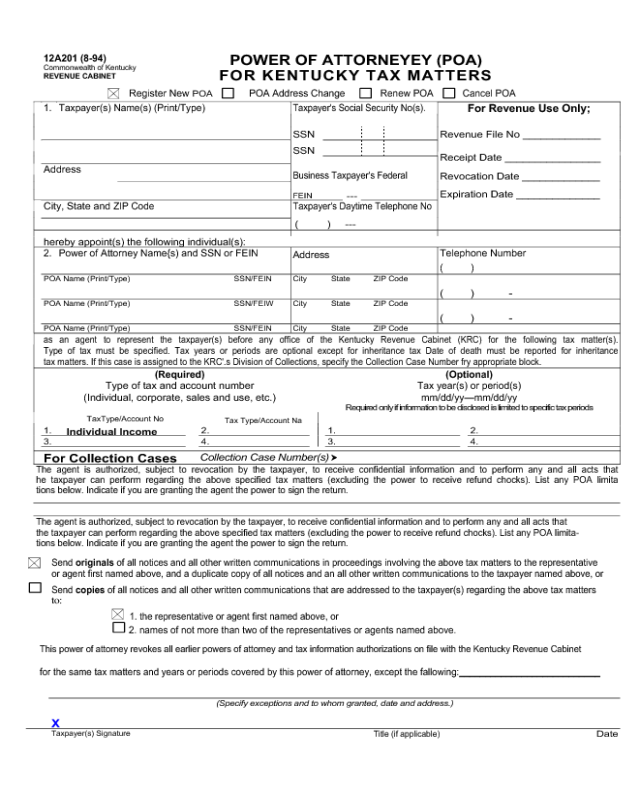

Fillable Printable Power of Attorney for Tax Matters - Kentucky

Fillable Printable Power of Attorney for Tax Matters - Kentucky

Power of Attorney for Tax Matters - Kentucky

12A201 (8-94)

Commonwealth of Kentucky

REVENUE CABINET

POWER OF ATTORNEYEY (POA)

