- State of Alabama Worker's Compensation Information

- Disputed Claim for Compensation - Louisiana

- Compensation Hearing Notice of Appeal - Tennessee

- Supervisor's Injury or Illness Report - Pennsyvania

- Claimant Rights and Responsibilities - New Jersey

- Worker's Compensation Employer's Quarterly Report - Washington

Fillable Printable Application for Ohio Workers' Compensation Coverage

Fillable Printable Application for Ohio Workers' Compensation Coverage

Application for Ohio Workers' Compensation Coverage

What happens next?

Once BWC processes your

application you will receive notice

of:

• A new employer kit explaining

your rights and responsibilities,

and cost savings tips for your

business. The kit includes an

MCO Selection Guide with

instructions on how to select

a manage care organization

to manage the medical part

of your company’s workers’

compensation claims; Certificate

of Ohio Workers’ Compensation

Coverage, including the

effective date of coverage,

which is the day BWC received

your signed application and; the

$120 non-refundable application

fee. You must post the Certificate

of Ohio Workers’ Compensation

Coverage as proof of coverage;

• BWC requests 12-month

estimated payroll. The estimated

payroll provided will determine

your estimated annual

premium, which BWC uses to

calculate future installment

payments due.

Coverage is not in effect until BWC receives the completed application and the $120 non-refundable application fee. BWC cannot process incomplete applications.

Workers’ compensation coverage protects you and your employees

in the event of a work-related injury, disease or death. In Ohio,

all employers with one or more employees must carry workers’

compensation coverage. It’s the law. Coverage becomes effective when

BWC receives this completed application and the $120 non-refundable

application fee. Independent contractors and subcontractors also must

obtain coverage for their employees.

BWC considers officers of a corporation employees for the purposes

of workers’ compensation; except for an individual incorporated as a

corporation with no employees.

However, if you are self-employed, a partner in a business, an officer of a

family farm corporation or an individual incorporated as a corporation,

you are not automatically covered. You may elect coverage for yourself

by selecting Yes in the elective coverage section and owners/officers/

ministers information section of this application.

Note: Even if you do not elect coverage for yourself you must have

coverage for any employees you hire.

1. Apply for coverage online at www.bwc.ohio.gov, or complete all

fields on this application for coverage;

2. Provide as many details as possible. When describing the nature

of the business, include the type of work performed and the

equipment used;

3. Sign and date the application. It’s not valid without a signature;

4. Mail the completed application with the $120 non-refundable

application fee to: Ohio Bureau of Workers’ Compensation

P.O. Box 15698

Columbus, OH 43215-0698

Please make check or money order payable to the Ohio Bureau of

Workers’ Compensation.

It’s easy to obtain coverage by following these steps:

BWC-7503 (Rev. May 26, 2015) Instruction page 1 of 4

U-3

Application for

Ohio Workers’ Compensation Coverage

Have question? Need assistance? BWC is here to help!

Call 1-800-644-6292, and listen to the options to reach a customer service representative.

You can dial the number nationwide, and in Canada and Mexico from 7:30 a.m. to 5:30 p.m. EST.

Remember, you can access information and request services by visiting BWC’s Web site at www.bwc.ohio.gov.

online form

Ohio law requires employers to obtain workers’ compensation coverage for their employees from the first date of hire. Indicate the

date your employees first earned wages in Ohio or the date you estimate your employees will first earn wages in Ohio. If you do

not provide this information, you may be assessed a penalty for non-covered periods where coverage should have been obtained.

Be sure to supply your federal employer identification number (FEIN). You can obtain a FEIN number by calling the Internal Revenue

Service. If you have applied for a FEIN, but have not received one, write “applied for” in the appropriate box, and you may supply

it at a later date. Domestic household employers, sole proprietors and partnerships who do not need a FEIN should supply a Social

Security number of the sole proprietor, one of the home owners or partners.

BWC uses your primary physical Ohio location to assign one customer service office for all your policy services. Please provide the

address for your primary Ohio location best capable of handling and resolving your policy issues or an out of state location if you

have no physical Ohio location. BWC will send all employer related correspondence including your invoice to the mailing address.

If no mailing address is provided, BWC will use the primary physical Ohio location for all employer notifications.

General Information

Retain for your records Instruction page 2 of 4

Select the one business entity type that applies to your company. For workers’ compensation purposes, there are four possible

business entity types that apply to a corporation (i.e., limited liability company acting as a corporation, corporation, individual

incorporated as a corporation with no employees and family farm corporation). Select the business entity type that best describes

your corporate structure. Be sure to include the corporation date, charter number and state where incorporated. If incorporated in

a state other than Ohio, the charter number may be referred to as some other identifier name.

