Fillable Printable Form1099G2010

Fillable Printable Form1099G2010

Form1099G2010

T

A

B

L

E

A

T

A

B

L

E

B

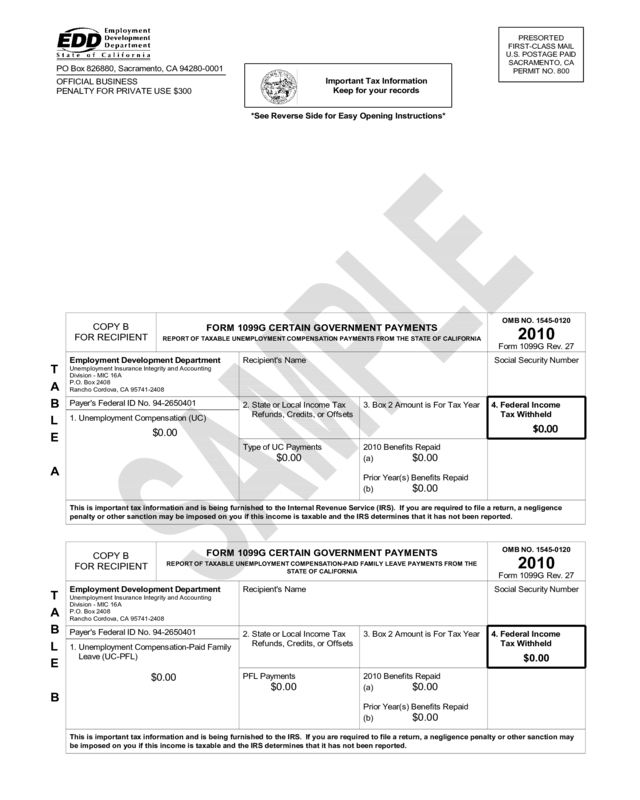

COPY B

FOR RECIPIENT

Employment Development Depa rtment

Payer's Federa l ID No. 94-2650401

This is important tax information and is being furnished to the Internal Revenue Service (IRS). If you are required to file a return, a negligence

penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

FORM 1099G CERTAIN GOVERNMENT PAYMENTS

REPORT OF TAXABLE UNEMPLOYMENT COMP ENSATION PAYMENTS FROM THE STATE OF CALIFORNIA

3. Box 2 Amount is For Tax Year

2010 Bene fits Repa id

(a)

$0.00

Prior Year(s) Benefits Repaid

(b)

$0.00

OMB NO. 1545-0120

2010

Form 1099G Rev. 27

Social Se curity Number

4. Federal Income

Recipient's Name

2. State or Local Income Tax

Type of UC Payments

$0.00

Unemployment Insurance Integrity and Accounting

Division - MIC 16A

P.O. Box 2408

Rancho Cordova, CA 95741-2408

$0.00

1. Unemployment Compensation (UC)

Refunds, Credits, or Offsets Tax Withheld

PRESORTED

FIRST-CLASS MAIL

U.S. POSTAGE PAID

SACRAMENTO, CA

PERMI T NO. 800

PO Box 826880, Sacramento , CA 94280-0001

OFFICIAL BUSINESS

PENALTY FOR PRIVATE USE $300

COPY B

FOR RECIPIENT

Employment Development Department

Payer's Federa l ID No. 94-2650401

$0.00

This is important tax information and is being furnished to the IRS. If you are required t o file a return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and the IRS determines that it has not been reported.

FORM 1099G CERTAIN GOVERNMENT PAYMENTS

REPORT OF TAXABLE UNEMPLOYMENT COMPENSATION-PAID FAMILY LEAVE PAYMENTS FROM THE

STATE OF CALIFORNIA

3. Box 2 Amount is For Tax Year

2010 Bene fits Repa id

(a)

$0.0

Prior Year(s) Benefits Repaid

(b)

$0.00

OMB NO. 1545-0120

2010

Form 1099G Rev. 27

Social Se curity Number

4. Federal Income

Recipient's Name

2. State or Local Income Tax

PFL Payments

$0.

