Fillable Printable Agriculture Disaster Relief (Form Mo-Agdr)

Fillable Printable Agriculture Disaster Relief (Form Mo-Agdr)

Agriculture Disaster Relief (Form Mo-Agdr)

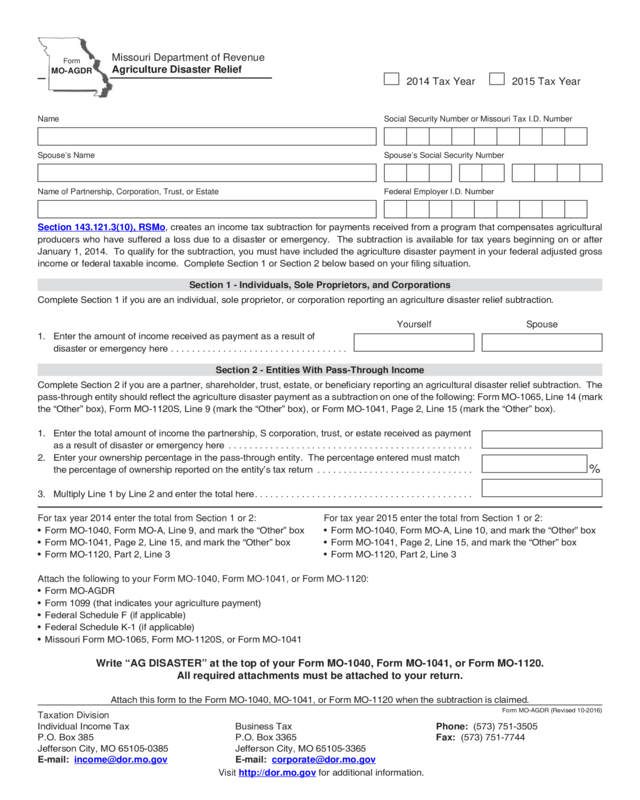

Form

MO-AGDR

Missouri Department of Revenue

Agriculture Disaster Relief

Name

Social Security Number or Missouri Tax I.D. Number

Spouse’s Name

Spouse’s Social Security Number

2014 Tax Year 2015 Tax Year

Attach the following to your Form MO-1040, Form MO-1041, or Form MO-1120:

• FormMO-AGDR

• Form1099(thatindicatesyouragriculturepayment)

• FederalScheduleF(ifapplicable)

• FederalScheduleK-1(ifapplicable)

Section 1 - Individuals, Sole Proprietors, and Corporations

1. Entertheamountofincomereceivedaspaymentasaresultof

1. Enterthetotalamountofincomethepartnership,Scorporation,trust,orestatereceivedaspayment

asaresultofdisasteroremergencyhere ...............................................

Yourself Spouse

2. Enteryourownershippercentageinthepass-throughentity.Thepercentageenteredmustmatch

thepercentageofownershipreportedontheentity’staxreturn .............................. %

Taxation Division

IndividualIncomeTax BusinessTax Phone:(573)751-3505

P.O.Box385 P.O.Box3365 Fax:(573)751-7744

JeffersonCity,MO65105-0385 JeffersonCity,MO65105-3365

Visit http://dor.mo.govforadditionalinformation.

FormMO-AGDR(Revised10-2016)

Section 143.121.3(10), RSMo,createsanincometaxsubtractionforpaymentsreceivedfromaprogramthatcompensatesagricultural

producerswhohavesufferedalossduetoadisasteroremergency.Thesubtractionisavailablefortaxyearsbeginningonorafter

January1,2014.Toqualifyforthesubtraction,youmusthaveincludedtheagriculturedisasterpaymentinyourfederaladjustedgross

AttachthisformtotheFormMO-1040,MO-1041,orFormMO-1120whenthesubtractionisclaimed.

Name of Partnership, Corporation, Trust, or Estate FederalEmployerI.D.Number

For tax year 2014 enter the total from Section 1 or 2:

• FormMO-1040,FormMO-A,Line9,andmarkthe“Other”box

• FormMO-1041,Page2,Line15,andmarkthe“Other”box

• FormMO-1120,Part2,Line3

For tax year 2015 enter the total from Section 1 or 2:

• FormMO-1040,FormMO-A,Line10,andmarkthe“Other”box

• FormMO-1041,Page2,Line15,andmarkthe“Other”box

• FormMO-1120,Part2,Line3

Section 2 - Entities With Pass-Through Income

CompleteSection2ifyouareapartner,shareholder,trust,estate,orbeneciaryreportinganagriculturaldisasterreliefsubtraction.The

pass-throughentityshouldreecttheagriculturedisasterpaymentasasubtractionononeofthefollowing:FormMO-1065,Line14(mark

disasteroremergencyhere ..................................

3. MultiplyLine1byLine2andenterthetotalhere..........................................

• MissouriFormMO-1065,FormMO-1120S,orFormMO-1041

Write “AG DISASTER” at the top of your Form MO-1040, Form MO-1041, or Form MO-1120.

All required attachments must be attached to your return.

CompleteSection1ifyouareanindividual,soleproprietor,orcorporationreportinganagriculturedisasterreliefsubtraction.

the“Other”box),FormMO-1120S,Line9(markthe“Other”box),orFormMO-1041,Page2,Line15(markthe“Other”box).

incomeorfederaltaxableincome.CompleteSection1orSection2belowbasedonyourlingsituation.

Reset Form

Print Form