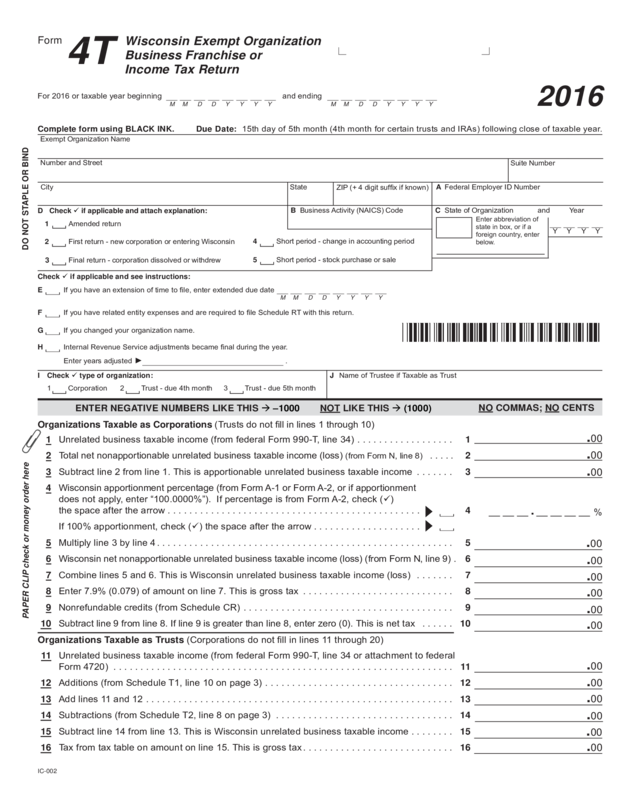

Fillable Printable 2016-Form4Tf - Wisconsin Department Of Revenue

Fillable Printable 2016-Form4Tf - Wisconsin Department Of Revenue

2016-Form4Tf - Wisconsin Department Of Revenue

IC-002

Wis c o n s i n Exempt Organization

Business Franchise or

Income Tax Return

Form

Organizations Taxable as Corporations (Trusts do not ll in lines 1 through 10)

1 Unrelated business taxable income (from federal Form 990-T, line 34) .................. 1

2 Total net nonapportionable unrelated business taxable income (loss) (from Form N, line 8) ..... 2

3 Subtract line 2 from line 1. This is apportionable unrelated business taxable income ....... 3

4 Wisconsin apportionment percentage (from Form A-1 or Form A-2, or if apportionment

does not apply, enter “100.0000%”). If percentage is from Form A-2, check (ü)

the space after the arrow ............................................... 4

If 100% apportionment, check (ü) the space after the arrow ....................

5 Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Wisconsin net nonapportionable unrelated business taxable income (loss) (from Form N, line 9) . 6

7 Combine lines 5 and 6. This is Wisconsin unrelated business taxable income (loss) ....... 7

8 Enter 7.9% (0.079) of amount on line 7. This is gross tax ............................ 8

9 Nonrefundable credits (from Schedule CR) ....................................... 9

10 Subtract line 9 from line 8. If line 9 is greater than line 8, enter zero (0). This is net tax ...... 10

Organizations Taxable as Trusts (Corporations do not ll in lines 11 through 20)

11 Unrelated business taxable income (from federal Form 990-T, line 34 or attachment to federal

Form 4720) ............................................................... 11

12 Additions (from Schedule T1, line 10 on page 3) ................................... 12

13 Add lines 11 and 12 ......................................................... 13

14 Subtractions (from Schedule T2, line 8 on page 3) ................................. 14

15 Subtract line 14 from line 13. This is Wisconsin unrelated business taxable income ........ 15

16 Tax from tax table on amount on line 15. This is gross tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

2016

4T

For 2016 or taxable year beginning and ending

M Y Y Y Y M D D M Y Y Y Y M D D

DO NOT STAPLE OR BIND

Check ü if applicable and see instructions:

E

If you have an extension of time to le, enter extended due date

M Y Y Y YM D D

F If you have related entity expenses and are required to le Schedule RT with this return.

Complete form using BLACK INK. Due Date: 15th day of 5th month (4th month for certain trusts and IRAs) following close of taxable year.

D Check ü if applicable and attach explanation:

Exempt Organization Name

C

State of Organization and Year

Enter abbreviation of

state in box, or if a

foreign country, enter

below.