Unemployment Insurance Integrity and Accounting

Division - MIC 16A

P.O. Box 2408

Rancho Cordova, CA 95741-2408

Leave (UC-PFL)

$0.00

1. Unemployment Compensation-Paid Family

Refunds, Credits, or Offsets Tax Withheld

*See Reverse Side for Easy Opening Instructions*

Important Tax Information

Keep for your records

State Disab ility Insura nce (SDI) contributio ns withheld ma y be de ductible fo r ta xpayers who itemize their de ductio ns for federal inco me

tax purposes. For assistance, call the IRS at 1-800-829-1040.

BOX 1 Total TAXABLE Unemployment Compensation (UC) paid to you by the Employment Development Department.

The amount shown includes all payment(s) with issue date(s) within the calendar year 2010.

BOX 4 Federa l Income Tax withheld from taxable UC pa id to yo u in 2010 by the Employm ent Dev elopment Depa rtment.

Type of UC payments (may include amounts withheld for child support obligation):

UI - Unem ployment Insurance

DUA - Disaster Unemployment Assistance

DI - Disability Insurance paid a s a substitute for UI be nefits to an individual who is ineligible for UI as

a result of a disa bility. These be n efits are taxable and reported as UC in accorda nce with Federal

Ta x Regulations Se ction 1.85-1.

Benefits repaid during calendar year 2010.

(a) Amo unts yo u paid on a ben efit o verpa yme nt for a claim filed in 2010.

(b) Amounts you paid on a benefit overpayment for a claim filed in prior years.

The amounts reported do not include penalties, interest, or other costs.

T

A

B

L

E

A1

Paid Fa mily Lea ve Insurance (PFL) contributions withheld ma y be deductible for tax payers who item ize their de ductions for fede ral income

tax purposes. For assistance, call the IRS at 1-800-829-1040.

BOX 1 Total TAXABLE Unemployment Compensation-Paid Family Leave (UC-PFL) paid to you by the Employment Development

Department.

The amount shown includes all payment(s) with issue date(s) within the calendar year 2010.

If you did not receive PFL payments, Box 1 of Table B will display $0.00.

BOX 4 Federal Income Tax withheld do es not apply to PFL pa yments.

PFL payments (may include amounts withheld for child support obligation):

PFL - Paid Family Leave Insurance. These benefits are taxable and reportable in accordance with Sections 61

and 85 o f the Interna l Revenue Code .

Benefits repaid during calendar year 2010.

(a) Amo unts yo u paid on a ben efit o verpa yme nt for a claim filed in 2010.

(b) Amounts you paid on a benefit overpayment for a claim filed in prior years.

The amounts reported do not include penalties, interest, or other costs.

T

A

B

L

E

B1

PLEASE READ THE FOLLOWING INSTRUCTIONS:

THE AMOUNT IN BOX 1 OF TABLE A AND TABLE B IS CONSIDERED TAXABLE INCOME UNDER FEDERAL

LAW. Therefore, this am ount should be reported as income i f you are required to file a feder al income tax return. Table

A1 or B1 explai ns the i nformation in each box of Tabl e A or Table B.

If you have questions on how to r eport unempl oyment compensation, benefit s repaid, or income tax wi thheld, call the

IRS at 1-800-829-1040.

If you disagree with the am ounts shown in Table A or Table B, call the 1099G customer service line at 1-866-401-2849:

General Infor mati on: Automated System available 24 hours daily, 7 days per week.

Customer Service: Weekdays ..................... 8 a.m. - 5 p.m .

For more information you can vi sit our Web site at http://www.edd.ca.gov/Unemployment /FAQ_for_1099G.htm

Para más información, favor de visitar nuestro siti o web en

htt p://www.edd.ca. gov/Unemployment/FAQ_for_1099G_en_Espanol.htm

Si ud. no está de acuerdo con la cantidad que aparece en la Tabla " A" o Tabla "B", llame a los encargados del

formular io 1099G a la línea de Servicios al Cliente al 1-866-401- 2849 .