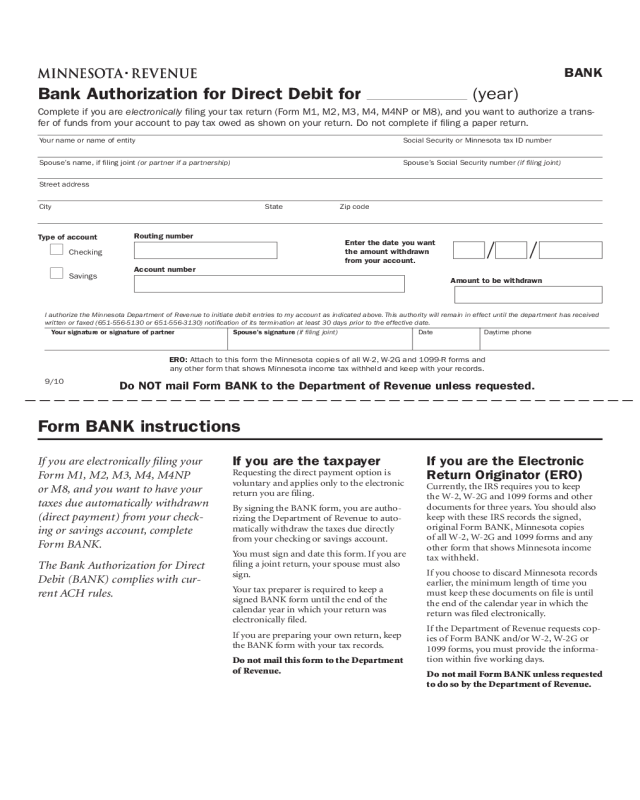

Fillable Printable Bank Authorization Form - Minnesota

Fillable Printable Bank Authorization Form - Minnesota

Bank Authorization Form - Minnesota

Your signature or signature of partner Spouse’s signature (if filing joint) Date Daytime phone

I authorize the Minnesota Department of Revenue to initiate debit entries to my account as indicated above. This authority will remain in effect until the department has received

written or faxed (651-556-5130 or 651-556-3130) notification of its termination at least 30 days prior to the effective date.

Bank Authorization for Direct Debit for (year)

Your name or name of entity Social Security or Minnesota tax ID number

Spouse’s name, if ling joint (or partner if a partnership) Spouse’s Social Security number (if filing joint)

Street address

City State Zip code

Type of account

Checking

Savings

Complete if you are electronically ling your tax return (Form M1, M2, M3, M4, M4NP or M8), and you want to authorize a trans-

fer of funds from your account to pay tax owed as shown on your return. Do not complete if ling a paper return.

BANK

ERO: Attach to this form the Minnesota copies of all W-2, W-2G and 1099-R forms and

any other form that shows Minnesota income tax withheld and keep with your records.

Do NOT mail Form BANK to the Department of Revenue unless requested.

Routing number

Account number

9/10

Amount to be withdrawn

Enter the date you want

the amount withdrawn

from your account.

Form BANK instructions

If you are the taxpayer

Requesting the direct payment option is

voluntary and applies only to the electronic

return you are filing.

By signing the BANK form, you are autho‑

rizing the Department of Revenue to auto‑

matically withdraw the taxes due directly

from your checking or savings account.

You must sign and date this form. If you are

filing a joint return, your spouse must also

sign.

Your tax preparer is required to keep a

signed BANK form until the end of the

calendar year in which your return was

electronically filed.

If you are preparing your own return, keep

the BANK form with your tax records.

Do not mail this form to the Department

of Revenue.

If you are electronically filing your

Form M1, M2, M3, M4, M4NP

or M8, and you want to have your

taxes due automatically withdrawn

(direct payment) from your check-

ing or savings account, complete

Form BANK.

The Bank Authorization for Direct

Debit (BANK) complies with cur-

rent ACH rules.

If you are the Electronic

Return Originator (ERO)

Currently, the IRS requires you to keep

the W‑2, W‑2G and 1099 forms and other

documents for three years. You should also

keep with these IRS records the signed,

original Form BANK, Minnesota copies

of all W‑2, W‑2G and 1099 forms and any

other form that shows Minnesota income

tax withheld.

If you choose to discard Minnesota records

earlier, the minimum length of time you

must keep these documents on file is until

the end of the calendar year in which the

return was filed electronically.

If the Department of Revenue requests cop‑

ies of Form BANK and/or W‑2, W‑2G or

1099 forms, you must provide the informa‑

tion within five working days.

Do not mail Form BANK unless requested

to do so by the Department of Revenue.