Fillable Printable Authorization For Insurance Premium Deduction 4562 1

Fillable Printable Authorization For Insurance Premium Deduction 4562 1

Authorization For Insurance Premium Deduction 4562 1

Page 1 of 3

AUTHORIZATION FOR INSURANCE

PREMIUM DEDUCTION

State Form 54969 (R / 3-13)

INDIANA PUBLIC RETIREMENT SYSTEM

1977 POLICE OFFICERS’ & FIREFIGHTERS’

PENSION & DISABILITY FUND

1 North Capitol Avenue, Suite 011

Indianapolis, IN 46204-2014

Telephone: (888) 526-1687 (Toll-free)

Fax: (866) 591-9441 (Toll-free)

E-mail: questions@inprs.in.gov

Web site: www.inprs.in.gov

*This agency is requesting disclosure of Soci al Security numbers in accordance with Internal Revenue Code 3405; dis closure is

mandatory and this form cannot be processed without it.

INSTRUCTIONS

1. Remove the instruction pages inclu ded with this form prior to returning the completed form to the Indiana Public Retirement

System (INPRS) at the address shown above.

2. Type or print using black ink. Compl ete all information and plac e the Member’s name, Social Security number and Pension ID

number at the top of each page as requested.

3. This completed form may be delivered to the lobby of INPRS at the address indicated on the form. Lobby hours are 8 a. m. to 5

p.m. on weekdays. The agency is closed on weekends and holidays, including all State-designated holidays.

4. Questions or changes? Call customer service, toll-free, at (888) 526-1687, Monday – Friday, 8 a.m.- 8 p.m. EST.

ABOUT THE AUTHO RIZATION FOR INSURANCE PREMIUM DEDUCTION

Important Legal Notice

This is a benefit enacted by Congress in 2006. INPRS is proceeding with implementation of the program based on its understanding

of the information currently availabl e from the IRS, with the anticipation that the program might require revisions and adjustments as

the provisions of the Pension Protection Act are interpreted and clarified. By participating i n the program, you acknowledge that

changes may be required and that changes could affect your eligibility or the eligibility of your insurance carrier or policy. It may also

result in reversal of some transactions. You agree that any benefit or privilege granted under this pro gram is subject to change or

revocation, that you will coop erate with any adjustments and that INPRS is not responsible for an y consequence of any ch ange to

the program, including unexpected tax liab ility, interest and penalties.

Waiver of Claims

By signing this form, I agree that I will not make any legal claim of any kind against INPRS, its staff and advisors should my

participation in this program result in unexpected tax l iability to me, includ ing interest and penalties. I understand that my ability to

participate in this program is a valua ble benefit for which I am willing to agree to this waiver of all claims. I further release INPRS, its

staff and advisors from any liability arising from the admi nistration of payments to any insurer.

Eligibility for Tax-free Distributions for Health and Long Term Care Instructions

• Public Safety Officer means an individual serving a public agency in an official capacity, with or without compensation, as a law

enforcement officer, as a firefighter, as a chaplain for a police or fire department, or as a member of a rescue squad or

ambulance crew.

• Eligible Retired Public Safety Officer (including police, corrections, probation, parole and judicial officers), means an individual

who, by reason of disability or attainment of normal retirement age, is separated from service as a public safety officer with the

employer who maintains the eligibl e retireme nt plan from which distributions are made.

• Normal retirement age for determination of eligibility means a member who has retired with an unreduce d ben efit.

Insurance Carrier Agreement Information

• You must submit a separate copy of the Insurance Carri er Agreement (State Form 55017) for each insurance policy you are

designating for direct payme nt by INPRS.

• The insurance premiums designated will be paid directly to the insurance company or to employers who have self-insured plans

by INPRS and the payment will be ded ucted from your monthly benefit.

• You can use income from more than one retirement plan to pay insurance premiums, but the maximum income exclusion the

IRS allows for all plans combined is $ 3,00 0 per year. You are responsible for complying with this federal limit and for the

consequences if your designated insurance premiums excee d the limit.

