Fillable Printable Application for Retirement Insurance Benefits

Fillable Printable Application for Retirement Insurance Benefits

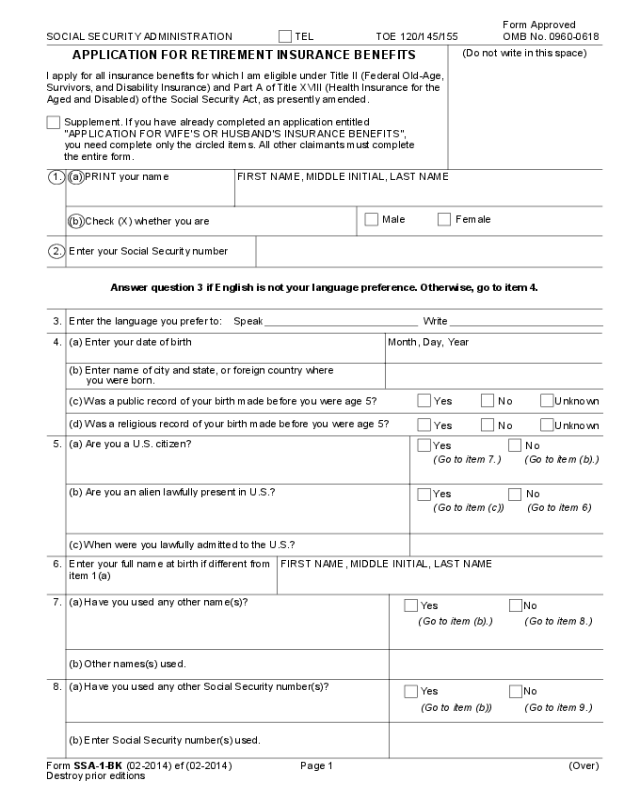

Application for Retirement Insurance Benefits

2.

WriteSpeak

1.

(b) Enter Social Security number(s) used.

(a) Have you used any other name(s)?

(b) Check (X) whether you are

Answer question 3 if English is not your language preference. Otherwise, go to item 4.

Enter the language you prefer to:

(a) Enter your date of birth

Enter your Social Security number

FIRST NAME, MIDDLE INITIAL, LAST NAME(a) PRINT your name

Page 1 (Over)

Yes

No

(d) Was a religious record of your birth made before you were age 5?

Yes No Unknown

(c) Was a public record of your birth made before you were age 5?

Yes No Unknown

Male Female

(b) Enter name of city and state, or foreign country where

you were born.

Enter your full name at birth if different from

item 1(a)

FIRST NAME, MIDDLE INITIAL, LAST NAME

Yes No

8. (a) Have you used any other Social Security number(s)?

6.

Month, Day, Year

NoYes

(a) Are you a U.S. citizen?

(b) Are you an alien lawfully present in U.S.?

(b) Other names(s) used.

(Go to item 7.) (Go to item (b).)

(Go to item (b).) (Go to item 8.)

(Go to item (b)) (Go to item 9.)

3.

4.

5.

7.

Form Approved

OMB No. 0960-0618

TEL TOE 120/145/155

SOCIAL SECURITY ADMINISTRATION

APPLICATION FOR RETIREMENT INSURANCE BENEFITS

I apply for all insurance benefits for which I am eligible under Title II (Federal Old-Age,

Survivors, and Disability Insurance) and Part A of Title XVIII (Health Insurance for the

Aged and Disabled) of the Social Security Act, as presently amended.

Supplement. If you have already completed an application entitled

"APPLICATION FOR WIFE'S OR HUSBAND'S INSURANCE BENEFITS",

you need complete only the circled items. All other claimants must complete

the entire form.

(Do not write in this space)

(c) When were you lawfully admitted to the U.S.?

