Fillable Printable Application For Michigan Net Operating Loss Refund Mi-1045

Fillable Printable Application For Michigan Net Operating Loss Refund Mi-1045

Application For Michigan Net Operating Loss Refund Mi-1045

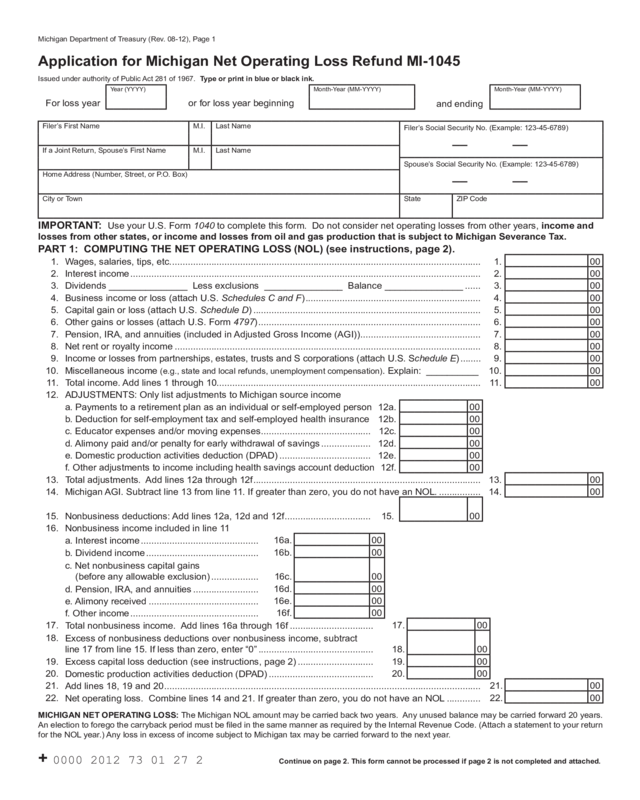

Michigan Department of Treasury (Rev. 08-12), Page 1

Application for Michigan Net Operating Loss Refund MI-1045

Issued under authority of Public Act 281 of 1967. Type or print in blue or black ink.

Year (YYYY) Month-Year (MM-YYYY) Month-Year (MM-YYYY)

For loss year or for loss year beginning

and ending

Filer’s First Name M.I. Last Name

Filer’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name M.I. Last Name

Spouse’s Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, or P.O. Box)

City or Town State ZIP Code

IMPORTANT: Use your U.S. Form 1040 to complete this form. Do not consider net operating losses from other years, income and

losses from other states, or income and losses from oil and gas production that is subject to Michigan Severance Tax.

PART 1: COMPUTING THE NET OPERATING LOSS (NOL) (see instructions, page 2).

1. Wages, salaries, tips, etc. ...................................................................................................................... 1. 00

2. Interest income ...................................................................................................................................... 2. 00

3. Dividends _______________ Less exclusions _______________ Balance _______________ ...... 3. 00

4. Business income or loss (attach U.S. Schedules C and F) ................................................................... 4. 00

5. Capital gain or loss (attach U.S. Schedule D) ....................................................................................... 5. 00

6. Other gains or losses (attach U.S. Form 4797) ..................................................................................... 6. 00

7. Pension, IRA, and annuities (included in Adjusted Gross Income (AGI)) .............................................. 7. 00

8. Net rent or royalty income ..................................................................................................................... 8. 00

9. Income or losses from partnerships, estates, trusts and S corporations (attach U.S. Schedule E) ........ 9. 00

10. Miscellaneous income (e.g., state and local refunds, unemployment compensation). Explain: __________ 10. 00

11. Total income. Add lines 1 through 10..................................................................................................... 11. 00

12. ADJUSTMENTS: Only list adjustments to Michigan source income

a. Payments to a retirement plan as an individual or self-employed person 12a. 00

b. Deduction for self-employment tax and self-employed health insurance 12b. 00

c. Educator expenses and/or moving expenses .......................................... 12c. 00

d. Alimony paid and/or penalty for early withdrawal of savings ................... 12d. 00

e. Domestic production activities deduction (DPAD) ................................... 12e. 00

f. Other adjustments to income including health savings account deduction 12f. 00

13. Total adjustments. Add lines 12a through 12f ....................................................................................... 13. 00

14. Michigan AGI. Subtract line 13 from line 11. If greater than zero, you do not have an NOL. ................ 14. 00

15. Nonbusiness deductions: Add lines 12a, 12d and 12f ................................. 15. 00

16. Nonbusiness income included in line 11

a. Interest income .............................................

