Fillable Printable Application For Exemption

Fillable Printable Application For Exemption

Application For Exemption

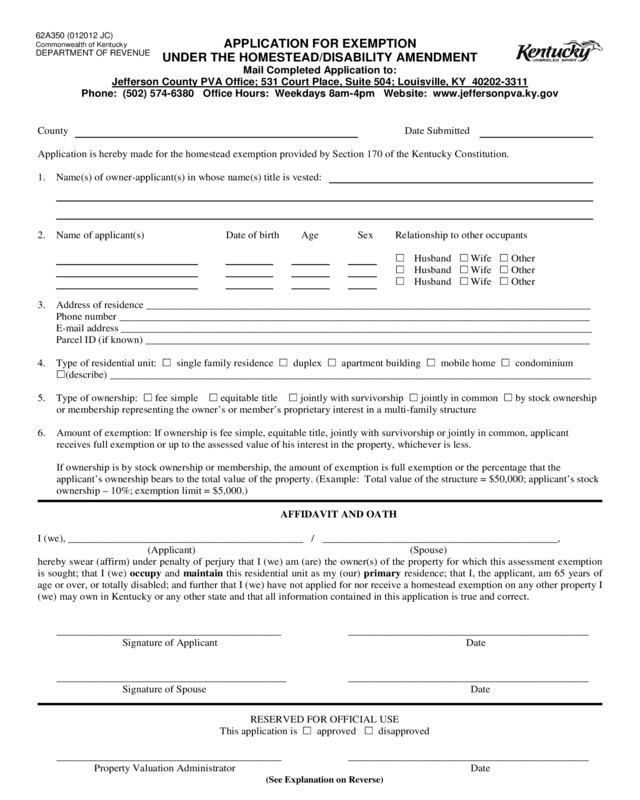

APPLICATION FOR EXEMPTION

UNDER THE HOMESTEAD/DISABILITY AMENDMENT

Mail Completed Application to:

Phone: (502) 574-6380 Office Hours: Weekdays 8am-4pm Website: www.jeffersonpva.ky.gov

Jefferson County PVA Office; 531 Court Place, Suite 504; Louisville, KY 40202-3311

County Date Submitted

Application is hereby made for the homestead exemption provided by Section 170 of the Kentucky Constitution.

1. Name(s) of owner-applic ant(s) in whose name(s) title is vested:

2. Name of applicant(s) Date of birth Age Sex Relationship to other occupants

Husband Wife Other

Husband Wife Other

Husband Wife Other

3. Address of residence _____________________________________________________________________________________

Phone number __________________________________________________________________________________________

E-mail address __________________________________________________________________________________________

Parcel ID (if known) _____________________________________________________________________________________

4. Type of residential unit: single family residence duplex ap a rtment building mobile home condominium

(describe) ____________________________________________________________________________________________

5. Type of ownership: fee simple equitable title joi ntly with sur vivorship j ointly in co mmon by stock ownership

or membership representing the owner’s or member’s proprietary interest in a multi-family structure

6. Amount of exemptio n: If ownership is fee simple, eq uitable title, jointly with survi vo r ship or jo intly in common, applic a nt

receives full exemption or up to the assessed value of his interest in the property, whichever is less.

If ownership is by st ock ownership or membership, the a mount of exempt ion is full exemption o r the perc entage that t he

applicant’s ownership bears to the total value of the property. (Example: Total value of the structure = $50,000; applica nt’s sto c k

ownership – 10%; exemption limit = $5,000.)

AFFIDAVIT AND OATH

I (we), _____________________________________________ / _____________________________________________,

(Applicant) (Spouse)

hereby swear (affirm) under penalty of perjury that I (we) a m (are) the owner(s) of the property for which this assessment exemption

is sought; that I (we) occupy and maintain this residential unit as my (our) primary residence; that I, the applicant, am 65 years of

age or over, or totally disabled; and further that I ( we) have not applied for nor receive a homestead exemption on any other property I

(we) may own in Kentucky or any other state and that all information contained in this application is true and correct.