• Premium payments will begin the first month after INPRS receives a completed and signed form. Incomplete an d unsigned

forms will not be processed and you will be notified that you must resubmit the form.

RETIRED MEMBER INFORMATION

Retired member’s name

Social Security number (last 4 digits)*

Pension ID (PID) number

Address

Telephone number with area code

Other telephone number with area code

City

State

ZIP Code

E-mail address

RETIRED MEMBER REQUESTED AC TION

(Select one) New designation Change to previously designated policy Stop previously designated payments

Reset Form

Page 2 of 3

Retired member’s name

Social Security number (last 4 digits)*

Pension ID (PID) number

INSURANCE CARRIER IN FORMATION

Insurance carrier name

Group/policy number

Address

Telephone number with area code

Other telephone number with area code

City

State

ZIP Code

E-mail address

Insurance types (Select all that apply)

Medical Dental Vision Long term care

Premium amount

$

EMPLOYER INFORMATION

Employer name

Submission unit number

Address

Telephone number with area code

Other telephone number with area code

City

State

ZIP Code

E-mail address

EMPLOYER REQUESTED ACTION

Insurance carrier change

Current carrier

New carrier

Premium amount to be deducted

$

As of date

(mm/dd/yyyy)

Deduction withholding change

Current carrier

New deduction amount

$

As of date

(mm/dd/yyyy)

AUTHORIZED AGENT AFFIDAVIT

As authorized agent for the employer that administers the above named insurance pl an, I certify that this individual is a covered

participant in the ______________________________________________________ _____________ employer insurance plan.

Name of insurance plan

Authorized agent’s signature (Controller, clerk-treasurer, or trustee)

Authorized agent’s name

(printed)

Date

(mm/dd/yyyy)

RETIRED MEMBER ACKNOWLEDGEMENT

1. I hereby authorize INPRS to d educt the monthly insurance prem ium amount set forth above directly from my monthly pension

benefit. I understand that this will result in a decrease in my monthly benefit payment.

2. I understand is my responsibility, as the participant, to inform INPRS of any change related to m y healt h insurance premium

deduction including, but not limited to, coverage, insurance company or premium changes. I freely accept this obligation to notify

INPRS.

3. I understand it is my responsibility, as the p a r ticipant, to inform the insurance vendor of any change related to my healt h

insurance premium de duction including, but not limited to, coverage, insurance company or pr emium changes. I freely accept

this obligation to notify the insurance vendor.

4. I understand that INPRS is not responsible for lapsed premiums or lapsed insurance policy coverage or any other coverage or

benefit issues that may arise between my insurance carrier and me.

5. I certify that I am eligible to have the designated insurance premiums excluded from ta xable income.

6. I understand the maximum amount of insurance premiums excludible from income from all retirement plans is $3000 per year.

7. I take full responsibility for the accuracy and truth of all information I have provided and certify I am entitled to these benefits.

8. I understand that I may not request additional tax-preferred treatment of the applicable exclusion amount (up to $3,000

annually), from any other qualified retirement plans (i.e., Governmental defined benefit plans, 457 plans or 403(b) plans).

9. I understand that INPRS is complying with federal law by withholding insurance premiums from my pension ben efits. In doing

so, INPRS is only performing an administrative function and is only resp onsible for payment of premiums, as required by law.

10. I understand that any and all tax implications of my election are my responsibility alone and I agree that I will make no claim

against INPRS for consequences of my election.

I have read and I understand the information in this form and its instructions and agree to all the conditions for this election, inc luding

the Waiver of Claims (on page 1).

Retired member’s signature

Date (mm/dd/yyyy)

Page 3 of 3

Retired member’s name

Social Security number (last 4 digits)*

Pension ID (PID) number

FREQUENTLY ASKED QUESTIONS (FAQS) FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS

(This FAQ applies only to members of the 1977 Fund.)

Q1: What does this benefit provide?

