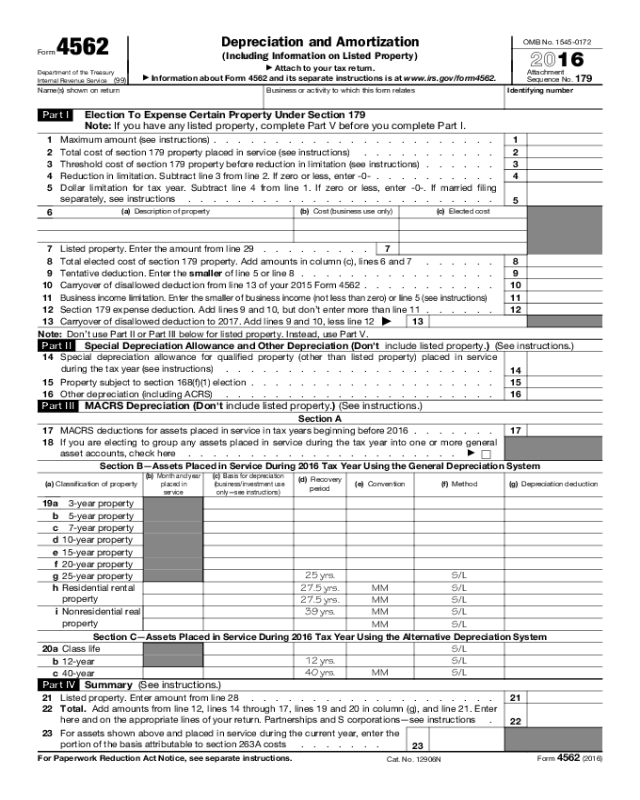

Form 4562 (2016)

