Fillable Printable 2016 Form 8919

Fillable Printable 2016 Form 8919

2016 Form 8919

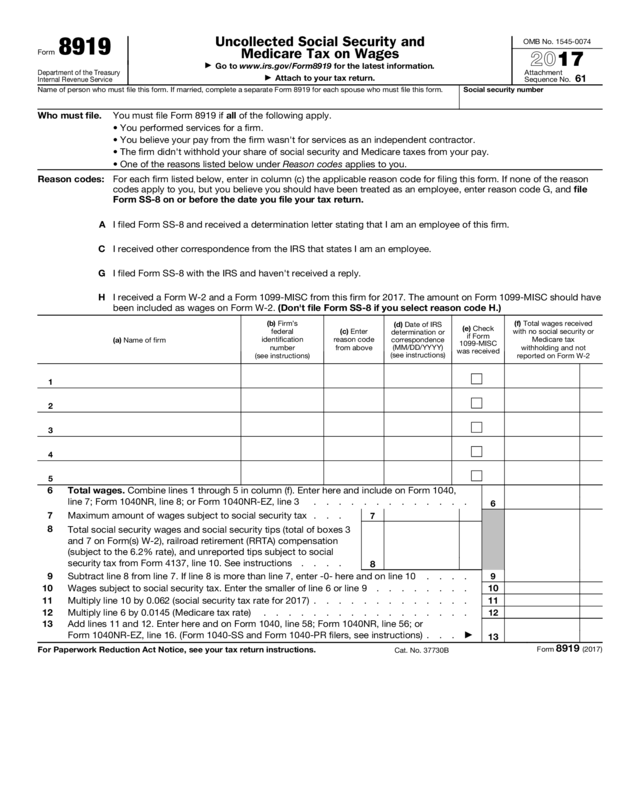

Form 8919

Department of the Treasury

Internal Revenue Service

Uncollected Social Security and

Medicare Tax on Wages

▶

Go to www.irs.gov/Form8919 for the latest information.

▶

Attach to your tax return.

OMB No. 1545-0074

2017

Attachment

Sequence No.

61

Name of person who must file this form. If married, complete a separate Form 8919 for each spouse who must file this form. Social security number

Who must file. You must file Form 8919 if all of the following apply.

• You performed services for a firm.

• You believe your pay from the firm wasn't for services as an independent contractor.

• The firm didn't withhold your share of social security and Medicare taxes from your pay.

• One of the reasons listed below under Reason codes applies to you.

Reason codes:

For each firm listed below, enter in column (c) the applicable reason code for filing this form. If none of the reason

codes apply to you, but you believe you should have been treated as an employee, enter reason code G, and file

Form SS-8 on or before the date you file your tax return.

A I filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

C I received other correspondence from the IRS that states I am an employee.

G I filed Form SS-8 with the IRS and haven't received a reply.

H I received a Form W-2 and a Form 1099-MISC from this firm for 2017. The amount on Form 1099-MISC should have

been included as wages on Form W-2. (Don't file Form SS-8 if you select reason code H.)

(a) Name of firm

(b) Firm’s

federal

identification

number

(see instructions)

(c) Enter

reason code

from above

(d) Date of IRS

determination or

correspondence

(MM/DD/YYYY)

(see instructions)

(e) Check

if Form

1099-MISC

was received

(f) Total wages received

with no social security or

Medicare tax

withholding and not

reported on Form W-2

1

2

3

4

5

6 Total wages. Combine lines 1 through 5 in column (f). Enter here and include on Form 1040,

line 7; Form 1040NR, line 8; or Form 1040NR-EZ, line 3 . . . . . . . . . . . . .

6

7 Maximum amount of wages subject to social security tax . . .

7

8

Total social security wages and social security tips (total of boxes 3

and 7 on Form(s) W-2), railroad retirement (RRTA) compensation

(subject to the 6.2% rate), and unreported tips subject to social

security tax from Form 4137, line 10. See instructions . . . .

8

9 Subtract line 8 from line 7. If line 8 is more than line 7, enter -0- here and on line 10 . . . .

9

10 Wages subject to social security tax. Enter the smaller of line 6 or line 9 . . . . . . . . 10

11 Multiply line 10 by 0.062 (social security tax rate for 2017) . . . . . . . . . . . . . 11

12 Multiply line 6 by 0.0145 (Medicare tax rate) . . . . . . . . . . . . . . . . .

12

13 Add lines 11 and 12. Enter here and on Form 1040, line 58; Form 1040NR, line 56; or

Form 1040NR-EZ, line 16. (Form 1040-SS and Form 1040-PR filers, see instructions) . . .

▶

13

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 37730B

Form 8919 (2017)

Form 8919 (2017)

Page 2

Future Developments

For the latest information about developments related to Form

8919 and its instructions, such as legislation enacted after they

were published, go to www.irs.gov/Form8919.

What's New

Increase in wage amount subject to social security tax. On

line 7, the maximum amount of wages subject to social security

tax has increased from $118,500 to $127,200 for 2017.