___________________________________________ ______________________________________________

Signature of Applicant Date

____________________________________________ ______________________________________________

Signature of Spouse Date

RESERVE D FOR OFFI CIAL USE

This app lic a tion is approved disapproved

___________________________________________ ______________________________________________

Proper ty Valuatio n Administr a tor Date

(See Explanation on Reverse)

62A350 (012012 JC)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

EXPLANATION

1. To apply for the homestead exemption, this application-affidavit must be s ubmit ted duri ng the year in whi ch exempt ion i s s ought

for residential property located in J efferson County to the Jefferson County Property Valuation Administrator’s Office (JCPVA).

Once approved, annual reapplication is not required.

Applicants seeking the homestead e xemption under the disability provision must file this application-affidavit by December 31

st

of the year in which e xemp t ion is soug ht. Under KRS 132.810 (effective 1/1/2012) those applying under the disabil ity

provision are required to docu ment t heir disabil ity only at the time of initial a pplication. Once appro ved, annua l

reapplication is not required. However, applicants are required to report any change in their disability classification to

the JCPVA. Failure to do so could result in back taxes, penalties and interest for any back years an applicant did not

legally qualify for the exemption.

2. What does homestead exemption mean?

Under the provisions of the Homestead Amendment, a person or persons must be 65 years of age or older or totally disabled

duri ng the year for which application is made, and must own, occupy and maintain a residential unit fo r suc h exemption. Only

1 exemption per resid e nce is allowed. Applicants must not have applied for nor received a homestead exemption on any other

property they may own in Ken t ucky o r any other state other than their primary legal residence for which application is made.

3. Age Requirement

A pers on or pers ons ownin g, living in and maintaining a resi dential unit must meet the 65 yea rs of age requireme nt. If onl y one

spouse is 65, the age requirement is met.

4. Verification of Age & Jefferson County Residence

A person must own and occupy the property for which exemption is sought as his or her Primary Residence. A Pri mary

Residence is a person’s fixed permanent or principal home for legal, voting and tax purposes. Date of birth of the applicant(s)

and proof of Jefferson County residence can be verified by submitting a copy of one of the following forms of identification:

1. Valid J efferson County Dri ver’s License i ssued by the Jeffe rson County Circuit Court Cle rk’s Office.

2. Valid Personal ID Card issued by the Jefferson County Cir cuit Court Cle rk’s Office . The address shown o n t he car d

must match the address of residence for which application is made.

Or, if the applicant(s) date of birth is substantiated by providing a copy of one of the secondary sources listed below, the

applicant(s)

must also provide a copy of his or her current Voter ID Card issued by the Louisville/Jefferson County E lec tion

Center as proof of his or her Jefferson County Residence. The address shown on the card must match the address of residence for

which applic a tion is made.

1. Red, White & Blue Medicare Card issued

by Social Security

4. Cens us Reco rd s

5. Insurance Policies

2. Birth Certificate or Birth Registrat ion

6. Marriage Records

3. Confirmation or Baptismal Records

7. School Records

5. Disability Requirements

A person must be classified as totally disabled under a program authorized or administered by an agency of the United States

government or by an y retirement syst em either wit hin o r wit hout the Commonwealth of Kentucky. Applicants must document

their disability with a copy of their award letter from their retirement system that declares the date they became eligible for

disabilit y bene fits. Applicants must also document their date of birth and pr imary residenc e for which applic a tion is made. To be

eligible, applica nts mu st have maintained their disability classification and rece ived disability payments und e r such classification

for the entire year.

6. KRS 132.810(2) (h) provides, “When title to property which is exempted, either in whole or in part, under the homestead

exemption is transferred, the owner, administrator, executor, trustee, guardian, conservator, curator or agent shall report such

transfer to the p r operty valuation ad ministrator.”

7. Fraudulent Misrepresentations

Unde r the provi s i ons of KRS 132.990(1), “Any person who willfully fails to supply the property valuation administrator or the

Department of Revenue with a complete list of his property and such facts with regard thereto as may be required or who violates

any of the provisions of KRS 132.570 shall be fined not more that five hundred dollars ($500).”