A: The HELPS Retirees provision of the Pension Protection Act (PPA) of 2006 allows eligible retir ed public safety officers to use up

to $3,000 per year from their qualified govern ment retirement plan, on a tax-exclu ded basis, to pay for health insurance or long-term

care insurance premiums. In order for you to get the tax- excluded benefit, the money must be paid directly from your pension fund to

a health or long-term care insurance company. Further, in order to receive the tax exclusion, you must claim it as a deduction on

your IRS Form 1040, as explained in the Form 1040 instructions.

Q2: Who is an eligible retired public safety officer for purposes of the exclusion?

A: Eligible retired public safety officers include those who have separated from service with their INPRS-covered employer due to

disability or after reaching normal retirement age. A public safety officer who retires before reaching normal retirement age is not an

eligible retired public safety officer, unless the public safety officer retires by reason of dis ability. In addition, survivors are not eligible

to make this election.

Q3: OK, I know that I’m an eligible retired public safety officer. What do I need to do to get this benefit?

A: Contact INPRS at (888) 526-1687 and ask about the $3,000 tax-excluded benefit for purchasing health insurance or long-term

care insurance under the 1977 Fund. The election form is availa ble online at www.INPRS.in.gov

. You must submit your election form

to the 1977 Fund by December 1 of each year.

Q4: What happens if both my spouse and I are eligible retired public safety officers?

A: Both you and your spouse woul d be eligible to use up to $3,000 each o n a tax-excluded basis to purchase health insurance or

long-term care insurance for a total famil y limit of $6,000. But the premiums would have to be directly deducted for both you an d your

spouse.

Q5: Under what circumstances are the provisions of HELPS available for retired public safety officers?

A: The favorable tax treatment is available only when an eligible r etired public safety officer chooses to have an amou nt subtracted

from his or her distributions from an Eligible Government Plan and that amount is used to pay qualified health insurance premiums.

The employer sponsoring the Eligible Government Plan is not required to offer such an electio n.

Q6: Are eligible retired public safety officers limited in the amount they can exclude from gross income under the HELPS

Retirees provision of the PPA?

A: Yes. The aggregate amount that is permitted to be excluded, for an y taxabl e year, from an eligible retired public safety officer’s

gross income is limited to $3,000. For purposes of applying this $3,000 lim itation, distributions with respect to an eligible retired

public safety officer that are used to pay for qualified health insurance premiums from all Eligible Government Plans are cumulative.

Q7: Are amounts used to pay qualified health insurance premiums that are excluded from gross income taken into account

for purposes of determin i ng the itemized deduction for med ical care expenses?

A: No. Amounts used to pay qualified health i nsura nce premiums that are excluded from gross incom e un der 402(I) are not taken

into account in determining the itemized deduction for medical care expenses.

Q8: What if the IRS does not agree with my income tax exclusion?

INPRS is released from any unexpected ta x liability for the fund mem ber as a result of them making this election.

IC 36-8-8-17.2

INSTRUCTIONS FOR

AUTHORIZATION FOR INSURANCE PREMIUM DEDUCTION

State Form 54969 (R / 3-13)

Page 1 of 2

IMPORTANT

1. Remove the instruction pages inclu ded with this form prior to returning the completed form to the Indiana Public Retirement System

(INPRS) at the address shown on the form.

2. Type or print using black ink. Compl ete all information and plac e the Member’s name, Social Security number and Pension ID

number at the top of each page as requested.

3. This completed form may be delivered to the lobby of INPRS at the address indicated on the form. Lobby hours are 8 a. m. to 5

p.m. on weekdays. The agency is closed on weekends and holidays, including all State-designated holidays.

4. Questions or changes? Call customer service, toll-free, at (888) 526-1687, Monday – Friday, 8 a.m.- 8 p.m. EST.

Entry field Field description

RETIRED MEMBER INFORMATION

Retired member’s name Enter the complete name of the retired member.

Social Security number Enter the last 4 digits of the retired member’s Social Security number.

Pension ID (PID) number Enter the retired member’s Pension ID (PID) numb er.

Address, City, State, ZIP Code Enter the retired member’s street or mailing address.

Telephone number/Other telephone number Enter telephone numbers including area codes for the retired member.

E-mail address Enter the retired member’s e-mail address, if applicable.

