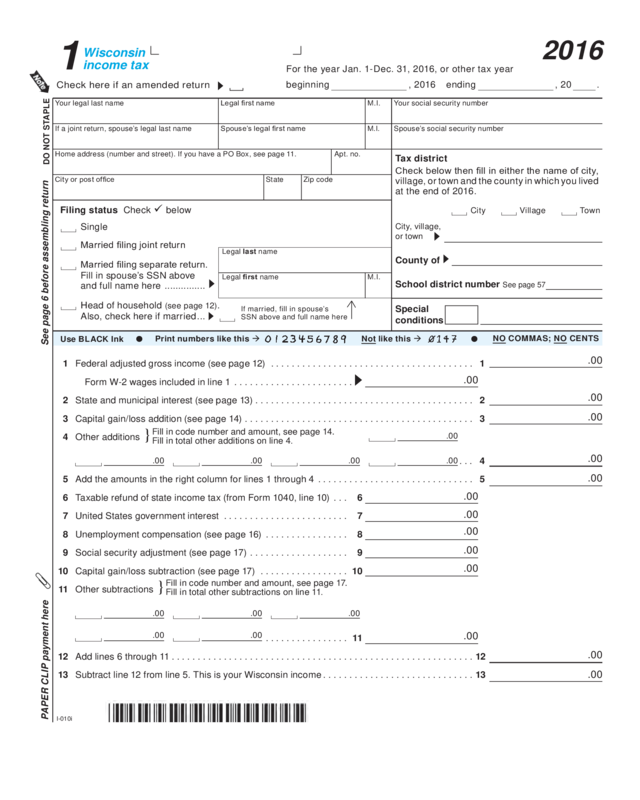

Fillable Printable 2016 I-010 Form 1, Wisconsin Income Tax (Fillable)

Fillable Printable 2016 I-010 Form 1, Wisconsin Income Tax (Fillable)

