Fillable Printable Self-Audit Checklist - Australia

Fillable Printable Self-Audit Checklist - Australia

Self-Audit Checklist - Australia

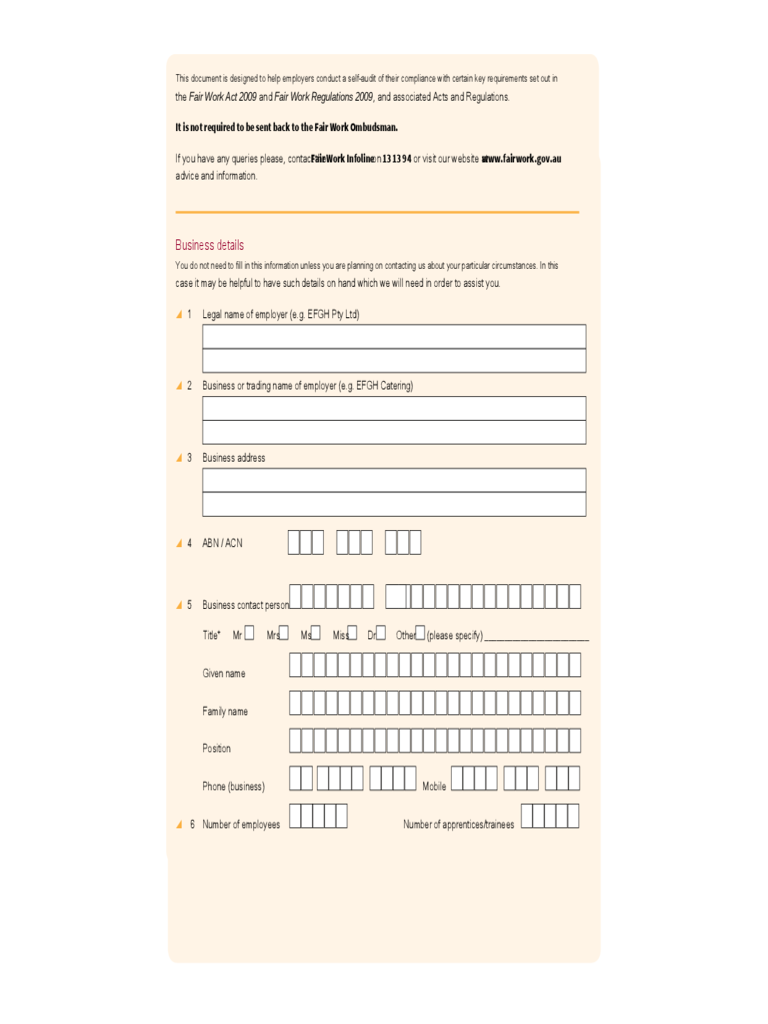

This document is designed to help employers conduct a self-audit of their compliance with certain key requirements set out in

the Fair Work Act 2009 and Fair Work Regulations 2009, and associated Acts and Regulations.

It is not required to be sent back to the Fair Work Ombudsman.

If you have any queries please, contact the Fair Work Infoline on 13 13 94 or visit our website at www.fairwork.gov.au

advice and information.

