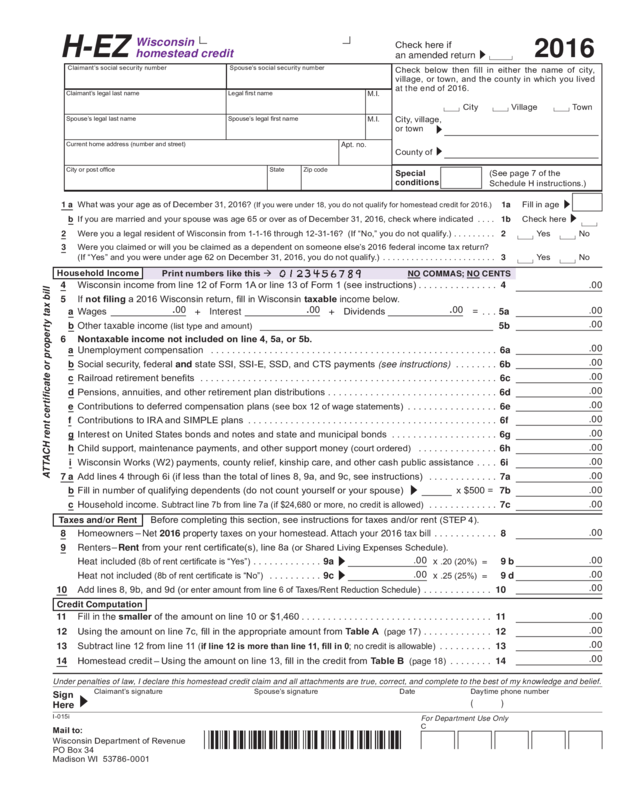

Fillable Printable 2016 I-015 Schedule H-Ez, Wisconsin Homestead Credit - Short Form

Fillable Printable 2016 I-015 Schedule H-Ez, Wisconsin Homestead Credit - Short Form

2016 I-015 Schedule H-Ez, Wisconsin Homestead Credit - Short Form

8 Homeowners –Net 2016 property taxes on your homestead. Attach your 2016 tax bill ............ 8

9 Renters–Rent from your rent certicate(s), line 8a (or Shared Living Expenses Schedule).

Heat included

(8b of rent certicate is “Yes”)

.............9a x .20 (20%) = 9 b

Heat not included

(8b of rent certicate is “No”)

..........9c x .25 (25%) = 9 d

10 Add lines 8, 9b, and 9d (

or enter amount from line 6 of Taxes/Rent Reduction Schedule

) ............. 10

.00

.00

.00

.00

.00

.00

.00

.00

Credit Computation

Taxes and/o r R ent

4 Wisconsin income from line 12 of Form 1A or line 13 of Form 1 (see instructions) ............... 4

5 If not ling a 2016 Wisconsin return, ll in Wisconsin taxable income below.

a Wages + Interest + Dividends = ... 5a

b Other taxable income (list type and amount) 5b

6 Nontaxable income not included on line 4, 5a, or 5b.

a Unemployment compensation ...................................................... 6a

b Social security, federal and state SSI, SSI-E, SSD, and CTS payments (see instructions) ........ 6b

c Railroad retirement benets ........................................................ 6c

d Pensions, annuities, and other retirement plan distributions ................................ 6d

e Contributions to deferred compensation plans (see box 12 of wage statements) ................. 6e

f Contributions to IRA and SIMPLE plans ............................................... 6f

g Interest on United States bonds and notes and state and municipal bonds .................... 6g

h Child support, maintenance payments, and other support money (court ordered) ............... 6h

i Wisconsin Works (W2) payments, county relief, kinship care, and other cash public assistance .... 6i

7 a Add lines 4 through 6i (if less than the total of lines 8, 9a, and 9c, see instructions) ............. 7a

b Fill in number of qualifying dependents (do not count yourself or your spouse) x $500 = 7b

c Household income.