Yes No

(Go to item (c)) (Go to item 6)

Form SSA-1-BK (02-2014) ef (02-2014)

Destroy prior editions

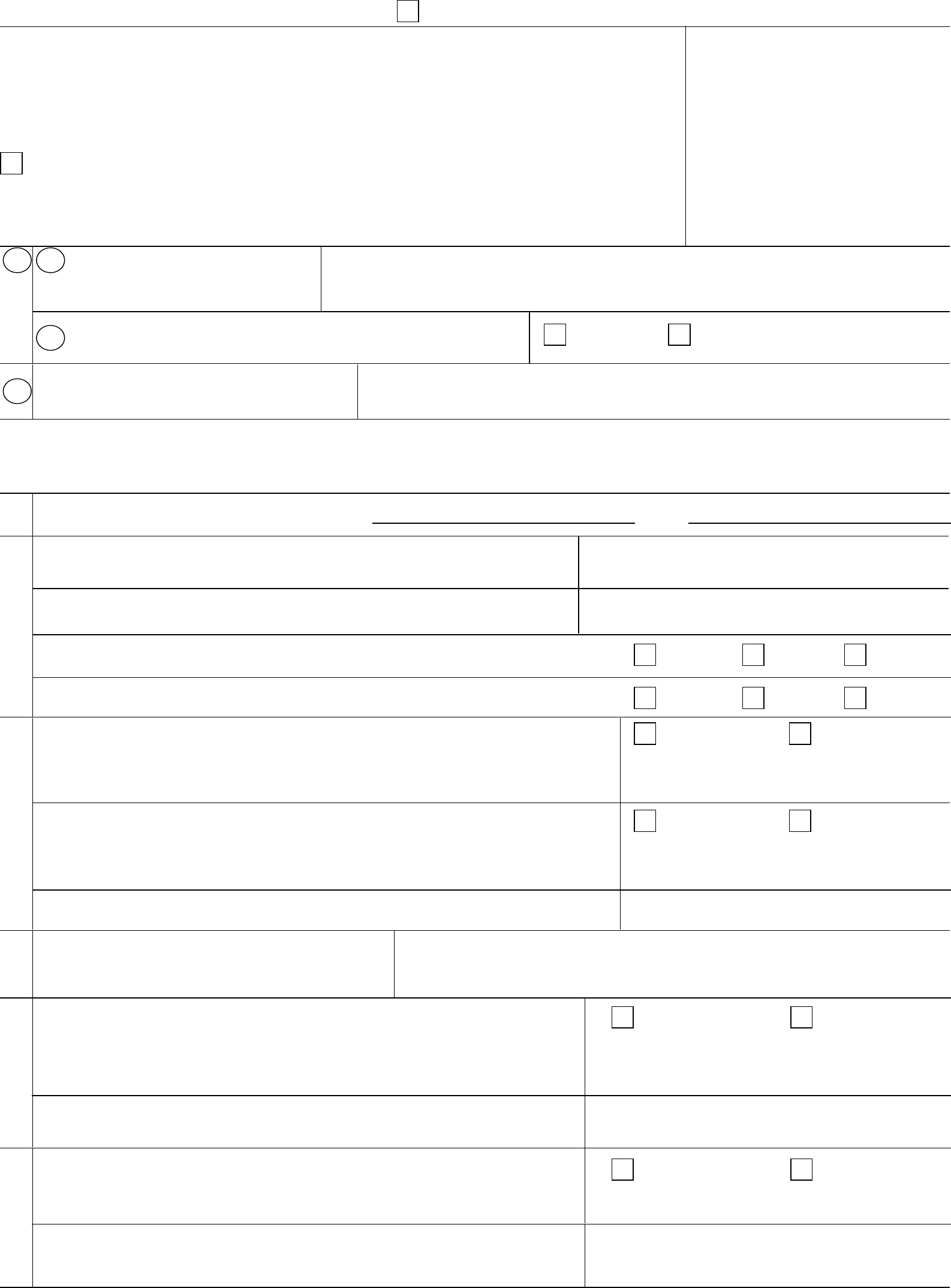

11.

10.

12.

13.

(a) Were you in the active military or naval service (including

Reserve or National Guard active duty or active duty for

training) after September 7, 1939 and before 1968?

Did you or your spouse (or prior spouse) work in the railroad industry

for 5 years or more?

(a) Do you (or your spouse) have Social Security credits (for example

based on work or residence) under another country's Social

Security system?