RETIRED MEMBER REQUESTED ACTION

Select one

New designation – You must submit a sep arate copy of the Insurance Carrier

Agreement (State Form 55017) for each insurance policy you are designa ting for

direct payment b y INPRS.

Change to previousl y designated policy - You must submit a separate copy of the

Insurance Carrier Agreement (State F orm 55017) for each insurance policy you

are designating for direct payment by INPRS

Stop previously designated payments – This action ends payment for insurance

coverage and therefore, insurance coverage.

INSURANCE CARRIER INFORMATION

Insurance carrier’s name Enter the complete name of the insurance c arrier.

Group/policy number Enter the complete group insurance or individual policy n umber.

Address, City, State, ZIP Code Enter the insurance carrier’s street or mailing address.

Telephone number/Other telephone number Enter telephone numbers including area codes for the insurance carrier.

E-mail address Enter the insurance carrier e-mail a ddress, if applicable.

EMPLOYER INFORMATION

Employer’s name Enter the complete name of the employer.

Submission unit number Enter the submission unit number for the employer.

Address, City, State, ZIP Code Enter the employer’s street or mailing address.

Telephone number/Other telephone number Enter telephone numbers including area codes for the employer.

E-mail address Enter the employer’s e-mail address, if app licable.

EMPLOYER REQUESTED ACTION

Insurance carrier change If this option is selected, complete the items in the following fields.

Current carrier Enter the name of the current carrier.

New carrier Enter the name of the new carrier.

Premium amount to be deducted Enter the premium amount to be deducted from each ben efit payment.

As of date Enter the effective date of this action; format = mm/dd/yyyy.

Deduction withholding cha ng e If this option is chosen, enter the items in the following fields.

Current carrier Enter the name of the current carrier.

New deduction amount Enter the amount to be deducted for insurance from each benefit payment.

As of date Enter the effective date of this action; format = mm/dd/yyyy.

AUTHORIZED AGENT AFFIDAVIT

Name of insurance plan Enter the name of the insurance plan. This should be the same as the carrier named

earlier on the form.

Authorized agent’s signature The authorized agent must be a controller, clerk-treasurer, or trustee. The authorized

agent must sign and date this form.

Authorized agent’s name The authorized agent ’s printed name must be included

Date The authorized agent must inc lud e the date the form was signed; format =

mm/dd/yyyy.

RETIRED MEMBER ACKNOWLEDGEMENT

Retired member’s signature The retired member must sign and date this section of the form.

Date The retired member must include the date the form was signed; format = mm/dd/yyyy.

INSTRUCTIONS FOR

AUTHORIZATION FOR INSURANCE PREMIUM DEDUCTION

State Form 54969 (R / 3-13)

Page 2 of 2

HELPFUL INFORMATION

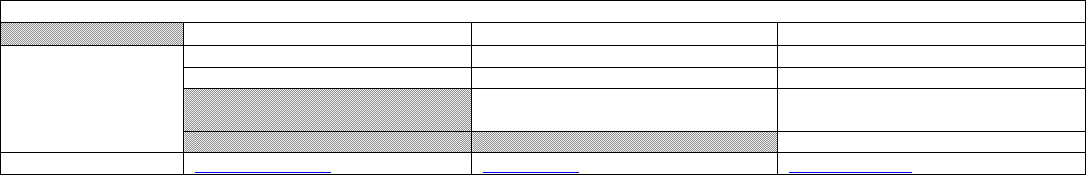

INPRS/PERF INTERNAL REVENUE SERVICE

INDIANA DEPARTMENT OF REVENUE

Telephone

numbers

(888) 526-1687 Toll-free (800) 829-1040 Toll-free (317) 233-4018 Indianapolis local

(866) 591-9441 Fax Toll-free (800) 829-4477 TeleTax (317) 232-2240 Tax questions

(800) 829-4059 TDD (hearin g

impaired)

(317) 233-4952 TDD (hearin g

impaired)

(317) 233-2329 Fax

Web site

www.inprs.in.gov

www.irs.gov www.in.gov/dor