General Instructions

Purpose of form. Use Form 8919 to figure and report your

share of the uncollected social security and Medicare taxes

due on your compensation if you were an employee but were

treated as an independent contractor by your employer. By

filing this form, your social security earnings will be credited to

your social security record. For an explanation of the difference

between an independent contractor and an employee, see

Pub. 1779, Independent Contractor or Employee, available at

IRS.gov.

▲

!

CAUTION

Don't use this form:

• For services you performed as an independent contractor.

Instead, use Schedule C (Form 1040), Profit or Loss From

Business, or Schedule C-EZ (Form 1040), Net Profit From

Business, to report the income. And use Schedule SE (Form

1040), Self-Employment Tax, to figure the tax on net earnings

from self-employment.

• To figure the social security and Medicare tax owed on tips

you didn't report to your employer, including any allocated tips

shown on your Form(s) W-2 that you must report as income.

Instead, use Form 4137, Social Security and Medicare Tax on

Unreported Tip Income.

Firm. For purposes of this form, the term “firm” means any

individual, business enterprise, company, nonprofit

organization, state, or other entity for which you performed

services. This firm may or may not have paid you directly for

these services.

Form SS-8, Determination of Worker Status for Purposes of

Federal Employment Taxes and Income Tax Withholding.

File Form SS-8 if you want the IRS to determine whether you are

an independent contractor or an employee. See the form

instructions for information on completing the form. If you

select reason code G, you must file Form SS-8 on or before

the date you file Form 8919. Don't attach Form SS-8 to your

tax return. Form SS-8 must be filed separately.

Form 8959, Additional Medicare Tax. A 0.9% Additional

Medicare Tax applies to Medicare wages, Railroad Retirement

Tax Act compensation, and self-employment income over a

threshold amount based on your filing status. Use Form 8959 to

figure this tax. For more information on Additional Medicare Tax,

go to IRS.gov and enter “Additional Medicare Tax” in the search

box.

Specific Instructions

Lines 1 through 5. Complete a separate line for each firm. If

you worked as an employee for more than five firms in 2017,

attach additional Form(s) 8919 with lines 1 through 5

completed. Complete lines 6 through 13 on only one Form

8919. The line 6 amount on that Form 8919 should be the

combined totals of all lines 1 through 5 of all your Forms 8919.

Column (a). Enter the name of the firm for which you

worked. If you received a Form 1099-MISC from the firm,

enter the firm’s name exactly as it is entered on Form

1099-MISC.

Column (b). The federal identification number for a firm

can be an employer identification number (EIN) or a social

security number (SSN) (if the firm is an individual). An EIN is

a nine-digit number assigned by the IRS to a business. Enter

an EIN like this: XX-XXXXXXX. Enter an SSN like this: XXX-XX-

XXXX. If you received a Form 1099-MISC from the firm, enter

the firm’s federal identification number that is entered on Form

1099-MISC. If you don't know the firm’s federal identification

number, you can use Form W-9, Request for Taxpayer

Identification Number and Certification, to request it from the

firm. If you are unable to obtain the number, enter “unknown.”

Column (c). Enter the reason code for why you are filing this

form. Enter only one reason code on each line. If none of the

reason codes apply to you, but you believe you should have

been treated as an employee, enter reason code G, and file

Form SS-8 on or before the date you file your tax return.

Don't attach Form SS-8 to your tax return. Form SS-8 must

be filed separately.

Enter reason code C if you were designated as a “section 530

employee” by the IRS. You are a section 530 employee, for

these purposes, if you were determined to be an employee by

the IRS prior to January 1, 1997, but your employer was granted

relief from payment of employment taxes under section 530 of

the Revenue Act of 1978.

Enter reason code H if you received both a Form W-2 and a

Form 1099-MISC from the firm and the amount on the Form

1099-MISC should have been included as wages on Form W-2

as an amount you received for services you provided as an

employee. If reason code H applies to your situation, don't file

Form SS-8. Examples of amounts that are sometimes

erroneously included on Form 1099-MISC that should be

reported as wages on Form W-2 include employee bonuses,

awards, travel expense reimbursements not paid under an

accountable plan, scholarships, and signing bonuses. Generally,

amounts paid by an employer to an employee aren't reported on

Form 1099-MISC. Form 1099-MISC is used for reporting

nonemployee compensation, rents, royalties, and certain other

payments.

▲

!

CAUTION

If you enter reason code G, you or the firm that paid

you may be contacted for additional information. Use

of this reason code isn't a guarantee that the IRS will

agree with your worker status determination.

If the IRS doesn't agree that you are an employee, you may be

billed for the additional tax, penalties, and interest resulting from

the change to your worker status.

Column (d). Complete only if reason code A or C is entered in

column (c).

Line 6. Also enter this amount on Form 8959, line 3, if you are

required to file that form.

Line 8. For railroad retirement (RRTA) compensation, don't

include an amount greater than $127,200, which is the amount

subject to the 6.2% rate for 2017.

Line 13. Form 1040-SS and Form 1040-PR filers: the amount on

line 13 should be included in the line 6 amount in Part I of your

Form 1040-SS or Form 1040-PR, whichever you file. See the

instructions for those forms for directions on how to report the

tax due on line 6 of those forms.