Yes No

9.

(a) Are you, or during the past 14 months have you been, unable

to work because of illnesses, injuries or conditions?

FIRST NAME, MIDDLE INITIAL, LAST NAME

(b) If "Yes", enter the date you became unable to work.

(b) Enter date(s) of service

(c) Are you (or your spouse) filing for foreign Social Security benefits?

Yes No

Yes

No

NoYes

Yes No

NoYes

Page 2

Yes

No Unknown

NoYes

14.

(If "No," go on

to item 15.)

(If "Yes,"

answer (b)

and (c).)

(a) Are you entitled to, or do you expect to be entitled to, a pension or

annuity (or a lump sum in place of a pension or annuity) based on your

work after 1956 not covered by Social Security?

(b) I became entitled, or expect to become entitled, beginning

(c) I became eligible, or expect to become eligible, beginning

MONTH, DAY, YEAR

MONTH

MONTH

YEAR

YEAR

(If "No," go

to item 11.)

(If "No," go

to item 12.)

(If "No," go

to item 14.)

(If "Unknown,"

go to item 11.)

(If "Yes,"

answer (b)

and (c).)

(If "Yes," answer

(b) and (c).)

(If "Yes,"

answer (b)

and (c).)

Do not answer question 9 if you are one year past full retirement age or older; go to question 10.

(a) Have you (or has someone on your behalf) ever filed an

application for Social Security, Supplemental Security

Income, or hospital or medical insurance under Medicare?

(c) Enter Social Security number(s) of person named in

(b). (If unknown, so indicate.)

Month, Year Month, Year

(b) List the country(ies):

From: To:

Answer question 14 only if you were born January 2, 1924, or later. Otherwise go on to question 15.

I agree to promptly notify the Social Security Administration if I become

entitled to a pension, an annuity, or a lump sum payment based on

my employment not covered by Social Security, or if such pension or

annuity stops.

(b) Enter name of person(s) on whose Social Security

record you filed other application.

Form SSA-1-BK (02-2014) ef (02-2014)

(c) Have you ever been (or will you be) eligible for monthly benefits

from a military or civilian Federal agency? (Include Veterans

Administration benefits only if you waived Military retirement pay).

Form SSA-1-BK (02-2014) ef (02-2014)

