Fillable Printable 592-B Form - Franchise Tax Board

Fillable Printable 592-B Form - Franchise Tax Board

592-B Form - Franchise Tax Board

Form 592-B 2012

For Privacy Notice, get form FTB 1131.

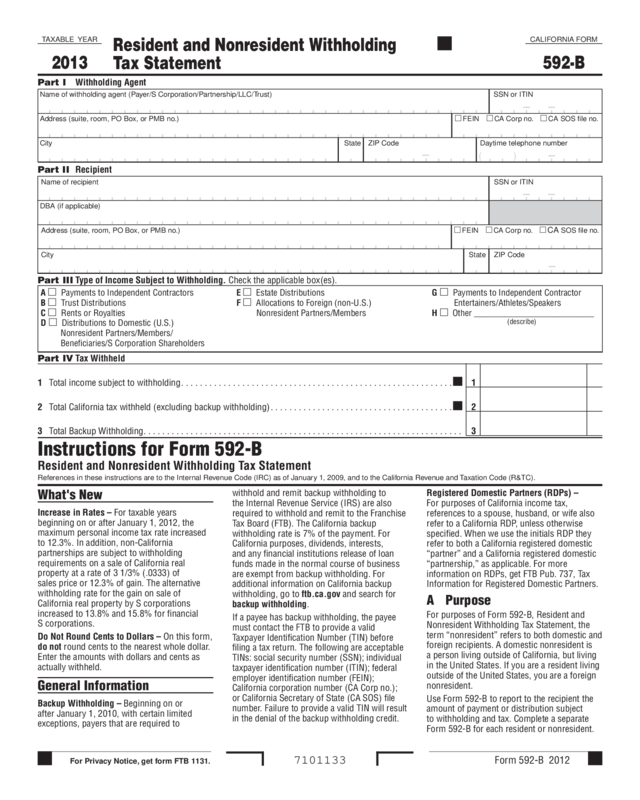

Name of withholding agent (Payer/S Corporation/Partnership/LLC/Trust) SSN or ITIN

Address (suite, room, PO Box, or PMB no.)

FEIN CA Corp no. CA SOS file no.

City State ZIP Code Daytime telephone number

Resident and Nonresident Withholding

Tax Statement

CALIFORNIA FORM

592-B

7101133

T AXABLE YEAR

2013

Instructions for Form 592-B

Resident and Nonresident Withholding Tax Statement

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

What's New

Increase in Rates – For taxable years

beginning on or after January 1, 2012, the

maximum personal income tax rate increased

to 12.3%. In addition, non-California

partnerships are subject to withholding

requirements on a sale of California real

property at a rate of 3 1/3% (.0333) of

sales price or 12.3% of gain. The alternative

withholding rate for the gain on sale of

California real property by S corporations

increased to 13.8% and 15.8% for financial

S corporations.

Do Not Round Cents to Dollars – On this form,

do not round cents to the nearest whole dollar.

Enter the amounts with dollars and cents as

actually withheld.

General Information

Backup Withholding – Beginning on or

after January 1, 2010, with certain limited

exceptions, payers that are required to

withhold and remit backup withholding to

the Internal Revenue Service (IRS) are also

required to withhold and remit to the Franchise

Tax Board (FTB). The California backup

withholding rate is 7% of the payment. For

California purposes, dividends, interests,

and any financial institutions release of loan

funds made in the normal course of business

are exempt from backup withholding. For

additional information on California backup

withholding, go to ftb.ca.gov and search for

backup withholding.

If a payee has backup withholding, the payee

must contact the FTB to provide a valid

Taxpayer Identification Number (TIN) before

filing a tax return. The following are acceptable

TINs: social security number (SSN); individual

taxpayer identification number (ITIN); federal

employer identification number (FEIN);

California corporation number (CA Corp no.);

or California Secretary of State (CA SOS) file

number. Failure to provide a valid TIN will result

in the denial of the backup withholding credit.

