- Direct Deposit Authorization - Florida State University

- Direct Deposit Authorization Agreement - Alabama

- Direct Deposit Authorization Sample Form - Indiana

- Direct Deposit Authorization - Arizona

- In-home Supportive Services Provider Direct Deposit Enrollment/Change/Cancellation Form - California

- Direct Deposit of Annuity Payments - Pennsylvania

Fillable Printable Authorization Form for Direct Deposit - Washington

Fillable Printable Authorization Form for Direct Deposit - Washington

Authorization Form for Direct Deposit - Washington

Complete this form by including your account information.

See the back of the form for attachment instructions.

My Benet Statement Options

These options are not available for DCP.

c Send a statement when a change is made to my account and at the end of the year.

c Do not send me paper statements.

By signing this form, I authorize and request:

• The Department of Retirement Systems (DRS) to transfer the full amount of my monthly benet payment, after

authorized deductions, to the designated nancial institution for deposit.

• The designated nancial institution to provide information to DRS regarding address changes and/or account

information, to ensure proper and timely processing of deposit transactions.

• The designated nancial institution to refund to DRS any overpayments to my account made subsequent to my

death or payments made in error. This last bullet does not apply to DCP.

Signature Date

Print Name (Last, First, Middle) Social Security Number

Not sure which of the following options to choose? See the back of this form for more information.

I am a (check one):

c Retiree c Survivor/Beneciary c Legal Order Payee c Separated from Service

Are you receiving money from someone else’s account? If so, please provide their name and Social Security number.

Information about My Benet Payments

Check the retirement system(s) or plan(s) from which you receive benets – these will be deposited into one

account. If you have multiple benet plans, and you would like them deposited into different accounts, please

complete a separate form for each.

c Deferred Compensation Program (DCP)

c Public Safety Employees’ (PSERS)

c Law Enforcement Ofcers’ & Fire Fighters’

(LEOFF)

c Public Employees’ (PERS)

c State Patrol (WSPRS)

c School Employees (SERS)

c Judicial (JRS)

c Teachers’ (TRS)

c Judicial Retirement Account (JRA)

Important – It is possible that your rst payment may be mailed to your bank, and will not be an electronic transfer. All

remaining payments will be electronic transfers to your account.

My Personal Information

Print Name (Last, First, Middle) Social Security Number

Mailing Address City State ZIP Phone Number

Alternate Phone Number Email Address

*DRSMS145*

DRS MS 145 (R 02/15) Page 1 of 2

Authorization for

Direct Deposit

Send completed form to:

Department of Retirement Systems

PO Box 48380 ꔷ Olympia, WA 98504-8380

www.drs.wa.gov

ꔷ Toll Free: 800.547.6657

Olympia Area: 360.664.7000 ꔷ TTY: 711

Account Type

Please select one:

c Checking

c Savings

DRS can only transmit funds to a personal checking or savings account.

