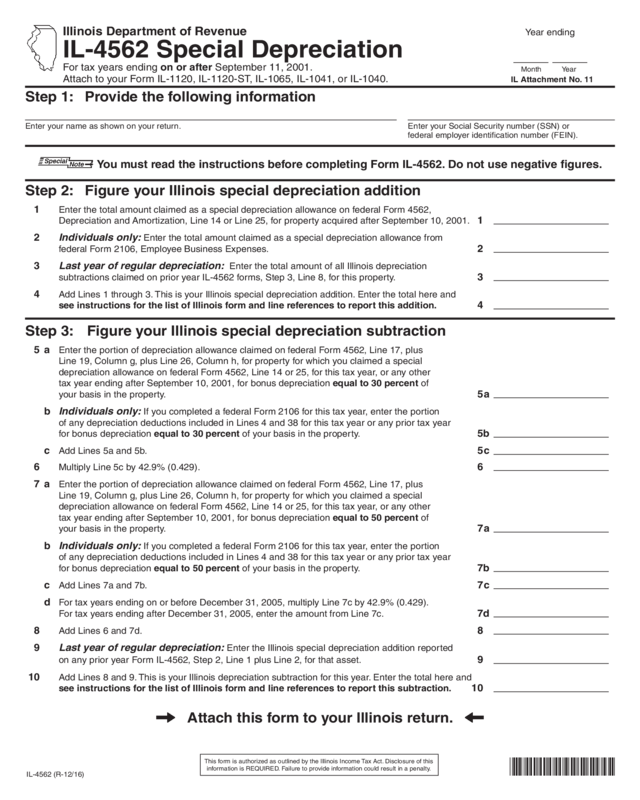

Fillable Printable 2016 Form Il-4562, Special Depreciation

Fillable Printable 2016 Form Il-4562, Special Depreciation

2016 Form Il-4562, Special Depreciation

Illinois Department of Revenue Year ending

IL-4562 Special Depreciation

For tax years ending on or after September 11, 2001.

Month Year

Attach to your Form IL-1120, IL-1120-ST, IL-1065, IL-1041, or IL-1040.

IL Attachment No. 11

Step 1: Provide the following information

Enter your name as shown on your return. Enter your Social Security number (SSN) or

federal employer identification number (FEIN).

You must read the instructions before completing Form IL-4562. Do not use negative figures.

Step 2: Figure your Illinois special depreciation addition

1 Enter the total amount claimed as a special depreciation allowance on federal Form 4562,

Depreciation and Amortization, Line 14 or Line 25, for property acquired after September 10, 2001.

1

2 Individuals only: Enter the total amount claimed as a special depreciation allowance from

federal Form 2106, Employee Business Expenses.

2

3 Last year of regular depreciation: Enter the total amount of all Illinois depreciation

subtractions claimed on prior year IL-4562 forms, Step 3, Line 8, for this property.

3

4 Add Lines 1 through 3. This is your Illinois special depreciation addition. Enter the total here and

see instructions for the list of Illinois form and line references to report this addition.

4

Step 3: Figure your Illinois special depreciation subtraction

5 a Enter the portion of depreciation allowance claimed on federal Form 4562, Line 17, plus

Line 19, Column g, plus Line 26, Column h, for property for which you claimed a special

depreciation allowance on federal Form 4562, Line 14 or 25, for this tax year, or any other

tax year ending after September 10, 2001, for bonus depreciation equal to 30 percent of

your basis in the property.

5 a

b Individuals only: If you completed a federal Form 2106 for this tax year, enter the portion

of any depreciation deductions included in Lines 4 and 38 for this tax year or any prior tax year

for bonus depreciation equal to 30 percent of your basis in the property.

5 b

c Add Lines 5a and 5b. 5 c

6 Multiply Line 5c by 42.9% (0.429). 6

7 a Enter the portion of depreciation allowance claimed on federal Form 4562, Line 17, plus

Line 19, Column g, plus Line 26, Column h, for property for which you claimed a special

depreciation allowance on federal Form 4562, Line 14 or 25, for this tax year, or any other

tax year ending after September 10, 2001, for bonus depreciation equal to 50 percent of

your basis in the property.

7 a

b Individuals only: If you completed a federal Form 2106 for this tax year, enter the portion

of any depreciation deductions included in Lines 4 and 38 for this tax year or any prior tax year

for bonus depreciation equal to 50 percent of your basis in the property.

7 b

c Add Lines 7a and 7b. 7 c

d For tax years ending on or before December 31, 2005, multiply Line 7c by 42.9% (0.429).

For tax years ending after December 31, 2005, enter the amount from Line 7c.

7 d

8 Add Lines 6 and 7d. 8

9 Last year of regular depreciation: Enter the Illinois special depreciation addition reported

on any prior year Form IL-4562, Step 2, Line 1 plus Line 2, for that asset.

9

10 Add Lines 8 and 9. This is your Illinois depreciation subtraction for this year. Enter the total here and

see instructions for the list of Illinois form and line references to report this subtraction. 10

Attach this form to your Illinois return.

IL-4562 (R-12/16)

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

*166220001*

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Reset

Print