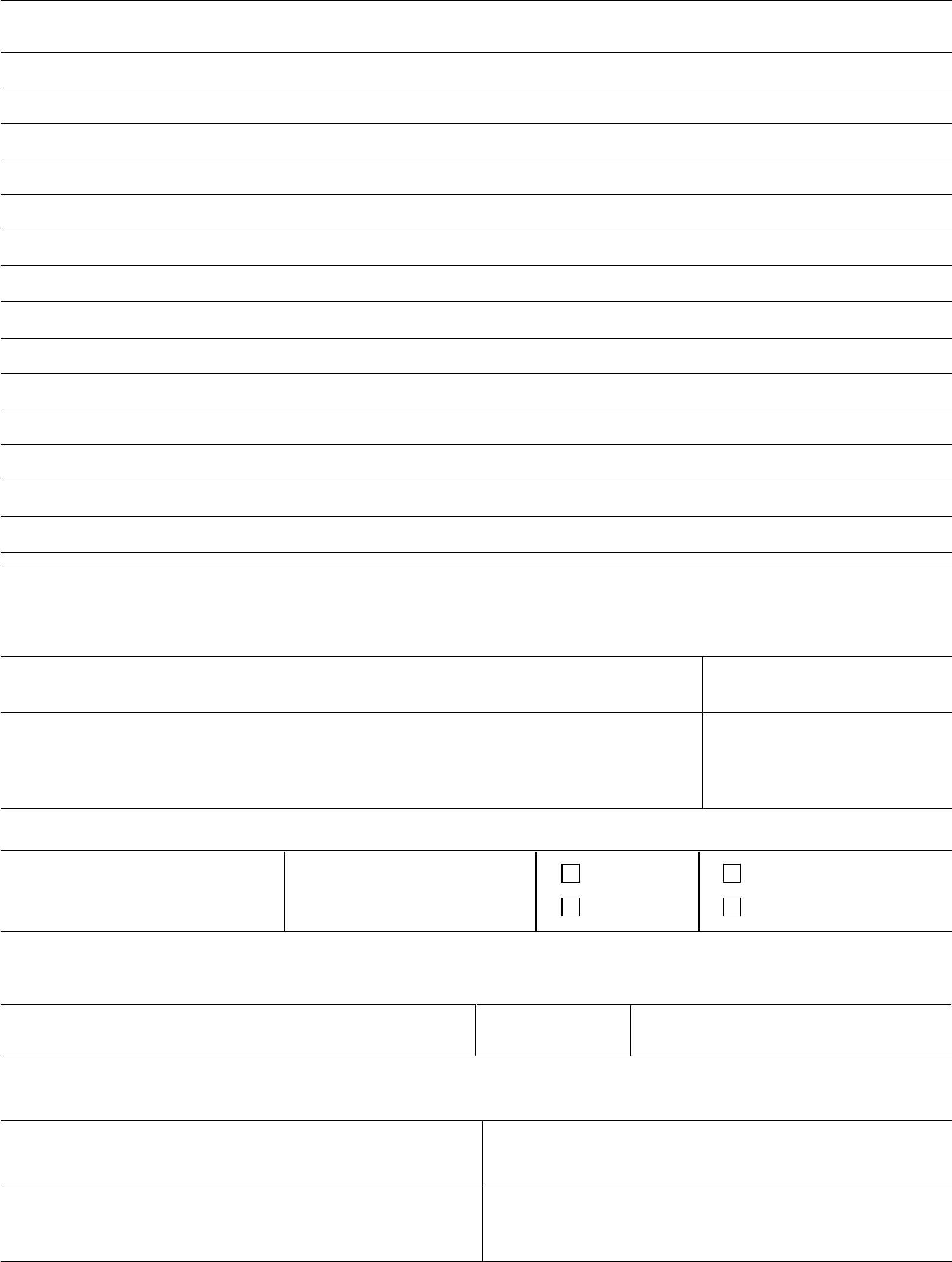

Page 3

NoYes

15.

(a) Give the following information about your current marriage. If not currently married, write "None"

Go on to item 16(b).

Spouse's Social Security number (If none or unknown, so indicate)

Marriage performed by:

Spouse's name (including maiden name) When (Month, day, year)

When (Month, day, year) Where (Name of City and State)

Spouse's date of birth (or age) If spouse deceased, give date of death

Other (Explain in "Remarks")

Where (Name of City and State)

(b) Enter information about any other marriage if you:

• Had a marriage that lasted at least 10 years; or

• Were divorced, remarried the same individual within the year immediately following the year of the divorce, and

the combined period of marriage totaled 10 years or more.

16.

How marriage ended (If still in effect,

write "Not Ended.")

(If "Yes," answer item 16.) (If "No," go to item 17.)

If your claim for retirement benefits is approved, your children (including adopted children and stepchildren)

or dependent grandchildren (including step grandchildren) may be eligible for benefits based on your

earnings record.

Spouse's name (including maiden name) When (Month, day, year) Where (Name of City and State)

(c) Enter information about any marriage if you:

• Have a child(ren) who is under age 16 or disabled or handicapped (age 16 or over and disability began before

age 22); and

• Were married for less than 10 years to the child's mother or father, who is now deceased; and

• The marriage ended in divorce If none, write "None."

Use the 'Remarks' space on page 6 for marriage continuation or explanation.

Have you been married?

Clergyman or public official

• Had a marriage that ended due to death of your spouse, regardless of duration; or

Use the "Remarks" space to enter the additional marriage information. If none, write "None." Go on to item 16 (c) if

you have a child(ren) who is under age 16 or disabled or handicapped (age 16 or over and disability began before

age 22); and you are divorced from the child's other parent, who is now deceased, and the marriage lasted less

than 10 years.