Y Y Y Y

Number and Street

City State

B Business Activity (NAICS) Code

A

Federal Employer ID Number

ZIP (+ 4 digit sufx if known)

2 First return - new corporation or entering Wisconsin

4 Short period - change in accounting period

1 Amended return

5 Short period - stock purchase or sale

3 Final return - corporation dissolved or withdrew

Suite Number

I Check ü type of organization:

1 Corporation 2 Trust - due 4th month 3 Trust - due 5th month

J Name of Trustee if Taxable as Trust

PAPER CLIP check or money order here

.00

NOT LIKE THIS (1000)

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS –1000

G If you changed your organization name.

.00

H Internal Revenue Service adjustments became nal during the year.

Enter years adjusted ► .

.00

%

.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

This line will auto-populate from Schedule T1, line 10, page 3

This line will auto-populate from Schedule T2, line 8, page 3

Go to Page 2

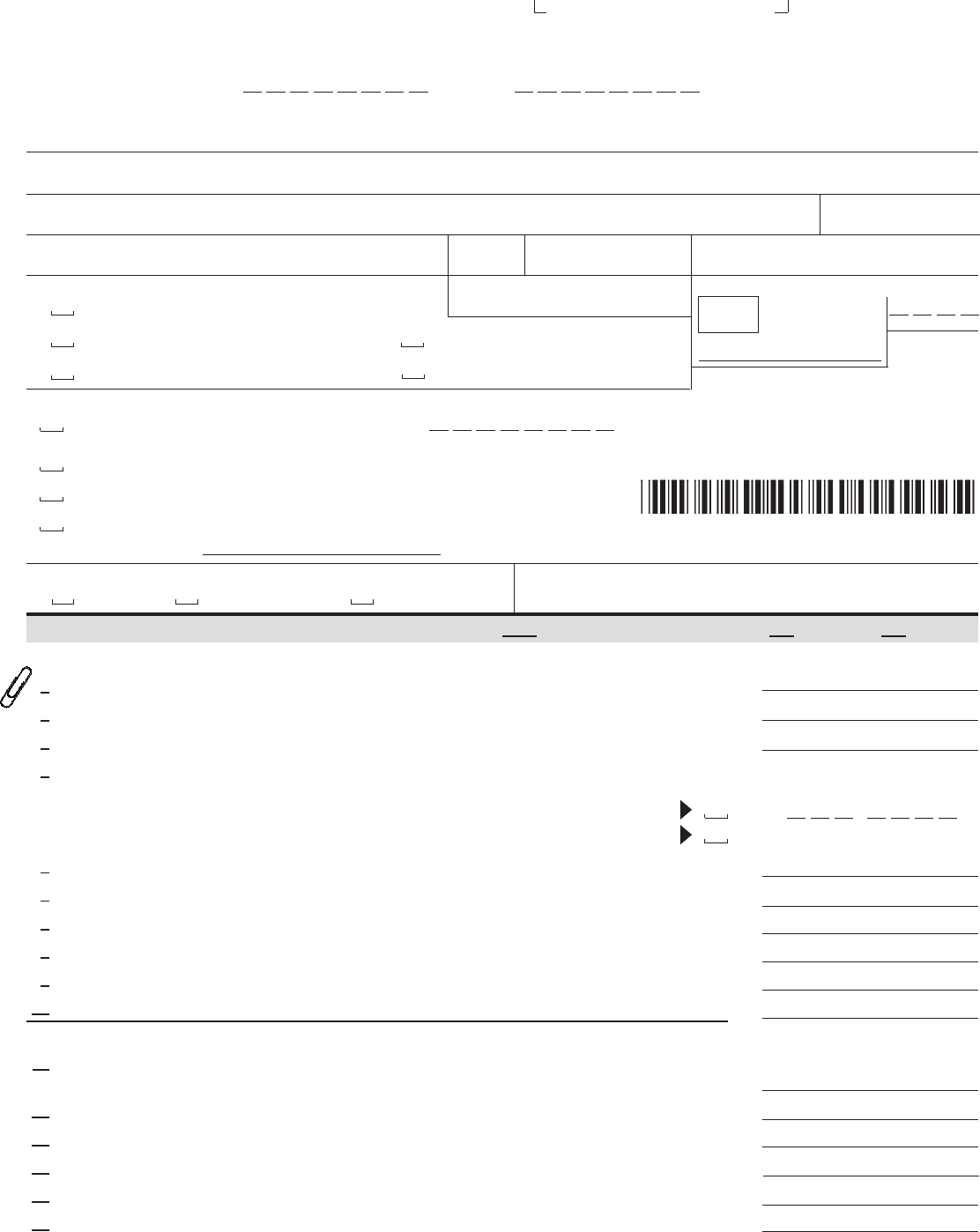

17 Nonrefundable credits (from Schedule CR) ....................................... 17

18 Net income tax paid to other states ............................................. 18

19 Add lines 17 and 18 ......................................................... 19

20 Subtract line 19 from line 16. If line 19 is greater than line 16, enter zero (0). This is net tax ... 20

21 Tax from line 10 or 20 ....................................................... 21

22 Economic development surcharge (see instructions) ............................ . . . . . . 22

23 Endangered resources donation (decreases refund or increases amount owed) ... . ....... 23

24 Veterans trust fund donation (decreases refund or increases amount owed) ...... . ....... 24

25 Add lines 21 through 24 ...................................................... 25

26 Estimated tax payments less refund from Form 4466W. .. 26

27 Wisconsin tax withheld ............................ 27 23

28 Refundable credits (from Schedule CR) .............. 28

29 Amended Return Only – amount previously paid ........ 29

30 Add lines 26 through 29 ........................... 30

31 Amended Return Only – amount previously refunded .... 31

32 Subtract line 31 from 30 ...................................................... 32