16a. 00

b. Dividend income ...........................................

16b. 00

c. Net nonbusiness capital gains

(before any allowable exclusion) ..................

16c. 00

d. Pension, IRA, and annuities .........................

16d. 00

e. Alimony received ..........................................

16e. 00

f. Other income .................................................

16f. 00

17.

Total nonbusiness income. Add lines 16a through 16f ................................

17.

00

18.

Excess of nonbusiness deductions over nonbusiness income, subtract

line 17 from line 15. If less than zero, enter “0” ............................................

18. 00

19. Excess capital loss deduction (see instructions, page 2) ............................. 19.

00

20.

Domestic production activities deduction (DPAD) ........................................

20.

00

21.

Add lines 18, 19 and 20 .........................................................................................................................

21. 00

22.

Net operating loss. Combine lines 14 and 21. If greater than zero, you do not have an NOL .............

22. 00

MICHIGAN NET OPERATING LOSS: The Michigan NOL amount may be carried back two years. Any unused balance may be carried forward 20 years.

An election to forego the carryback period must be led in the same manner as required by the Internal Revenue Code. (Attach a statement to your return

for the NOL year.) Any loss in excess of income subject to Michigan tax may be carried forward to the next year.

+ 0000 2012 73 01 27 2 Continue on page 2. This form cannot be processed if page 2 is not completed and attached.