Registered Domestic Partners (RDPs) –

For purposes of California income tax,

references to a spouse, husband, or wife also

refer to a California RDP, unless otherwise

specified. When we use the initials RDP they

refer to both a California registered domestic

“partner” and a California registered domestic

“partnership,” as applicable. For more

information on RDPs, get FTB Pub. 737, Tax

Information for Registered Domestic Partners.

A Purpose

For purposes of Form 592-B, Resident and

Nonresident Withholding Tax Statement, the

term “nonresident” refers to both domestic and

foreign recipients. A domestic nonresident is

a person living outside of California, but living

in the United States. If you are a resident living

outside of the United States, you are a foreign

nonresident.

Use Form 592-B to report to the recipient the

amount of payment or distribution subject

to withholding and tax. Complete a separate

Form 592-B for each resident or nonresident.

Part I Withholding Agent

Part III Type of Income Subject to Withholding. Check the applicable box(es).

Part IV Tax Withheld

1 Total income subject to withholding.......................................................... 1

2 Total California tax withheld (excluding backup withholding)....................................... 2

3 Total Backup Withholding.................................................................... 3

Name of recipient SSN or ITIN

DBA (if applicable)

Address (suite, room, PO Box, or PMB no.)

FEIN CA Corp no. CA SOS file no.

City State ZIP Code

Part II Recipient

A Payments to Independent Contractors

B Trust Distributions

C Rents or Royalties

D Distributions to Domestic (U.S.)

Nonresident Partners/Members/

Beneficiaries/S Corporation Shareholders

E

Estate Distributions

F Allocations to Foreign (non-U.S.)

Nonresident Partners/Members

G

Payments to Independent Contractor

Entertainers/Athletes/Speakers

H

Other ___________________________

(describe)

( )

Page 2 Form 592-B 2012

THIS PAGE INTENTIONALLY LEFT BLANK

visit our website:

ftb.ca.gov

Form 592-B 2012 Page 3

Pass-through entities which were withheld

upon by another entity should use Form 592,

Resident and Nonresident Withholding

Statement, to flow-through the withholding

to their S corporation shareholders, partners,

members, or beneficiaries whether they are

residents or nonresidents of California.

Use Form 592-V, Payment Voucher for

Resident and Nonresident Withholding, to

remit withholding payments during the year.

To remit foreign partner withholding payments

use Form 592-A, Payment Voucher for Foreign

Partner or Member Withholding.

B Common Errors/Helpful Hints

• Get taxpayer identification numbers (TINs)

from all payees.

•

Complete all fields.

•

Complete all forms timely to avoid penalties.

C Who Must Complete

Form 592-B must be completed by any person

who:

•

Has withheld on payments to residents or

nonresidents.

•

Has withheld backup withholding on

payments to residents or nonresidents.

•

Is a pass-through entity that was withheld

upon and must flow-through the withholding

credit.

Record Keeping

The withholding agent retains the proof of

withholding for a minimum of four years

and must provide it to the FTB upon request.

Form 592-B is provided to the recipient to file

with their state tax return. This form can be

provided to the payee electronically. For more

information go to ftb.ca.gov and search for

electronic 592-B requirements. A broker can

provide Form 592-B as a composite statement.

For more information go to ftb.ca.gov and

search for composite 592-B.

D When To Complete

Form 592-B must be provided to:

•

Each resident or nonresident by January 31

following the close of the calendar year,

except for brokers as stated in Internal

Revenue Code (IRC) Section 6045.

• A recipient before February 15 following the

close of the calendar year for brokers.

•

Foreign partners in a partnership or foreign

members in a limited liability company (LLC)

on or before the 15th day of the 4th month

following the close of the taxable year.

If all the partners in the partnership or members

in the LLC are foreign, Form(s) 592-B must be

provided on or before the 15th day of the 6th

month after the close of the taxable year.

When making a payment of withholding

tax to the IRS under IRC Section 1446, a

partnership must notify all foreign partners of

their allocable shares of any IRC Section 1446

tax paid to the IRS by the partnership. The

partners use this information to adjust the

amount of estimated tax that they must

otherwise pay to the IRS. The notification to

the foreign partners must be provided within

10 days of the installment due date, or, if paid

later, the date the installment payment is made.