33 Interest, penalty, and late fee due (from Form U, line 17 or 26).

If you annualized income on Form U, check (ü) the space after the arrow .......... 33

34 Tax due. If the total of lines 25 and 33 is larger than line 32, subtract line 32 from the total of

lines 25 and 33 ............................................................. 34

35 Overpayment. If line 32 is larger than the total of lines 25 and 33, subtract the total of lines

25 and 33 from line 32 ....................................................... 35

36 Enter amount of line 35 you want credited on 2017 estimated tax .. 36

37 Subtract line 36 from line 35. This is your refund ................................. 37

38 Enter total gross receipts from all unrelated trade or business activities ................. 38

2016 Form 4T Page 2 of 3

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

If you are not ling your return electronically, make your check payable to and mail your return to:

Wisconsin Department of Revenue

PO Box 8908

Madison WI 53708-8908

You must le a copy of your federal Form 990-T or 4720, including attachments, with your Form 4T.

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Signature of Ofcer or Trustee

Preparer’s Signature

Date

Date

Title

Preparer’s Federal Employer ID Number

Additional Information Required

1 Person to contact concerning this return: Phone #: Fax #:

2 City and state where books and records are located for audit purposes:

3 Are you the sole owner of any limited liability companies (LLCs)? Yes No If yes, complete Schedule DE and include with this

return. Did you include the incomes of these entities in this return? Yes No

4 Did you purchase any taxable tangible personal property or taxable services for storage, use, or con sumption in Wisconsin without payment

of a state sales or use tax?

Yes No

If yes, you may owe Wisconsin use tax. See instructions for how to report use tax.

(You will not be liable for Wisconsin use tax if you hold a Wisconsin Certicate of Exempt Status.)

5 List the locations of your Wisconsin operations:

Third

Party

Designee

Print

Designee’s

Name

Personal Identication Number (PIN)

Do you want to allow another person to discuss this return with the department? Yes Complete the following. No