Reset Form

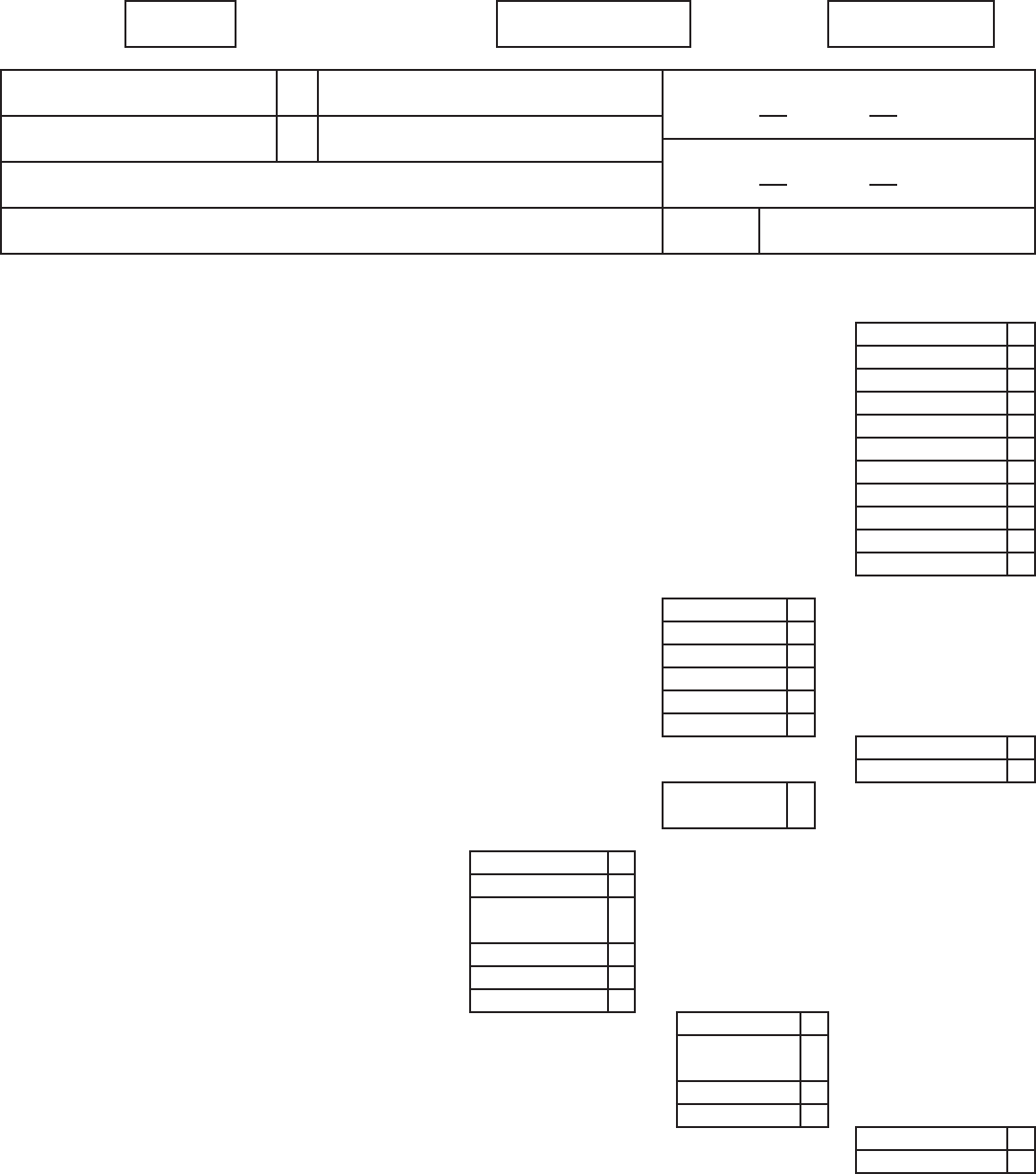

2012 MI-1045, Page 2

Filer’s Social Security Number

Application for Refund From Carryback of Net Operating Loss

PART 2: REDETERMINING YOUR MICHIGAN INCOME TAX

A B C

23. Year you are carrying the NOL to ..................................................

24. Reported federal AGI .................................................................... 00 00 00

25.

Additions from MI-1040, Schedule 1 and DPAD. Explain: ______

___________________________________________________ 00 00 00

26. Balance. Add lines 24 and 25 ........................................................ 00 00 00

27.

Subtractions from MI-1040, Schedule 1. Explain: ____________

___________________________________________________ 00 00 00

28. Balance. Subtract line 27 from line 26 ........................................... 00 00 00

29. Enter Net Operating Loss from line 22 .......................................... 00 00 00

30. Balance. Subtract line 29 from line 28 ........................................... 00 00 00

31. Michigan exemption allowance...................................................... 00 00 00

32. Taxable balance. Subtract line 31 from line 30 ............................. 00 00 00

33.

Tax. Multiply line 32 by applicable tax rate.

If less than zero, enter “0”.............................................................. 00 00 00

34. Nonrefundable tax credits.............................................................. 00 00 00

35.

Tax due. Subtract line 34 from line 33.

If less than zero, enter “0”.............................................................. 00 00 00

36. a. Refundable tax credits ............................................................... 00 00 00

b. Tax withheld ............................................................................... 00 00 00

c. Tax paid with prior returns .......................................................... 00 00 00

d. Estimated tax payments ............................................................ 00 00 00

37. Total of items 36a through 36d ...................................................... 00 00 00

38. Tax previously refunded or carried to next year............................. 00 00 00

39. Balance of tax paid. Subtract line 38 from line 37 ......................... 00 00 00

40. Overpayment. Subtract line 35 from line 39 .................................. 00 00 00

Taxpayer Certication. I declare under penalty of perjury that the information in this return

and attachments is true and complete to the best of my knowledge.

Preparer Certication. I declare under penalty of perjury that this

return is based on all information of which I have any knowledge.

