Fillable Printable 2017 Form 588 Nonresident Withholding Waiver Request

Fillable Printable 2017 Form 588 Nonresident Withholding Waiver Request

2017 Form 588 Nonresident Withholding Waiver Request

Form 588 2017 Side 1

( )

( )

( )

( )

( )

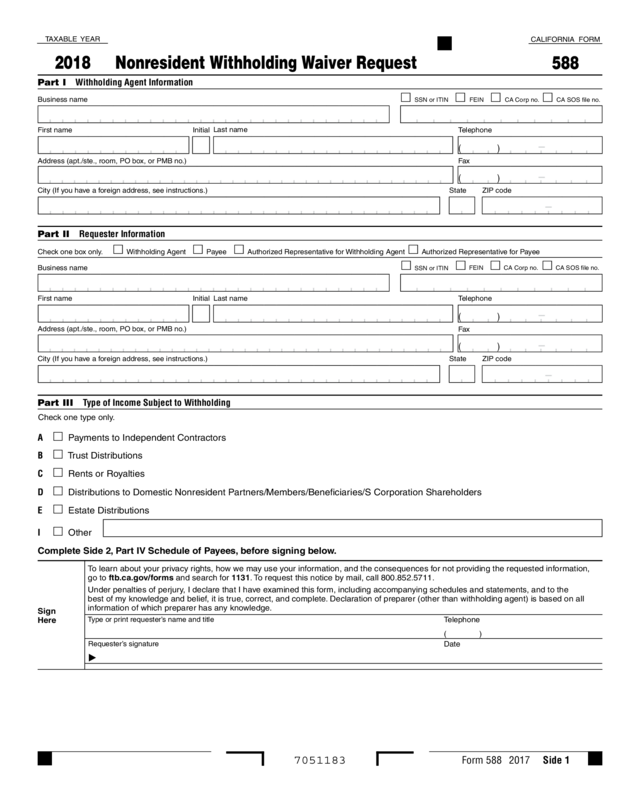

TAXABLE YEAR

2018

Nonresident Withholding Waiver Request

CALIFORNIA FORM

588

Part I Withholding Agent Information

Part II Requester Information

Part III Type of Income Subject to Withholding

Business name

Business name

SSN or ITIN

SSN or ITIN

FEIN

FEIN

CA Corp no.

CA Corp no.

CA SOS file no.

CA SOS file no.

First name

First name

Check one box only.

Check one type only.

Withholding Agent

Payee Authorized Representative for Withholding Agent Authorized Representative for Payee

Initial

Initial

Last name

Last name

Telephone

Telephone

Telephone

Date

Fax

Fax

State

State

ZIP code

ZIP code

Address (apt./ste., room, PO box, or PMB no.)

Address (apt./ste., room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.)

City (If you have a foreign address, see instructions.)

A Payments to Independent Contractors

B Trust Distributions

I Other

C Rents or Royalties

D Distributions to Domestic Nonresident Partners/Members/Beneficiaries/S Corporation Shareholders

E Estate Distributions

Complete Side 2, Part IV Schedule of Payees, before signing below.

Sign

Here

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information,

go to ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the

best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all

information of which preparer has any knowledge.