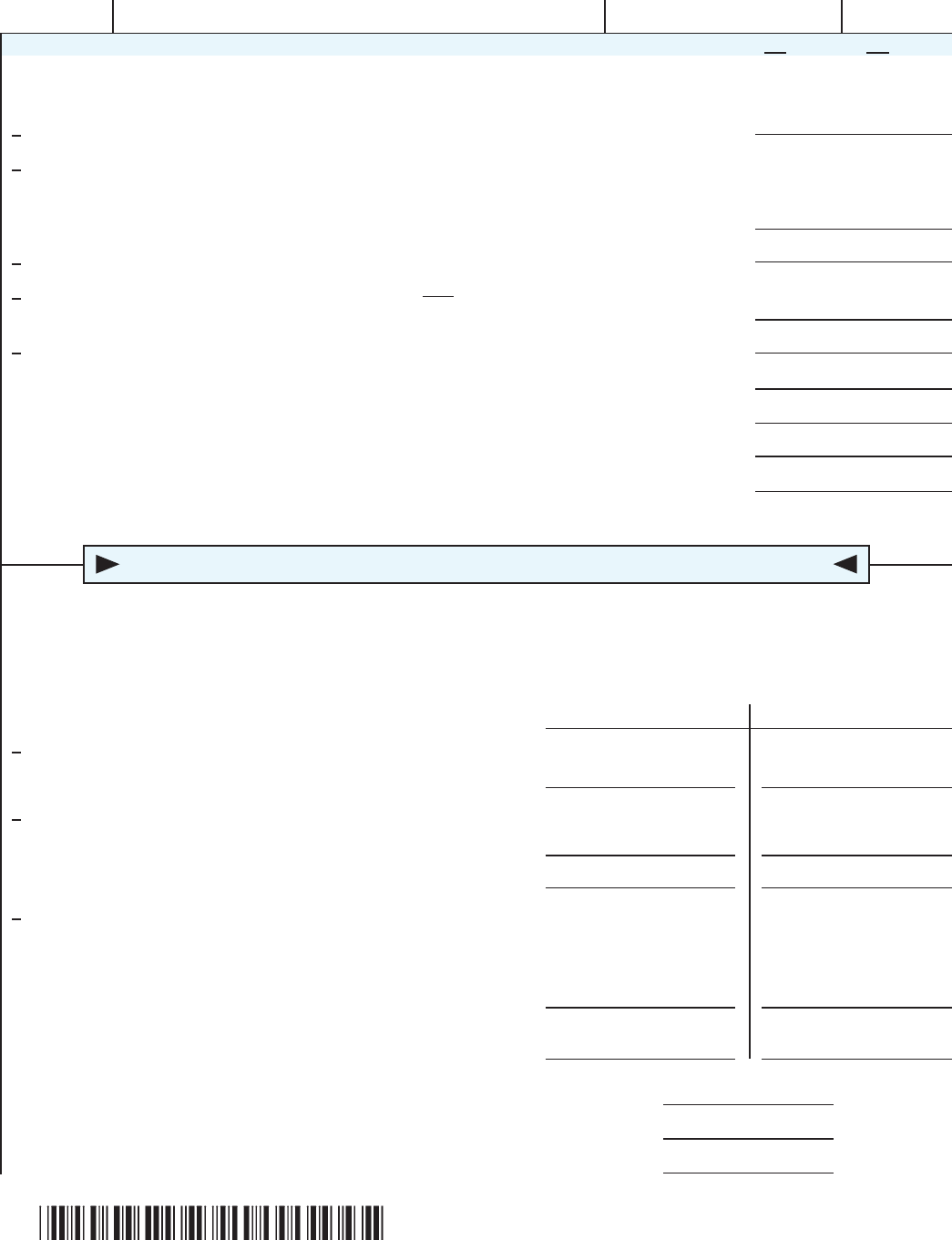

2016 I-010 Form 1, Wisconsin Income Tax (Fillable)

1 Federal adjusted gross income (see page 12) ....................................... 1

Form W‑2 wages included in line 1 .......................

2 State and municipal interest (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Capital gain/loss addition (see page 14) ............................................ 3

4 Other additions

... 4

5 Add the amounts in the right column for lines 1 through 4 .............................. 5

6 Taxable refund of state income tax (from Form 1040, line 10) ... 6

7 United States government interest ........................ 7

8 Unemployment compensation (see page 16) ................ 8

9 Social security adjustment (see page 17) ................... 9

10 Capital gain/loss subtraction (see page 17) ................. 10

11 Other subtractions

................ 11

12 Add lines 6 through 11 .......................................................... 12

13 Subtract line 12 from line 5. This is your Wisconsin income ............................. 13

Married ling separate return.

Fill in sp o us e’s SS N a b ove

and fu ll n am e h e re ...............

Wisconsin

income tax

2016

1

I‑010i

PAPER CLIP payme nt h ere

Se e p a g e 6 before asse m b l i ng ret u rn

Tax distric t

Check below then ll in either the name of city,

village, or town and the county in which you lived

at the en d of 2016.

County of

School district number

See page 57

Spouse’s social security number

Your s ocial s ec u ri ty n u m berLegal rst nameYour legal last name

Spouse’s legal rst nameIf a join t r e t ur n , s pou se’s leg a l l ast n a me

Ho me ad d ress (number a nd stre e t). If y o u have a PO Box, s ee pa ge 11. Ap t. no.

StateCity or post ofce Zip code

Married ling joint return

Filing status Check

below

Head of household

(see page 12).

Also, check here if married ...

Single

Village TownCity

M.I.

M.I.

Special

conditions

City, village,

or town

DO N OT S TAPLE

}

Fill in code number and amount, see page 14.

Fill in total other additions on line 4.

}

Fill in code number and amount, see page 17.

Fill in total other subtractions on line 11.

Legal last name

Legal rst name

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

M.I.

If married, fill in spouse’s

SS N ab ove a n d fu l l na me h e re

.00

.00.00.00.00

.00 .00 .00

.00 .00

For the year J an. 1‑ De c. 31, 2 016, or ot her t a x year

begi nning , 2016 endin g , 20 .