Spouse's Social Security number (If none or unknown, so indicate)

Marriage performed by:

When (Month, day, year) Where (Name of City and State)

Spouse's date of birth (or age) If spouse deceased, give date of death

Other (Explain in "Remarks")

How marriage ended

Clergyman or public official

To whom married When (Month, day, year) Where (Name of City and State)

Spouse's Social Security number (If none or unknown, so indicate)

Marriage performed by:

When (Month, day, year) Where (Name of City and State)

Spouse's date of birth (or age) If spouse deceased, give date of death

Other (Explain in "Remarks")

How marriage ended

Clergyman or public official

(Turn to Page 4)

Page 4

(a) How much were your total earnings last year?

19.

18. (a) Did you have wages or self-employment income covered under Social

Security in all years from 1978 through last year?

(b) List the years from 1978 through last year in which you did not have

wages or self-employment income covered under Social Security.

Enter below the names and addresses of all the persons, companies, or government agencies for whom you have

worked this year, last year, and the year before last. IF NONE, WRITE "NONE" BELOW AND GO ON TO ITEM 20.

NoYes

This year

Month Year Month Year

NAME AND ADDRESS OF EMPLOYER

(If you had more than one employer, please list them in order beginning

with your last (most recent) employer.)

Work Began

Work Ended (If still

working, show "Not

Ended")

Yes No

20. May we ask your employers for wage information needed to process your claim?

21.

In what kind of trade or business were you

self-employed? (For example, storekeeper, farmer,

physician)

Last year

Yes No

(If "No," go

to item 22.)

NONE

$

22.

*Enter the appropriate monthly limit after reading the instructions, "How Work

Affects Your Benefits".

Mar. Apr.

May Jul. Aug.

Sept. Oct. Nov. Dec.

Feb.Jan.

ALL

Amount

Jun.

NoYes

(If you need more space, use "Remarks".)

(If "No," answer

item (b).)

(b) Check the year or

years in which you

were self-employed

(If "Yes," go

to item 19.)

Were your net earnings from

your trade or business $400 or

more? (Check "Yes" or "No")

(b) Place an "X" in each block for EACH MONTH of last year in which you did

not earn more than *$ in wages, and did not perform substantial

services in self-employment. These months are exempt months. If no months

were exempt months, place an "X" in "NONE". If all months were exempt

months, place an "X" in "ALL".

THIS ITEM MUST BE COMPLETED, EVEN IF YOU ARE AN EMPLOYEE.

(a) Were you self-employed this year and/or last year?

17. List below FULL NAME OF ALL your children (including adopted children, and stepchildren) or dependent

grandchildren (including stepgrandchildren) who are now or were in the past 6 months UNMARRIED and:

• UNDER AGE 18

• AGE 18 TO 19 AND ATTENDING SECONDARY SCHOOL OR ELEMENTARY

SCHOOL FULL-TIME

• DISABLED OR HANDICAPPED (age 18 or over and disability began before age 22)

Form SSA-1-BK (02-2014) ef (02-2014)

(IF THERE ARE NO SUCH CHILDREN, WRITE "NONE" BELOW AND GO ON TO ITEM 18.)

Also list any student who is between the ages of 18 to 23 if such student was both: 1. Previously entitled to Social

Security benefits on any Social Security record for August 1981; and 2. In full-time attendance at a

post-secondary school.

NoYes

(If "Yes,"

answer (b).)

Do you want to enroll in Medicare Part B (Medical insurance)?

If you are within 2 months of age 65 or older, blind or disabled,

do you want to file for Supplemental Security Income?

Page 5

Form SSA-1-BK (02-2014) ef (02-2014)

26.

Answer this item ONLY if you are now in the last 4 months of your taxable year (Sept., Oct., Nov., and Dec., if

your taxable year is a calendar year.

If you use a fiscal year, that is, a taxable year that does not end December 31 (with income tax return due April 15),

enter here the month your fiscal year ends.

(Month)

$

(b) Place an "X" in each block for EACH MONTH of next year in which you do

not expect to earn more than *$ in wages, and do not expect to

perform substantial services in self-employment. These months will be

exempt months. If no months are expected to be exempt months, place an

"X" in "NONE". If all months are expected to be exempt months, place an "X"

in "ALL".