Type or print requester’s name and title

Requester’s signature

7051183

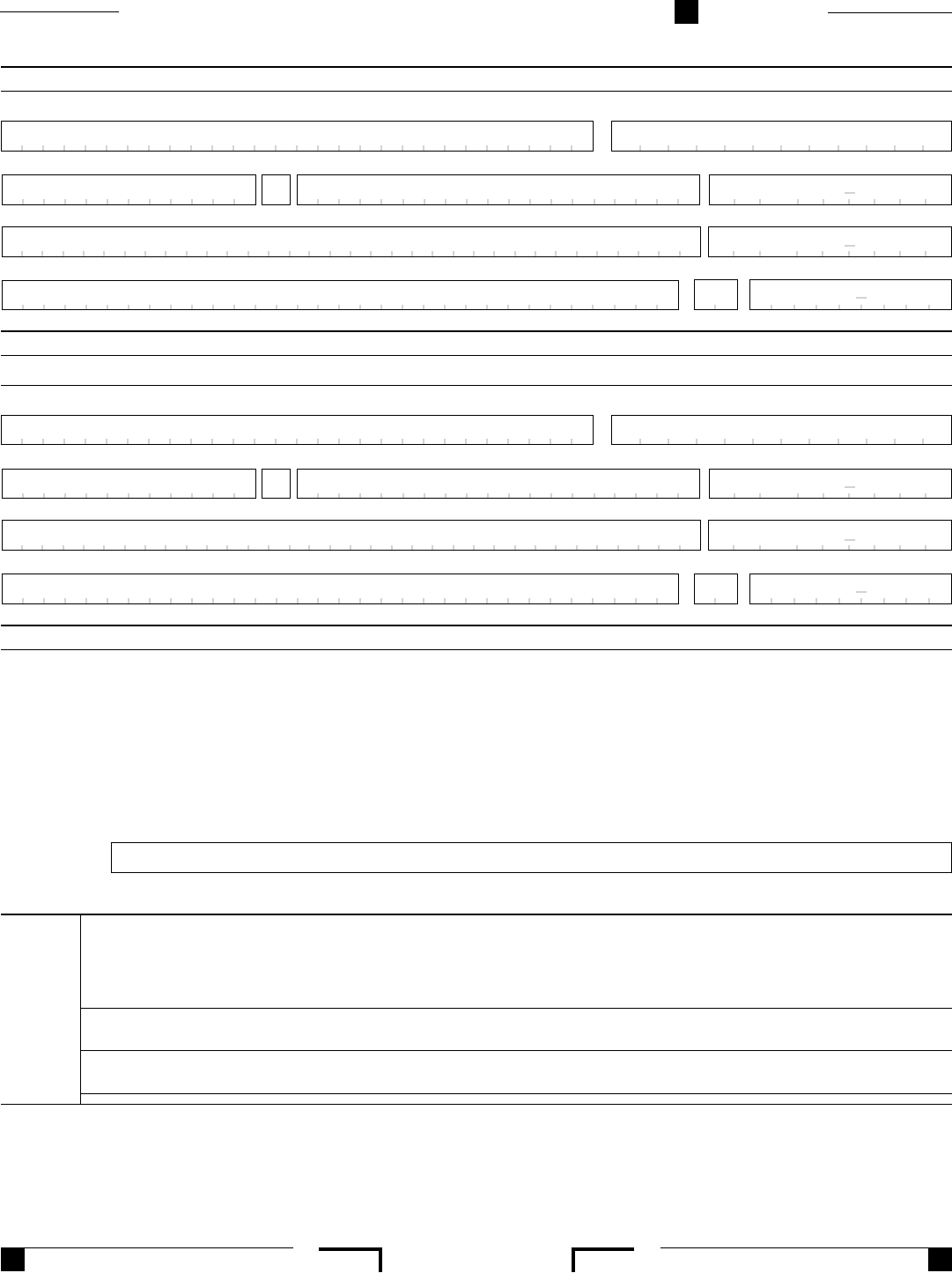

Side 2 Form 588 2017

Requester Name: Requester TIN:

Part IV Schedule of Payees

Do not use your own version of the Schedule of Payees to report additional payees. We can only accept and process additional payees reported on this form. See instructions.

Business name

Business name

Business name

SSN or ITIN

FEIN CA Corp no.

CA Corp no.

CA Corp no.

CA SOS file no.

First name

First name

First name

Initial

Initial

Initial

Last name

Last name

Last name

Address (apt./ste., room, PO box, or PMB no.)

Address (apt./ste., room, PO box, or PMB no.)

Address (apt./ste., room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.)

City (If you have a foreign address, see instructions.)

City (If you have a foreign address, see instructions.)

Reason for Waiver Request (Check box next to one Reason Code.)

Reason for Waiver Request (Check box next to one Reason Code.)

Reason for Waiver Request (Check box next to one Reason Code.)

Newly Admitted Date (mm/dd/yyyy) (Must be included when selecting Reason Code “D.”)

Newly Admitted Date (mm/dd/yyyy) (Must be included when selecting Reason Code “D.”)

Newly Admitted Date (mm/dd/yyyy) (Must be included when selecting Reason Code “D.”)

A B C D E

A B C D E

A B C D E

State

State

State

ZIP code

ZIP code

ZIP code

SSN or ITIN

SSN or ITIN

FEIN

FEIN

CA SOS file no.

CA SOS file no.