Filer’s Signature Date Preparer’s PTIN, FEIN or SSN

Spouse’s Signature Date Preparer’s Business Name (print or type)

Preparer’s Business Address (print or type)

By checking this box, I authorize Treasury to discuss my return with my preparer.

Line-by-Line Instructions for Parts 1 and 2

Note: The Michigan NOL is generally carried back two years. See

instructions, page 4, for exceptions.

Part 1: Computing Net Operating Loss

To complete Part 1, use the entries on your U.S. Form 1040 for the year the

loss occurred. Do not consider income and losses from other states, income

and losses from oil and gas production, or net operating loss deductions

(NOLD) from other years.

Line 10: Miscellaneous income includes state and local refunds,

unemployment benets, alimony received and any other miscellaneous

taxable income.

Line 14: Subtract line 13 from line 11. This amount should equal your

federal AGI if you have no income or losses from other states, income and

losses from oil and gas production, or net operating loss deductions from

other years.

Line 19: The excess capital loss must be calculated on a U.S. Form 1045

Schedule A, line 21 or 22, then entered on this line.

Line 20: Enter the domestic production activities deduction as calculated on

line 12e.

Part 2: Redetermining Your Michigan Income Tax

Line 25: Include any additions from Michigan Schedule 1. Also include

DPAD attributable to Michigan.

Line 27: Include any subtractions from Michigan Schedule 1.

Line 30: If line 30 is less than zero, carry amount to line 29 in the next

column. This amount cannot exceed line 29 of the preceding column.

Line 34: Enter the total of nonrefundable credits claimed on your original

return.

Line 36a: Enter the total of refundable credits for homestead property tax,

farmland preservation and any other refundable credits claimed for the tax

year(s) you are carrying the loss. Any credit entered here must be adjusted for

the NOLD adjustment to household income, if applicable. Be sure to attach

your amended credit form.

Line 36c: For the year listed on line 23 , enter total tax paid with the annual

return plus any additional tax paid after original return was led.