Phone Number

Go to Page 3

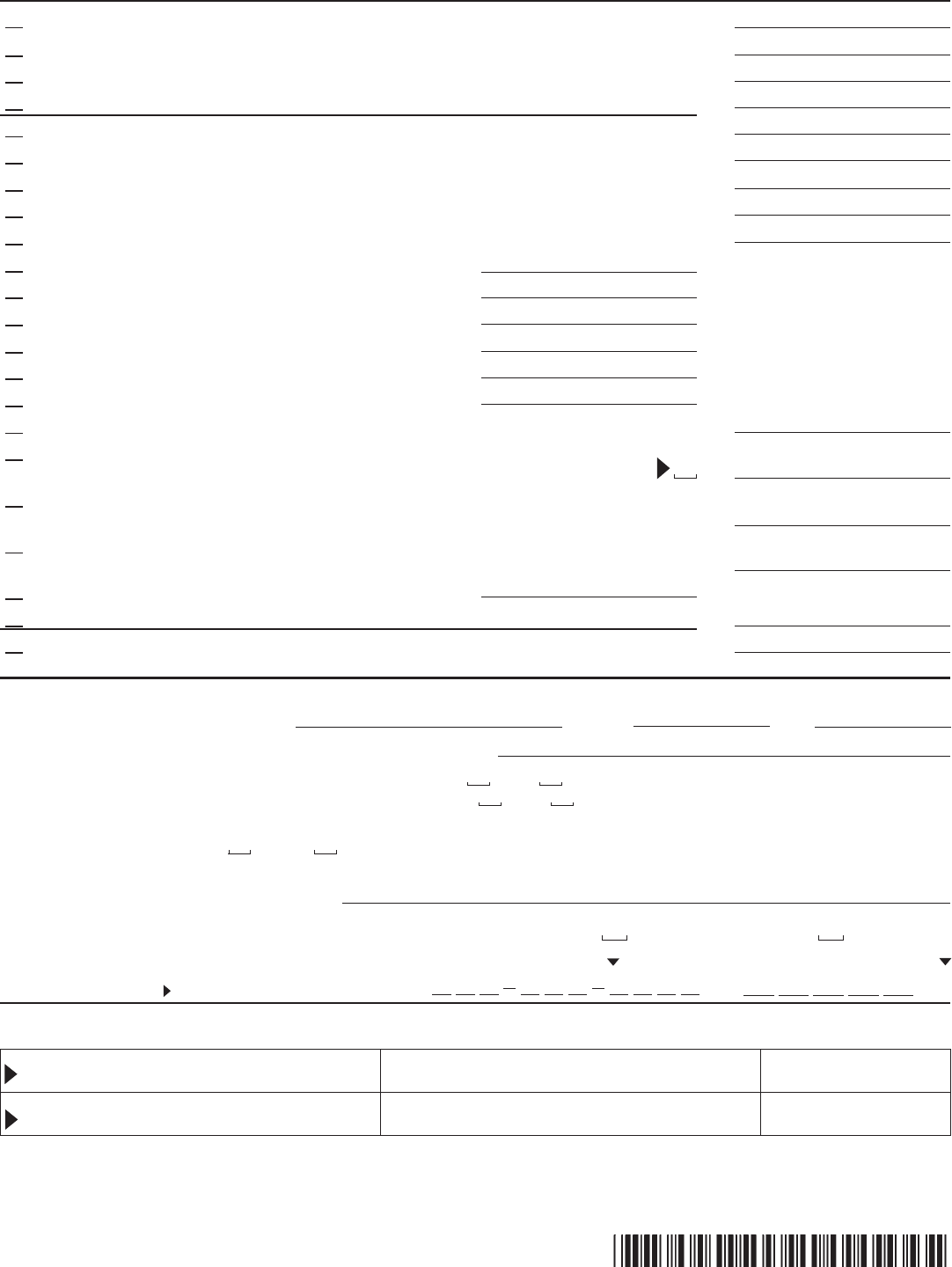

1 Interest income (less related expenses) from state and municipal obligations .............. 1

2 State and local franchise or income taxes ......................................... 2

3 Capital gain/loss adjustment ................................................... 3

4 Federal net operating loss carryover ............................................. 4

5 Related entity expenses (from Sch. RT, Part I or Sch. 2K-1, 3K-1, or 5K-1) ............... 5

6 Domestic production activities deduction .......................................... 6

7 Transitional adjustments ...................................................... 7

8 Credits computed (see instructions):

8a Business development credit ................................................... 8a

8b Community rehabilitation program credit........................................... 8b

8c Development zones credits..................................................... 8c

8d Economic development tax credit ................................................ 8d

8e Enterprise zone jobs credit ..................................................... 8e

8f Farmland preservation credit ................................................... 8f

8g Jobs tax credit............................................................... 8g

8h Manufacturing and agriculture credit.............................................. 8h

8i Manufacturing investment credit ................................................. 8i

8j Research expense credit ...................................................... 8j

8k Technology zone credit ........................................................ 8k

9 Other: 9

10 Total (enter on page 1, line 12) ................................................. 10

2016 Form 4T Page 3 of 3

Schedule T1 – Trust Additions (See instructions)

1 Interest income (less related expenses) from United States government obligations .......... 1

2 Capital gain/loss adjustment ...................................................... 2

3 Wisconsin net operating loss carryforward ........................................... 3

4 Deductible related entity expenses (from Sch. RT, Part II or Sch. 2K-1, 3K-1, or 5K-1) ......... 4

5 Income from related entities whose expenses were disallowed (obtain Schedule RT-1 from

related entity and submit with your return) ........................................... 5

6 Transitional adjustments ......................................................... 6

7 Other: 7

8 Total (enter on page 1, line 14) .................................................... 8

Schedule T2 – Trust Subtractions (See instructions)

Return to Page 1