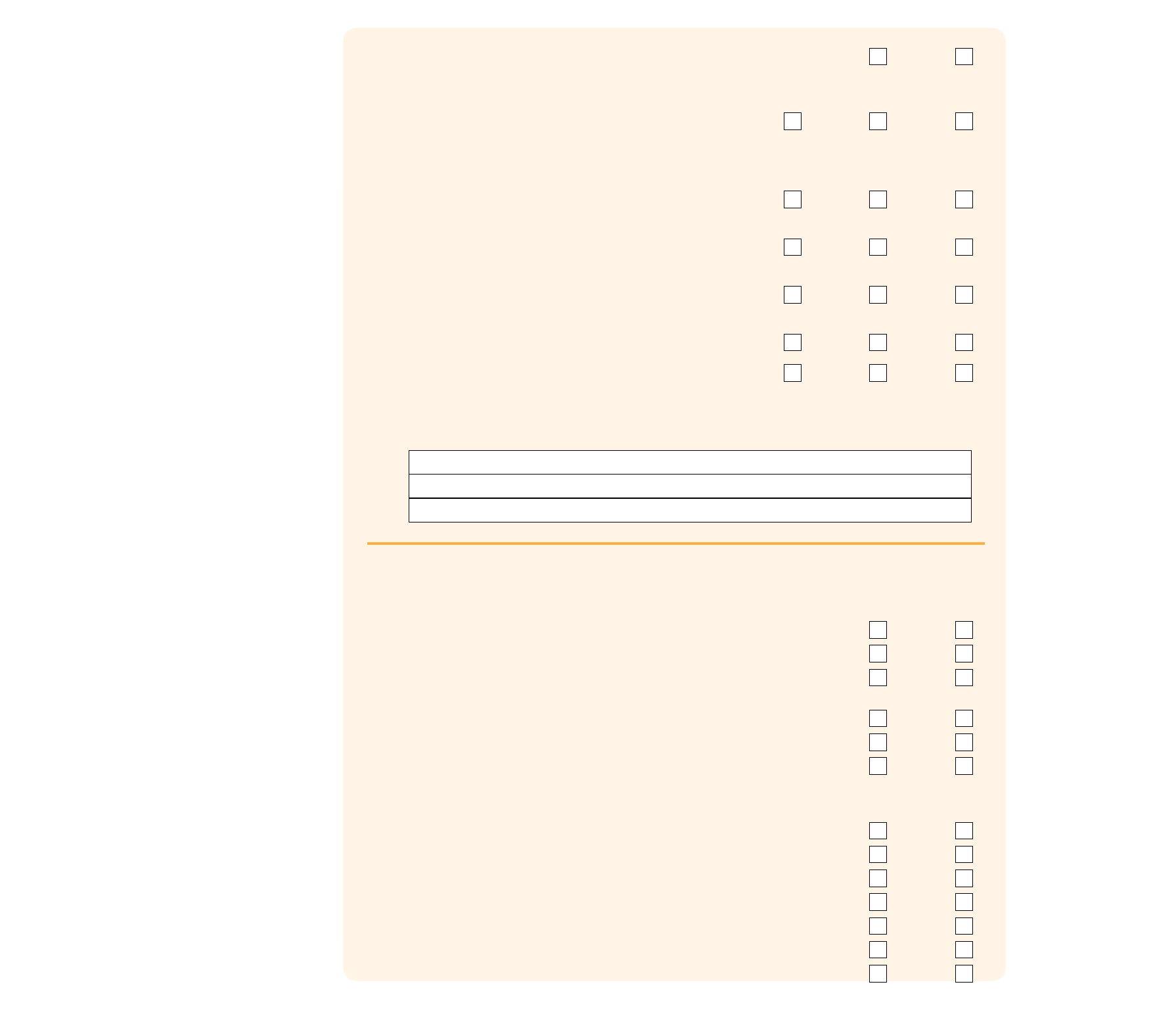

Business details

You do not need to fill in this information unless you are planning on contacting us about your particular circumstances. In this

case it may be helpful to have such details on hand which we will need in order to assist you.