See Treas. Regs. Section 1.1446-3(d)(1)(i)

for information that must be included in

the notification and for exceptions to the

notification requirement. For California

withholding purposes, withholding agents

should make a similar notification. No

particular form is required for this notification,

and it is commonly done on the statement

accompanying the distribution or payment.

However, the withholding agent may choose

to report the tax withheld to the payee on a

Form 592-B.

E Penalties

The withholding agent must furnish complete

and correct copies of Form(s) 592-B to the

recipient (payee) by the due date.

If the withholding agent fails to provide

complete, correct, and timely Form(s) 592-B

to the recipient (payee), the penalty per

Form 592-B is:

• $50 for each payee statement not provided

by the due date.

•

$100 or 10 percent of the amount required

to be reported (whichever is greater), if the

failure is due to intentional disregard of the

requirement.

Specific Instructions

Year – Make sure the year in the upper left

corner of Form 592-B represents the calendar

year in which the withholding took place. If an

S corporation’s, partnership’s, LLC’s, or trust’s

current distribution represents a prior taxable

year of California source income, the taxable

year on Form 592-B must represent the year

the income was earned. (Except for foreign

partners in a partnership, withholding of tax

by withholding agents must be on a calendar-

year basis, regardless of the accounting period

adopted by the payee or withholding agent.)

For foreign partners in a partnership, or foreign

members in an LLC, make sure the year in the

upper left corner of Form 592-B is the year that

the partnership’s or LLC’s taxable year ended.

For example, if the partnership’s or LLC’s

taxable year ended December 31, 2011, use

the 2011 Form 592-B.

Private Mail Box (PMB) – Include the PMB

in the address field. Write “PMB” first, then

the box number. Example: 111 Main Street

PMB 123.

Foreign Address – Enter the information in

the following order: City, Country, Province/

Region, and Postal Code. Follow the country’s

practice for entering the postal code. Do not

abbreviate the country’s name.

Part I – Withholding Agent

Enter the withholding agent’s name,

identification number, address, and telephone

number.

Part II – Recipient

Enter the name of recipient, DBA (if applicable),

identification number, and address for the

recipient (payee).

If the recipient is a grantor trust, enter

the grantor’s individual name and social

security number (SSN) or individual taxpayer

identification number (ITIN). Do not enter the

name of the trust or trustee information. (For

tax purposes, grantor trusts are transparent.

The individual grantor must report the income

and claim the withholding on the individual’s

California tax return.)

If the recipient is a non-grantor trust, enter

the name of the trust and the trust’s federal

employer identification number (FEIN). Do not

enter trustee information.

If the trust has applied for a FEIN, but it has

not been received, zero fill the space for the

trust’s FEIN and attach a copy of the federal

application behind Form 592-B. After the FEIN

is received, amend Form 592-B to submit the

assigned FEIN.

Only withholding agents can complete an

amended Form 592-B. Upon completion, the

withholding agent should provide a copy of

the amended Form 592-B to the recipient. If a

recipient notices an error, the recipient should

contact the withholding agent.

If the recipients are married/RDP, enter only

the name and SSN or ITIN of the primary

spouse/RDP. However, if the recipients intend

to file separate California tax returns, the

withholding agent should split the withholding

and complete a separate Form 592-B for each

spouse/RDP.

Part III – Type of Income

Subject to Withholding

Check the box(es) for the type of income

subject to withholding.

Part IV – Tax Withheld

Line 1

Enter the total income subject to withholding.

Line 2

Enter the total California tax withheld

(excluding backup withholding). The amount

of tax to be withheld is computed by applying

a rate of 7% on items of income subject to

withholding, i.e. interest, dividends, rents and

royalties, prizes and winnings, premiums,

annuities, emoluments, compensation

for personal services, and other fixed or

determinable annual or periodical gains, profits

and income. For foreign partners, the rate is

8.84% for corporations, 10.84% for banks

Page 4 Form 592-B 2012

and financial institutions, and 12.3% for all

others. For pass-through entities, the amount

withheld is allocated to partners, members,

S corporation shareholders, or beneficiaries,

whether they are residents or nonresidents of

California, in proportion to their ownership or

beneficial interest.

