Fillable Printable 2017 Form 540-Es Estimated Tax For Individuals

Fillable Printable 2017 Form 540-Es Estimated Tax For Individuals

2017 Form 540-Es Estimated Tax For Individuals

ONLINE SERVICES: Use Web Pay and enjoy the ease of our free online payment service.

Go to ftb.ca.gov for more information. You can schedule your payments

up to one year in advance.

Do not mail this form if you use Web Pay.

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

CAUTION: You may be required to pay electronically. See instructions.

Your first name Last name

Initial

If joint payment, spouse’s/RDP’s first name

Last name

Initial

Address (number and street) PO box or PMB no.

Apt no./ste. no.

City (If you have a foreign address, see instructions)

State

ZIP code

Your SSN or ITIN

Spouse’s/RDP’s SSN or ITIN

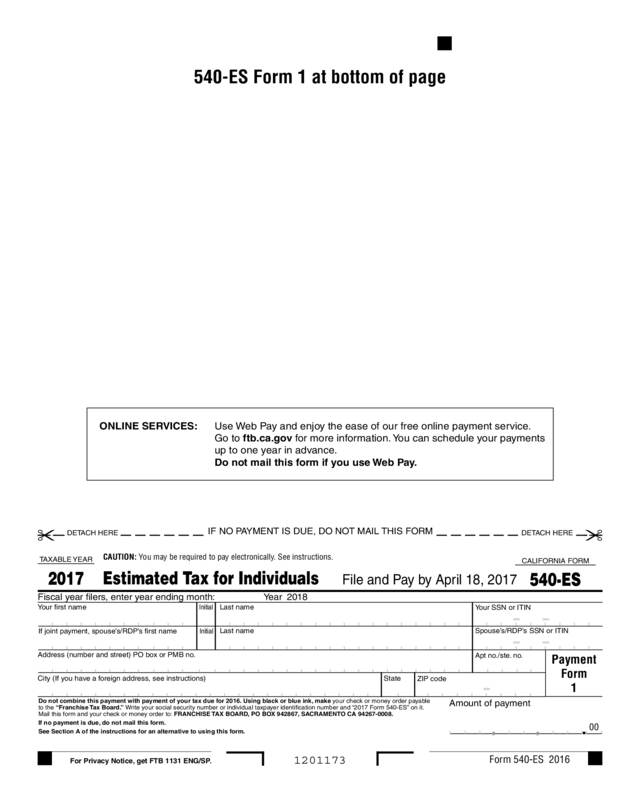

540-ES Form 1 at bottom of page

1201173

TAXABLE YEAR

2017

Estimated Tax for Individuals

CALIFORNIA FORM

540-ES

File and Pay by April 18, 2017

Fiscal year filers, enter year ending month: Year 2018

Payment

Form

1

Amount of payment

Form 540-ES 2016

DETACH HERE DETACH HERE

.

,

,

00

Do not combine this payment with payment of your tax due for 2016. Using black or blue ink, make your check or money order payable

to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2017 Form 540-ES” on it.

Mail this form and your check or mone

y order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

If no payment is due, do not mail this form.

See Section A of the instructions for an alternative to using this form.

For Privacy Notice, get FTB 1131 ENG/SP.

CAUTION: You may be required to pay electronically. See instructions.

TAXABLE YEAR

2017

Estimated Tax for Individuals

CALIFORNIA FORM

540-ES

File and Pay by June 15, 2017

Payment

Form

2

Fiscal year filers, enter year ending month: Year 2018

Your first name Last name

Initial

If joint payment, spouse’s/RDP’s first name

Last name

Initial

Address (number and street) PO box or PMB no.

Apt no./ste. no.

City (If you have a foreign address, see instructions)

State

ZIP code

Your SSN or ITIN

Spouse’s/RDP’s SSN or ITIN

Do not combine this payment with payment of your tax due for 2016. Using black or blue ink, make your check or money order payable

to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2017 Form 540-ES” on it.

Mail this form and your check or mone

y order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

If no payment is due, do not mail this form.

See Section A of the instructions for an alternative to using this form.

Amount of payment

For Privacy Notice, get FTB 1131 ENG/SP.

Your first name Last name

Initial

If joint payment, spouse’s/RDP’s first name

Last name

Initial

Address (number and street) PO box or PMB no.

Apt no./ste. no.

City (If you have a foreign address, see instructions)

State

ZIP code

Your SSN or ITIN

Spouse’s/RDP’s SSN or ITIN

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

CAUTION: You may be required to pay electronically. See instructions.

TAXABLE YEAR

2017

Estimated Tax for Individuals

CALIFORNIA FORM

540-ES

File and Pay by Sept. 15, 2017

Fiscal year filers, enter year ending month: Year 2018

Payment

Form

3

Do not combine this payment with payment of your tax due for 2016. Using black or blue ink, make

your check or money order payable

to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2017 Form 540-ES” on it.

Mail this f

orm and your chec

k or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

If no payment is due, do not mail this form.

See Section A of the instructions for an alternative to using this form.

For Privacy Notice, get FTB 1131 ENG/SP.