Subtract line 7b from line 7a (if $24,680 or more, no credit is allowed)

............. 7c

Print numbers like this

NO COMM AS; NO CENTS

1 a What was your age as of December 31, 2016?

(If you were under 18, you do not qualify for homestead credit for 2016.)

1a Fill in age

b If you are married and your spouse was age 65 or over as of December 31, 2016, check where indicated .... 1b Check here

2 Were you a legal resident of Wisconsin from 1-1-16 through 12-31-16? (If “No,” you do not qualify.) ......... 2 Yes No

3 Were you claimed or will you be claimed as a dependent on someone else’s 2016 federal income tax return?

(If “Yes” and you were under age 62 on December 31, 2016, you do not qualify.) ........................ 3 Yes No

Before completing this section, see instructions for taxes and/or rent (STEP 4).

11 Fill in the smaller of the amount on line 10 or $1,460 .................................... 11

12 Using the amount on line 7c, ll in the appropriate amount from Table A

(page 17)

............. 12

13 Subtract line 12 from line 11

(if line 12 is more than line 11, ll in 0; no credit is allowable)

.......... 13

14 Homestead credit – Using the amount on line 13, ll in the credit from Table B

(page 18)

........ 14

I-015i

Claimant’s signature Spouse’s signature Date Daytime phone number

Mail to:

Wisconsin Department of Revenue

PO Box 34

Madison WI 53786-0001

Und e r p e n a lties of l a w, I declare t his hom estead c r edit c l aim and a ll att a chment s a re tru e, correct , a n d comp lete to the b e st of my know l edge an d b e lief.

.00

.00

.00 .00

Household Income

Sign

Here

ATTACH r e n t c er tifi c a t e or pro p er ty tax bil l

For Department Use Only

C

( )

Check below then fill in either the name of city,

village, or town, and the county in which you lived

at th e end o f 2016.

City

Wisconsin

homeste ad c r e d it

2016

H‑EZ

County of

Legal rst nameClaimant’s legal last name

Spouse’s legal rst nameSpouse’s legal last name

Current home address (number and street)

StateCity or post ofce Zip code

Spouse’s social security number

M.I.

M.I.

City, village,

or town

Village Town

Special

conditions

(See page 7 of the

Schedule H instructions.)

Apt. no.

Claimant’s social security number

Check here if

an amended return

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

If you qualify for homestead credit, you may be able to use

Schedule H-EZ to file your claim. See “Do you Qualify?”

and “Which Schedule to File” on page 4 of the Schedule H

instructions.

Filling in Schedule H-EZ Use black ink. Round off cents

(drop amounts under 50¢ and increase amounts from 50¢ to 99¢

to the next dollar). Do not use commas or dollar signs.

Amending Schedule H-EZ See “Amending Schedule H or

H-EZ” on page 6 of the Schedule H instructions.

STEP 1: CLAIMANT INFORMATION

Print or type all information requested in the spaces provided.

Include your social security number (and your spouse’s, if

applicable) and your tax district. Do not use an address label.

STEP 2: QUESTIONS

Complete lines 1 through 3. For more information on legal

residency, see the instructions for line 2 of Schedule H.

STEP 3: HOUSEHOLD INCOME

Note: If your spouse died in 2016, see Part 5 on page 16 of the

Schedule H instructions before you continue.

Line 4 – Income from Tax Return Fill in the income from

your 2016 Wisconsin income tax return. For more information,

including instructions for when you have already f iled your return,

see the instructions for line 7 of Schedule H.

Line 5 – Income - No Tax Return Fill in your total (and

your spouse’s total, if married) wages, interest, dividends,

and other income taxable to Wisconsin on lines 5a and 5b.

Attach a separate schedule if more space is needed. For more

information, including an available subtraction for medical and

long-term care insurance costs, see the instructions for line 8

of Schedule H.