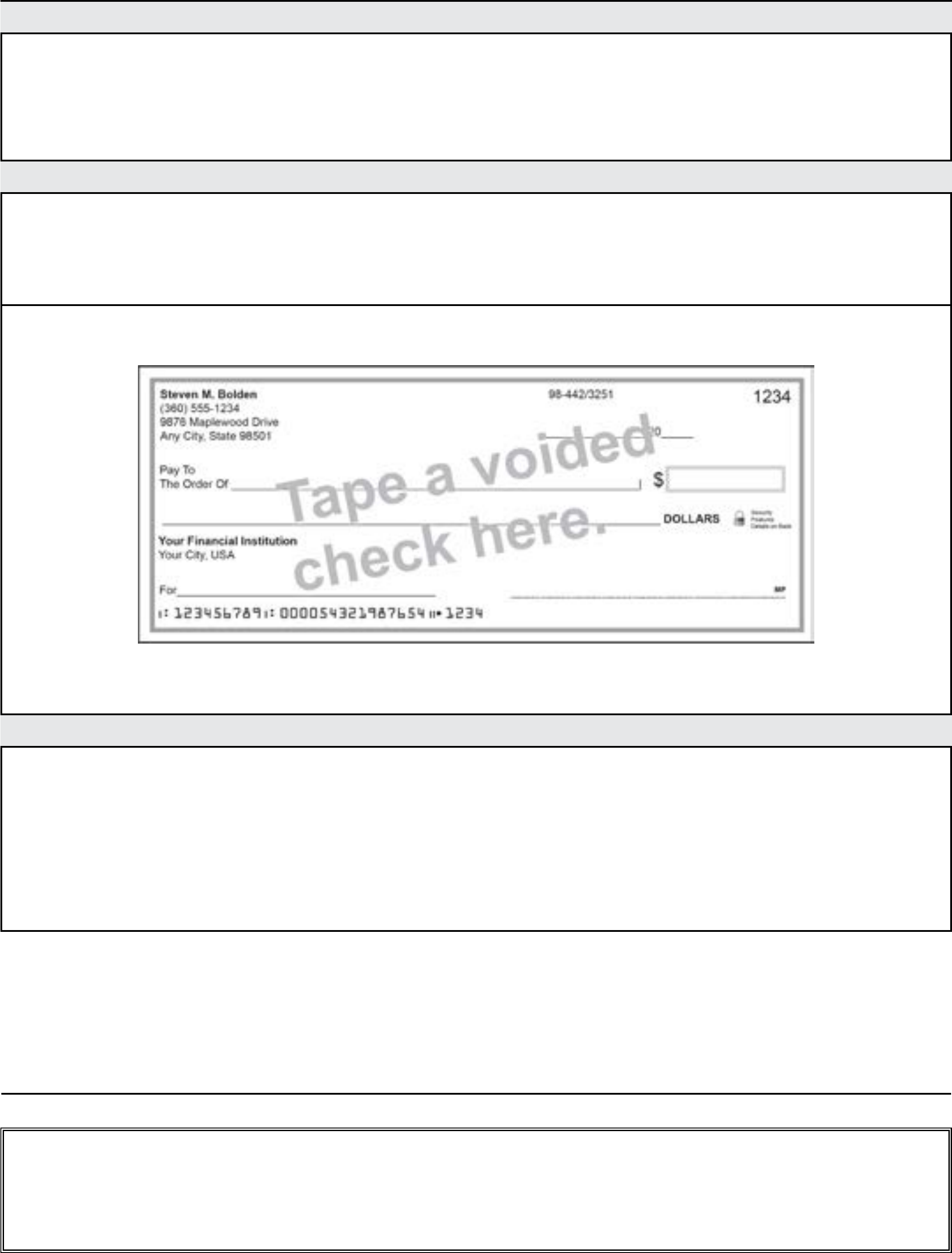

To complete this form, please include one of the following:

• A voided check or copy of a voided check

• A direct deposit form from your nancial institution

• A deposit slip (for your savings account)

Tape your account information in the space below OR include your nancial institution’s direct deposit form

when you submit this Authorization for Direct Deposit. Please do not use staples.

Which one am I? Use the denitions below to choose an option. (see the front of the form)

Retiree: A DRS member who contributed to a retirement system and is now collecting a retirement benet.

Survivor/Beneciary: A person, estate, organization or trust receiving a benet from a deceased DRS member’s

account.

Legal Order Payee:

A person awarded a portion of a retirement benet.

Separated from Service: An unretired DCP participant or retirement systems member who is no longer working in a

DRS-covered plan.

International transfers: Due to federal restrictions, we cannot transfer electronic funds if they will be immediately

credited to an account outside of the United States.

DRS MS 145 (R 02/15) Page 2 of 2

Department of Retirement Systems (DRS) requires that you provide your Social Security number for this form.

• DRS will use your Social Security number as a reference number and to ensure that any funds disbursed under

your account are correctly reported to the IRS.

• DRS will not disclose your Social Security number unless required by law.

• Internal Revenue Code Sections 6041(a) and 6109 allow DRS to request your Social Security number.