Fillable Printable 2016-Form Hr-T - Wisconsin Department Of Revenue

Fillable Printable 2016-Form Hr-T - Wisconsin Department Of Revenue

2016-Form Hr-T - Wisconsin Department Of Revenue

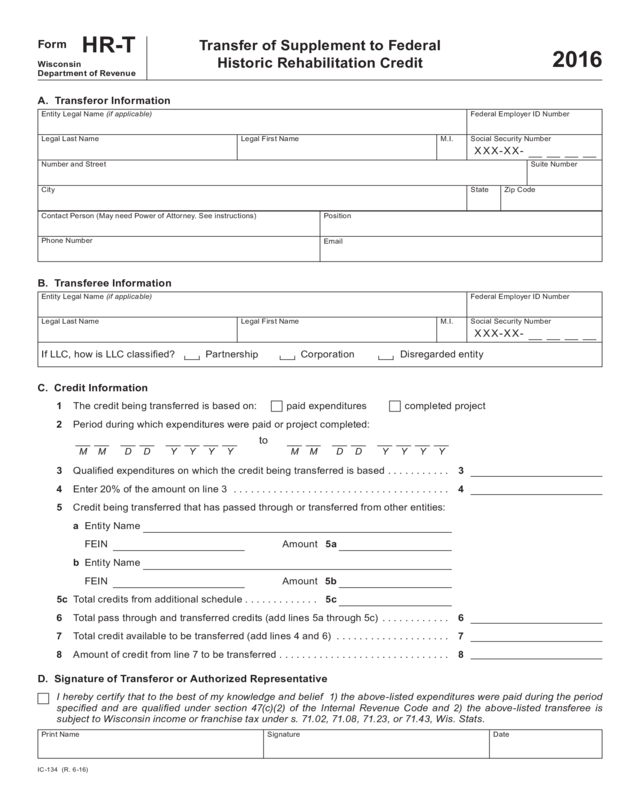

IC-134 (R. 6-16)

Transfer of Supplement to Federal

Historic Rehabilitation Credit

2016

Form

HR-T

Wisconsin

Department of Revenue

Print Name DateSignature

D. Signature of Transferor or Authorized Representative

I hereby certify that to the best of my knowledge and belief 1) the above-listed expenditures were paid during the period

specied and are qualied under section 47(c)(2) of the Internal Revenue Code and 2) the above-listed transferee is

subject to Wisconsin income or franchise tax under s. 71.02, 71.08, 71.23, or 71.43, Wis. Stats.

Entity Legal Name (if applicable)

Legal Last Name

Number and Street

City

Contact Person (May need Power of Attorney. See instructions) Position

Phone Number

Email

Suite Number

State Zip Code

Federal Employer ID Number

Social Security NumberM.I.Legal First Name

A. Transferor Information

XXX-XX-

Entity Legal Name (if applicable)

Legal Last Name

Federal Employer ID Number

Social Security NumberM.I.Legal First Name

B. Transferee Information

XXX-XX-

3 Qualiedexpendituresonwhichthecreditbeingtransferredisbased ........... 3

4 Enter 20% of the amount on line 3 ...................................... 4

5 Credit being transferred that has passed through or transferred from other entities:

a Entity Name

FEIN Amount 5a

b Entity Name

FEIN Amount 5b

5c Total credits from additional schedule . . . . . . . . . . . . . 5c

6 Total pass through and transferred credits (add lines 5a through 5c) ............ 6

7 Total credit available to be transferred (add lines 4 and 6) .................... 7

8 Amount of credit from line 7 to be transferred .............................. 8

C. Credit Information

1 Thecreditbeingtransferredisbasedon: paidexpenditures completedproject

2 Periodduringwhichexpenditureswerepaidorprojectcompleted:

to

M M D D Y Y Y Y M M D D Y Y Y Y

IfLLC,howisLLCclassied? Partnership Corporation Disregardedentity

IC-134 (R. 6-16)

- 2 -

Instructions for 2016 Form HR-T

GENERAL INSTRUCTIONS

Purpose of Form HR-T

Use Form HR-T to notify the department of the intent to transfer Wisconsin’s supplement to federal historic reha-

bilitationcreditandrequestcerticationofownershipofthecredittobetransferred.

How to File

DonotleFormHR‑Twithyour2016Wisconsinincomeorfranchisetaxreturn.Instead,boththetransferorand

transfereemustattachScheduleHRtotheirrespectivetaxreturnstoreportthecompletedtransfer.

Mail Form HR-T to:

Wisconsin Department of Revenue

Administration Technical Services

POBox8933

MadisonWI53708‑8933

SPECIFIC INSTRUCTIONS

Sections A and B

Identifying number. Enter the federal employee identication number (FEIN) for a business that has been

issued a FEIN. Enter the last four digits of the social security number for an individual not required to obtain

a FEIN.

APowerofAttorney(FormA‑222)executedbythetaxpayerisrequiredbytheWisconsinDepartmentofRevenue

inorderforthetaxpayer’srepresentativetoperformcertainactsonbehalfofthetaxpayerandtoreceiveand

inspectcertaintaxinformation.Theformisavailableatrevenue.wi.gov/forms/misc/a-222.pdf

Section C

Line 3. Fillintheamountofqualiedrehabilitationexpendituresonwhichthecreditbeingtransferredisbased.If

thecreditisbasedonwhentherehabilitationworkiscompleted,llinthetotalqualiedrehabilitationexpenditures

fortheproject.Ifthecreditisbasedonwhentheexpendituresarepaid,onlyllinthequaliedrehabilitation

expenditurespaidduringtheperiodenteredonline2.

Required Attachments

YoumustlewithFormHR‑T:

• AcopyofthecerticationagreementwiththeWisconsinEconomicDevelopmentCorporation.

• Acopyoftheproposedtransferdocuments(forexample,asalesagreement).

• For a credit passed through from a partnership, tax‑option (S) corporation, estate, or trust, a copy of

Schedule3K‑1,5K‑1,or2K‑1.

• For a credit passed through from a partnership or LLC treated as a partnership that is allocated per a written

agreement, a copy of the agreement.

Additional Information

• For more information, you may:

• Access Common Questions at revenue.wi.gov/faqs/pcs/historic_transfer.html

• Email your question to isetechsvc@revenue.wi.gov

• Call(608)266‑7177