Page 2

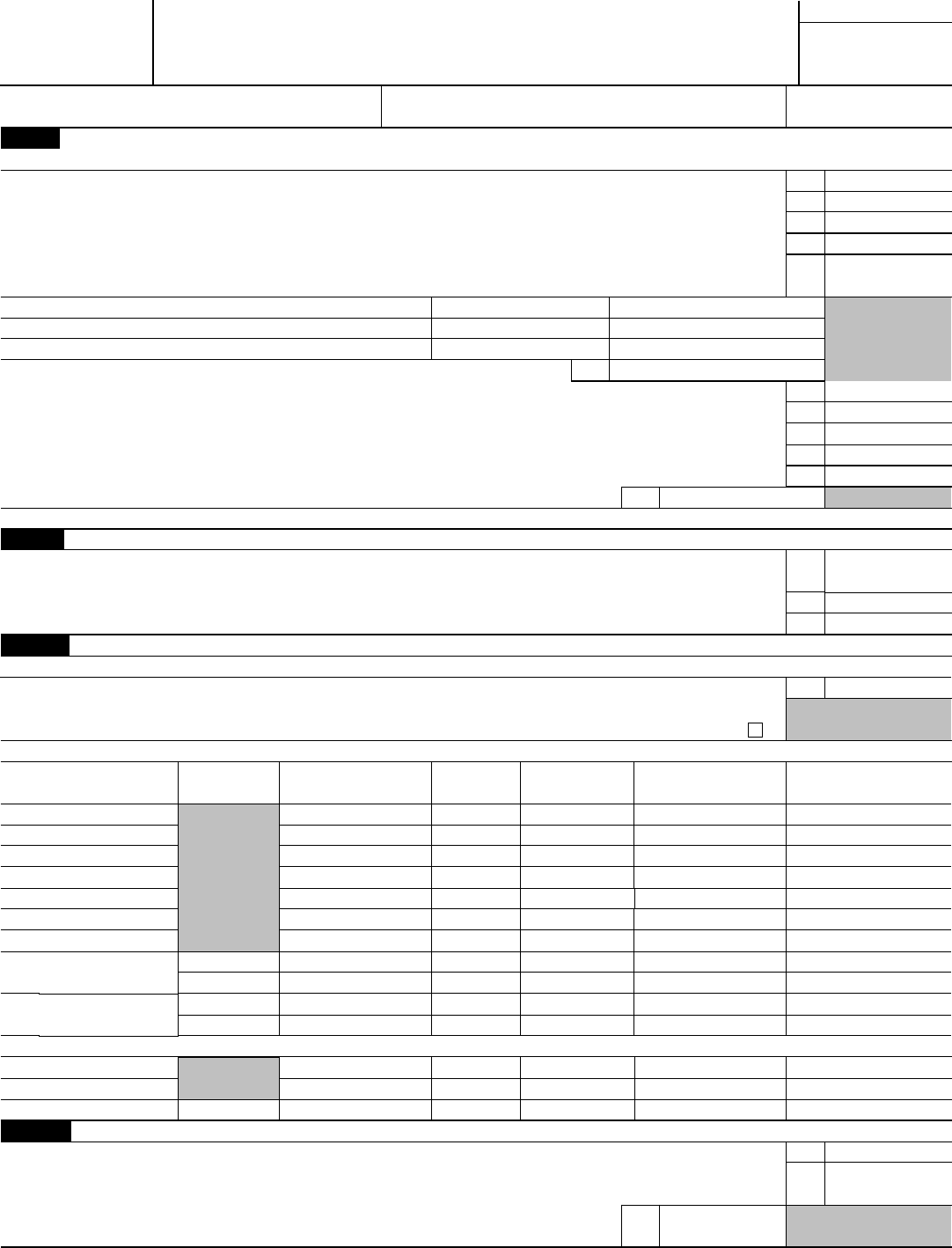

Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, certain computers, and property

used for entertainment, recreation, or amusement.)

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a,

24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable.

Section A—Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.)

24a

Do you have evidence to support the business/investment use claimed?

Yes No

24b

If “Yes,” is the evidence written?

Yes No

(a)

Type of property (list

vehicles first)

(b)

Date placed

in service

(c)

Business/

investment use

percentage

(d)

Cost or other basis

(e)

Basis for depreciation

(business/investment

use only)

(f)

Recovery

period

(g)

Method/

Convention

(h)

Depreciation

deduction

(i)

Elected section 179

cost

25

Special depreciation allowance for qualified listed property placed in service during

the tax year and used more than 50% in a qualified business use (see instructions) .

25

26 Property used more than 50% in a qualified business use:

%

%

%

27 Property used 50% or less in a qualified business use:

%

S/L –

%

S/L –

%

S/L –

28 Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 . 28

29 Add amounts in column (i), line 26. Enter here and on line 7, page 1 . . . . . . . . . . . . 29

Section B—Information on Use of Vehicles

Complete this section for vehicles used by a sole proprietor, partner, or other “more than 5% owner,” or related person. If you provided vehicles

to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

30

Total business/investment miles driven during

the year (don’t include commuting miles) .

(a)

Vehicle 1

(b)

Vehicle 2

(c)

Vehicle 3

(d)

Vehicle 4

(e)

Vehicle 5

(f)

Vehicle 6

31

Total commuting miles driven during the year

32 Total other personal (noncommuting)

miles driven . . . . . . . . .

33 Total miles driven during the year. Add

lines 30 through 32 . . . . . . .

Yes No Yes No Yes No Yes No Yes No Yes No

34 Was the vehicle available for personal

use during off-duty hours? . . . . .

35 Was the vehicle used primarily by a more

than 5% owner or related person? . .

36

Is another vehicle available for personal use?

Section C—Questions for Employers Who Provide Vehicles for Use by Their Employees

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren’t

more than 5% owners or related persons (see instructions).

37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by

your employees? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your

employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . .

39 Do you treat all use of vehicles by employees as personal use? . . . . . . . . . . . . . . . .

40 Do you provide more than five vehicles to your employees, obtain information from your employees about the

use of the vehicles, and retain the information received? . . . . . . . . . . . . . . . . . . .

41 Do you meet the requirements concerning qualified automobile demonstration use? (See instructions.) . . .

Note: If your answer to 37, 38, 39, 40, or 41 is “Yes,” don’t complete Section B for the covered vehicles.

Part VI Amortization

(a)

Description of costs

(b)

Date amortization

begins

(c)

Amortizable amount

(d)

Code section

(e)

Amortization

period or

percentage

(f)

Amortization for this year

42 Amortization of costs that begins during your 2016 tax year (see instructions):

43 Amortization of costs that began before your 2016 tax year . . . . . . . . . . . . . 43

44 Total. Add amounts in column (f). See the instructions for where to report . . . . . . . . 44

Form 4562 (2016)