Domestic household coverage: Applies to full or part-time domestic workers employed inside or outside your private residence

and includes private chauffeurs. Domestic household employers who pay workers $160 or more in a calendar quarter must have

workers’ compensation insurance. Normally these workers provide domestic services such as gardening, housekeeping, babysitting,

etc. However, you should include workers you hire as employees to provide home improvement for construction type activities

to your residence if the worker does not have his or her own business or their own workers’ compensation insurance. Please

check the appropriate box under Domestic household employer that applies to the type of worker you will hire, and supply a 12

-month payroll estimate so BWC may calculate your future installment payments due. If you are hiring a contractor to perform

these services, you may want to verify he or she has active workers’ compensation coverage.

Sole proprietors and partners (including limited liability companies acting as a sole proprietor or partnership): Sole proprietors and

partners are exempt from workers’ compensation coverage. However, you must cover your employees. If you qualify for elective

coverage, you can elect coverage by selecting Yes in the elective coverage section and owners/officers/ministers information

section of this application.

Limited liability companies: These companies can elect to be treated as a corporation, sole proprietorship or partnership for

income tax purposes. Because of this, owners of a limited liability company can be treated differently depending upon the form

of entity they elect for income tax purposes. Therefore, if you file your income taxes as a sole proprietorship or partnership,

coverage is elective for the owners. If you file your income taxes as a corporation, coverage for the owners is not elective except

for an individual incorporated as a corporation. Please check the appropriate limited liability company box advising whether you

are acting as a sole proprietor, partnership or a corporation.

Corporations: Corporate officer reportable wages are subject to a minimum and maximum, which is based on the statewide average

weekly wage (SAWW) calculated annually by the Ohio Department of Job and Family Services. The minimum payroll reporting

limit will be 50 percent of the SAWW and the maximum payroll reporting limit will be 150 percent of the SAWW. The minimum

reportable payroll applies only to active executive officers of the corporation (i.e., officers engaged in the decision making and

the day to day operation of the corporation). Officers of a corporation who earn between the minimum and maximum will report

their actual W-2 wages. For S-corporations, officers must report wages for services they perform. This may include W-2 wages as

well as all or part of ordinary income from Schedule K-1 up to the maximum.

Note: Visit BWC’s website (choose: Ohio Employers; Payroll reporting information under Financial Info heading), or call BWC to

obtain the minimum and maximum payroll reporting requirement amounts applicable for each policy period.

Individuals incorporated as a corporation (with no employees): To qualify for this business entity type you must have a single/

sole owner with no employees. The single/sole owner with no employees can elect coverage by selecting Yes in the elective

coverage section and owners/officers/ministers information section of this application. By law, corporations having more than

one owner or a single/sole owner with employees must have workers’ compensation coverage for all personnel associated with

the corporation, including all corporate officers.

Family farm corporation: These officers are exempt from workers’ compensation coverage. However, they must cover their

employees. These family farm corporate officers can elect coverage by selecting Yes in the elective coverage section and owners/

officers/ministers information section of this application. To qualify as a family farm corporation, you must meet the following

criteria:

• The family farm must be founded for the purpose of farming animal or plant products intended for consumption by human

beings or animals (excluding nurseries and flower production enterprises);

• A majority of the shareholders must be related within the fourth degree of kinship (siblings, parents, grandparents, aunts,

uncles, great aunts, great uncles or first cousins) or be the spouse of such persons;

• No shareholder may be a corporation;

• At least one of the related persons within the corporation must reside on or actively operate the farm.

Business entity information

Effective July 27, 2006, for all successions taking place on or after Sept. 1, 2006, in situations where a successor takes over the entire

operation, any and all existing and future liabilities or credits will transfer to the successor in addition to the experience. Pursuant to

Ohio Administrative Code 4123-17-02 you may be considered a successor if you continue the previous employer’s operations, even

if there is no purchase. In such cases, it will be the successor’s responsibility to notify BWC of the succession. When you acquire or

purchase a business, you must apply for Ohio workers’ compensation coverage if you have one or more employees. An exception

to this would be when the operations are continued by a family member. In such case you may complete Notification of Policy

Update to Make Changes to the Existing Policy (U-117).

If an employer purchases or acquires only a portion of the business, BWC transfers only that portion of the former employer’s

experience to the succeeding employer. BWC will inspect the former employer’s payroll and claims records to determine what

should transfer to the successor for rate calculation purposes.

Business acquisition/associated policy information

Instruction page 3 of 4 Retain for your records

Coverage on the owners or officers of a corporation and a limited liability company acting as a corporation (except for individuals

incorporated as a corporation) is not voluntary. However, coverage on certain owners or ministers is elective. The categories of

individuals that qualify for elective coverage are listed below.

• Sole proprietor

• Partnership

• Limited liability company acting as a sole proprietor

• Limited liability company acting as a partnership

• Family farm corporate officers

• Ordained or associate ministers of a religious organizations in the exercise of their ministries

• Individual incorporated as a corporation (with no employees)

If you qualify for elective coverage, you can elect coverage by selecting Yes in the Elective coverage section and owners/officers/

ministers information section of this application. If you choose not to cover yourself at this time, you may elect coverage at a later

time and/or to add additional qualifying owners or ministers by completing the Application for Elective Coverage (U-3S). Remember,

if you choose not to cover yourself and you are injured at work, BWC will not provide coverage, and other insurance may not cover

your work-related disability or medical bills.

