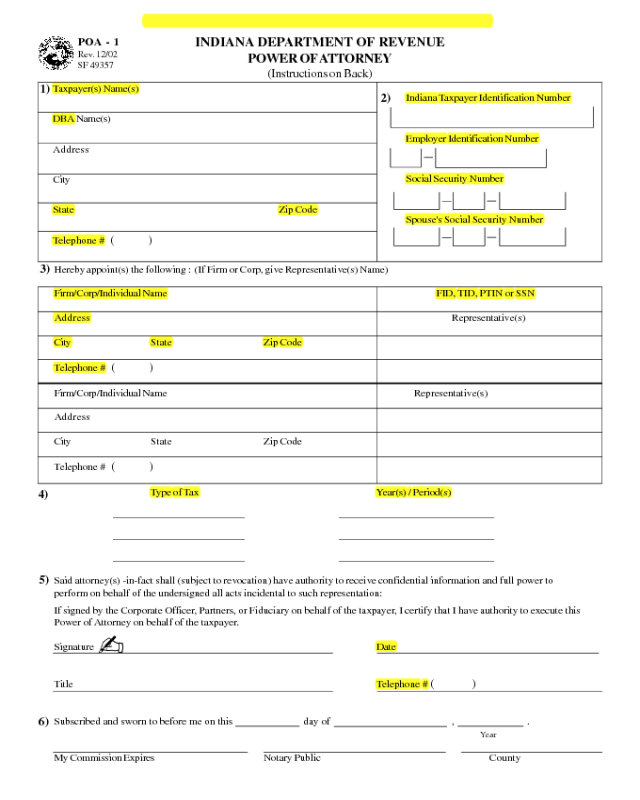

Fillable Printable Department of Revenue Power of Attorney - Indiana

Fillable Printable Department of Revenue Power of Attorney - Indiana

Department of Revenue Power of Attorney - Indiana

1)

Indiana Taxpayer Identification Number

Employer Identification Number

Social Security Number

Spouse's Social Security Number

Taxpayer(s) Name(s)

DBA Name(s)

Address

City

State Zip Code

Telephone # ( )

INDIANA DEPARTMENT OF REVENUE

POWER OF ATTORNEY

(Instructions on Back)

POA - 1

Rev. 12/02

SF 49357

2)

3)

Hereby appoint(s) the following : (If Firm or Corp, give Representative(s) Name)

Firm/Corp/Individual Name FID, TID, PTIN or SSN

Address Representative(s)

City State Zip Code

Telephone #

( )

Firm/Corp/Individual Name Representative(s)

Address

City State Zip Code

Telephone # ( )

Type of Tax Year(s) / Period(s)

____________________________ _________________________________

____________________________ _________________________________

____________________________ _________________________________

Said attorney(s) -in-fact shall (subject to revocation) have authority to receive confidential information and full power to

perform on behalf of the undersigned all acts incidental to such representation:

If signed by the Corporate Officer, Partners, or Fiduciary on behalf of the taxpayer, I certify that I have authority to execute this

Power of Attorney on behalf of the taxpayer.

Signature Date

Title Telephone # ( )

Subscribed and sworn to before me on this day of , .

Year

My Commission Expires Notary Public County

4)

5)

6)

Reset

Print

All highlighted areas must be completed or the form may not be processed.