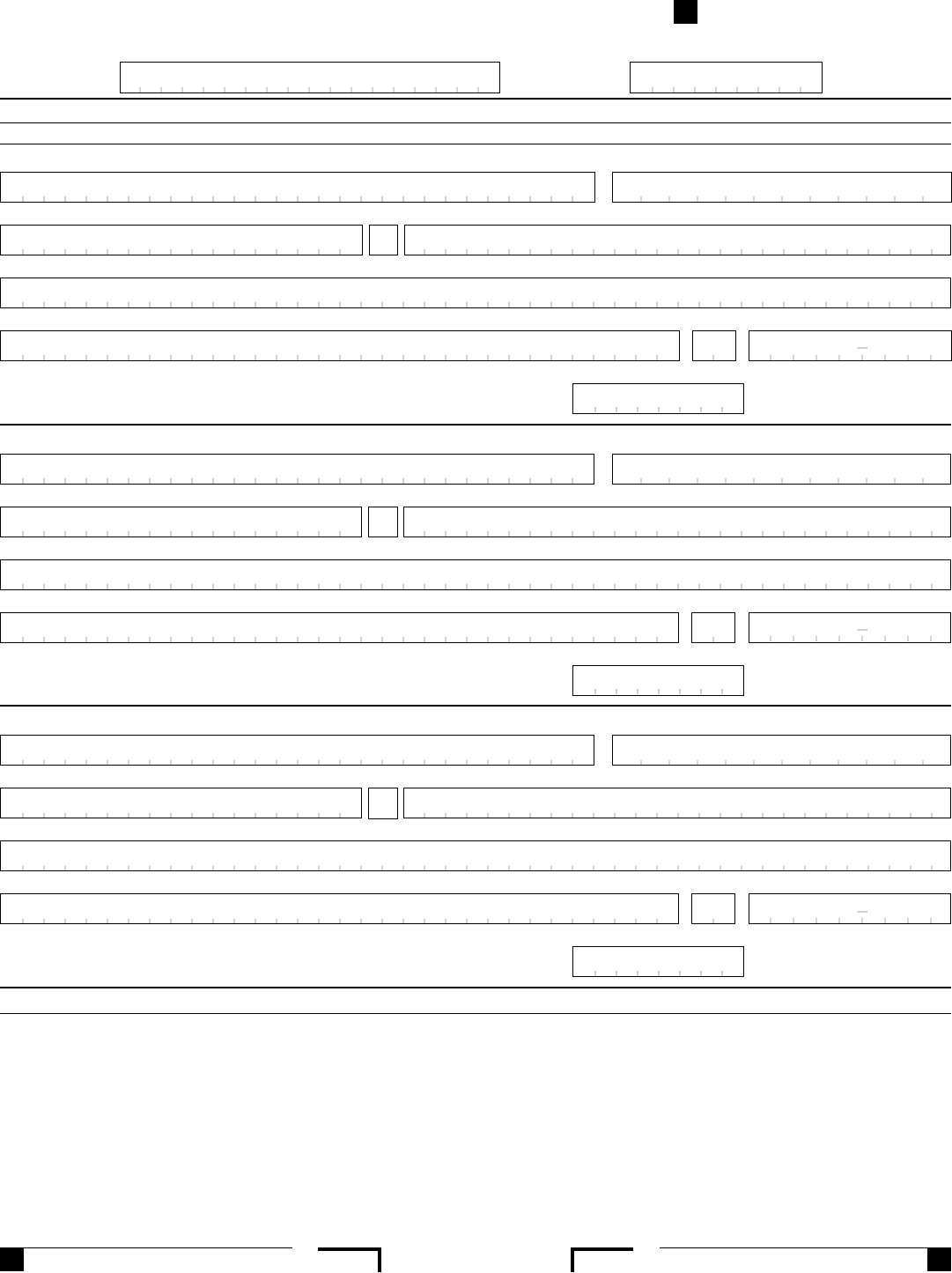

Waiver Request Reason Codes

A Payee has California state tax returns on file for the two most current taxable years in which the payee has a filing requirement. Payee is considered

current on any tax obligations with the Franchise Tax Board (FTB).

B Payee is making timely estimated tax payments for the current taxable year. Payee is considered current on any tax obligations with the FTB.

C Payee is a corporation that is not qualified to do business and does not have a permanent place of business in California but is filing a tax return

based on a combined report with a corporation that does have a permanent place of business in California. Attach a copy of Schedule R-7, Election to

File a Unitary Taxpayers’ Group Return, from the combined report.

D Payee is a newly admitted S corporation shareholder, partner of a partnership, or member of a limited liability company. In the “Newly Admitted Date”

box, provide the date this shareholder, partner, or member was admitted. The waiver will expire at the end of the calendar year succeeding the date

the payee was newly admitted. Once expired, the payee must have the most current California tax return due on file or estimated tax payments for the

current taxable year in order to have a new waiver granted.

E Other – Attach a specific reason and include substantiation that would justify a waiver from withholding. If payee is a group return participant, attach a

copy of Schedule 1067A, Nonresident Group Return Schedule, from the group return.

7052183