Specific payroll reporting requirements associated with elective coverage are listed below.

Sole proprietors and partners (including limited liability companies acting as a sole proprietor or partnership): For all individuals

electing coverage, the reportable wages are subject to a minimum and maximum, which is based on the SAWW calculated annually

by the Ohio Department of Job and Family Services. The minimum payroll reporting limit will be 50 percent of the SAWW and the

maximum payroll reporting limit will be 150 percent of the SAWW. Individuals who earn between the minimum and maximum will

report their actual net incomes based on their form 1040, Schedule C for sole proprietors, or form 1065 Schedule K-1 for partnerships,

inclusive of any draws.

Officers of a family farm corporation: For corporate officers of a family farm electing coverage, the reportable wages are subject to

a minimum and maximum, which is based on the SAWW calculated annually by the Ohio Department of Job and Family Services.

The minimum payroll reporting limit will be 50 percent of the SAWW and the maximum payroll reporting limit will be 150 percent

of the SAWW. Officers of a corporation who earn between the minimum and maximum will report their actual W-2 wages. For

S-corporations, officers must report wages for services they perform. This may include W-2 wages as well as all or part of ordinary

income from Schedule K-1 up to the maximum.

Religious organizations: Ohio law requires religious organizations to cover their paid employees. However, ordained ministers and

associate ministers are not considered employees for the purpose of workers’ compensation. When a minister is covered under

the religious organization’s policy, actual earnings are reportable and are not subject to the minimum and maximum. Ministers not

covered under the religious organization’s policy can complete an application for coverage and elect coverage on themselves as a

sole proprietor. Ministers electing coverage as a sole proprietor are subject to the minimum and maximum reporting requirements

as described above.

Individuals incorporated as a corporation (with no employees): For individual corporate officers electing coverage, the reportable

wages are subject to a minimum and maximum, which is based on the SAWW calculated annually by the Ohio Department of Job

and Family Services. The minimum payroll reporting limit will be 50 percent of the SAWW, and the maximum payroll reporting limit

will be 150 percent of the SAWW. Officers of a corporation who earn between the minimum and maximum will report their actual

W-2 wages. For S-corporations, officers must report wages for services they perform. This may include W-2 wages as well as all or

part of ordinary income from Schedule K-1 up to the maximum.

Note: Visit BWC’s website (choose Employers, Payroll reporting information under Financial Information heading, then click on

Minimum and maximum payroll reporting requirements. You may also call BWC to obtain the minimum and maximum reporting

requirement amounts applicable for each policy year.

Elective coverage

You must provide name, home address, Social Security number, title/relationship and percentage of ownership interest, if any.

(Attach additional sheets, if necessary). Additionally, individuals that qualify for elective coverage must indicate whether or not they

wish to elect coverage for themselves in this section.

Religious organizations must list the ordained or associate ministers they elect to cover under the religious organization’s policy

in this section.

Owners/officers/ministers information

Instruction page 4 of 4

Certification - Signature required

All applications require a signature. Please be sure to complete this area.

Coverage is not in effect until BWC receives the completed application and the $120 non-refundable application fee.

BWC will not process incomplete applications.

Retain for your records

You may segregate your payroll by state if you elect to obtain non-BWC coverage for work done outside of Ohio. Please refer to

BWC’s Notice of Election to Obtain Coverage from Other States for Employees Working Outside of Ohio (U-131) and instructions to

determine if this election is available to your business.

Ohio employers: You must disclose payroll information for employees who work both within and outside of Ohio. If you elect

coverage from another state, you:

• ShouldNOTincludeworkdoneoutsideofOhiowhenreportingpayrollorcalculatingpremiumpaymentstoBWCforwork

done in Ohio;

• MustreportpayrollforworkdoneoutsideofOhiotoBWConaseparateform.(Thisisforrecordkeepingpurposesonly.You

do NOT have to pay an Ohio premium for out-of-state work.)

Out-of-state employers: BWC will recognize out-of-state coverage for employees who are residents of another state but work

temporarily in Ohio for no more than 90 days.

If you specifically hire employees to work in Ohio, you must obtain coverage from BWC regardless of where you hired the workers.

Out-of-state considerations

Ohio law allows for employers who pay a premium greater than the minimum $120 to select a payment plan installment schedule.

Employers who report the minimum premium will automatically be set up on a one pay. The option you select may not be available

for your first policy period. If you meet the qualifications for the payment plan option you selected, the payment plan schedule will

be available for your first full policy year.

Premium payment installment

Provide the estimated 12-month payroll for each operation conducted by your employees as well as the number of employees

you have under each operation. For individuals who qualify for elective coverage, list only those who have elected coverage in the

owner/officer/minister information section.