Line 3

Enter the total backup withholding. Compute

backup withholding by applying a 7% rate

to all reportable payments subject to IRS

backup withholding with a few exceptions. For

California purposes dividends, interests, and

any financial institutions release of loan funds

made in the normal course of business are

exempt from backup withholding.

Instructions for Recipient

This withholding of tax does not relieve you of

the requirement to file a California tax return

within three months and fifteen days (two

months and fifteen days for a corporation)

after the close of your taxable year.

You may be assessed a penalty if:

•

You do not file a California tax return.

• You file your tax return late.

• The amount of withholding does not satisfy

your tax liability.

How to Claim the Withholding

Report the income as required and enter the

amount from Form 592-B, Part IV, line 2 on

your California tax return as real estate and

other withholding from Form(s) 592-B or 593.

Attach a copy of Form 592-B to your California

tax return. If you received a composite

statement from a broker, attach only the

Form 592-B information. Make a copy for your

records.

If you have backup withholding, you must

contact the FTB to provide a valid Taxpayer

Identification Number (TIN) before filing a

tax return. The following are acceptable TINs:

social security number (SSN); individual

taxpayer identification number (ITIN); federal

employer identification number (FEIN);

California corporation number (CA Corp. no.);

or California Secretary of State (CA SOS) file

number. Failure to provide a valid TIN will

result in the denial of the backup withholding

credit. Using the information provided on this

page, contact us as soon as you receive this

form.

If you are an S corporation, partnership, or

LLC, you may either flow-through the entire

amount to your shareholders, partners, or

members or claim the withholding, to the

extent of your outstanding tax liability, on your

tax return.

If the withholding exceeds the amount of tax

you still owe on your tax return, you must

flow-through the excess to your shareholders,

partners, or members.

If you do not have an outstanding balance on

your tax return, you must flow-through the

entire amount to your shareholders, partners,

or members. Use Form 592 to flow the

withholding to your shareholders, partners, or

members.

If you are an estate or trust, you must flow-

through the withholding to your beneficiaries

if the related income was distributed. Use

Form 592 to flow-through the withholding to

your beneficiaries. If you did not distribute the

income, you must claim the withholding on the

fiduciary return, Form 541, California Fiduciary

Income Tax Return.

The amount shown as “Total income subject

to withholding” may be an estimate or may

only reflect how withholding was calculated.

Be sure to report your actual taxable California

source income. If you are an independent

contractor or receive rents or royalties, see

your contract and/or Form 1099 to determine

your California source income. If you are a

shareholder, partner, member, or beneficiary of

an S corporation, partnership, LLC, estate, or

trust, see your California Schedule K-1 (100S,

565, 568, 541), Share of Income, Deductions,

Credits, etc., issued by that entity to determine

your California source income.

Additional Information

For more information or to speak to a

representative regarding this form, call the

Withholding Services and Compliance’s

automated telephone service at: 888.792.4900

or 916.845.4900.

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0651

You can download, view, and print California

tax forms and publications at ftb.ca.gov.

OR to get forms by mail, write to:

TAX FORMS REQUEST UNIT

FRANCHISE TAX BOARD

PO BOX 307

RANCHO CORDOVA CA 95741-037

For all other questions unrelated to withholding

or to access the TTY/TDD number, see the

information below.

Internet and Telephone Assistance

Website: ftb.ca.gov

Telephone: 800.852.5711 from within the

United States

916.845.6500 from outside the

United States

TTY/TDD: 800.822.6268 for persons with

hearing or speech impairments

Asistencia Por Internet y Teléfono

Sitio web: ftb.ca.gov

Teléfono: 800.852.5711 dentro de los

Estados Unidos

916.845.6500 fuera de los Estados

Unidos

TTY/TDD: 800.822.6268 personas con

discapacidades auditivas y del

habla