1 Legal name of employer (e.g. EFGH Pty Ltd)

2 Business or trading name of employer (e.g. EFGH Catering)

3 Business address

4 ABN / ACN

5 Business contact person

Title* Mr Mrs Ms Miss Dr Other (please specify) __________________________

Given name

Family name

Position

Phone (business) Mobile

6 Number of employees Number of apprentices/trainees

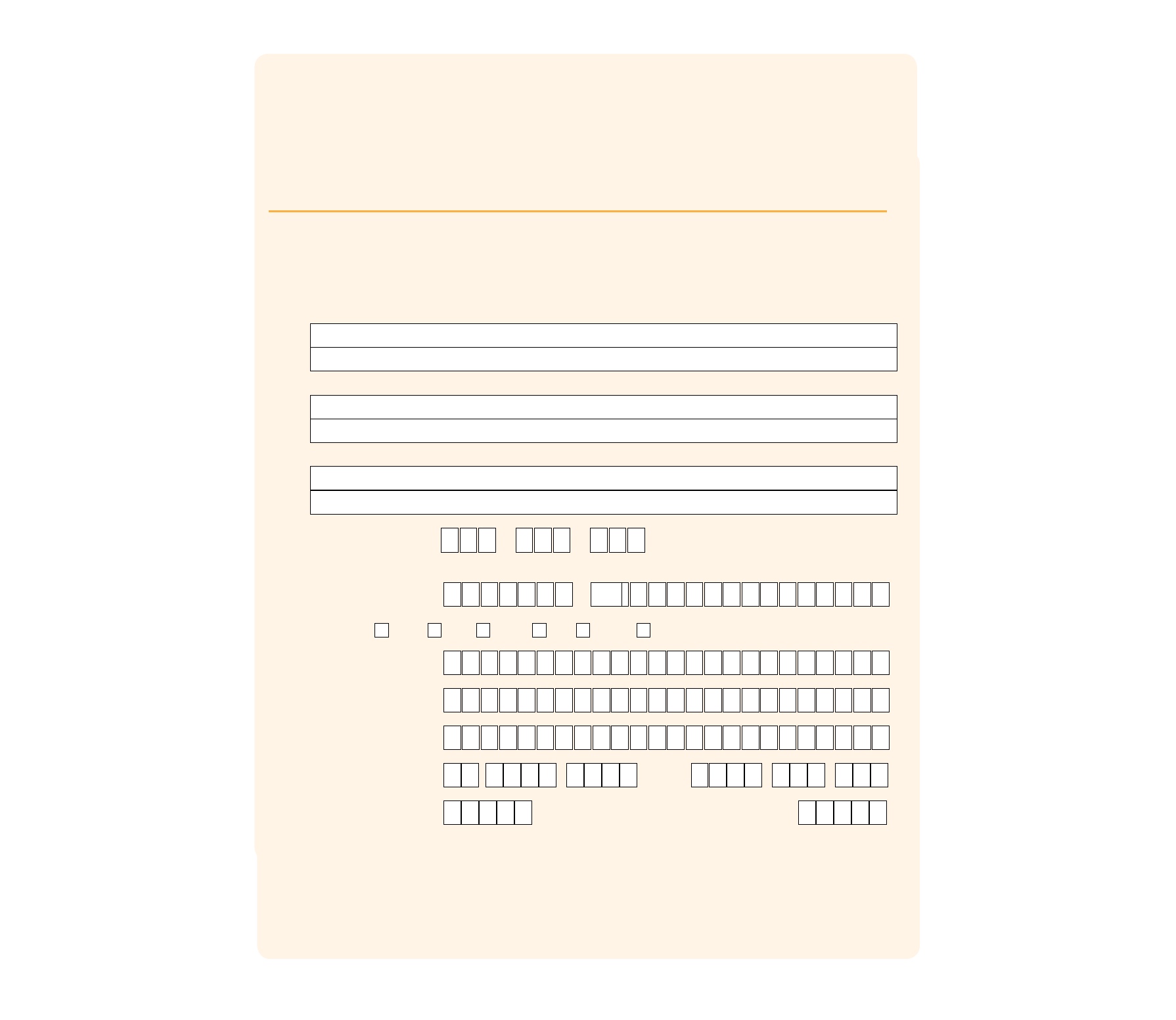

Industrial instruments

7

The laws surrounding industrial instruments have changed. Are you aware of which of the following current instruments (if

any) cover and apply to your employees?

Modern award

Award-based transitional instrument

Agreement-based transitional instrument

Division 2B State employment agreement*

Enterprise Agreement

Other:

*

These are State employment instruments that were in operation immediately before 1 January 2010, and have since moved into the national workplace relations system. Division 2B

State awards terminated on 31 December 2010. From this date a modern award will generally apply to these employers.

Unsure?

Contact the

Fair Work Infoline

on

13 13 94

or your industry association.

Modern awards & the National Employment Standards (NES)

8 Ar e you aware of the modern awards (if any) which may cover and apply

to your employees?

YES NO

9 Are you aware of the National Employment Standards (NES) which apply

from 1 January 2010?

YES NO

10 Are you aware of your obligations with respect to:

Requests for flexible working arrangements? YES NO

Notice of termination?

YES NO

Redundancy pay? YES NO

11 Are all new employees given a Fair Work Information Statement?

YES NO

12 Do you retain details of how the statement was given? YES NO

13 Are you aware of how the modern awards and National Employment

Standards interact with your existing workplace agreements? YES NO

Did you answer NO to any of the above questions? List the actions you need to take to meet the modern awards and

NES entitlements checklist requirements.

For information about modern awards and the NES, visit

www.fairwork.gov.au/nes

Leave Entitlements

14 Do you maintain accurate records of employee leave entitlements? YES NO

15 Do you have processes in place for employees to apply for:

Annual leave?