Payroll by operation type (does not apply to domestic household employers)

A complete description of your business is necessary to classify your operations. If you supply inadequate information, BWC could

misclassify your policy. To prevent this from occurring, BWC asks that you supply in-depth information regarding your processes,

the equipment used and any final product you may produce.

Operations description (does not apply to domestic household employers)

BWC-7503 (Rev. May 26, 2015) Application Page 1 of 4

U-3

Application for

Ohio Workers’ Compensation Coverage

Business purchase/Associated policy information

List policy(s)# Name

*Did you acquire/purchase this

*Previous owner’s name and BWC policy number

*Date you acquired/purchased

*Did you acquire/purchase all

business? Yes No

business

or part of an existing business

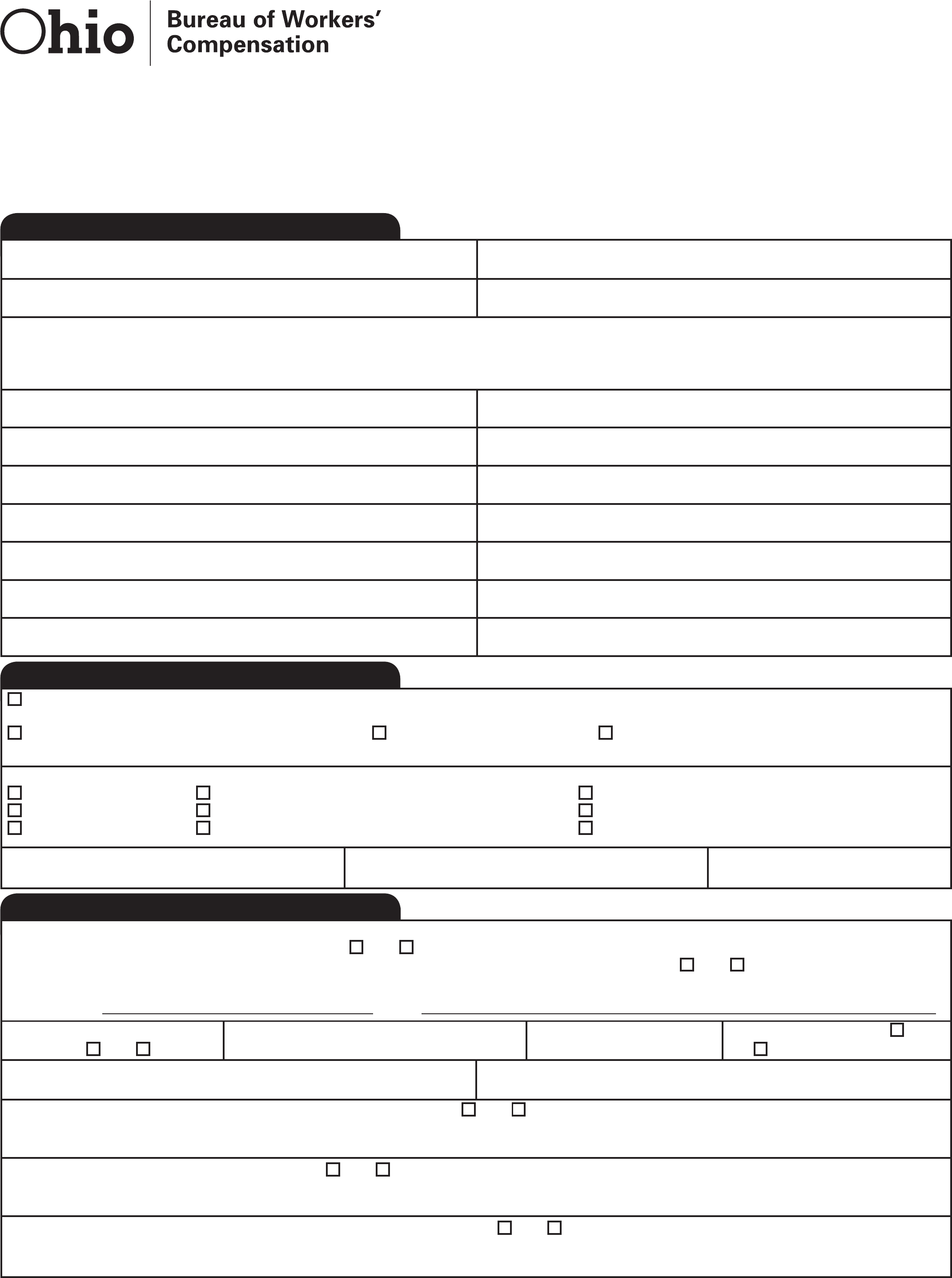

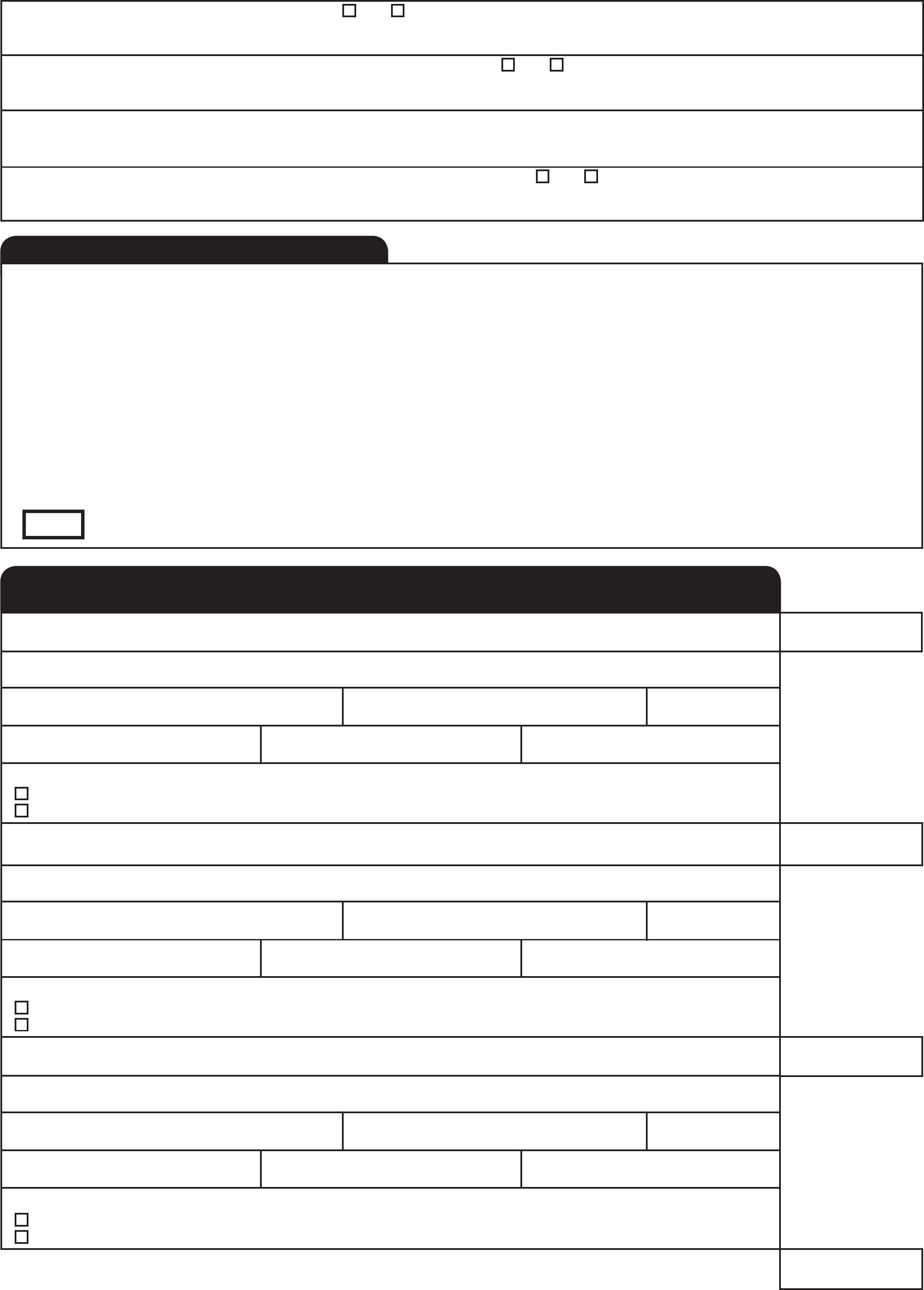

General information - completed by all employer types

Business entity information

Domestic household: Applies to full/part-time domestic workers employed inside or outside your private residence.

Check the type of services your domestic household employees will perform within your residence.

Domestic inside and/or outside yard/ground maintenance Home improvement/Maintenance Construction (new/addition/roofing) on or in your home.

12-month payroll estimate ___________________

*Please check the one business entity type below that applies to you.

Sole proprietor Limited liability company acting as a sole proprietor Corporation

Partnership Limited liability company acting as a partnership Individual incorporated as a corporation

Limited partnership Limited liability company acting as a corporation Family farm corporation

Incorporation date Charter number State where incorporated

Have questions? Need assistance? BWC is here to help!

Call 1-800-644-6292, and listen to the options to reach a customer service representative.

You can dial the number nationwide, and in Canada and Mexico from 7:30 a.m. to 5:30 p.m. EST.

Remember, you can access information and request services by visiting BWC’s Web site at www.bwc.ohio.gov.

BWC will not process incomplete applications. All required fields (*) must be completed.

BWC will also not process applications without a $120 non-refundable application fee.

*Legal business name or homeowner Trade name or doing business as name

*Date employees first earned wages in Ohio. If no employees, enter *Federal employer identification number or Social Security number

today’s date.