Lines 6a through 6i – Nontaxable Income Fill in all nontaxable

household income received in 2016 from any of the sources

indicated. If you are married, combine the incomes of both

spouses. Do not include amounts reported on line 4, 5a, or 5b.

For more information, see the instructions for lines 9a through

9g, 9i, and 9j of Schedule H. Note: Include Medicare premium

deductions i n a ny amounts entered on lines 6b or 6c.

Line 7a Is the amount on line 7a less than your rent or property

taxes? If yes, attach a note explaining how you paid your rent

or property taxes and your other living expenses (food, utilities,

clothing, etc.).

Line 7b – Qualifying Dependents Fill in the number of

qualifying dependents. Multiply that amount by $500. Fill in the

result on line 7b. For a definition of “qualifying dependent,” see

the instructions for line 12b of Schedule H.

STEP 4: TAXES AND/OR RENT

Homeowners – Fill in the net 2016 property taxes on your

homestead on line 8. For more information, including a definition

of “net property taxes,” see the instructions for line 13 of

Schedule H.

Renters – Complete lines 9a and 9b if heat was included in

your rent and/or lines 9c and 9d if heat was not included. For

more information, see the instructions for line 14 of Schedule H.

Exception Do any of the following apply to you? If yes, you

may be requi re d to re duc e you r net pr op erty ta xes an d /or rent

or attach additional information to Schedule H-EZ.

• You owned/rented a mobile or manufactured home and/or the

land on which it was located (see item 3 under Exceptions:

Homeowners on page 12 of the Schedule H instructions and

item 4 under Exceptions: Renters on page 12).

• There are names on the property tax b ill other th an yours or

your spouse’ s and/or you owned your homestead with others

in 2016 (see items 1 and 2 under Exceptions: Homeowners

on page 11 of the Schedule H instructions).

• The property tax bill does not show any lottery and gaming

credit (see item 5 under Exceptions: Homeowners on page 12

of the Schedule H instructions).

• You moved during 2016 (see item 2 under Exception:

Homeowners and/or Renters on page 13 of the Schedule H

instructions).

• You received a) any Wisconsin Works (W2) payments or

b) county relief of $400 or more for any month of 2016.

Complete the Taxes/Rent Reduction Schedule below.

Instructions for Schedule H-EZ

STEP 5: CREDIT COMPUTATION

Lines 11 through 14 – Refer to Tables A and B on pages 17

and 18 of the Schedule H instructions to determine your home-

stead credit. If filing a Wisconsin income tax return, fill in the

credit amount on line 31 of Form 1A or line 45 of Form 1. Do

you want the Department of Revenue to compute your credit?

If yes, do not complete these lines. The department will notify

you of the amount of your credit.

STEP 6: SIGNING AND FILING YOUR CLAIM

Sign and Date Your Claim You must sign and date your

Schedule H-EZ. If married, your spouse must also sign. Note:

A homestead credit claim may not be signed for or filed on behalf

of a deceased person.

How to Assemble Before filing Schedule H-EZ, see “How to

Assemble” on page 14 of the Schedule H instructions.

