Fillable Printable 2016 Ic-092 Form 9B Miscellaneous Income (Fillable)

Fillable Printable 2016 Ic-092 Form 9B Miscellaneous Income (Fillable)

2016 Ic-092 Form 9B Miscellaneous Income (Fillable)

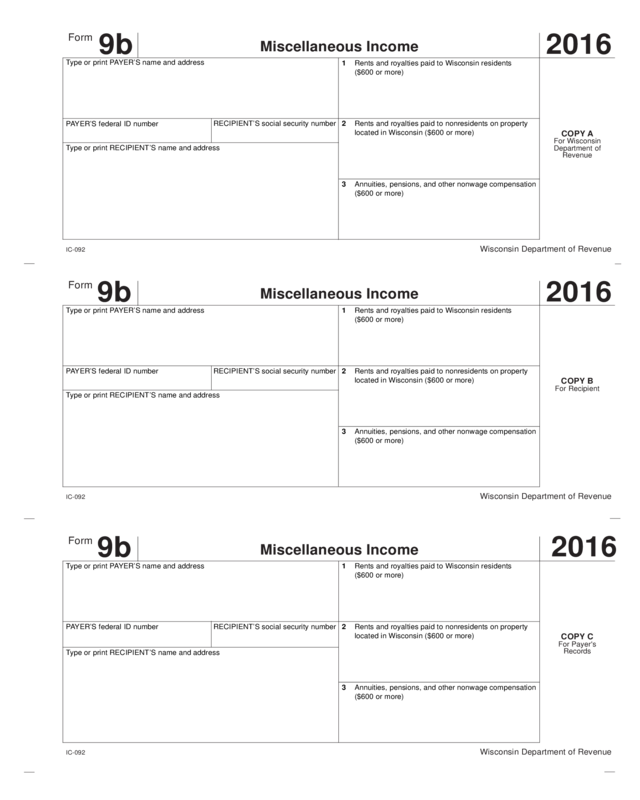

IC-092 Wisconsin Department of Revenue

Type or print PAYER’S name and address

PAYER’S federal ID number

Type or print RECIPIENT’S name and address

RECIPIENT’S social security number

1

Rents and royalties paid to Wisconsin residents

($600 or more)

2 Rents and royalties paid to nonresidents on property

located in Wisconsin ($600 or more)

3 Annuities, pensions, and other nonwage compensation

($600 or more)

COPY A

For Wisconsin

Department of

Revenue

2016

Miscellaneous Income

IC-092 Wisconsin Department of Revenue

Type or print PAYER’S name and address 1 Rents and royalties paid to Wisconsin residents

($600 or more)

2 Rents and royalties paid to nonresidents on property

located in Wisconsin ($600 or more)

3 Annuities, pensions, and other nonwage compensation

($600 or more)

COPY C

For Payer's

Records

2016

Miscellaneous Income

Miscellaneous Income

IC-092 Wisconsin Department of Revenue

Type or print PAYER’S name and address

PAYER’S federal ID number

Type or print RECIPIENT’S name and address

RECIPIENT’S social security number

1 Rents and royalties paid to Wisconsin residents

($600 or more)

2 Rents and royalties paid to nonresidents on property

located in Wisconsin ($600 or more)

3 Annuities, pensions, and other nonwage compensation

($600 or more)

COPY B

For Recipient

2016

PAYER’S federal ID number

Type or print RECIPIENT’S name and address

RECIPIENT’S social security number

Form

9b

Form

9b

Form

9b

Instructions

Tab to navigate within form. Information from Copy A

will copy to B and C.

Save

Print

Clear

Instructions for 2016 Form 9b

Item to Note: Federal Form 1099-MISC, 1099-R, or W-2, as appropriate, may be used (or may be required) instead of

Wisconsin Form 9b. The due dates shown below also apply to these forms.

Who Must File Form 9b?