*Primary physical (Ohio) location: If no Ohio location, provide your out-of-state location

(Attach additional locations, if applicable)

Street (Do not use P.O. box) City State ZIP code

*Location phone Location fax number

Email address Website

*Contact name *Contact phone

Mailing address: If different from primary physical (Ohio) location City

Street

State, ZIP code Mailing address phone

Mailing address fax number Email address

Contact name Contact phone

online form

*Do you have a purchase agreement associated with the transaction? Yes No

If yes, BWC may request a copy of the agreement.

Did you acquire or purchase the former employer’s contracts or customers? Yes No

Explain

Has the business been in continuous operation? Yes No

Explain

*Have there been other Ohio workers’ compensation policies associated

with this operation or any other affiliated operation? Yes No

*Do any of the principals have workers’ compensation coverage in this or

any other operation; or have they had workers’ compensation coverage

in any operation in the past? Yes No

Previous employer contact name

Previous employer phone number

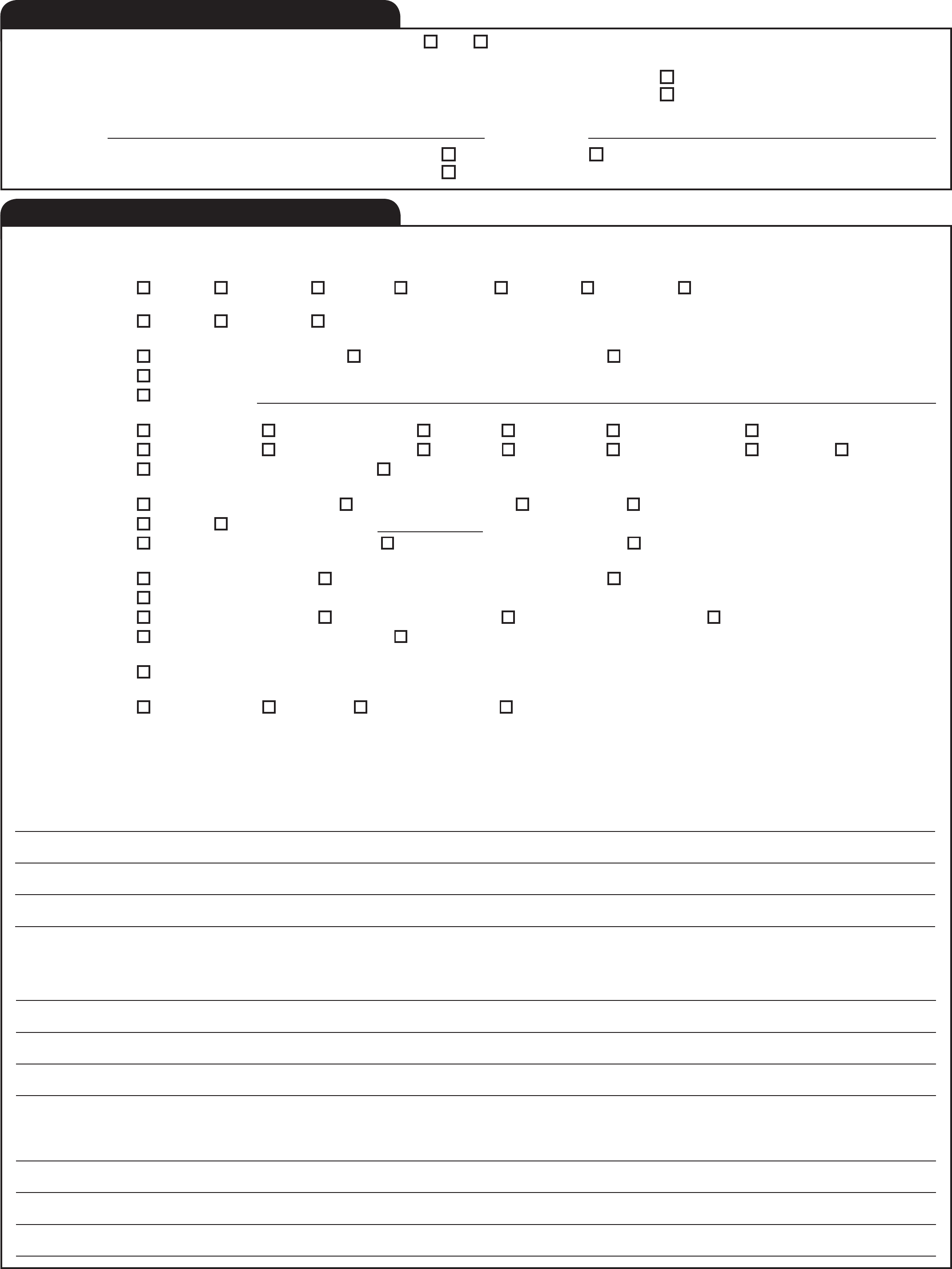

Elective coverage

See additional details in the business entity information and elective coverage sections for completing the application, which describe the reporting

requirements for elective coverage.

Coverage on the owners or officers of a corporation and a limited liability company acting as a corporation (except for individuals incorporated as

a corporation with no employees) is not voluntary.

