Fillable Printable Blank Power of Attorney Form - Indiana

Fillable Printable Blank Power of Attorney Form - Indiana

Blank Power of Attorney Form - Indiana

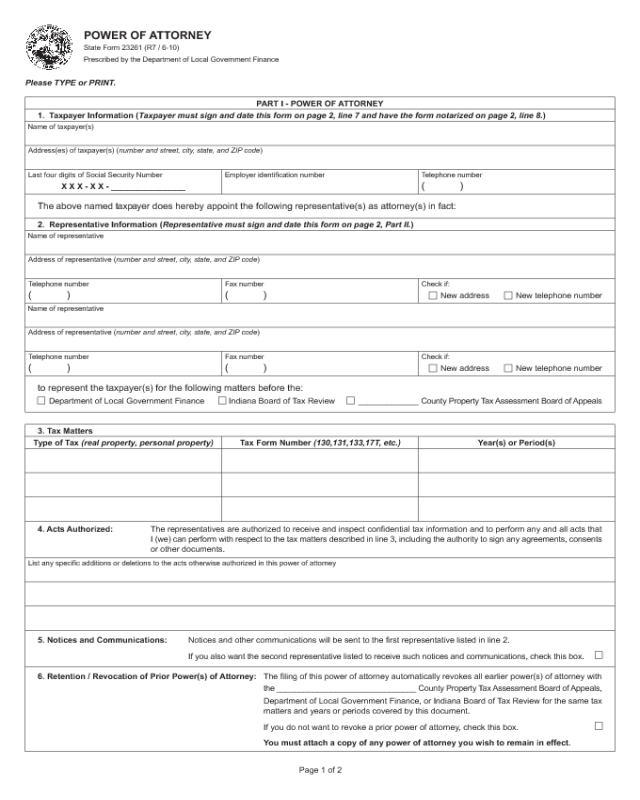

POWER OF ATTORNEY

State Form 23261 (R7 / 6-10)

Prescribed by the Department of Local Government Finance

Name of taxpayer(s)

Address(es) of taxpayer(s) (number and street, city, state, and ZIP code)

Telephone number

( )

The above named taxpayer does hereby appoint the following representative(s) as attorney(s) in fact:

New address New telephone number

Last four digits of Social Security Number Employer identification number

Check if:Fax number

( )

Please TYPE or PRINT.

PART I - POWER OF ATTORNEY

1. Taxpayer Information (Taxpayer must sign and date this form on page 2, line 7 and have the form notarized on page 2, line 8.)

X X X - X X - ________________

2. Representative Information (Representative must sign and date this form on page 2, Part II.)

Name of representative

Address of representative (number and street, city, state, and ZIP code)

Telephone number

( )

New address New telephone number

Check if:Fax number

( )

Name of representative

Address of representative (number and street, city, state, and ZIP code)

Telephone number

( )

to represent the taxpayer(s) for the following matters before the:

Department of Local Government Finance Indiana Board of Tax Review _____________ County Property Tax Assessment Board of Appeals

3. Tax Matters

4. Acts Authorized: The representatives are authorized to receive and inspect confidential tax information and to perform any and all acts that

I (we) can perform with respect to the tax matters described in line 3, including the authority to sign any agreements, consents

or other documents.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney

Type of Tax (real property, personal property) Tax Form Number (130,131,133,17T, etc.) Year(s) or Period(s)

5. Notices and Communications: Notices and other communications will be sent to the first representative listed in line 2.

If you also want the second representative listed to receive such notices and communications, check this box.

6. Retention / Revocation of Prior Power(s) of Attorney: The filing of this power of attorney automatically revokes all earlier power(s) of attorney with

the _______________________________ County Property Tax Assessment Board of Appeals,

Department of Local Government Finance, or Indiana Board of Tax Review for the same tax

matters and years or periods covered by this document.

If you do not want to revoke a prior power of attorney, check this box.

You must attach a copy of any power of attorney you wish to remain in effect.