NO COMM AS; NO CENTS

Pri nt numbe rs l i ke th is

Not like t hi s

Use B LACK In k

Chec k her e if an am end ed retu rn

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

Go to Page 2

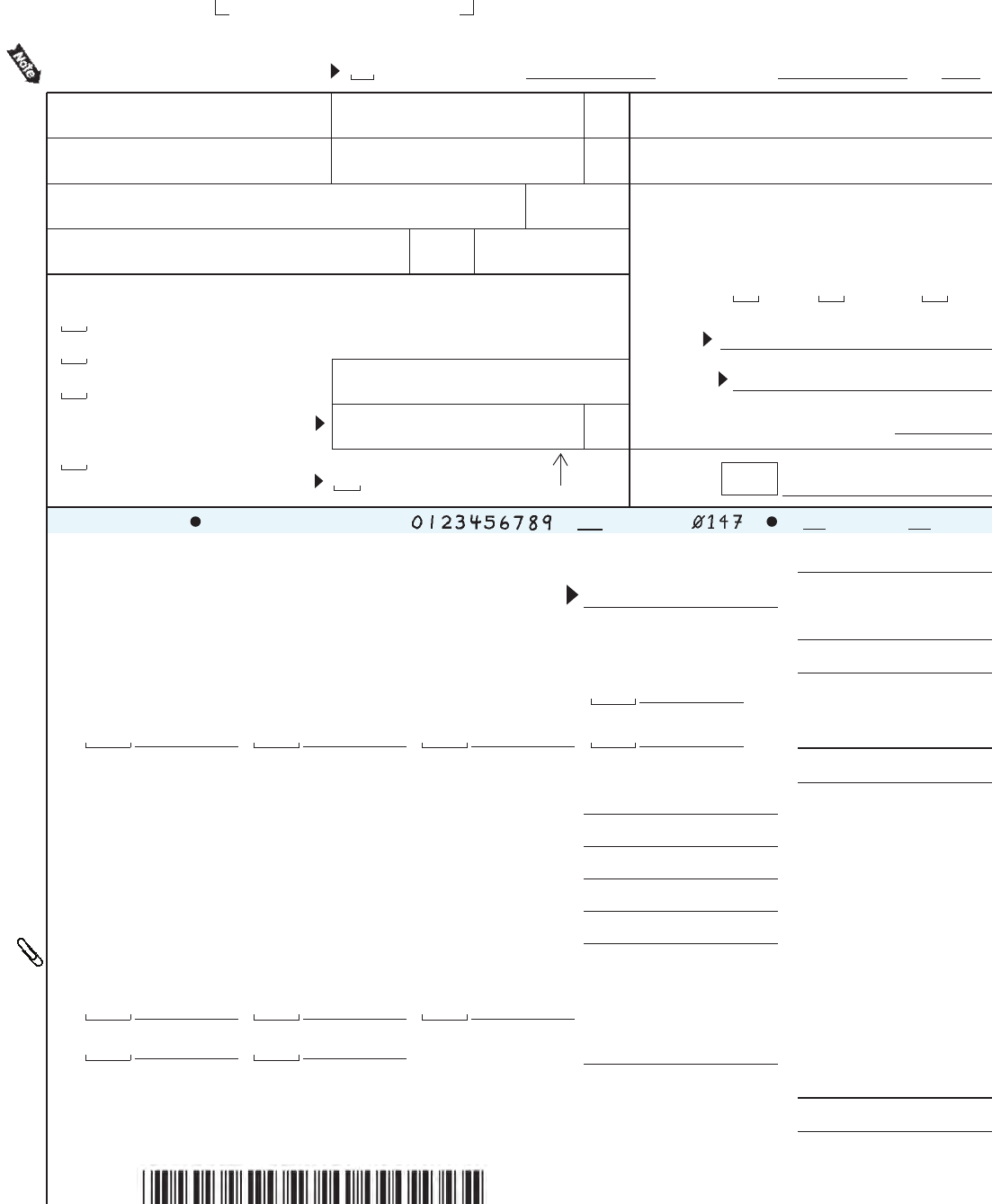

32 Add lines 29, 30, and 31 ....................................................... 32

33 Subtract line 32 from line 28. If line 32 is larger than line 28, ll in 0. This is your net tax ..... 33

34 Sales a n d u s e tax due on Inter n et, mail o rder, or other out‑of‑state p u r chas es (see page 38) 34

If you certify that no sales or use tax is due, check here .........................

35 Donations (decreases refund or increases amount owed)

a Endangered resources e Milit ary family relief ......

b Cancer researc h ..... f

Second Harvest/Feeding Amer.

c Vetera ns t rust fund ... g Red Cross WI Disaster Relief

d Multiple sclerosis .... h Special Olympics Wisc o nsin

Total (add lines a through h) ...