However, coverage on certain owners or ministers is voluntary. Listed below are the categories of individuals that qualify for elective coverage.

• Sole proprietor • Family farm corporate ofcers

• Partnership • Ordained or associate minister of a religious organization

• Limited liability company acting as a sole proprietor • Individual incorporated as a corporation (with no employees)

• Limited liability company acting as a partnership

If someone at your company meets the qualifications for elective coverage, please enter all of their names in the owner/officers/minister informa-

tion section. If you select yes to request elective coverage, please understand that by electing coverage that you are acknowledging your agree-

ment to the minimum payroll reporting requirements outlined in the U-3 instructions. Remember, if you choose not to cover yourself and you are

injured at work, BWC will not provide coverage, and other insurance may not cover your work-related disability or medical bills.

n

Please initial to acknowledge you have read and understand the elective coverage guidelines.

Application Page 2 of 4

Owners/officers/ministers information –

Please provide the required information for all owners and officers. If you are a

religious organization and wish to elect coverage on your ministers, you must also provide this information for the ministers.

*Name #1 (last, first, middle) *% Ownership

*Home address (street or PO Box)

*City *State *ZIP code

*Social Security number *Title Phone

*For individuals that qualify, do you wish to elect coverage?

Yes I do wish to elect coverage for myself.

No I understand that BWC will not pay benefits for my work-related injury if I do not elect coverage.

*Name #2 (last, first, middle) *% Ownership

*Home address (street or PO Box)

*City *State *ZIP code

*Social Security number *Title Phone

*For individuals that qualify, do you wish to elect coverage?

Yes I do wish to elect coverage for myself.

No I understand that BWC will not pay benefits for my work-related injury if I do not elect coverage.

*Name #3 (last, first, middle) *% Ownership

*Home address (street or PO Box)

*City *State *ZIP code

*Social Security number *Title Phone

*For individuals that qualify, do you wish to elect coverage?

Yes I do wish to elect coverage for myself.

No I understand that BWC will not pay benefits for my work-related injury if I do not elect coverage.

*Total ownership %

How many employees of the former employer did you hire? _______

Did you acquire or purchase any machinery or equipment from the former employer? Yes No

Explain

Will you conduct business in the same/similar manner as the former employer? Yes No

Explain

Are you operating in the former employer’s location? Yes No

Explain

Application Page 3 of 4

Operations description

*Check all types that apply to your Ohio operations.

Agriculture Crop Livestock Dairy Vegetable Poultry Orchard Berry/vineyard

Extraction Mining Oil or gas Quarry

Construction Permanent yard operations Residential three stories and under Interior trim/cabinets

Commercial, industrial and dwellings more than three stories

Other (describe)

Transportation Owned goods Non-owned goods Ground Air carrier Water transport Interstate carrier

Gen. Freight Parcel People Appliance Furniture Oil Gas

Distance Local 200 miles or less More than 200 miles

Commercial Wholesale: Sales_____% Retail: Sales_____% Packaging Drivers/delivery

(merchandising) Repair Principal products sold

Coffee or tea house (no cooking) Beverages_____% of total sales Food _____% of total sales

Service Restaurant – fast food Restaurant – wait service (not counter) Delivery

Alcohol ____% of receipts compared to total sales

Warehousing for others Religious organization Residential house cleaning Commercial cleaning

Vacant residential cleaning Domestic employees working in your home

Elevated Cleaning from Stool, ladder etc.

Office work/

Medical office Attorney Real estate agent

Property management (not property preservation)

*Describe your services or products, including your methods of operations. Include raw and semi-finished materials used (attach additional

documentation, if necessary). Note: It is important for you to provide as much information as possible for BWC to properly determine your correct

classification.

*Describe machinery, equipment and tools (attach additional documentation, if necessary).

*If you do not have a primary physical Ohio location, provide an explanation for not having an Ohio location and/or reason you are applying for Ohio coverage.

Out-of-state considerations

Are you an Ohio employer with employees working outside Ohio? Yes No

Are your employees covered under another workers’ compensation policy issued for a state other than Ohio? Yes If yes, provide the information below.

No

Insurer name:

Policy number:

Was the contract of hire for your employees entered into: Select one Exclusively in Ohio Exclusively in a state other than Ohio

