Fillable Printable 2848 Iowa Power of Attorney Form

Fillable Printable 2848 Iowa Power of Attorney Form

2848 Iowa Power of Attorney Form

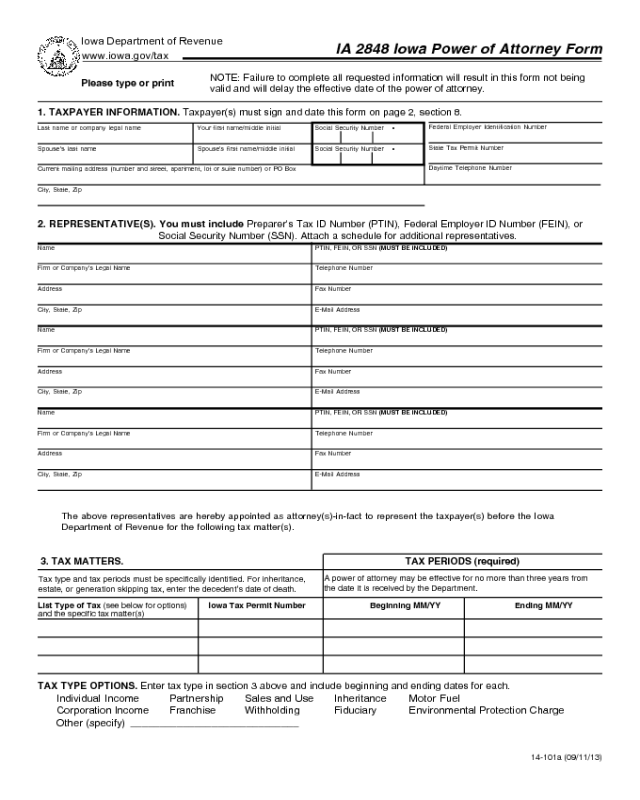

IA 2848 Iowa Power of Attorney Form

NOTE: Failure to complete all requested information will result in this form not being

valid and will delay the effective date of the power of attorney.

www.iowa.gov/tax

Iowa Department of Revenue

2. REPRESENTATIVE(S). You must include Preparer’s Tax ID Number (PTIN), Federal Employer ID Number (FEIN), or

Social Security Number (SSN). Attach a schedule for additional representatives.

Name PTIN, FEIN, OR SSN (MUST BE INCLUDED)

Firm or Company’s Legal Name Telephone Number

Address Fax Number

City, State, Zip E-Mail Address

Name PTIN, FEIN, OR SSN (MUST BE INCLUDED)

Firm or Company’s Legal Name Telephone Number

Address Fax Number

City, State, Zip E-Mail Address

Name PTIN, FEIN, OR SSN (MUST BE INCLUDED)

Firm or Company’s Legal Name Telephone Number

Address Fax Number

City, State, Zip E-Mail Address

Please type or print

The above representatives are hereby appointed as attorney(s)-in-fact to represent the taxpayer(s) before the Iowa

Department of Revenue for the following tax matter(s).

TAX TYPE OPTIONS. Enter tax type in section 3 above and include beginning and ending dates for each.

Individual Income Partnership Sales and Use Inheritance Motor Fuel

Corporation Income Franchise Withholding Fiduciary Environmental Protection Charge

Other (specify) _____________________________

14-101a (09/11/13)

A power of attorney may be effective for no more than three years from

the date it is received by the Department.

List Type of Tax (see below for options) Iowa Tax Permit Number Beginning MM/YY Ending MM/YY

Tax type and tax periods must be specifically identified. For inheritance,

estate, or generation skipping tax, enter the decedent’s date of death.