35i

36 Penalties on IRAs, retirement plans, MSAs, etc. (see page 39) .. x .33 = 36

37 Credit repayments and other penalties (see page 40) ................................ 37

38 Add lines 33, 34, 35i, 36 and 37 ................................................. 38

14 Wisconsin income from line 13 .................................................. 14

15 Standard deduction. See table on page 55, OR ................................ 15

If someone else can claim you (or your spouse) as a dependent, see page 30 and check here

16 Subtract line 15 from line 14. If line 15 is larger than line 14, ll in 0 ..................... 16

17 Exemptions (Caution: See page 30)

a Fill in exemptions from your federal return x $700 .. 17a

b Check if 65 or older You + Spouse = x $250 ..17b

c Add lines 17a and 17b ...................................................... 17c

18 Subtract line 17c from line 16. If line 17c is larger than line 16, ll in 0. This is taxable income . 18

19 Tax (see table on page 48) ..................................................... 19

20 Itemized deduction credit. Enclose Schedule 1, page 4 ............... 20

21 Armed forces member credit (must be stationed outside U.S. See page 31) .. 21

22 School property tax credit

a Rent pa i d in 2 016–he at in clude d

Re nt pa id i n 2 016–he at not i nclud e d

b Pro p erty ta xes p ai d o n h o me i n 2 016

23 Worki ng f a mi li e s ta x credi t

24 Certain nonrefundable credits from line 11 of Schedule CR ........... 24

25 Add credits on lines 20 through 24 ............................................... 25

26 Subtract line 25 from line 19. If line 25 is larger than line 19, ll in 0 ..................... 26

27 Alternative minimum tax. Enclose Schedule MT .................................... 27

28 Add lines 26 and 27 .......................................................... 28

29 Married couple credit.

Enclose Schedule 2, page 4 ............ 29

30 Other credits from Schedule CR, line 35 .. 30

31 Net income tax paid to another state.

Enclose Schedule OS .......... 31

Find credit from

table page 33

..22a

}

Find credit from

table page 34

..22b

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

NO COMMAS; NO CENTS

2016

Form 1 Page 2 of 4

Name SSN

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00 .00

If lin e 14 is les s t h a n $10,000

and if married ling separate,

see p age 35 ..23

}

Go to Page 3

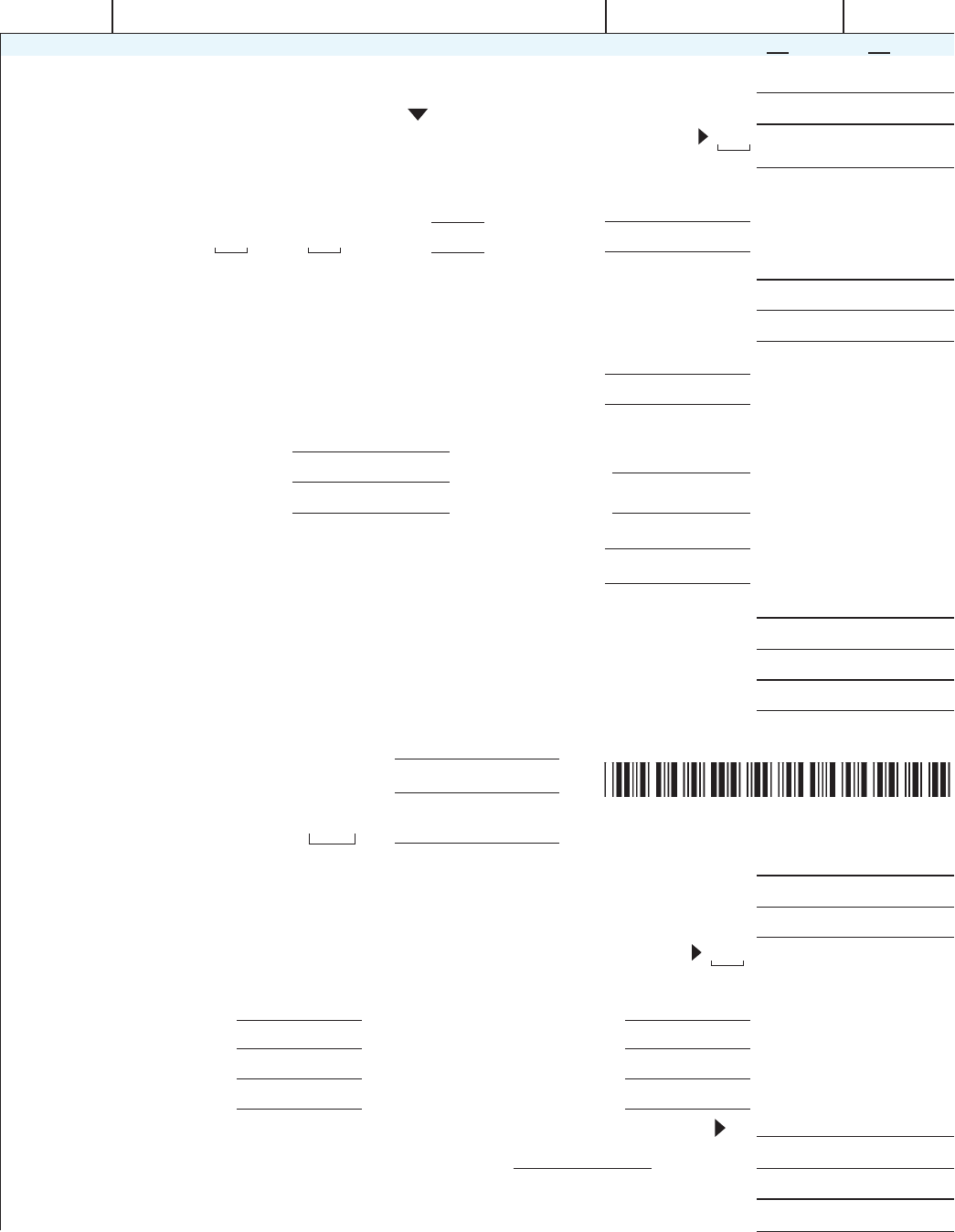

39 Amount f rom lin e 38 ......................................................... 39