Individuals, duciaries, partnerships, limited liability companies, and corporations doing business in Wisconsin and making

payments to individuals of rents, royalties, or certain nonwage compensation must le Form 9b. Payers other than corpora-

tions must report rents and royalties only if the payer deducts the payments in computing Wisconsin net income. Amounts

not properly reported on Form 9b may be disallowed as deductions. Failure to le Form 9b by the due dates listed below,

or ling an incorrect or incomplete Form 9b due to willful neglect, may result in a penalty of $10 for each violation.

Note: If you must le federal information returns electronically, you generally must le Wisconsin information returns

electronically. For more information, see Publications 117 and 172 on the Department’s web site at revenue.wi.gov, call

(608) 266-2776, e-mail DORW-2DataQuestions, or write to the W-2 Coordinator, Wisconsin Department of Revenue, PO

Box 8906, Madison, Wl 53708-8906.

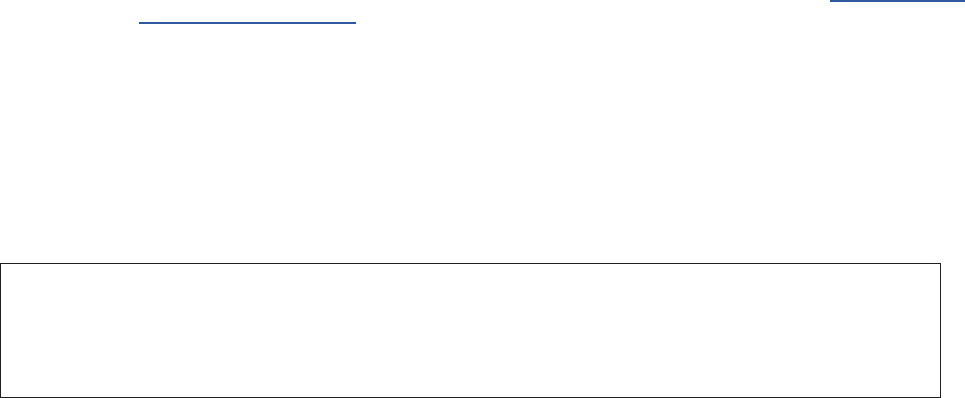

What is the Due Date for Filing Form 9b?

The due date for ling Form 9b with the Department of Revenue depends on the type of payer (corporate or noncorporate)

and the type of payment being reported (nonwage payments, rents, or royalties). The chart below summarizes the due

dates for ling the 2016 Form 9b with the Department of Revenue. (Note: The person ling the Form 9b with the Depart-

ment of Revenue is required to furnish the recipient of the payment with a copy of the Form 9b by January 31, 2017.)

Where Do I File Form 9b?

Send Copy A of the Form 9b to: Wisconsin Department of Revenue

PO Box 8920

Madison, Wl 53708-8920

Give Copy B of Form 9b to the recipient of the payment and keep Copy C for your records.

Specic Instructions

Note: If state, county, or stadium sales taxes are imposed on the service provider and you (as the buyer) pay them to the

service provider, report them on Form 9b as part of the reportable payment. However, if sales taxes are imposed on you

(as the buyer) and collected from you by the service provider, do not report the sales taxes on Form 9b.

Box 1. Report rents and royalties of $600 or more paid to a Wisconsin resident, regardless of the location of the property

to which such payments relate.

Box 2. Report rents and royalties of $600 or more paid to a nonresident on property located in Wisconsin.

Box 3. Report annuities, pensions, and other nonwage compensation of $600 or more paid to Wisconsin residents, and

payments of $600 or more made to nonresidents for services performed in Wisconsin.

If an employee receives wages subject to withholding and additional amounts not subject to withholding, report the total

compensation on a wage statement Form W-2, not on Form 9b.

If you have withheld Wisconsin income taxes from annuities, pensions, or nonwage compensation, you must le Form

1099 or W-2, as appropriate, instead of Form 9b.

Type of Payment Type of Payer Due Date Extension Available

Nonwage ................All ..............March 1, 2017 ...........60 days

Rent or Royalty ......... Noncorporate .........March 1, 2017 ...........60 days

Rent or Royalty ..........Corporation ..........March 15, 2017. . . . . . . . . . . 60 days

Return to Page 1

Return to Page 1