*Enter the appropriate monthly limit after reading the instructions, "How Work

Affects Your Benefits".

NoYes

NoYes

MEDICARE INFORMATION

Amount

(a) How much do you expect your total earnings to be this year?

*Enter the appropriate monthly limit after reading the instructions, "How Work

Affects Your Benefits".

(b) Place an "X" in each block for EACH MONTH of this year in which you did

not or will not earn more than *$ in wages, and did not or will not

perform substantial services in self-employment. These months are exempt

months. If no months are or will be exempt months, place an "X" in "NONE".

If all months are or will be exempt months, place an "X" in "ALL".

23.

$Amount

DO NOT ANSWER ITEM 26 IF YOU ARE FULL RETIREMENT AGE AND 6 MONTHS OR OLDER; GO TO ITEM 27.

24.

25.

PLEASE READ CAREFULLY THE INFORMATION ON THE BOTTOM OF PAGE 8 AND ANSWER ONE OF THE

FOLLOWING ITEMS:

NONE

Mar. Apr.

May Jul. Aug.

Sept.

Oct.

Nov. Dec.

Feb.Jan.

ALL

Jun.

(a) How much do you expect to earn next year?

NONE

Mar. Apr.

May Jul. Aug.

Sept. Oct. Nov. Dec.

Feb.Jan.

ALL

Jun.

(a) I want benefits beginning with the earliest possible month, and will accept an age-related reduction.

(b) I am full retirement age (or will be within 12 months), and want benefits beginning with the earliest possible

month providing there is no permanent reduction in my ongoing monthly benefits.

(c) I want benefits beginning with .

If this claim is approved and you are still entitled to benefits at age 65, or you are within 3 months of age 65 or older you

could automatically receive Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage at

age 65. If you live in Puerto Rico or a foreign country, you are not eligible for automatic enrollment in Medicare Part B,

and you will need to contact Social Security to request enrollment.

COMPLETE ITEM 27 ONLY IF YOU ARE WITHIN 3 MONTHS OF AGE 65 OR OLDER

27.

28.

Medicare Part B (Medical Insurance) helps cover doctor's services and outpatient care. It also covers some other

services that Medicare Part A does not cover, such as some of the services of physical and occupational therapists and

some home health care. If you enroll in Medicare Part B, you will have to pay a monthly premium. The amount of your

premium will be determined when your coverage begins. In some cases, your premium may be higher based on

information about your income we receive from the Internal Revenue Service. Your premiums will be deducted from any

monthly Social Security, Railroad Retirement, or Office of Personnel Management benefits you receive. If you do not

receive any of these benefits, you will get a letter explaining how to pay your premiums. You will also get a letter if there

is any change in the amount of your premium.

You can also enroll in a Medicare prescription drug plan (Part D). To learn more about the Medicare prescription drug

plans and when you can enroll, visit www.medicare.gov or call 1-800-MEDICARE (1-800-633-4227; TTY

1-877-486-2048). Medicare can also tell you about agencies in your area that can help you choose your prescription

drug coverage. The amount of your premium varies based on the prescription drug plan provider. The amount you pay

for Part D coverage may be higher than the listed plan premium, based on information about your income we receive

from the Internal Revenue Service.

If you have limited income and resources, we encourage you to apply for the Extra Help that is available to assist you

with Medicare prescription drug costs. The Extra Help can pay the monthly premiums, annual deductibles, and

prescription co-payments. To learn more or apply, please visit www.socialsecurity.gov, call 1-800-772-1213 (TTY

1-800-325-0778) or visit the nearest Social Security office.

1. Signature of Witness

I declare under penalty of perjury that I have examined all the information on this form, and on any

accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that

anyone who knowingly gives a false or misleading statement about a material fact in this information, or

causes someone else to do so, commits a crime and may be sent to prison, or face other penalties, or both.

City and State

Witnesses are required ONLY if this application has been signed by mark (X) above. If signed by mark (X), two

witnesses who know the applicant must sign below, giving their full addresses. Also, print the applicant's name in the

Signature block.