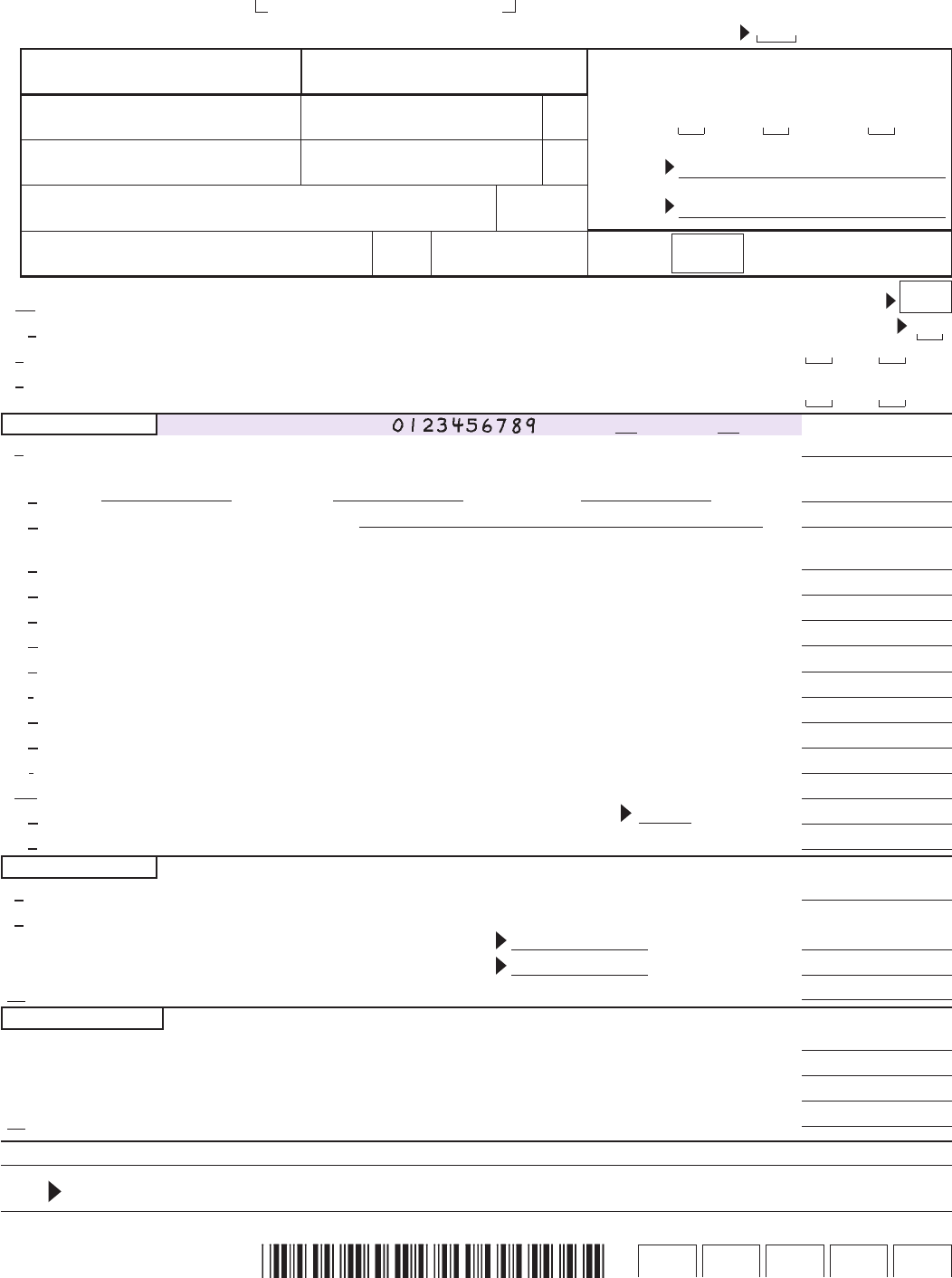

1 Homeown ers – f ill in the net 2016

property taxes on your homestead ............... 1

2

Renters – if heat was included,

fill in 20% (.20)

,

or if heat was not included, fill in 25% (.25),

of rent from line 8a of the rent certificate(s) . 2

3

Add li ne 1 and line 2; fill in the smalle r

of the total or $1,460 ..................................... 3

4

Divide line 3 by 12 ........................................ 4

5

Num ber of mont hs in 2016 for w hich you di d

not receive a) any Wisconsin Works (W2)

payments or b) county relief payments of

$400 or more ................................................ 5

6

Multiply line 4 by line 5. Fill in here and

on line 10 (do not fill in line 8 or 9)

of Schedule H-EZ ......................................... 6

Taxes/Rent Reduction Schedule

Age 65 or older? The Property Tax Deferral Loan Program

can help pay your property taxes. See page 3 of Schedule H

for more information.