YES NO

Personal/carer’s leave? YES NO

Compassionate leave? YES NO

Parental leave? YES NO

Community service leave? YES NO

Long service leave? YES NO

Did you answer NO to any of the above questions? List the actions you need to take to meet the modern awards and leave checklist

requirements. For information about modern awards and leave, visit

www.fairwork.gov.au/leave

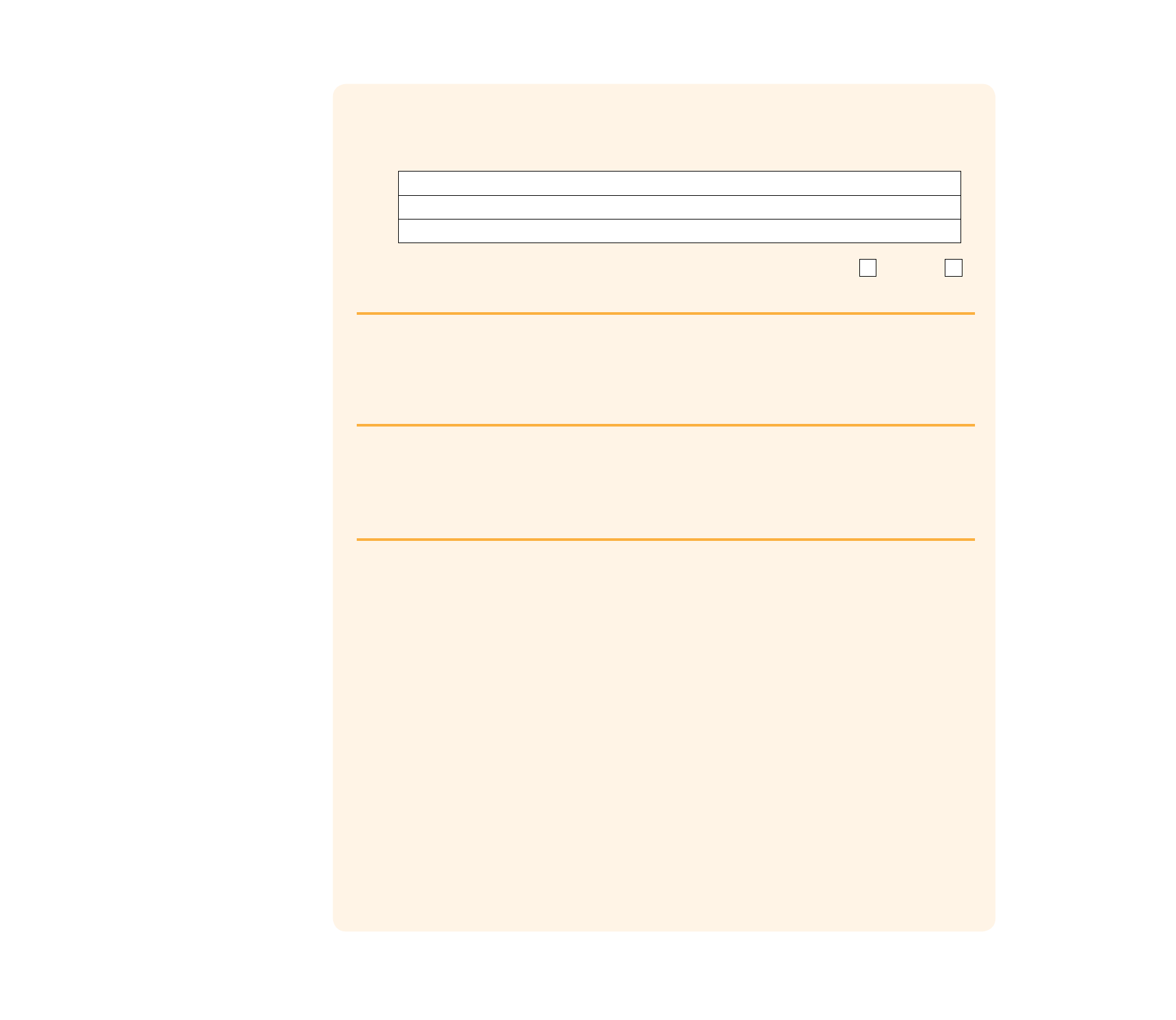

Pay & conditions

17 When ar e your employees paid?

Weekly

Fortnightly

Monthly

On which day:

Mon

Tue

Wed

Thur

Fri

Sat

Sun

Paid by:

Cheque

Cash

EFT

18 Do you include the following details on the employee’s pay slip?

Employer ABN YES NO

NO

Legal and/or trading name of employer YES NO

Employee name YES NO

Date of payment (e.g. 19/06/09) YES NO

Period of payment (e.g. 04/06/09 – 18/06/09) YES

NO

Gross and net amount of pay YES NO

For employees paid an hourly rate – the ordinary hourly rate of pay, number

of hours worked at that rate and the amount of payment at that rate N/A YES

For employees paid an annual rate (salary) that rate as at the

last day in the payment period N/A YES

NO

Details of any deductions made from the employee’s pay

Amount and the name of the superannuation fund (for employers

required to make superannuation contributions for the benefit of employees) YES NO

19 Do employees get a pay slip within 1 working day after they are paid? YES NO

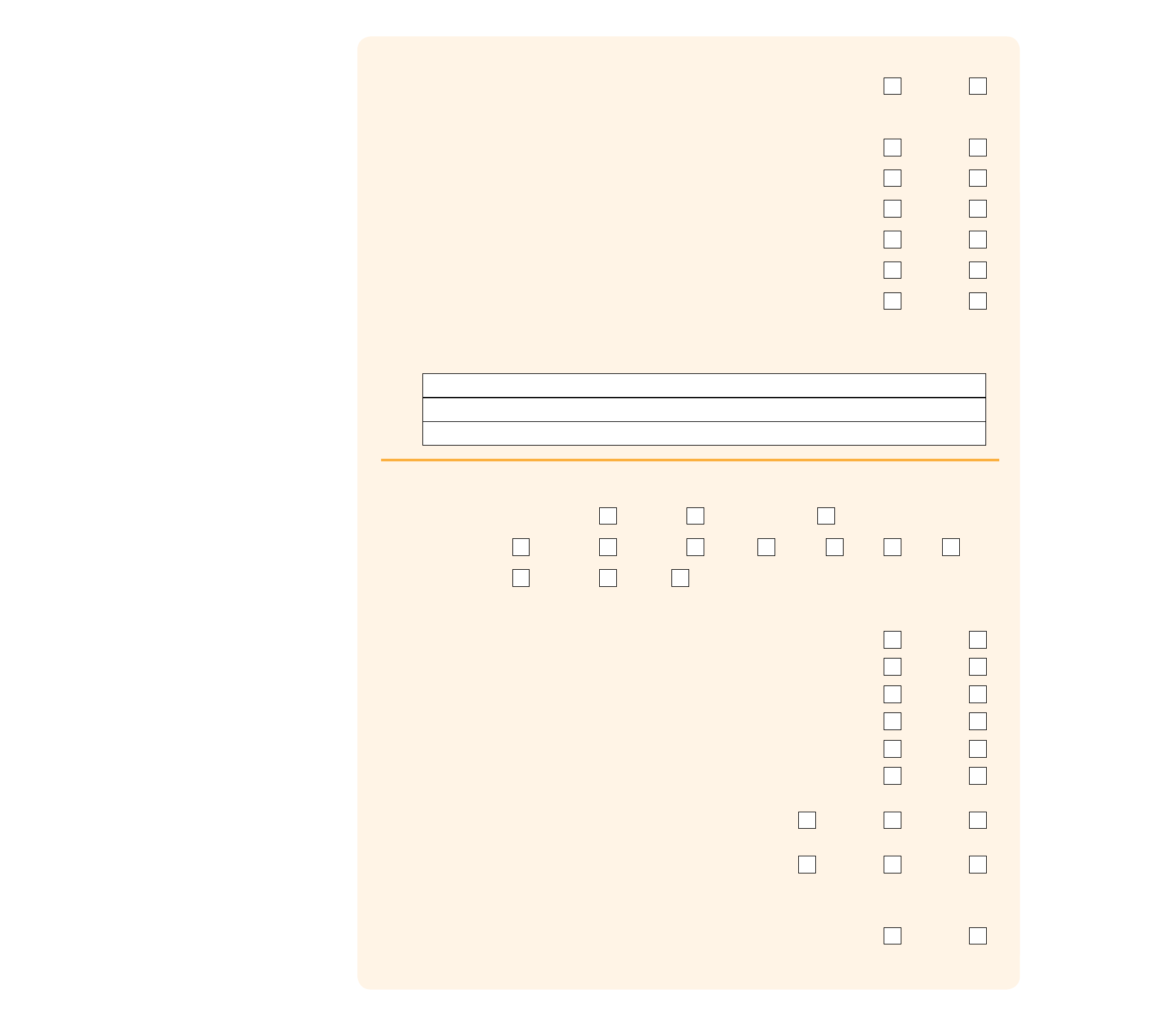

20 Do casual employees receive the correct loading for ordinary

time/overtime/weekend work and public holidays in accordance with

the relevant Award/Agreement? N/A YES NO

21 If work is performed on weekends, nights or public holidays

Do you accurately record the start and finish times for employees

who receive penalty rates? N/A YES NO

Do you pay the correct penalty rates (according to the relevant

Award/Agreement)? N/A YES NO

22 Are district/uniform/late work or other allowances being paid

as per the relevant Award/Agreement/Act? N/A YES NO

23 Do employees get the correct meal break according to

the relevant Award/Agreement? N/A YES NO

If no, are employees properly compensated? N/A YES NO

If you answered NO to any of the questions numbered 18-23, you may be in contravention of your workplace obligations. Visit

www.fairwork.gov.au/pay

or contact the

Fair Work Infoline

on

13 13 94

for advice.

Note:

any areas where you may need to take action in order to meet the pay and conditions checklist requirements..

Time & wages record keeping

24 Do you include these details on the employee’s records?

Note

: you can keep manual and/or electronic records.

Legal and/or trading name of employer YES NO

Employee name YES NO

Date the employee commenced work with the employer YES NO

Employee status – whether the employee undertakes part-time or full-time work

and whether they are engaged as a permanent, temporary or casual employee YES NO

Number of hours worked

YES NO

Number of overtime hours worked YES NO

Rate of pay