SIGNATURE OF APPLICANT

Date (Month, day, year)

Applicant's Mailing Address (Number and street, Apt No., P.O. Box, or Rural Route) (Enter Residence Address in

"Remarks," if different.)

ZIP Code County (if any) in which you now live

2. Signature of Witness

Address (Number and Street, City, State and ZIP Code)

SIGNATURE (First Name, Middle Initial, Last Name) (Write in ink.)

Form SSA-1-BK (02-2014) ef (02-2014)

Page 6

Telephone number(s) at which

you may be contacted during

the day

REMARKS (You may use this space for any explanations. If you need more space, attach a separate sheet.)

Address (Number and Street, City, State and ZIP Code)

Direct Deposit Payment Information (Financial Institution)

Routing Transit Number Account Number

Direct Deposit Refused

Enroll in Direct ExpressChecking

Savings

CLAIMANT

SSA OFFICE

RECEIPT FOR YOUR CLAIM FOR SOCIAL SECURITY RETIREMENT INSURANCE BENEFITS

Your application for Social Security benefits has been

received and will be processed as quickly as possible.

You should hear from us within days after you

have given us all the information we requested. Some

claims may take longer if additional information is

needed.

In the meantime, if you change your address, or if

TELEPHONE

NUMBER(S) TO CALL

IF YOU HAVE A

QUESTION OR

SOMETHING TO

REPORT

DATE CLAIM RECEIVED

there is some other change that may affect your claim,

you - or someone for you - should report the change.

The changes to be reported are listed on page 8.

Always give us your claim number when writing or

telephoning about your claim.

If you have any questions about your claim, we will be

glad to help you.

SOCIAL SECURITY CLAIM NUMBER

BEFORE YOU RECEIVE A

NOTICE OF AWARD

AFTER YOU RECEIVE A

NOTICE FOF AWARD

Page 7

- This information collection meets the requirements of 44 U.S.C. § 3507, as

amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we

display a valid Office of Management and Budget control number. We estimate that it will take about 11 minutes to read

the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR

LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at

www.socialsecurity.gov. Offices are also listed under U.S. Government agencies in your telephone directory or

you may call Social Security at 1-800-772-1213 (TTY 1-800-325-0778). You may send comments on our time

estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401. Send only comments relating to our time

estimate to this address, not the completed form.

Form SSA-1-BK (02-2014) ef (02-2014)

Collection and Use of Information From Your Application—Privacy Act Notice/Paperwork Reduction Act Notice

Sections 202, 205, and 223 of the Social Security Act, as amended, authorize us to collect this information. We will use

the information you provide to determine if you or a dependent are eligible for insurance coverage and/or monthly

benefits.

The information you furnish on this form is voluntary. However, if you fail to provide all or part of the requested

information it may prevent us from making an accurate and timely decision concerning your or a dependent's

entitlement to benefit payments.

We rarely use the information you supply for any purpose other than determining benefit payments for you or a

dependent. However, we may use it for the administration and integrity of our programs. We may also disclose

information to another person or to another agency in accordance with approved routine uses, which include but are not

limited to the following:

1. To enable a third party or an agency to assist us in establishing right to Social Security benefits and/or coverage;

2. To comply with Federal laws requiring the release of information from our records (e.g., to the Government

Accountability Office and Department of Veterans Affairs);

3. To make determinations for eligibility in similar health and income maintenance programs at the Federal, State,

and local level; and

4. To facilitate statistical research, audit, or investigative activities necessary to assure the integrity of Social

Security programs. (e.g., to the Bureau of Census and to private entities under contract with us).

We may also use the information you provide in computer matching programs. Matching programs compare our records

with records kept by other Federal, State, or local government agencies. Information from these matching programs can

be used to establish or verify a person's eligibility for federally-funded or administered benefit programs and for

repayment of incorrect payments or delinquent debts under these programs.

A complete list of routine uses for this information is available in our Privacy Act Systems of Records Notices entitled,

Earnings Recording and Self Employment Income System (60-0059) and Claims Folders Systems (60-0089).