Mail your completed form to: Michigan Department of Treasury

Lansing, MI 48956

+ 0000 2012 73 02 27 0

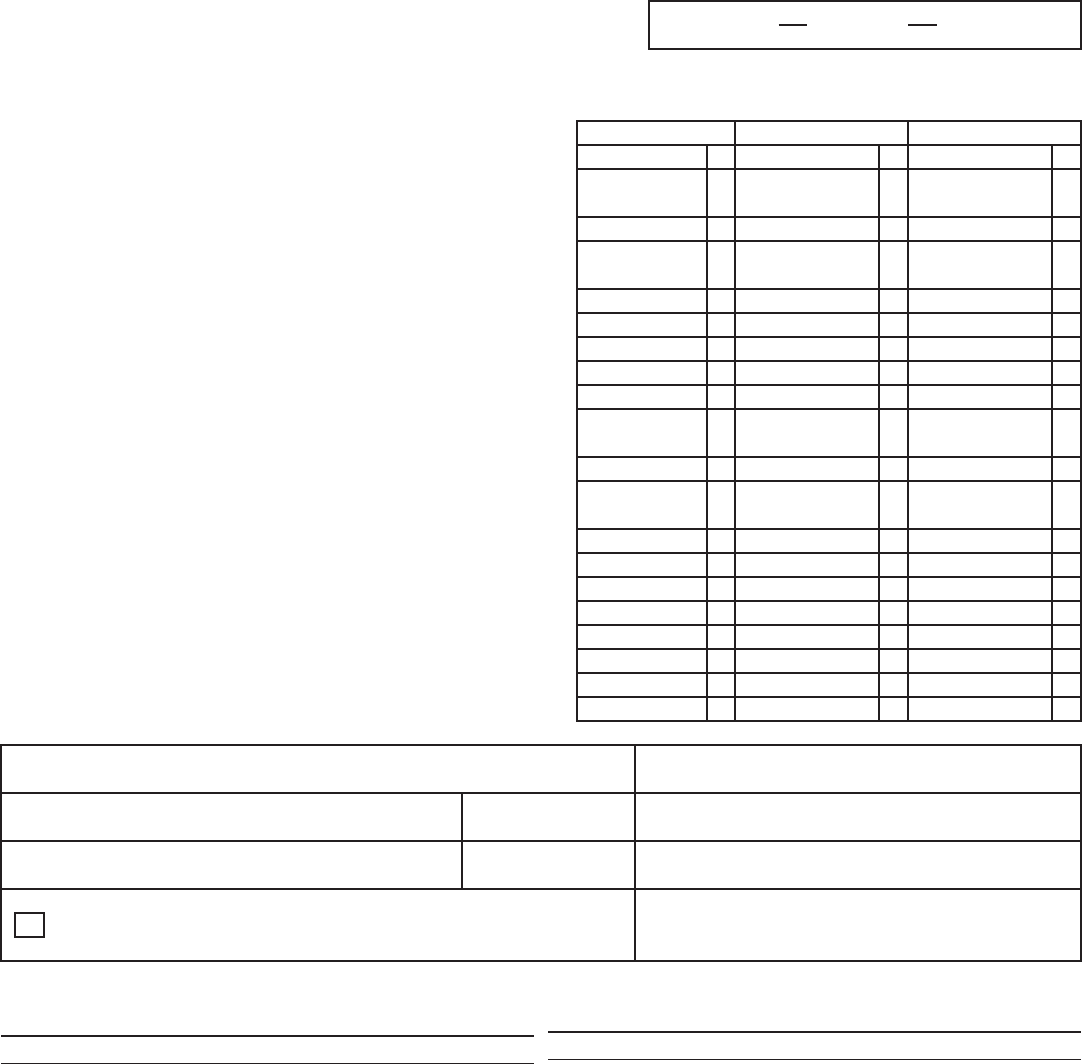

2012 MI-1045, Page 3

Filer’s Social Security Number

Computation of Federal Modied Taxable Income (FMTI) for

Household Income Only

NOTE: Do not complete this section if you are electing to forgo your carryback. Effective 2012, FMTI is not used and an NOL is not

allowed in determining Total Household Resources.

PART 3: ADJUSTING YOUR NOL FOR HOUSEHOLD INCOME

Step 1. Figure Your FMTI

A B C

41. Year you are carrying the NOL to ..................................................

42. Reported AGI for year shown on line 41 without NOLD ................ 00 00 00

43. a. Adjustments to AGI including DPAD (see instructions) .............. 00 00 00

b. Capital losses, in excess of capital gains ($3,000 maximum) ... 00 00 00

44. MODIFIED Federal AGI. Add lines 42 and 43a or 43b .................. 00 00 00

45. a. Medical (see instructions for limitations).................................... 00 00 00

b. Taxes ......................................................................................... 00 00 00

c. Contributions.............................................................................. 00 00 00

d. Interest....................................................................................... 00 00 00

e. Casualty loss ............................................................................. 00 00 00

f. Moving expenses....................................................................... 00 00 00

g. Miscellaneous (attach U.S. Schedule A; see inst.) .................... 00 00 00

h. Limit on itemized deductions ..................................................... 00 00 00

i. If you did not itemize, use the standard deduction .................... 00 00 00

46. Enter the total of 45a through h, or 45i if you did not itemize ........ 00 00 00

47. FMTI. Subtract line 46 from line 44. If less than zero, enter “0” .... 00 00 00

Step 2. Figure Your Carryback (If you are not carrying the loss back, go to Step 3.)

48.

Unabsorbed NOL. Enter in column A your

federal NOL as a positive amount ................................................. 00 00 00

49.

NOL to be carried to next succeeding year through 2011.

Subtract line 47 from line 48. Carry the amount on this line to

the next column, line 48. If less than zero, enter “0”...................... 00 00 00

Step 3. Figure Your Carryforward

50. Year the federal NOL occurred ......................................................

51. Enter the amount of the original federal NOL as a positive amount 00 00 00

52. Total of all NOLDs used for previous years ................................... 00 00 00

53.