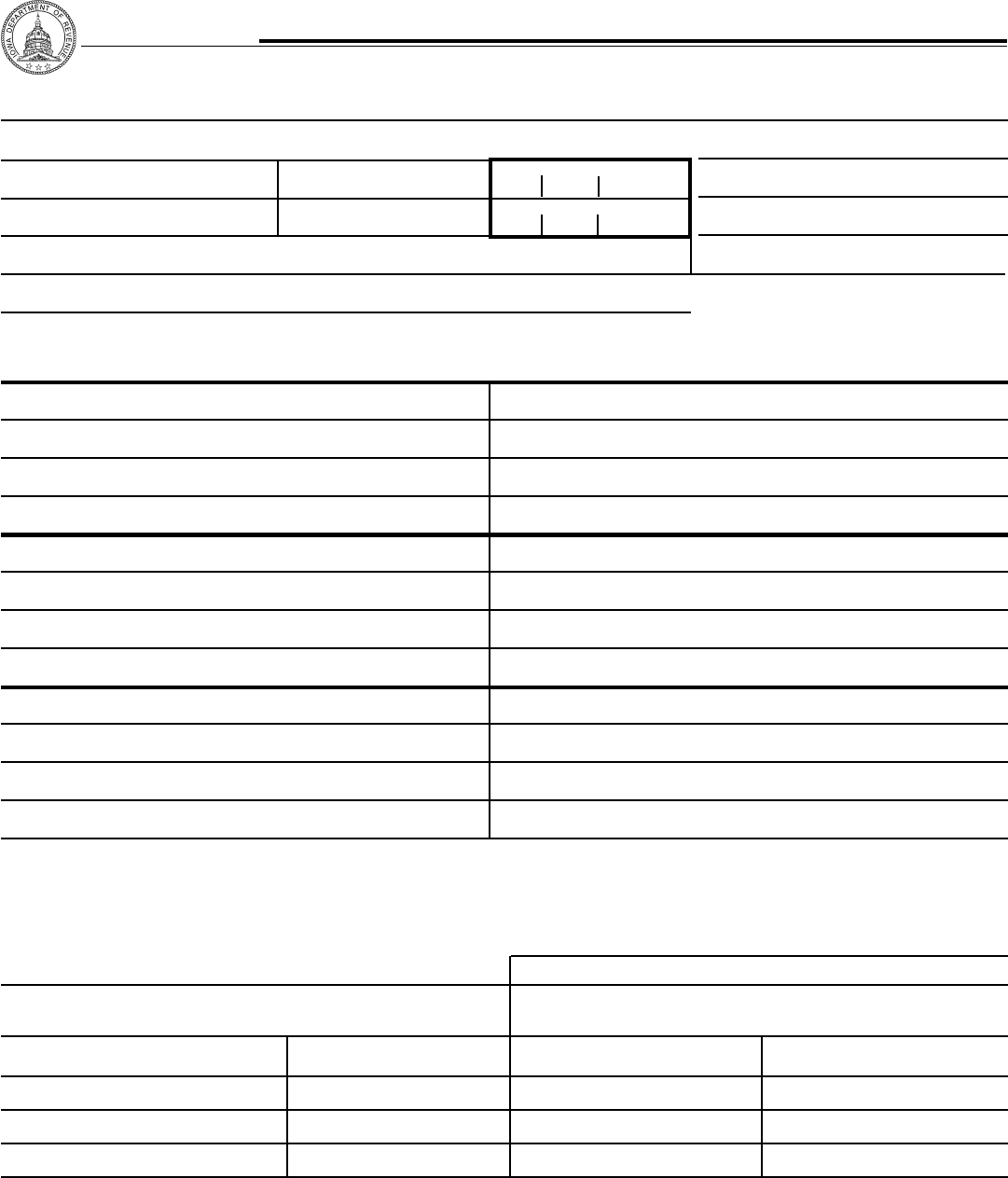

3. TAX MATTERS. TAX PERIODS (required)

Last name or company legal name Your first name/middle initial Social Security Number •

Spouse’s last name Spouse’s first name/middle initial Social Security Number •

Current mailing address (number and street, apartment, lot or suite number) or PO Box

City, State, Zip

Federal Employer Identification Number

State Tax Permit Number

Daytime Telephone Number

1. TAXPAYER INFORMATION. Taxpayer(s) must sign and date this form on page 2, section 8.

and the specific tax matter(s)

4. ACTS AUTHORIZED.

The representatives are authorized to receive and inspect confidential tax information and to perform any and all acts that

can be performed with respect to the tax matters described in section 3; for example, negotiate the authority to sign any

agreements, consents, or other documents, and to represent the taxpayer(s) in any informal and formal proceeding

involving the Department. The authority does not include the power to receive refund checks (see section 5 below), the

power to substitute another representative, unless specifically added below, or the power to sign certain returns. List any

specific additions or deletions to the acts otherwise authorized in this power of attorney:

Additions: ________________________________________________________________________________________

Deletions: _________________________________________________________________________________________

5. RECEIPT OF REFUND CHECKS.

If you want to authorize a representative named in section 2 to receive, BUT NOT TO ENDORSE OR CASH, refund

checks, initial here __________and list the name of that representative below.

Name of representative to receive refund check(s): _________________________________________________________

NOTE: By initialling, this does not authorize the representative to endorse or cash refund checks.

6. NOTICES AND COMMUNICATIONS.

Original notices and other written communications will be sent to you and the taxpayer, and a copy will be sent to the first

representative listed in section 2.

7. RETENTION / REVOCATION OF PRIOR POWER(S) OF ATTORNEY.

The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Iowa

Department of Revenue for the same tax matters and years or periods covered by this document.

If you do not want to revoke a prior power of attorney, check here:

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT T O REMAIN IN EFFECT .

8. SIGNATURE OF TAXPAYER(S).

If a tax matter concerns a joint individual income tax return, the provisions of 701 IAC 7.34(1) apply.

If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on

behalf of the taxpayer: I certify that I have the authority to execute this form on behalf of the taxpayer.