Any written agreements of hours worked, individual flexibility arrangements or

guarantees of annual earnings YES NO

Gross and net amount of pay

YES NO

Deduction details YES NO

Monetary allowances

YES NO

Leave accrued/taken YES NO

Superannuation details YES NO

Termination details YES NO

If you answered NO to any part of question 24 that applies in your circumstances, you may be in contravention of your workplace

obligations. Visit

www.fairwork.gov.au/resources

or contact the

Fair Work Infoline

on

13 13 94

for advice.

Note:

any areas where you may need to take action. in order to meet the time and wages record keeping requirements.

25 Did you know you have to keep time and wages records for 7 years? YES NO

Dismissal and bargaining

New unfair dismissal laws, including a small business fair dismissal code, apply under the Fair Work Act 2009 .New requirements

for employers and employees to bargain in good faith when making enterprise agreements also apply. These obligations

commenced on 1 July 2009.

More information

Contact the Fair Work Infoline on 13 13 94 or visit www.fairwork.gov.au

Download templates for time and wages records and pay slips www.fairwork.gov.au/resources

Fact sheets on workplace relations issues to read download or print www.fairwork.gov.au/resources

How do you contact the Fair Work Ombudsman?

Over the telephone

– call the Fair Work Infoline on 13 13 94 for the cost of a local call.

Over the internet

– visit our website at www.fairwork.gov.au

By email – via a special ‘Contact us’ email form available at www.fairwork.gov.au

By post

– address your letter to the Fair Work Ombudsman at GPO Box 9887 in your capital city.

In person

– visit one of our offices located in each capital city and in 18 regional areas across the country. Find your nearest

office at www.fairwork.gov.au

Contact the Translating and Interpreting Service (TIS) on 131 450

for the cost of a local call if you need help communicating

in English.

If you have a hearing or speech impairment you can call through the

National Relay Service (NRS):

TTY

users phone 133 677. Ask for the Fair Work Infoline 13 13 94.

Speak and Listen (speech-to-speech relay) users phone 1300 555 727. Ask for the Fair Work Infoline 13 13 94.

The Fair Work Ombudsman is committed to providing you advice that you can rely on. To do this we rely on the accuracy and

completeness of information you provide.

Your situation and the law can change so we encourage you to check back with us by looking at fairwork.gov.au.