Fillable Printable 2017 Form 3522 Llc Tax Voucher

Fillable Printable 2017 Form 3522 Llc Tax Voucher

2017 Form 3522 Llc Tax Voucher

FTB 3522 2016

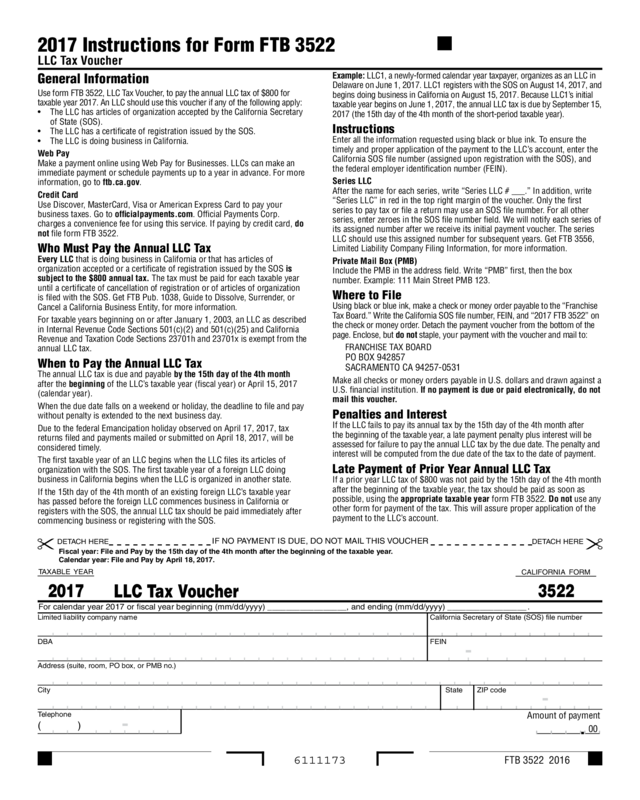

2017 Instructions for Form FTB 3522

LLC Tax Voucher

General Information

Use form FTB 3522, LLC Tax Voucher, to pay the annual LLC tax of $800 for

taxable year 2017. An LLC should use this voucher if any of the following apply:

• The LLC has articles of organization accepted by the California Secretary

of State (SOS).

• The LLC has a certificate of registration issued by the SOS.

• The LLC is doing business in California.

Web Pay

Make a payment online using Web Pay for Businesses. LLCs can make an

immediate payment or schedule payments up to a year in advance. For more

information, go to ftb.ca.gov.

Credit Card

Use Discover, MasterCard, Visa or American Express Card to pay your

business taxes. Go to officialpayments.com. Official Payments Corp.

charges a convenience fee for using this service. If paying by credit card, do

not file form FTB 3522.

Who Must Pay the Annual LLC Tax

Every LLC that is doing business in California or that has articles of

organization accepted or a certificate of registration issued by the SOS is

subject to the $800 annual tax. The tax must be paid for each taxable year

until a certificate of cancellation of registration or of articles of organization

is filed with the SOS. Get FTB Pub. 1038, Guide to Dissolve, Surrender, or

Cancel a California Business Entity, for more information.

For taxable years beginning on or after January 1, 2003, an LLC as described

in Internal Revenue Code Sections 501(c)(2) and 501(c)(25) and California

Revenue and Taxation Code Sections 23701h and 23701x is exempt from the

annual LLC tax.

When to Pay the Annual LLC Tax

The annual LLC tax is due and payable by the 15th day of the 4th month

after the beginning of the LLC’s taxable year (fiscal year) or April 15, 2017

(calendar year).

When the due date falls on a weekend or holiday, the deadline to file and pay

without penalty is extended to the next business day.

Due to the federal Emancipation holiday observed on April 17, 2017, tax

returns filed and payments mailed or submitted on April 18, 2017, will be

considered timely.

The first taxable year of an LLC begins when the LLC files its articles of

organization with the SOS. The first taxable year of a foreign LLC doing

business in California begins when the LLC is organized in another state.

If the 15th day of the 4th month of an existing foreign LLC’s taxable year

has passed before the foreign LLC commences business in California or

registers with the SOS, the annual LLC tax should be paid immediately after

commencing business or registering with the SOS.

Example: LLC1, a newly-formed calendar year taxpayer, organizes as an LLC in

Delaware on June 1, 2017. LLC1 registers with the SOS on August 14, 2017, and

begins doing business in California on August 15, 2017. Because LLC1’s initial

taxable year begins on June 1, 2017, the annual LLC tax is due by September 15,

2017 (the 15th day of the 4th month of the short-period taxable year).

Instructions

Enter all the information requested using black or blue ink. To ensure the

timely and proper application of the payment to the LLC’s account, enter the

California SOS file number (assigned upon registration with the SOS), and

the federal employer identification number (FEIN).

Series LLC

After the name for each series, write “Series LLC # ___.” In addition, write

“Series LLC” in red in the top right margin of the voucher. Only the first

series to pay tax or file a return may use an SOS file number. For all other

series, enter zeroes in the SOS file number field. We will notify each series of

its assigned number after we receive its initial payment voucher. The series

LLC should use this assigned number for subsequent years. Get FTB 3556,

Limited Liability Company Filing Information, for more information.

Private Mail Box (PMB)

Include the PMB in the address field. Write “PMB” first, then the box

number. Example: 111 Main Street PMB 123.

Where to File

Using black or blue ink, make a check or money order payable to the “Franchise

Tax Board.” Write the California SOS file number, FEIN, and “2017 FTB 3522” on

the check or money order. Detach the payment voucher from the bottom of the

page. Enclose, but do not staple, your payment with the voucher and mail to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA 94257-0531

Make all checks or money orders payable in U.S. dollars and drawn against a

U.S. financial institution. If no payment is due or paid electronically, do not

mail this voucher.

Penalties and Interest

If the LLC fails to pay its annual tax by the 15th day of the 4th month after

the beginning of the taxable year, a late payment penalty plus interest will be

assessed for failure to pay the annual LLC tax by the due date. The penalty and

interest will be computed from the due date of the tax to the date of payment.

Late Payment of Prior Year Annual LLC Tax

If a prior year LLC tax of $800 was not paid by the 15th day of the 4th month

after the beginning of the taxable year, the tax should be paid as soon as

possible, using the appropriate taxable year

form FTB 3522. Do not use any

other form for payment of the tax. This will assure proper application of the

payment to the LLC’s account.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER

DETACH HERE

Fiscal year: File and Pay by the 15th day of the 4th month after the beginning of the taxable year.

Calendar year: File and Pay by April 18, 2017.

TAXABLE YEAR

2017

LLC Tax Voucher

CALIFORNIA FORM

3522

For calendar year 2017 or fiscal year beginning (mm/dd/yyyy) _________________, and ending (mm/dd/yyyy) _________________ .

Limited liability company name California Secretary of State (SOS) file number

DBA FEIN

Address (suite, room, PO box, or PMB no.)

City State ZIP code

Telephone

( )

-

-

Amount of payment

6111173

-

.

00