40 Wisco nsin tax w i thheld. Encl ose wi thho lding stateme nts ..... 40

41 2016 estimated tax p ayments and amo unt

applied from 2015 return .............................. 41

42 Earned i n co m e cre di t. Num ber of qual ifyi n g chil d r en ..

Federal

credit .... x % = ......... 42

43 Farmlan d pres e rvati on credit. a Sch edule FC, line 18 ....... 43a

b Sc h edule FC‑A, li n e 13 ..... 43b

44 Repayment credit (see page 42) ........................ 44

45 Hom estead credi t. Enclose S che du le H or H‑EZ ............ 45

46 Eligible veterans an d s u rviving spouses pro perty tax cr edit ... 46

47 Ot h e r c r e di t s f r o m S ched ul e C R, lin e 3 9. Enclose Schedule CR 47

48 AMENDED RETURN ONLY–Amounts previously paid

(see page 44)

48

49 Add line s 40 th r ough 48 .............................. 49

50 AMENDED RETURN ONLY–

Amounts previously refunded

(see page 44)

50

51 Subt ract li ne 50 from l i n e 49 ................................................... 51

52 If line 51 is larg e r than li n e 39, subtract li n e 39 f r om line 51.

This is t he AMOUNT YOU OVERPAID ........................................... 52

53 Am o u nt of l i n e 52 you wa nt REFUNDED TO YOU .................................. 53

54 Amo unt of l i n e 52 you wa nt

APPLIED TO YOUR 2017 ESTIM ATED TAX .............. 54

55 I f l i n e 51 is smaller t h a n l i n e 39, subtract li ne 51 fro m li ne 39. Th is is th e

AMOUN T YOU OWE. Paper cli p p ayment to front of return .......................... 55

56

Underpayment interest. Fill in exception code ‑ See Sch. U

56

Al s o incl ude on li n e 55

(se e p age 46)

Name(s) shown on Form 1 Your social security number

2016

Form 1 Page 3 of 4

Mail your return to: Wisconsin Department of Revenue

If tax due .....................................PO Box 268, Madison WI 53790‑0001

If refund or no tax due.................PO Box 59, Madison WI 53785‑0001

If homestead credit claimed ........PO Box 34, Madison WI 53786‑0001

I‑010ai

.00

.00

.00

.00

.00

.00 .00

.00

.00

.00

.00

.00

.00

.00

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Your signature Spouse’s signature (if ling jointly, BOTH must sign) Date Daytime phone

( )

Sign here

.00

Third

Party

Designee

Designee’s

name

Phone

no. ( )

Personal

identication

number (PIN)

.00

Do you want to allow another person to discuss this return with the department (see page 47)? Yes Complete the following. No

Paper clip copies of your federal income tax return and schedules to this return.