Additional information regarding these and other systems of records notices, are available on-line at

www.socialsecurity.gov or at your local Social Security office.

Paperwork Reduction Act Statement

You (are) (are not) earning wages of more

than $ a month.

You (are) (are not) self-employed rendering

substantial services in your trade or business.

CHANGES TO BE REPORTED AND HOW TO REPORT

Failure to report may result in overpayments that must be repaid, and in possible monetary penalties

If you are under full retirement age, retirement benefits cannot be payable to you for any month before the month

in which you file your claim.

If you are over full retirement age, retirement benefits may be payable to you for some months before the month

in which you file this claim.

If your first month of entitlement is prior to full retirement age, your benefit rate will be reduced. However, if you do

not actually receive your full benefit amount for one or more months before full retirement age because benefits

are withheld due to your earnings, your benefit will be increased at full retirement age to give credit for this

withholding. Thus, your benefit amount at full retirement age will be reduced only if you receive one or more full

benefit payments prior to the month you attain full retirement age.

You change your mailing address for checks or

residence. (To avoid delay in receipt of checks you

should ALSO file a regular change of address notice

with your post office.)

Any beneficiary dies or becomes unable to handle

benefits.

Work Changes - On your application you told us you

expect total earnings for to be

$ .

(Report AT ONCE if this work pattern changes)

Page 8

You can make your reports online, by telephone,

mail, or in person, whichever you prefer.

If you are awarded benefits, and one or more of the

above change(s) occur, you should report by:

• Visiting the section "my Social Security" at our web

site at www.socialsecurity.gov.

• Calling us TOLL FREE at 1-800-772-1213.

• If you are deaf or hearing impaired, calling us

TOLL FREE at TTY 1-800-325-0778; or

• Calling, visiting or writing your local Social

Security office at the phone number and address

shown on your claim receipt.

For general information about Social Security, visit

our web site at www.socialsecurity.gov.

For those under full retirement age, the law requires

that a report of earnings be filed with SSA within 3

months and 15 days after the end of any taxable year

in which you earn more than the annual exempt

amount. You may contact SSA to file a report.

Otherwise, SSA will use the earnings reported by

your employer(s) and your self-employment tax

return (if applicable) as the report of earnings

required by law, to adjust benefits under the earnings

test. It is your responsibility to ensure that the

information you give concerning your earnings is

correct. You must furnish additional information as

needed when your benefit adjustment is not correct

based on the earnings on your record.

HOW TO REPORT

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE YOU ANSWER QUESTION 26.

You go outside the U.S.A. for 30 consecutive days or

longer.

Your citizenship or immigration status changes.

(Year)

You are confined to a jail, prison, penal institution or

correctional facility for more than 30 continuous days

for conviction of a crime, or you are confined for more

than 30 continuous days to a public institution by a

court order in connection with a crime.

You have an unsatisfied warrant for more than 30

continuous days for your arrest for a crime or

attempted crime that is a felony of flight to avoid

prosecution or confinement, escape from custody and

flight-escape. In most jurisdictions that do not classify

crimes as felonies, this applies to a crime that is

punishable by death or imprisonment for a term

exceeding one year (regardless of the actual sentence

imposed).

You have an unsatisfied warrant for more than 30

continuous days for a violation of probation or parole

under Federal or State law.

Custody Change - Report if a person for whom you

are filing or who is in your care dies, leaves your

care or custody, or changes address.

Your stepchild is entitled to benefits on your record and

you and the stepchild's parent divorce. Stepchild

benefits are not payable beginning with the month after

the month the divorce becomes final.

Change of Marital Status - Marriage, divorce,

annulment of marriage.

If you become the parent of a child (including an

adopted child) after you have filed your claim, let us

know about the child so we can decide if the child is

eligible for benefits. Failure to report the existence of

these children may result in the loss of possible

benefits to the child(ren).

Form SSA-1-BK (02-2014) ef (02-2014)

•

•

•

•

•

•

•

•

•

•

•

•

•

You become entitled to a pension, an annuity, or a

lump sum payment based on your employment not

covered by Social Security, or if such pension or

annuity stops.

•

•

•