Combination of Ohio and in a state other than Ohio

Application Page 4 of 4

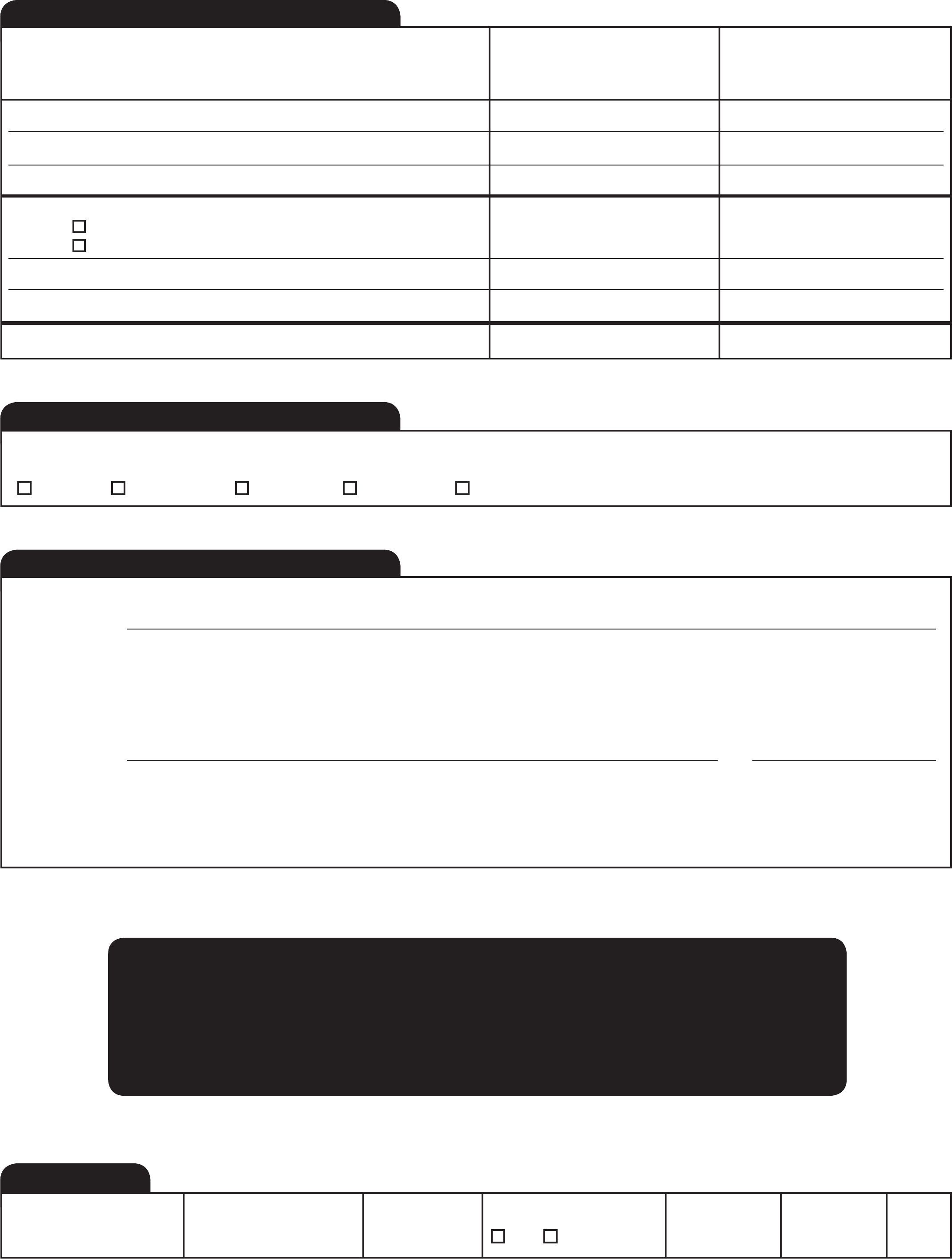

Policy number Application number Effective date Payment type Payment amount Date received Initials

Cash

Check

BWC USE ONLY

You may submit your application online and pay your $120 non-refundable application fee using a

checking or savings account, or a credit card (Master Card®, Visa® or American Express®) at www.

bwc.ohio.gov.

You may also submit the completed U-3 along with a $120 check or money order to:

Ohio Bureau of Workers’ Compensation

P.O. Box 15698

Columbus, OH 43215-0698

Payroll by operation type

*List all types of operations that apply (attach additional sheets if

necessary).

The following are in addition to the above:

Clerical Office personnel (no duties outside of the office, no counter service);

Telecommuter (clerical employees working from residence);

Traveling salespeople (no handling, servicing or delivery);

Drivers (truck or delivery);

Sole proprietors, partners or ministers (if elective-coverage is elected).

*For each operation type, estimate

total number of employees.

*For each operation type, estimate

total payroll for next 12 months.

Certification – signature required

Name (please print)

By my signature, I certify I have the authority to execute this application, and that the facts set forth on this application are true and correct to

the best of my knowledge and belief. I am aware that any person who does not secure or maintain workers’ compensation coverage and pay

all appropriate premiums in accordance with Ohio laws, or misrepresents, conceals facts, or makes false statements to obtain coverage may be

subject to civil, criminal and/or administrative penalties.

*Employer signature *Date

WARNING: Insurance is not in effect until BWC receives the application and the $120 non-refundable application fee.

BWC cannot process incomplete applications or applications submitted without payment.

Premium payment installment plan

Select the installment option that you will use for the next full policy year. For partial policy years, not starting on July 1, BWC will match as closely as

possible to your selection.

Annual (1) Semiannual (2) Quarterly (4) Bimonthly (6) Monthly (12)