Fillable Printable Pension Plan Application Form about HBP Plan

Fillable Printable Pension Plan Application Form about HBP Plan

Pension Plan Application Form about HBP Plan

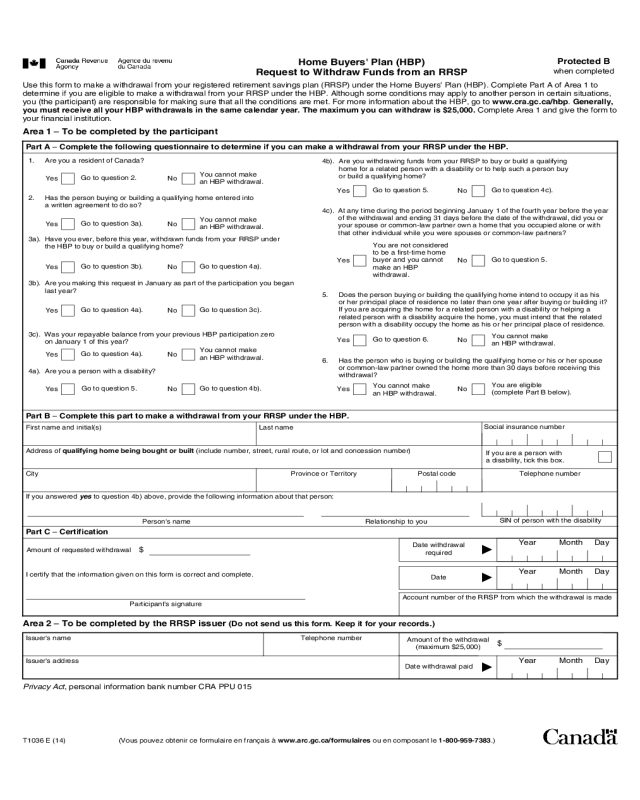

Home Buyers' Plan (HBP)

Request to Withdraw Funds from an RRSP

Protected B

when completed

Use this form to make a withdrawal from your registered retirement savings plan (RRSP) under the Home Buyers' Plan (HBP). Complete Part A of Area 1 to

determine if you are eligible to make a withdrawal from your RRSP under the HBP. Although some conditions may apply to another person in certain situations,

you (the participant) are responsible for making sure that all the conditions are met. For more information about the HBP, go to www.cra.gc.ca/hbp. Generally,

you must receive all your HBP withdrawals in the same calendar year. The maximum you can withdraw is $25,000. Complete Area 1 and give the form to

your financial institution.

Area 1 – To be completed by the participant

Part A – Complete the following questionnaire to determine if you can make a withdrawal from your RRSP under the HBP.

1. Are you a resident of Canada?

Yes

Go to question 2.

No

You cannot make

an HBP withdrawal.

2.

Has the person buying or building a qualifying home entered into

a written agreement to do so?

Yes

Go to question 3a).

No

You cannot make

an HBP withdrawal.

3a). Have you ever, before this year, withdrawn funds from your RRSP under

the HBP to buy or build a qualifying home?

Yes

Go to question 3b).

No

Go to question 4a).

3b). Are you making this request in January as part of the participation you began

last year?

Yes

Go to question 4a).

No

Go to question 3c).

3c). Was your repayable balance from your previous HBP participation zero

on January 1 of this year?

Yes

Go to question 4a).

No

You cannot make

an HBP withdrawal.

4a). Are you a person with a disability?

Yes

Go to question 5.

No

Go to question 4b).

4b).

Are you withdrawing funds from your RRSP to buy or build a qualifying

home for a related person with a disability or to help such a person buy

or build a qualifying home?

Yes

Go to question 5.

No

Go to question 4c).

4c). At any time during the period beginning January 1 of the fourth year before the year

of the withdrawal and ending 31 days before the date of the withdrawal, did you or

your spouse or common-law partner own a home that you occupied alone or with

that other individual while you were spouses or common-law partners?

Yes

You are not considered

to be a first-time home

buyer and you cannot

make an HBP

withdrawal.

No

Go to question 5.

5.

Does the person buying or building the qualifying home intend to occupy it as his

or her principal place of residence no later than one year after buying or building it?

If you are acquiring the home for a related person with a disability or helping a

related person with a disability acquire the home, you must intend that the related

person with a disability occupy the home as his or her principal place of residence.

Yes

Go to question 6.

No

You cannot make

an HBP withdrawal.

6.

Has the person who is buying or building the qualifying home or his or her spouse

or common-law partner owned the home more than 30 days before receiving this

withdrawal?

Yes

You cannot make

an HBP withdrawal.

No

You are eligible

(complete Part B below).

Part B – Complete this part to make a withdrawal from your RRSP under the HBP.

First name and initial(s) Last name

Social insurance number

Address of qualifying home being bought or built (include number, street, rural route, or lot and concession number)

If you are a person with

a disability, tick this box.

City Province or Territory Postal code Telephone number

If you answered yes to question 4b) above, provide the following information about that person:

Person's name Relationship to you

SIN of person with the disability

Part C – Certification

Amount of requested withdrawal $

Date withdrawal

required

Ż

Year Month Day

I certify that the information given on this form is correct and complete.

Date

Ż

Year Month Day

Participant's signature

Account number of the RRSP from which the withdrawal is made

Area 2 – To be completed by the RRSP issuer (Do not send us this form. Keep it for your records.)

Issuer's name Telephone number

Amount of the withdrawal

(maximum $25,000)

$

Issuer's address

Date withdrawal paid

Ż

Year Month Day

Privacy Act, personal information bank number CRA PPU 015

T1036 E (14)

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca/formulaires ou en composant le 1-800-959-7383.)