Withholding is required on the following, but is

not limited to:

•

Payments to nonresidents for services

rendered in California.

• Distributions of California source income

made to domestic nonresident partners,

members, and S corporation shareholders

and allocations of California source income

made to foreign partners and members.

•

Payments to nonresidents for rents if the

payments are made in the course of the

withholding agent’s business.

•

Payments to nonresidents for royalties from

activities sourced to California.

• Distributions of California source income to

nonresident beneficiaries from an estate or

trust.

•

Endorsement payments received for services

performed in California.

•

Prizes and winnings received by

nonresidents for contests in California.

However, withholding is optional if the total

payments of California source income are

$1,500 or less during the calendar year.

For more information on withholding get

FTB Pub. 1017, Resident and Nonresident

Withholding Guidelines. To get a withholding

publication, see Additional Information.

C Who Certifies this Form

Form 590 is certified by the payee. California

residents or entities exempt from the

withholding requirement should complete

Form 590 and submit it to the withholding

agent before payment is made. The withholding

agent is then relieved of the withholding

requirements if the agent relies in good faith

on a completed and signed Form 590 unless

notified by the Franchise Tax Board (FTB) that

the form should not be relied upon.

An incomplete certificate is invalid and the

withholding agent should not accept it. If the

withholding agent receives an incomplete

certificate, the withholding agent is required

to withhold tax on payments made to the

payee until a valid certificate is received. In

lieu of a completed exemption certificate, the

withholding agent may accept a letter from

the payee as a substitute explaining why they

are not subject to withholding. The letter must

contain all the information required on the

certificate in similar language, including the

under penalty of perjury statement and the

payee’s taxpayer identification number. The

withholding agent must retain a copy of the

certificate or substitute for at least four years

after the last payment to which the certificate

applies, and provide it upon request to the FTB.

If an entertainer (or the entertainer’s business

entity) is paid for a performance, the

entertainer’s information must be provided.

Do not submit the entertainer’s agent or

promoter information.

The grantor of a grantor trust shall be treated

as the payee for withholding purposes.

Therefore, if the payee is a grantor trust and

one or more of the grantors is a nonresident,

withholding is required. If all of the grantors

on the trust are residents, no withholding is

required. Resident grantors can check the

box on Form 590 labeled “Individuals —

Certification of Residency.”

D Definitions

For California non-wage withholding purposes,

nonresident includes all of the following:

•

Individuals who are not residents of

California.

•

Corporations not qualified through the

California Secretary of State (CA SOS)

to do business in California or having no

permanent place of business in California.

•

Partnerships or limited liability companies

(LLCs) with no permanent place of business

in California.

•

Any trust without a resident grantor,

beneficiary, or trustee, or estates where the

decedent was not a California resident.

Foreign refers to non-U.S.

For more information about determining

resident status, get FTB Pub. 1031,

Guidelines for Determining Resident Status.

Military servicemembers have special rules

for residency. For more information, get

FTB Pub. 1032, Tax Information for Military

Personnel.

Permanent Place of Business:

A corporation has a permanent place of

business in California if it is organized and

existing under the laws of California or it has

qualified through the CA SOS to transact

intrastate business. A corporation that has

not qualified to transact intrastate business

(e.g., a corporation engaged exclusively in

interstate commerce) will be considered as

having a permanent place of business in

California only if it maintains a permanent

office in California that is permanently staffed

by its employees.

E Military Spouse Residency

Relief Act (MSRRA)

Generally, for tax purposes you are considered

to maintain your existing residence or domicile.

If a military servicemember and nonmilitary

spouse have the same state of domicile, the

MSRRA provides:

•

A spouse shall not be deemed to have lost

a residence or domicile in any state solely

by reason of being absent to be with the

servicemember serving in compliance with

military orders.

•

A spouse shall not be deemed to have

acquired a residence or domicile in any

other state solely by reason of being there

to be with the servicemember serving in

compliance with military orders.