Amount of payment

DETACH HERE DETACH HERE

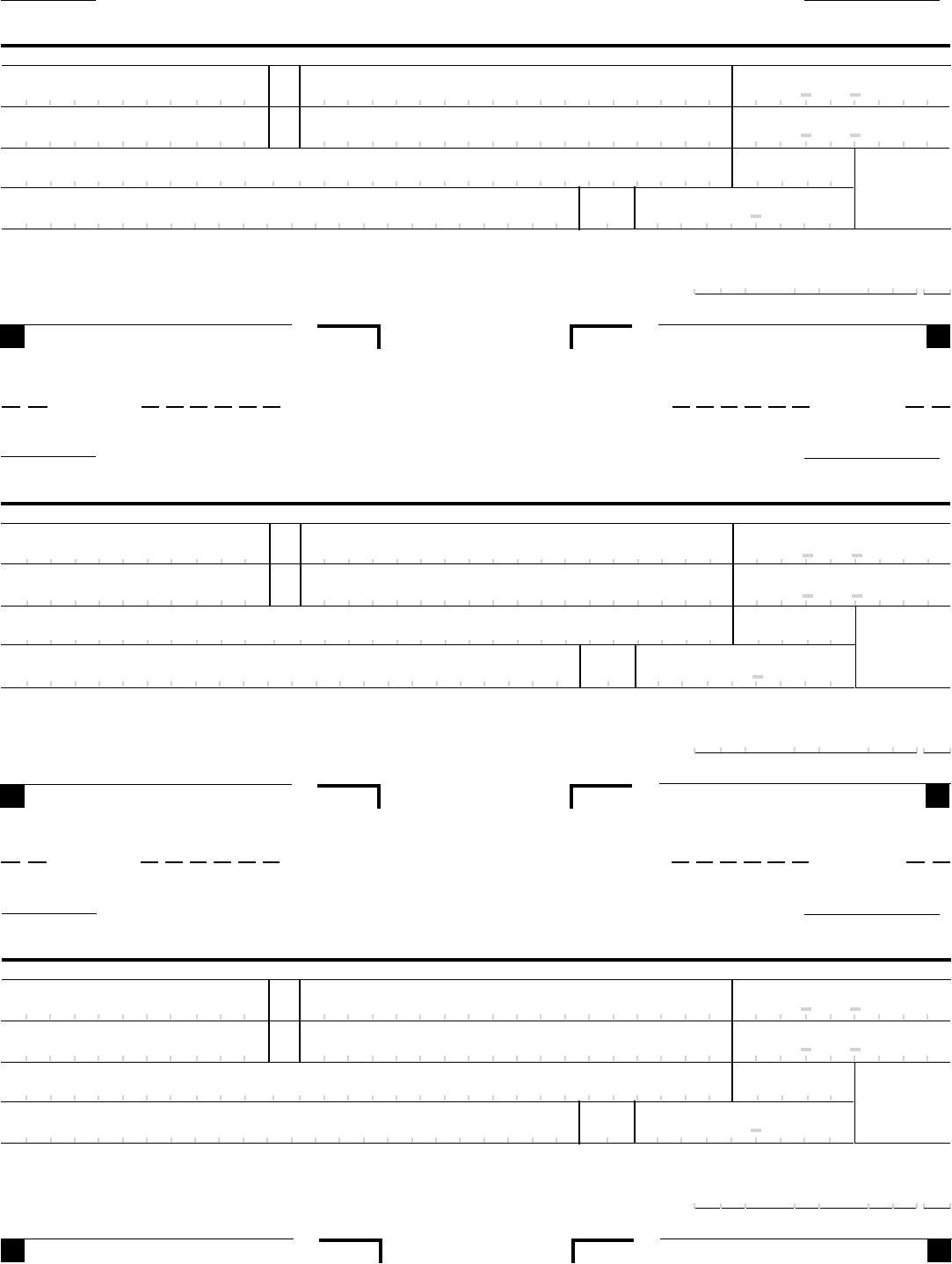

Your first name Last name

Initial

If joint payment, spouse’s/RDP’s first name

Last name

Initial

Address (number and street) PO box or PMB no.

Apt no./ste. no.

City (If you have a foreign address, see instructions)

State

ZIP code

Your SSN or ITIN

Spouse’s/RDP’s SSN or ITIN

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

CAUTION: You may be required to pay electronically. See instructions.

TAXABLE YEAR

2017

Estimated Tax for Individuals

CALIFORNIA FORM

540-ES

File and Pay by Jan. 16, 2018

Fiscal year filers, enter year ending month: Year 2018

Payment

Form

4

Amount of payment

DETACH HERE DETACH HERE

.

,

,

00

.

,

,

00

.

,

,

00

Do not combine this payment with payment of your tax due for 2016. Using black or blue ink, make your check or money order payable

to the “Franchise Tax Board.” Write your social security number or individual taxpayer identification number and “2017 Form 540-ES” on it. Mail

this form and your chec

k or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008.

If no payment is due, do not mail this form.

See Section A of the instructions for an alternative to using this form.

1201173

Form 540-ES 2016

1201173

Form 540-ES 2016

1201173

Form 540-ES 2016

For Privacy Notice, get FTB 1131 ENG/SP.