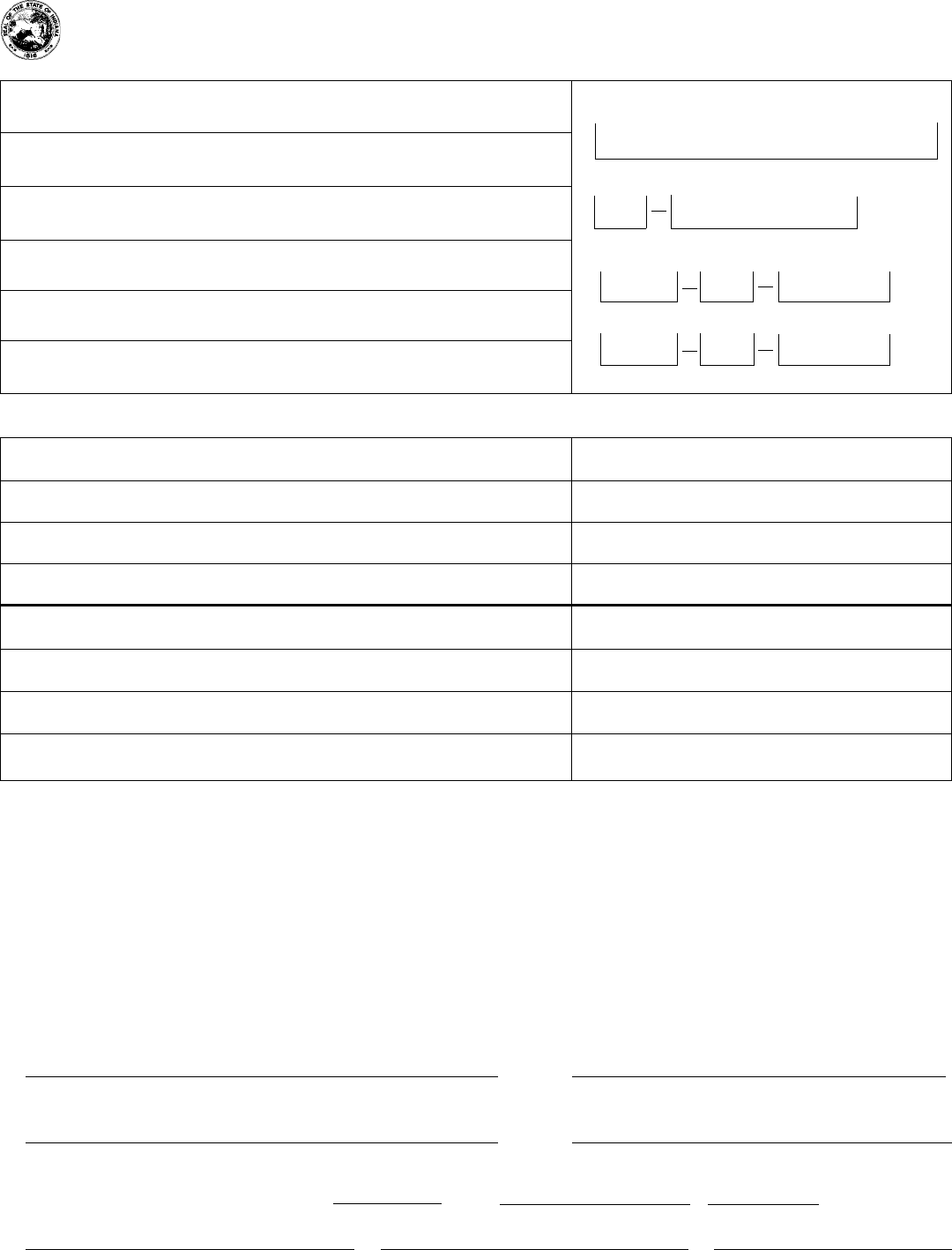

Pursuant to 45 IAC 15-3-4, a properly executed Power of Attorney

must contain all of the following information.

1. The taxpayer’s name, DBA Name, address and telephone number.

2. a. The taxpayer identification number (TID) is an Indiana Department of Revenue generated number. Each entity has

its own TID number, separate from the Corporation FID number; each location has a unique TID number.

b. Employer Identification Number (EIN) is a number given by the Internal Revenue Service.

c. Individual taxpayers should use their social security numbers until they are issued a TID number by the Department.

3. The name, Federal Identification number (FID), Taxpayer Identification Number (TID), Practitioner Tax Identification

Number (PTIN) or Social Security Number (SSN), address, and telephone number of the taxpayer’s representative.

An individual(s) must be named as the representative; a firm or corporation cannot be named as the representative.

4. The type(s) of the tax involved and the respective tax years must be expressly stated.

5. The Power of Attorney must be signed by the taxpayer or an individual authorized to execute the Power of Attorney.

6. The Power of Attorney must be notarized if the representative is NOT a public accountant, a certified public accoun-

tant, or a licensed attorney.

Important Information

The original Power of Attorney is required; copies are not acceptable.

A separate Power of Attorney must be filed for each TID number, or an attachment must accompany a Power of Attorney

listing the locations to be represented.

An invalid Power of Attorney will invalidate any documents associated with this Power of Attorney.

Instructions for Form POA-1