Subtract line 52 from line 51. This is the remaining NOL that can

be carried forward to the year on line 41 ....................................... 00 00 00

54.

Subtract line 47 (FMTI) from line 53. This is the remaining

NOL to carry forward. If less than zero, enter “0” .......................... 00 00 00

Line-by-Line Instructions for Part 3

Part 3: Adjusting Your NOL for Household Income

Line 41: May be applied to tax years 2011 and prior only.

Line 42: Include NOL carryovers or carrybacks from earlier years.

Line 43a: Add back any domestic production activities deduction. Also,

adjustments to AGI, such as taxable Social Security benets and IRA

deductions, must be recalculated based on federal modied AGI.

Line 45: Use 45a through h if you itemized. If you didn’t itemize, use 45i.

45a: Medical adjustments. The amount of medical adjustments you can

take varies with federal law from year to year. You must recalculate your

medical expense deduction based on modied federal AGI and the federal

limitation in effect for the year entered on line 41.

45c: Percentage limitations on charitable contributions are based on

modied federal AGI.

45g: Miscellaneous deductions are limited to 2 percent of AGI. This

amount cannot exceed 2 percent of modied federal AGI.

45h: If modied AGI exceeds certain amounts, itemized deductions may be

limited. See limitations in effect for the year entered on line 41.

Line 47: This is your FMTI. Your Michigan NOLD will be the amount on

this line or the amount from line 48 (or line 53 for carryforwards), whichever

is smaller. This amount cannot be less than zero.

Line 48: Enter your federal NOL in column A as a positive amount. Each

succeeding year will be the excess portion (if any) from line 49 of the

preceding column.

Line 49: Subtract line 47 from line 48. If the result is more than zero, this is

the excess NOL to be carried to the next year. If it is less than zero, the NOLD

is limited to the excess on line 48. This is the last year affected by the NOL.

Note: Effective January 1, 2012 an NOLD cannot reduce total household

resources and is no longer used on Michigan Property Tax Credit and Home

Heating Credit.

Line 54: If line 47 is less than line 53, subtract line 47 from line 53 and

enter here; then use line 47 as your NOLD to recalculate your credit. If

line 47 is greater than line 53 enter “0” and use line 53 as your NOLD to

recalculate your Michigan credits.

+ 0000 2012 73 03 27 8

Instructions for Form MI-1045

2012 MI-1045, Page 4

NOTE: The Michigan NOL is generally carried back two years. Any remaining unused loss after the carryback period, may be carried forward

20 years. Certain exceptions and limitations to the general carryback period that apply to federal NOLs also apply to Michigan NOLs. See

U.S. Form 1045 instructions for more information on the general carryback rules for federal NOLs.

What is a Net Operating Loss?

A net operating loss (NOL) occurs when a business has losses

in excess of its gains. The Michigan NOL deduction (NOLD)

is subject to allocation and apportionment as required by the

Michigan Income Tax Act. Income and losses attributed to other

states, and income and losses from oil and gas production subject

to Michigan Severance tax included in the federal NOL must be

eliminated from the Michigan NOL calculation in the loss year.

The Michigan NOL may be carried back in the same manner as

prescribed in Section 172 of the Internal Revenue Code as in effect

for the year the loss was incurred. If your NOL is not exhausted

in the carryback years, or you elect to forego the carryback, an

NOL carryforward will exist for subsequent years. The carryover

period is limited to 15 years for loss years before 1998. Beginning

with the 1998 tax year, the carryback period is generally limited

to two years for both federal and Michigan taxes, and any unused

loss may be carried forward 20 years. Exceptions to the general

carryback periods for federal purposes also apply to Michigan.

