Fillable Printable Audit Checklist - California

Fillable Printable Audit Checklist - California

Audit Checklist - California

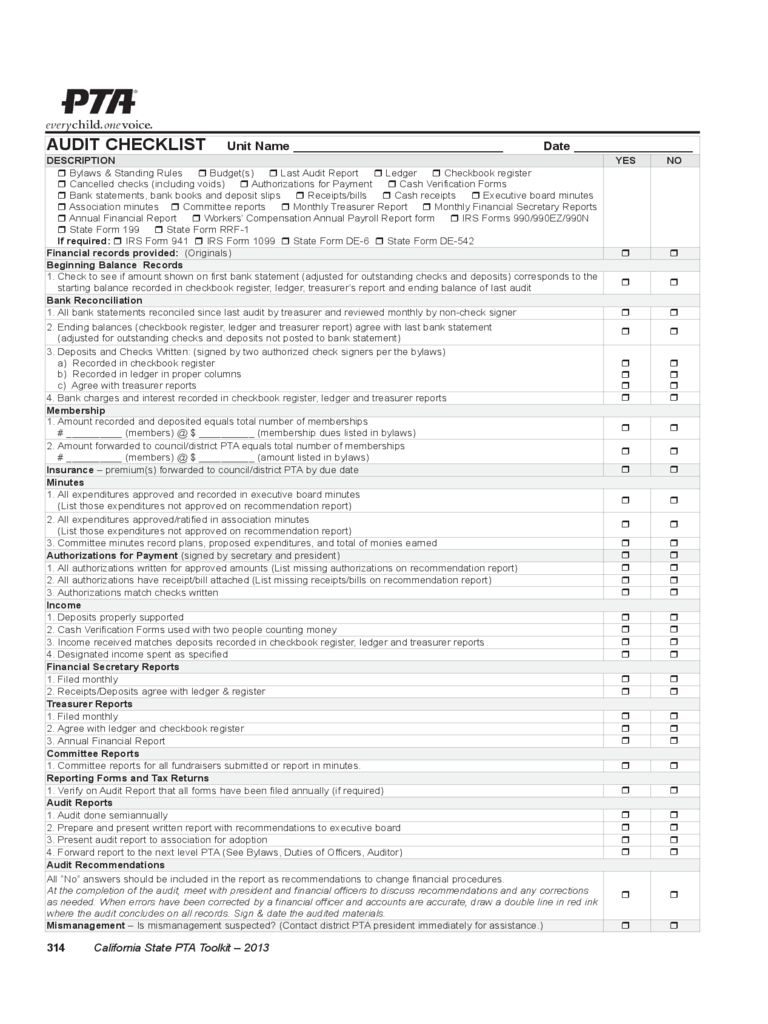

AUDIT CHECKLIST Unit Name ______________________________ Date _________________

DESCRIPTION YES NO

r Bylaws & Standing Rules r Budget(s) r Last Audit Report r Ledger r Checkbook register

r Cancelled checks (including voids) r Authorizations for Payment r Cash Verification Forms

r Bank statements, bank books and deposit slips r Receipts/bills r Cash receipts r Executive board minutes

r Association minutes r Committee reports r Monthly Treasurer Report r Monthly Financial Secretary Reports

r Annual Financial Report r Workers’ Compensation Annual Payroll Report form r IRS Forms 990/990EZ/990N

r State Form 199 r State Form RRF-1

If required: r IRS Form 941 r IRS Form 1099 r State Form DE-6 r State Form DE-542

Financial records provided: (Originals)

r r

Beginning Balance Records

1. Check to see if amount shown on first bank statement (adjusted for outstanding checks and deposits) corresponds to the

starting balance recorded in checkbook register, ledger, treasurer’s report and ending balance of last audit

r r

Bank Reconciliation

1. All bank statements reconciled since last audit by treasurer and reviewed monthly by non-check signer

r r

2. Ending balances (checkbook register, ledger and treasurer report) agree with last bank statement

(adjusted for outstanding checks and deposits not posted to bank statement)

r r

3. Deposits and Checks Written: (signed by two authorized check signers per the bylaws)

a) Recorded in checkbook register

b) Recorded in ledger in proper columns

c) Agree with treasurer reports

r

r

r

r

r

r

4. Bank charges and interest recorded in checkbook register, ledger and treasurer reports

r r

Membership

1. Amount recorded and deposited equals total number of memberships

# __________ (members) @ $ __________ (membership dues listed in bylaws)

r r

2. Amount forwarded to council/district PTA equals total number of memberships

# __________ (members) @ $ __________ (amount listed in bylaws)

r r

Insurance – premium(s) forwarded to council/district PTA by due date

r r

Minutes

1. All expenditures approved and recorded in executive board minutes

(List those expenditures not approved on recommendation report)

r r

2. All expenditures approved/ratified in association minutes

(List those expenditures not approved on recommendation report)

r r

3. Committee minutes record plans, proposed expenditures, and total of monies earned

r r

Authorizations for Payment (signed by secretary and president)

r r

1. All authorizations written for approved amounts (List missing authorizations on recommendation report)

r r

2. All authorizations have receipt/bill attached (List missing receipts/bills on recommendation report)

r r

3. Authorizations match checks written

r r

Income

1. Deposits properly supported

r r

2. Cash Verification Forms used with two people counting money

r r

3. Income received matches deposits recorded in checkbook register, ledger and treasurer reports

r r

4. Designated income spent as specified

r r

Financial Secretary Reports

1. Filed monthly

r r

2. Receipts/Deposits agree with ledger & register

r r

Treasurer Reports

1. Filed monthly

r r

2. Agree with ledger and checkbook register

r r

3. Annual Financial Report

r r

Committee Reports

1. Committee reports for all fundraisers submitted or report in minutes.

r r

Reporting Forms and Tax Returns

1. Verify on Audit Report that all forms have been filed annually (if required)

r r

Audit Reports

1. Audit done semiannually

r r

2. Prepare and present written report with recommendations to executive board

r r

3. Present audit report to association for adoption

r r

4. Forward report to the next level PTA (See Bylaws, Duties of Officers, Auditor)

r r

Audit Recommendations

All “No” answers should be included in the report as recommendations to change financial procedures.

At the completion of the audit, meet with president and financial officers to discuss recommendations and any corrections

as needed. When errors have been corrected by a financial officer and accounts are accurate, draw a double line in red ink

where the audit concludes on all records. Sign & date the audited materials.

r r

Mismanagement – Is mismanagement suspected? (Contact district PTA president immediately for assistance.)

r r

314 California State PTA Toolkit – 2013