FOR KENTUCKY TAX MATTERS

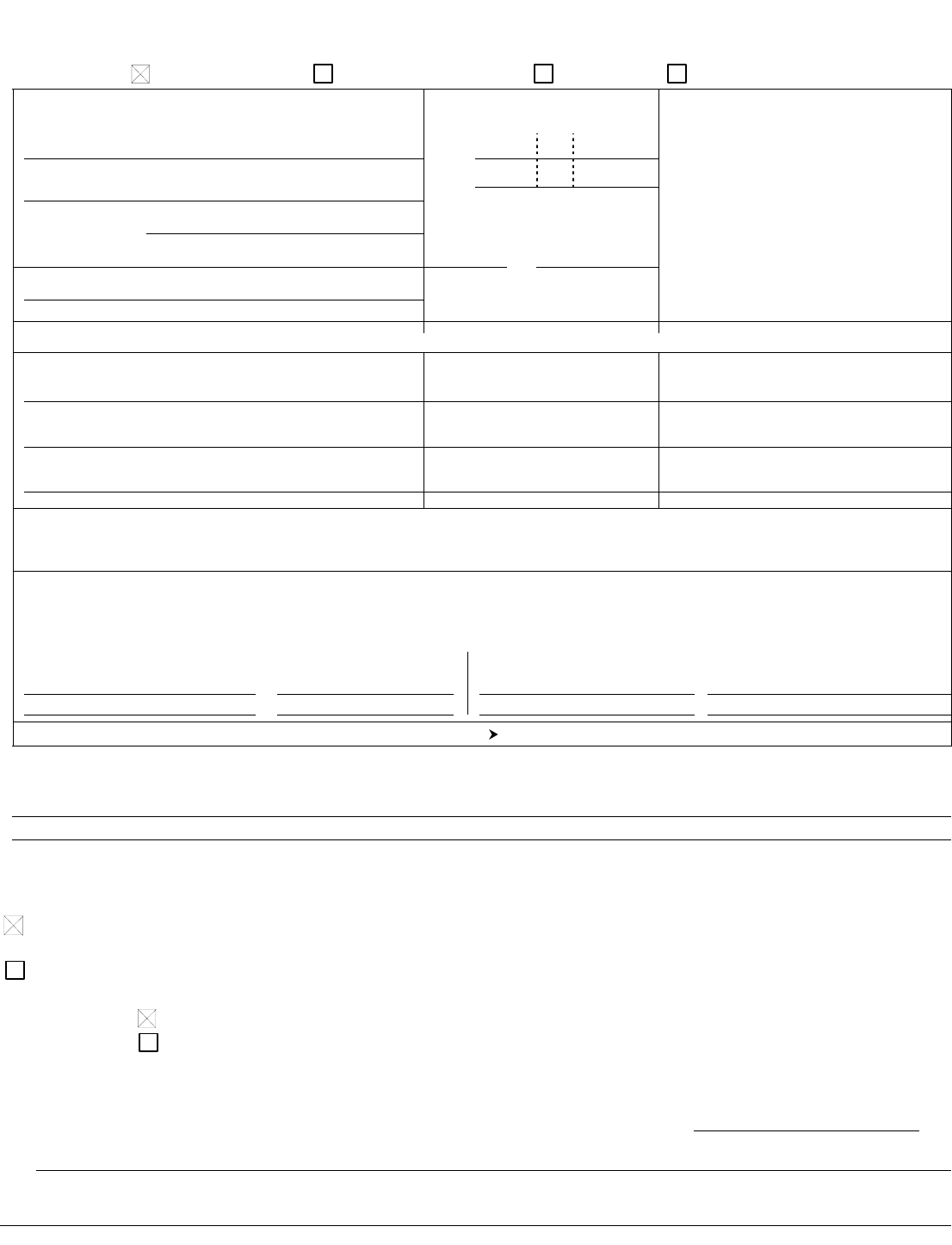

Register New

POA

POA Address Change

Renew POA

Cancel POA

For Revenue Use Only;

Taxpayer's Social Sec

urity No(s).

1. Taxpayer(s) Name(s) (Print/Type)

SSN Revenue File No _____________

SSN

Receipt Date ________________

Address

Business Taxpayer's Federal

Revocation Date _____________

FEIN

---

Expiration Date ______________

City, State and

ZIP Code

Taxpayer's Daytime Telephone No

( ) ---

hereby appoint(s) the following individual(s):

2.

Power of Attorney Name{s) and SSN or FEIN

Address

Telephone Number

(

0

)

POA Name (Print/Type) SSN/FEIN City State ZIP Code

( ) -

POA Name (Print/Type) SSN/FEIW City State ZIP Code

( ) -

POA Name (Print/Type) SSN/FEIN City State ZIP Code

as an agent to represent the taxpayer(s) before any office of the Kentucky Revenue Cabinet (KRC) for the following tax matter(s).

Type of tax must be specified. Tax years or periods are optional except for inheritance tax Date of death must be reported for inheritance

tax matters. If this case is assigned to the KRC'.s Division of Collections, specify the Collection Case Number fry appropriate block.

(Required)

Type of tax and account number

(Individual, corporate, sales and use, etc.)

(Optional)

Tax year(s) or period(s)

mm/dd/yy—mm/dd/yy

Required only if information to be disclosed is limited to specific tax periods

Tax

Type/Account No

Tax Type/Account Na

1.

Individual Income

2. 1. 2.

3. 4. 3. 4.

For Collection Cases

Collection Case Number(s)

The agent is authorized, subject to revocation by the taxpayer, to receive confidential information and to perform any and all acts that

he taxpayer can perform regarding the above specified tax matters (excluding the power to receive refund chocks). List any POA limita

tions below. Indicate if you are granting the agent the power to sign the return.

The agent is authorized, subject to revocation by the taxpayer, to receive confidential information and to perform any and all acts that

the taxpayer can perform regarding the above specified tax matters (excluding the power to receive refund chocks). List any POA limita-

tions below. Indicate if you are granting the agent the power to sign the return.

Send

originals

of all notices and all other written communications in proceedings involving the above tax matters to the representative

or agent first named above, and a duplicate copy of all notices and an all other written communications to the taxpayer named above, or

Send

copies

of all notices and all other written communications that are addressed to the taxpayer(s) regarding the above tax matters

to:

1. the representative or agent first named above, or

2. names of not more than two of the representatives or agents named above.

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the Kentucky Revenue Cabinet

for the same tax matters and years or periods covered by this power of attorney, except the fallowing:___________________________

(Specify exceptions and to whom granted, date and address.)

X

Taxpayer(s) Signature

Title (if applicable)

Date