Assemble your return (pages 1-4) and withholding statements in the order listed on page 6.

.00

Do Not Submit Photocopies

NO COMMAS; NO CENTS

.00

.00

.00

Return to Page 1

Go to Page 4

.00

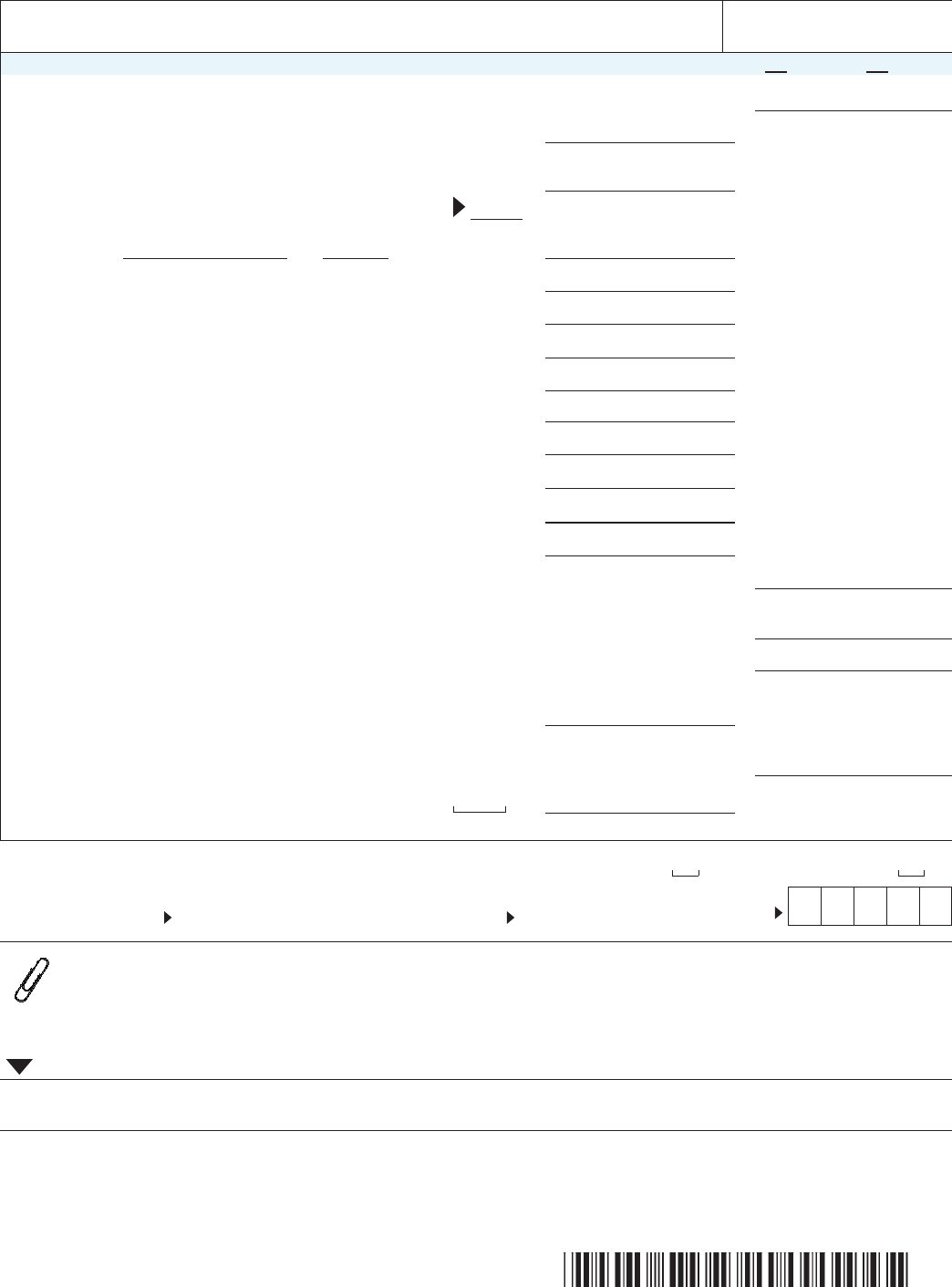

1 Medical and dental expenses from line 4 of federal Schedule A. See instructions for exceptions 1

2 Interest pa i d f r o m li ne s 10‑12 and 14 of federa l S ched ul e A. Do not in c l u de i nter e st p ai d

to purchas e a se co nd h o m e l o cated o utsid e Wiscon si n o r a re s i d en ce wh i c h i s a b o at .

Also, do not i nclud e inte re s t pa i d to pu rchas e o r h o ld U.S. g over n me nt s e c urit i e s a nd

interest fr o m a t ax‑opt i o n (S) c o rpo r at i o n i f clai me d a s a subt r a c t i o n .................... 2

3 Gift s to charity f r o m li ne 19 of feder a l S c h e du le A. See in st ructi o ns f o r except i o ns ......... 3

4 Casualty l o s s e s f r o m li ne 2 0 of fe d e r al S che dul e A, only if th e l o s s i s di re ctly r e late d to a

federally‑dec lared disaster .................................................... 4

5 Add lines 1 t h r o ug h 4 ......................................................... 5

6 Fill in your st an d ar d d ed ucti o n f r o m l in e 15 on page 2 of For m 1 ....................... 6

7 Subtract line 6 from line 5. If line 6 is more than line 5, ll in 0 .......................... 7

8 Rate of cre dit i s . 05 (5%). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Multip l y li ne 7 by lin e 8 . Fil l in h e re a n d on l in e 2 0 o n pa g e 2 of Form 1 .................. 9

1 Taxab le wage s , salarie s , tips, an d other e m ployee c ompe n sation.

Do NOT inc l u de deferred co m pensatio n, i nte r est, di v iden d s,

pensions, unemployment compensation, or other unearned income 1