Domicile is defined as the one place:

•

Where you maintain a true, fixed, and

permanent home.

•

To which you intend to return whenever you

are absent.

Page 2 Form 590 Instructions 2015

The payee must notify the withholding agent if

any of the following situations occur:

•

The individual payee becomes a nonresident.

• The corporation ceases to have a permanent

place of business in California or ceases to

be qualified to do business in California.

• The partnership ceases to have a permanent

place of business in California.

• The LLC ceases to have a permanent place

of business in California.

• The tax-exempt entity loses its tax-exempt

status.

If any of these situations occur, then

withholding may be required. For more

information, get Form 592, Resident and

Nonresident Withholding Statement,

Form 592-B, Resident and Nonresident

Withholding Tax Statement, and Form 592-V,

Payment Voucher for Resident and

Nonresident Withholding.

Additional Information

For additional information or to speak to

a representative regarding this form, call

the Withholding Services and Compliance

telephone service at:

Telephone: 888.792.4900

916.845.4900

Fax: 916.845.9512

OR write to:

WITHHOLDING SERVICES AND

COMPLIANCE MS F182

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0651

You can download, view, and print California

tax forms and publications at ftb.ca.gov.

OR to get forms by mail write to:

TAX FORMS REQUEST UNIT

FRANCHISE TAX BOARD

PO BOX 307

RANCHO CORDOVA CA 95741-0307

For all other questions unrelated to withholding

or to access the TTY/TDD numbers, see the

information below.

Internet and Telephone Assistance

Website: ftb.ca.gov

Telephone: 800.852.5711 from within the

United States

916.845.6500 from outside the

United States

TTY/TDD: 800.822.6268 for persons with

hearing or speech impairments

Asistencia Por Internet y Teléfono

Sitio web: ftb.ca.gov

Teléfono: 800.852.5711 dentro de los

Estados Unidos

916.845.6500 fuera de los Estados

Unidos

TTY/TDD: 800.822.6268 para personas con

discapacidades auditivas

o del habla

A military servicemember’s nonmilitary spouse

is considered a nonresident for tax purposes

if the servicemember and spouse have the

same domicile outside of California and the

spouse is in California solely to be with the

servicemember who is serving in compliance

with Permanent Change of Station orders.

California may require nonmilitary spouses of

military servicemembers to provide proof that

they meet the criteria for California personal

income tax exemption as set forth in the

MSRRA.

Income of a military servicemember’s

nonmilitary spouse for services performed

in California is not California source income

subject to state tax if the spouse is in California

to be with the servicemember serving in

compliance with military orders, and the

servicemember and spouse have the same

domicile in a state other than California.

For additional information or assistance in

determining whether the applicant meets the

MSRRA requirements, get FTB Pub. 1032.

Specific Instructions

Payee Instructions

Enter the withholding agent’s name.

Enter the payee’s information, including the

taxpayer identification number (TIN) and check

the appropriate TIN box.

You must provide an acceptable TIN as

requested on this form. The following are

acceptable TINs: social security number (SSN);

individual taxpayer identification number

(ITIN); federal employer identification number

(FEIN); California corporation number (CA Corp

no.); or CA SOS file number.

Private Mail Box (PMB) – Include the PMB

in the address field. Write “PMB” first, then

the box number. Example: 111 Main Street

PMB 123.

Foreign Address – Follow the country’s

practice for entering the city, county, province,

state, country, and postal code, as applicable,

in the appropriate boxes. Do not abbreviate the

country name.

Exemption Reason – Check the box that

reflects the reason why the payee is exempt

from the California income tax withholding

requirement.

Withholding Agent Instructions

Keep Form 590 for your records. The

certification remains valid for 5 years or until

the payee’s status changes. Do not send this

form to the FTB unless it has been specifically

requested.

For more information, contact Withholding

Services and Compliance, see Additional

Information.