The Michigan NOL

The Michigan Court of Appeals has ruled in two separate cases,

Preston v Treasury, 190 Mich App 491; 476 NW 2d 455, (1991)

and Beznos v Treasury, 224 Mich App 717; 569 NW 2d 908 (1997),

that the Michigan NOL and NOLD are computed separately and

independently of the federal NOL and NOLD. If you incurred a

federal NOL that you are carrying back to previous years, you

must determine the allowed Michigan NOL, if any, by completing

page 1 of Form MI-1045. If you incurred a Michigan NOL, but

are electing to forego the carryback, and carry the Michigan NOL

forward, you do not need to le this form until the year you actually

use the loss to offset Michigan income. If you incurred an NOL

from Michigan sources, but did not incur a corresponding federal

NOL, you must complete page 1 of Form MI-1045 to determine

your allowable Michigan NOL.

When to File Form MI-1045

If you are carrying back your NOL to prior years, Form MI-1045

must be led within four years after the date set for ling the return

in which the NOL was incurred. For example: If the original NOL

was incurred in 2008, then the original 2008 return was due April 15,

2009. You must le Form MI-1045 by April 15, 2013, to carryback

the 2008 Michigan NOL to a year that is otherwise outside of the

general 4 year statute of limitations. If your Michigan NOL is car-

ried forward, Form MI-1045 should be led in the year to which

it is being carried forward.

Using Form MI-1045

Use page 1 of Form MI-1045 to calculate your Michigan NOL for

the year of the loss. If you are carrying the loss back, you must

also complete page 2, Redetermining Your Michigan Income Tax.

Page 3 is used to determine the amount of your federal NOLD

that may be used to compute your household income for tax year

2011 or prior.

If you are ling a refund claim from the carryback of a Michigan

NOL, you must also le the appropriate amended credit claim

forms for each year the loss is being carried back. Attach the

amended credit claim forms to Form MI-1045.

The total amount of the federal NOLD used to arrive at federal

AGI must be added back on Form MI-1040. The Michigan NOLD

is then subtracted in its place on Form MI-1040. This amount will

be the NOL determined on Form MI-1045, page 1, line 22, less

any of the loss used in previous years. See the MI-1040 instruction

booklet for specic line references for the years involved.

Required Attachments

You must attach a copy of your federal income tax return (U.S.

Form 1040) and any supporting federal tax schedules or forms

that support the NOL. Be sure to indicate the location (city and

state) of any income or loss. If you have income or loss subject to

apportionment, see MI-1040H Schedule of Apportionment.

NOL Effects on Homestead Property Tax Credit

NOTE: Effective 2012, a NOL is not used to determine total

household resources. The NOLD/FTMI adjustment is allowed on

carrybacks only.

To determine household income for purposes of computing the

homestead property tax credit, the home heating credit, and the

farmland preservation tax credit, an NOLD is allowed for tax

year 2011 and prior. The amount of the NOLD that is allowed

cannot exceed your FMTI in the year to which it is being carried

back or carried forward. Claim the amount of the allowed

NOLD on the “other adjustments line” on the appropriate credit

forms for each applicable year. Caution: To deduct an NOLD

from household income, you must have a corresponding federal

NOLD. If you have a Michigan NOLD, but no federal NOLD,

you cannot take an NOLD in household income. Income and

losses from other states, income and losses from oil and gas

production, and federal itemized deductions must be considered

when calculating the NOL and NOLDs used for household income.

The amount of the allowable NOLD for use in household income

is calculated on page 3 of the MI-1045 form for both carrybacks

and carryforwards. The amount of the carryback deduction will be

the smaller of lines 47 or 48, and the amount of the carryforward

deduction will be the smaller of lines 47 or 53.

Example: Your 2010 FMTI is $20,000, and your 2010 federal

NOLD is $50,000. The amount of the 2010 NOLD of $50,000 that

may be used in 2010 household income is limited to $20,000. The

balance of $30,000 will be available for use in 2011 to the extent

of your 2011 FMTI.

Note: Effective January 1, 2012 an NOLD cannot reduce total

household resources and is no longer used on Michigan Property

Tax Credit and Home Heating Credit. For additional information

see instructions for Total Household Resources in the MI-1040

booklet on page 23.

Forms or Questions

Michigan tax forms are available on Treasury’s Web site at

www.michigan.gov/taxes. You may also call (517) 636-4486 to

have tax forms mailed to you or to ask technical questions.