2 Net prot or (loss) from self-employment from federal

Schedules C, C‑EZ, and F (

Form 1040

), Schedule K‑1

(Form 1065)

,

and any other taxab l e s e lf ‑empl oym e nt or e a rned i nco m e ....... 2

3 Comb in e li ne s 1 a n d 2 . T hi s i s ea rne d in com e ................ 3

4 Add the am o unt s fro m fe de r a l For m 10 4 0, li n e s 24, 28 and 3 2,

plus repayment of supplemental unemployment benets,

and cont ribu t i o ns to s e cs. 4 0 3(b) and 5 01(c)(18) p e ns i o n p la ns ,

included in line 36, and any Wisconsin disabilit y inc o me

exclusion. Fill i n t h e tot a l of t h e s e adj us t m ent s that app l y to

your or your spo us e’s incom e ............................. 4

5 Subtract line 4 from line 3. This is qualied earned income.

If less than zero, ll in 0 ................................. 5

6 Comp ar e t h e am o unt s i n colu mn s (A) and (B) of line 5.

Fill in the smaller amount here. If more than $16,000, ll in $16,000. . . . . . . . . . . 6

7 Rate of cre dit i s .03 (3%) ............................................. 7

8 Multip l y li ne 6 by lin e 7. Fill in her e a nd o n l in e 2 9 o n p ag e 2 of Form 1 ........ 8

Schedule 2 – Marr i e d Cou pl e Cr ed i t W h en Bo t h S p ou se s A r e Em p loyed (see pag e 3 6)

Whe n co mpl etin g thi s sch edul e, be sure to fi ll in your i nc ome i n c olum n (A) and your spou se’s inc ome i n c olum n (B)

(B) SPOUSE

Do not ll in

mor e t h a n $48 0.

x .03

(A) YOURSELF

2016

Form 1 Page 4 of 4

Schedule 1 – Itemized Deduction Credit (see page 30)

x .05

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

You must su bmi t t his p ag e wit h For m 1 if you cl aim ei t her o f th ese c red it s

Name SSN

.00

NO COMMAS; NO CENTS

Return to Page 1

Return to Page 1