________________________________________________________________________________

Signature Date

________________________________________________________________________________

Print Name Title

________________________________________________________________________________

Signature Date

________________________________________________________________________________

Print Name Title

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL NOT BE VALID,

AND THE FORM WILL BE RETURNED TO YOU.

14-101b (07/24/13)

MAIL TO:

Registration Services

Iowa Department of Revenue

PO Box 10470

Des Moines, IA 50306-0470

Or fax to:

515-281-3906

NOTE: In the case of a partnership, a power of attorney must be executed by all partners, or if executed in the name of the

partnership, by the partner or partners duly authorized to act for the partnership, who must certify that the partner(s) has

such authority .

Purpose of Form

Taxpayer information is confidential. The Iowa Department of

Revenue will discuss confidential tax information only with the

taxpayer, unless the taxpayer has a valid power of attorney

form on file with the Department.

A power of attorney is required by the Department when the

taxpayer wishes to authorize another person to perform one or

more of the following on behalf of the taxpayer:

a. To receive copies of notices or documents sent by the

Department, its representatives, or its attorneys.

b. To receive (but not to endorse and collect) checks in

payment of any refund of Iowa taxes, penalties, or

interest.

c. To request waivers (including offers of waivers) of

restrictions on assessment or collection of deficiencies in

tax and waivers of notice of disallowance of a claim for

credit or refund.

d. To request extensions of time for assessment or collection

of taxes.

e. To fully represent the taxpayer(s) in any formal or

informal meeting with the Department, hearing,

determination, final or otherwise, or appeal.

f. To enter into any compromise with the Department.

g. To execute any release from liability required by the

Department prerequisite to divulging otherwise

confidential information concerning taxpayer(s).

h. Other acts as expressly stipulated in writing by the

taxpayer.

Statute of limitations

A power of attorney may be effective for no more than three

years from the date it is received by the Department.

Specific tax periods must be identified

Each tax period must be separately stated. An unlimited

number of tax periods prior to the date on which the power of

attorney is received by the Department may be listed.

Who must sign?

Individual taxpayer. A power of attorney form must be signed

by the individual.

Joint returns. If a tax matter concerns a joint individual

income tax return, both taxpayers must sign and date.

Corporation. An officer of the corporation having authority to

legally bind the corporation must sign the power of attorney

form. The corporation must certify that the officer has such

authority.

Association. An officer of the association having authority to

legally bind the association must sign the power of attorney

form. The association must certify that the officer has such

authority.

Partnership. A power of attorney must be signed by all

partners, or if executed in the name of the partnership, by the

partner or partners duly authorized to act for the partnership,

who must certify that the partner(s) has such authority.

Canceling a power of attorney

A power of attorney may be revoked by a taxpayer at any time

by filing a statement of revocation with the Department. The

statement must indicate that the authority of the previous

power of attorney is revoked and must be signed and dated by

the taxpayer. Also, the name and address of each representative

whose authority is revoked must be listed or a copy of the

power of attorney must be attached. Revocation of the

authority to represent the taxpayer before the Department will

be effective on the date received by the Department.

Submitting a new power of attorney

A new power of attorney for a particular tax type(s) and tax

period(s) revokes a prior power of attorney for those tax

type(s) and tax period(s), unless the taxpayer indicates on the

new power of attorney form that a prior power of attorney is to

remain in effect. The effective date of a new power of attorney

is the date it is received by the Department.

For a previously-designated representative to remain as the

taxpayer’s representative when a new power of attorney form

is filed, a taxpayer must attach a copy of the prior power of

attorney form that designates the representative that the

taxpayer wishes to retain.

Withdrawing as a representative

A representative may withdraw from representing a taxpayer

by filing a statement with the Department. The statement must

be signed and dated by the representative and must identify the

name and address of the taxpayer(s) and the matter(s) from

which the representative is withdrawing.

Federal power of attorney

The Federal Power of Attorney form or a Military Power of

Attorney is accepted by the Iowa Department of Revenue. To

be valid, the Federal or Military form must include a statement

that it is applicable for Iowa purposes at the time it is executed.

In the case of a previously executed Federal or Military Power

of Attorney subsequently revised to apply for Iowa purposes, it

must contain a written statement that indicates it is being

submitted for use with State of Iowa forms and the statement

needs to be initialed by the taxpayer.

Iowa allows married taxpayers to file one Iowa Power of

Attorney form on behalf of both spouses. The IRS requires

separate Power of Attorney forms for each spouse. If the

Federal Power of Attorney is being used for Iowa purposes by

married taxpayers, both federal forms must be submitted to

Iowa.

Mail this form to:

Registration Services

Iowa Department of Revenue

PO Box 10470, Des Moines IA 50306-0470

or Fax this form to 515-281-3906.

Do not enclose this form with a return unless it is an

IA 706, IA 1041, or IA 843.

IA 2848 Iowa Power of Attorney Form Instructions

14-101c (12/21/12)