Page 1 of 2

Reset Form

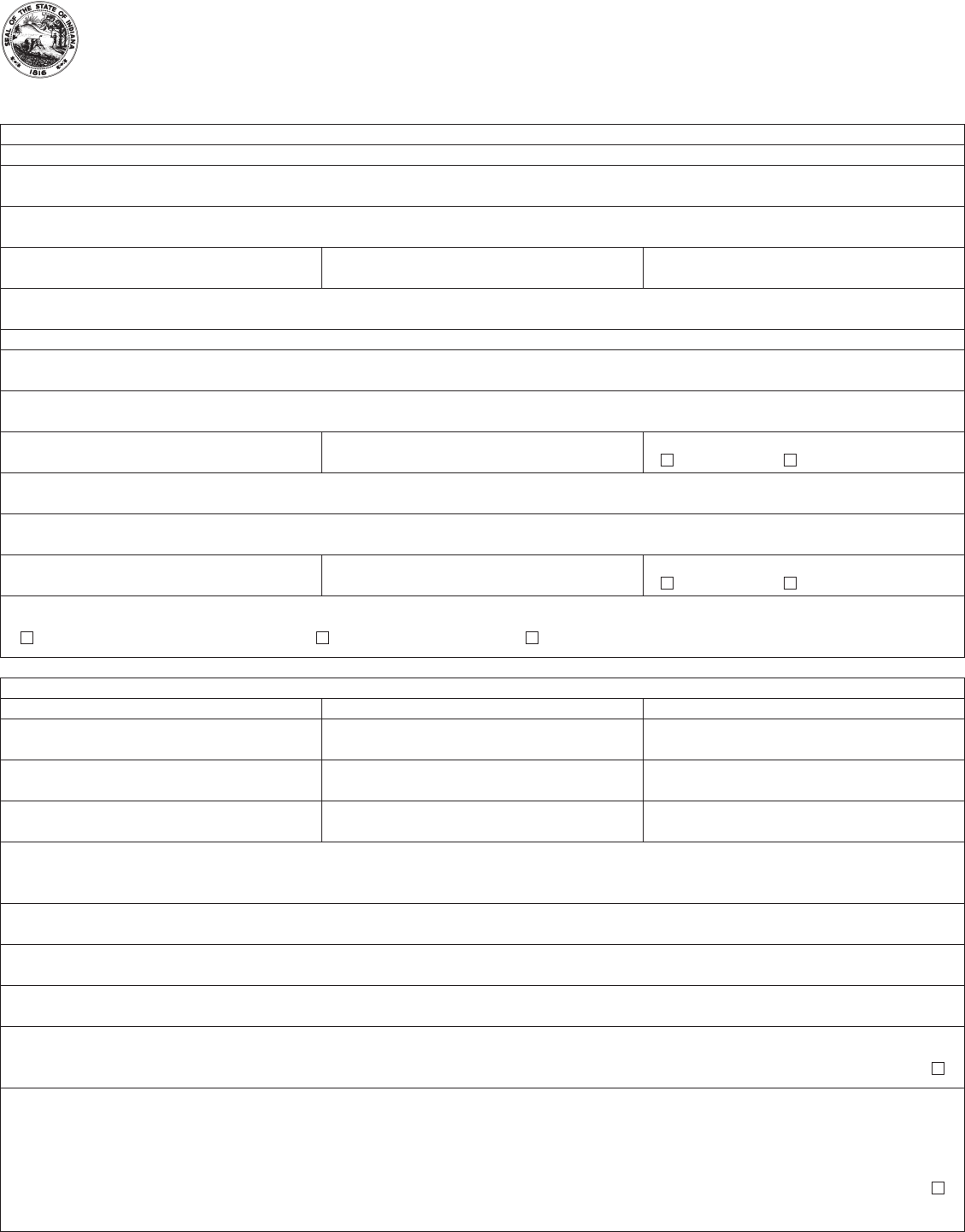

Page 2 of 2

7. Signature of Taxpayer: If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator or trustee

on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

The following applies if the authorized representative is a Certified Property Tax Representative pursuant to 50 IAC 15-5-5:

I understand that by authorizing ____________________________ as my Certified Property Tax Representative, I am aware of and accept the possibility

that the property value may increase as a result of filing an administrative appeal with the Property Tax Assessment Board of Appeals, and that I may be

compelled to appear at a hearing before the Property Tax Assessment Board of Appeals or the Department of Local Government Finance.

I further understand that the Certified Property Tax Representative is not an attorney and may not present arguments of a legal nature on my behalf.

If this power of attorney is not signed, dated and notarized, it will be returned.

Signature of taxpayer Date of signature (month, day, year)

Printed name of taxpayer Title (if applicable)

Signature of taxpayer Date of signature (month, day, year)

Printed name of taxpayer Title (if applicable)

8. Notarization

STATE OF ___________________________________________________

SS:

COUNTY OF _________________________________________________

Before me, a notary public in and for said state and county, personally appeared, this ______ day of ____________________________, ____________,

the taxpayer(s) or a person duly authorized to sign for and on behalf of the taxpayer(s), who acknowledged the execution of this Power of Attorney as

the voluntary act and deed of the taxpayer(s).

Signature of notary public

Date commission expires (month, day, year)

Typed or printed name of notary public

County of residence

PART II - DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

I am aware of the statutes, rules and regulations applicable to the matters specified in line 3;

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified there; and

I am one of the following:

a. Certified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

b. Certified Tax Representative pursuant to 50 IAC 15-5.

c. Other (specify) ____________________________________________________________________

If this declaration of representative is not signed and dated, the power of attorney will be returned.

DESIGNATION

(insert above letter - a, b, or c)

JURISDICTION (state, etc.) OR

ENROLLMENT CARD NUMBER

SIGNATURE DATE (month, day, year)